I think AUDNZD offers a great sell opportunity which i’m following closely for the right setup to form and get triggered. However keep in mind it is a bank holiday in USA on Friday and NFP (Non-Farm Payrolls) is to be released tomorrow.That means that tomorrow would probably be the last trade-able day for the week as I expect very low volatility on Friday.

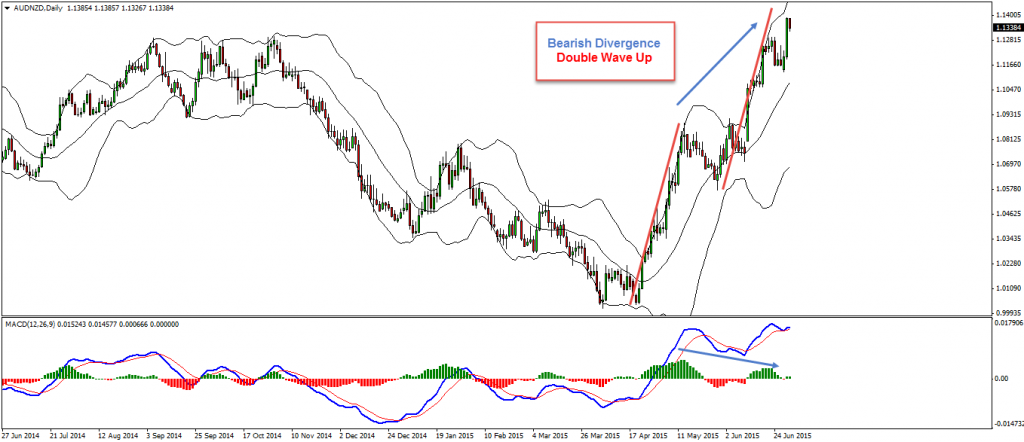

Back to the AUDNZD – pair almost completed a double wave up on the daily chart, it has bearish divergence which also puts pressure and it should soon start a down move. There are two ways i’m planning to join.

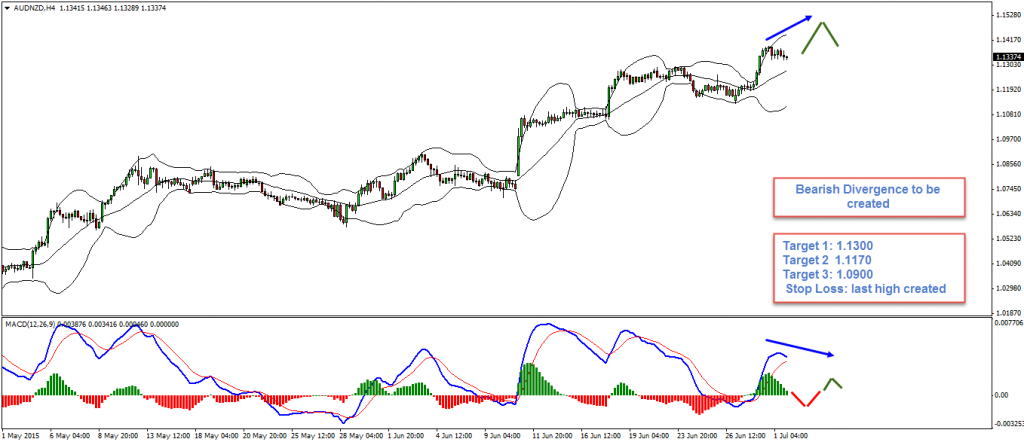

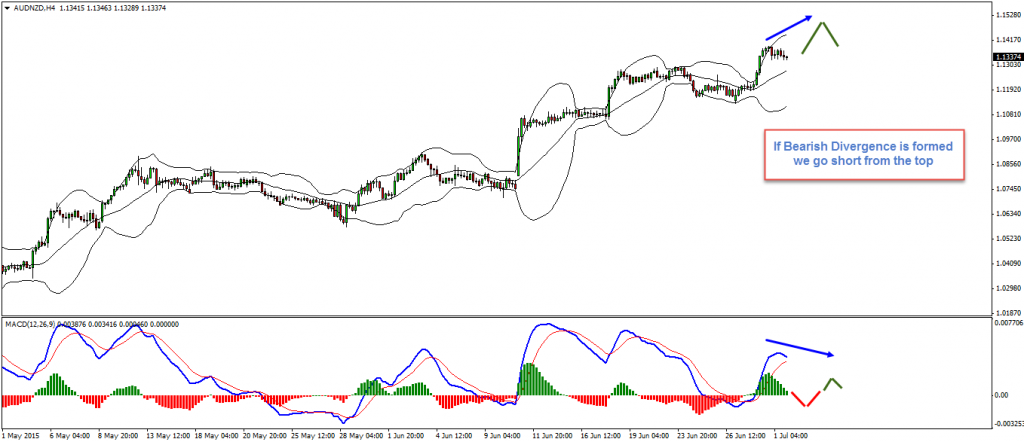

Scenario 1 – In case the pair pushes one more time higher, to complete a bearish divergence on the H4 chart near the 1.1430 level i will look to sell tops.

Scenario 2 – If the pair manages to create a false break by closing below 1.1300 i will be looking to sell rallies. Keep in mind we want to see strong powerful move down which will bring bears to the market and give us the opportunity to join on the correction.

If neither happens and the pair goes into flat range don’t force it.

Technical Analysis:

D1 – double wave up, bearish divergence, potential false break

H4 – potential bearish divergence

Entry:

Scenario 1 – Wait for another push up and bearish divergence to form on the H4 chart. Once we get the trigger we can sell versus the last high.

Target 1: 1.1300

Target 2: 1.1170

Target 3: 1.0900

Stop Loss: last high created

Scenario 2 – In case false break occurs and price closes strong below 1.13 we will be looking to sell rallies again versus the last high

Target 1: 1.1190

Target 2: 1.1080

Target 3: 1.0900

Stop Loss: last high created

Video Explanation:

Yours,

Vladimir