I believe NZDUSD didn’t yet finish it’s bullish move. It is very likely that the price will visit at least 0.7600. There is bullish pressure on the weekly chart because of the bullish divergence and also 20+ candles ride. On the H4 chart there is inverted head and shoulders pattern, which adds up to the bullish view. We can also expect to see duplication of the first bullish wave. There are two ways we can join. Either buy dips with bullish divergence to form or alternatively wait for the break of the major resistance around 0.7450 and then buy on the re-test. Remember that price must remain above 0.7290 in order for this two scenarios to be valid.

Technical Overview:

W1: 20+ candles ride on the Bollinger Bands, bullish divergence

H4: head & shoulders pattern, potential duplication of the first bullish wave created

Entry:

H4:

Scenario 1 – wait for the price to break the key resistance level around 0.7450 and then buy the pull-back.

Target 1: 0.7550

Target 2: 0.7630

Stop Loss: below 0.7450

Scenario 2:

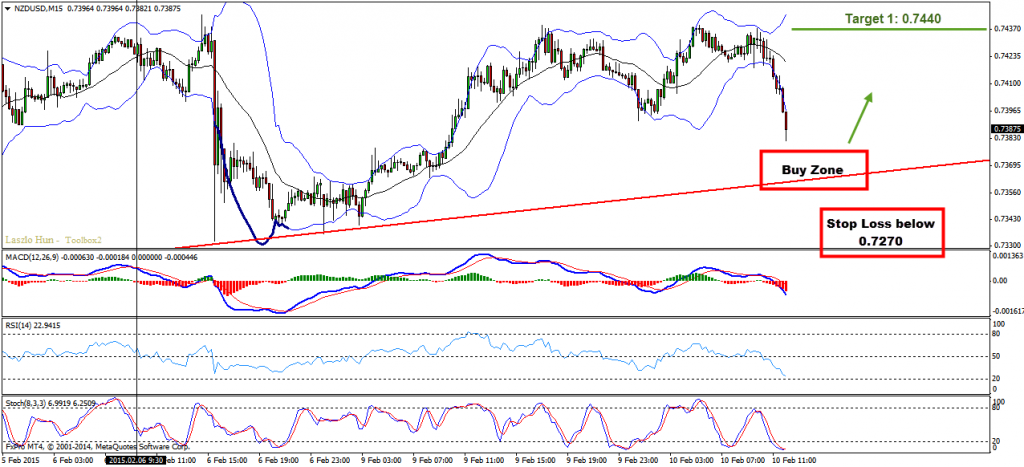

Wait for bullish hidden divergence to form on the intraday charts like H1 or even M15. There is a bullish trend line on the H1 chart that could play the role of dynamic support.

Target 1: 0.7440

Target 2: 0.7630

Stop Loss: below 0.7270

Video Explanation

Yours,

Vladimir