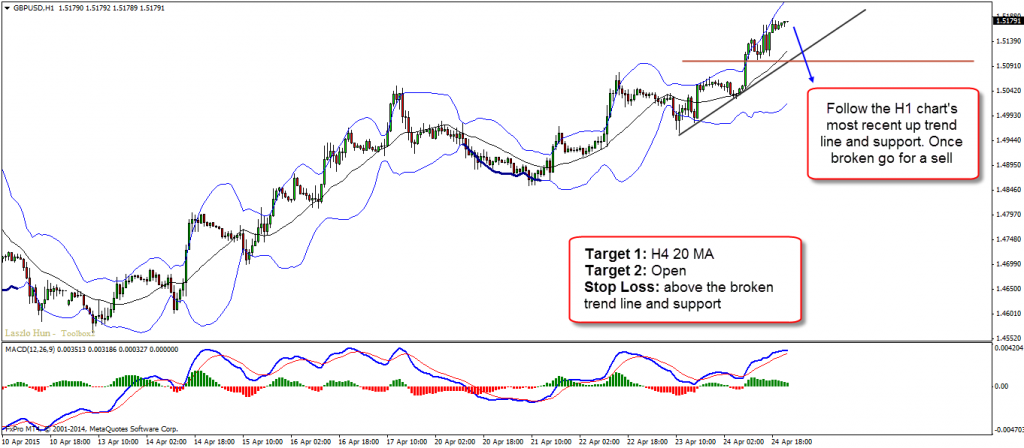

I think cable is a great opportunity to follow during the next week. Please keep in mind though that there is FOMC meeting on Thursday which may cause zig zags, ranges and false breaks. The plan is very simple. We can clearly see the potential double wave duplication on the H4 chart. There is also bollinger band duplication around the same place, on the Daily chart, as well as down trend line. I will be looking to join the bearish momentum on the H1 chart. Once the most recent up trend line, along with the most recent support level are broken down, I will look to short the pair. Since the entry is dynamic our targets are also dynamic. As a first target I will use the H4 chart 20 MA and depending on the entry will decide where the second target will be. Protection should be placed above the broken trend line and the supportive zone.

Technical Overview:

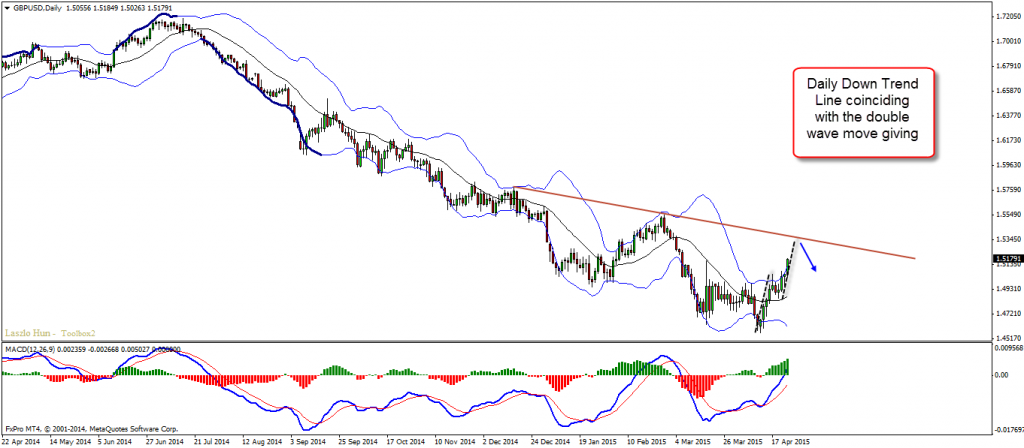

D1 – bollinger bands duplication, down trend line

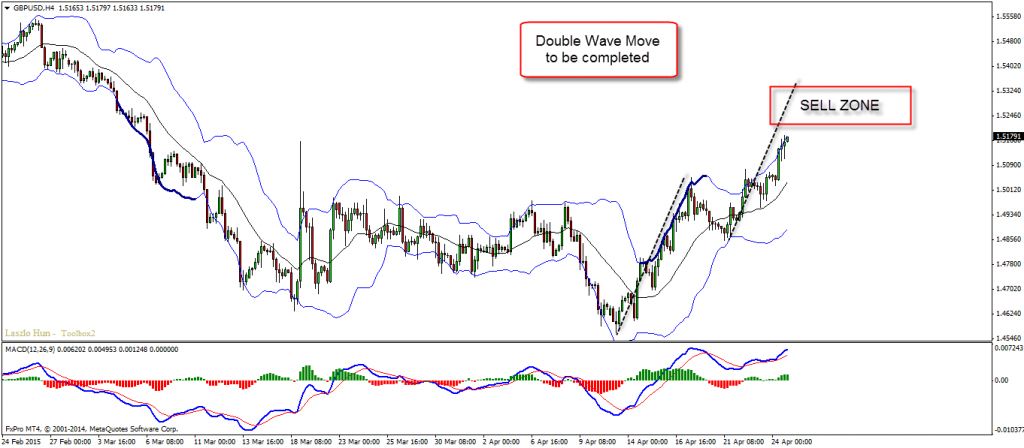

H4 – potential double wave move

H1 – up trend line

Entry:

H1 – follow the up trend line and the most recent support for a break. Once broken look to sell the pair.

Target 1: H4 20 MA

Target 2: Open

Stop Loss: above the broken trend line and support