Arabic Telegram Group:

اضغط هنا للانضمام إلى مجتمع التليجرام الخاص بنا

مرحبا ايها المتداولين!

في هذا المنشور ، سنتحدث عن خام غرب تكساس الوسيط والفرص التجارية المحتملة التي تظهر في الوقت الحالي. نقوم بتحليلنا على منصة MetaTrader4 (MT4). يمكن العثور هنا على بعض النصائح المفيدة والمفيدة للغاية حول منصة MT4.

سنقوم بإجراء تحليل إطار متعدد من الأعلى إلى الأسفل على السلعة لتحديد الإعدادات التجارية المحتملة.

- 1 WTI Crude Oil D1 (daily) Chart

- 2 المقاومة الرئيسية ، خط الاتجاه الهابط ، النقاط المحورية للإطار الزمني

- 3 WTI Crude Oil H4 (4 hours) Chart

- 4 تباعد هبوطي على الماكد ، تباعد هبوطي لمؤشر القوة النسبية ، نمط قمة مزدوجة

- 5 WTI Crude Oil H4 (4 hours) Chart

- 6 دعم RSI ، نمط القناة الصعودية

- 7 كيف تتداول إعداد النفط الخام (WTI) هذا؟

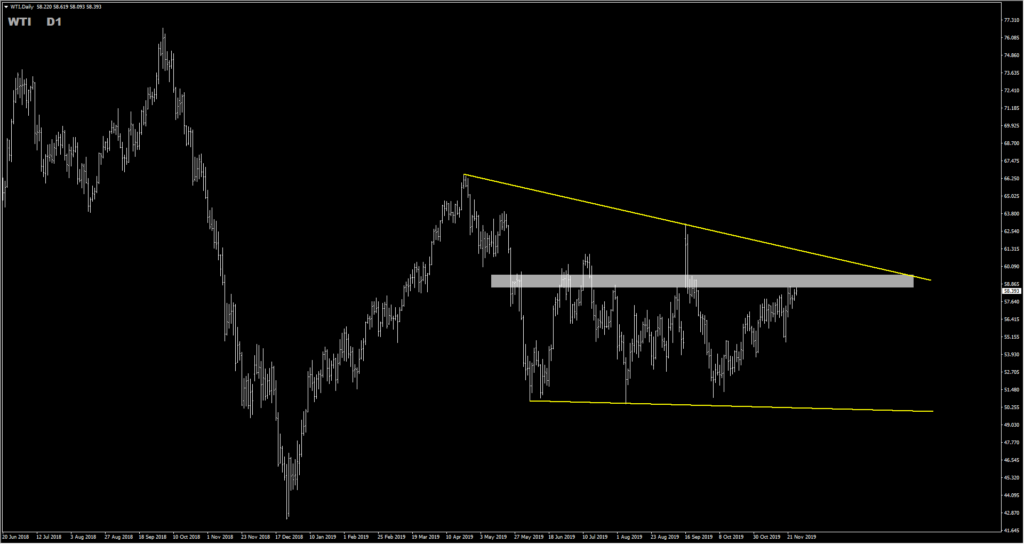

WTI Crude Oil D1 (daily) Chart

المقاومة الرئيسية ، خط الاتجاه الهابط ، النقاط المحورية للإطار الزمني

يظهر الرسم البياني اليومي أن النفط الخام عالق في نطاق واسع منذ منتصف عام 2019. لقد شهدنا الكثير من التقلبات في سبتمبر (خلال الاتجاه الهبوطي) وبمجرد أن يرتد السعر في أسفل النطاق ، يرتفع السعر مرة أخرى صعودًا نحو الأعلى .

توجد منطقة مقاومة قوية في نطاق 58.60 إلى 59.50. يختبر السعر حاليًا أسفل هذه المنطقة. بمعنى آخر ، طالما أن السلعة تتداول أسفل خط الاتجاه الهبوطي ، فيمكننا البدء في البحث عن إعدادات تجارة بيع محتملة.

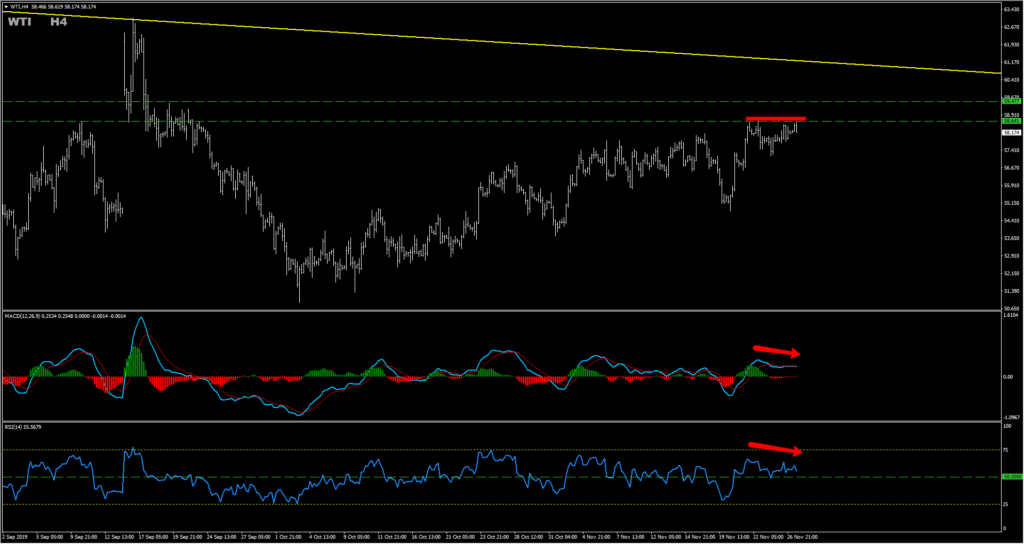

WTI Crude Oil H4 (4 hours) Chart

تباعد هبوطي على الماكد ، تباعد هبوطي لمؤشر القوة النسبية ، نمط قمة مزدوجة

على الرسم البياني H4 يصبح للاهتمام حقا. هناك عدة عوامل نحتاج إلى أخذها في الاعتبار.

يظهر كلا من مؤشر القوة النسبية ومؤشر القوة النسبية RSI كلاهما ضغط هبوطي وتباعد الاختلاف الهبوطي المحتمل. نرى أيضًا نموذج قمة مزدوجة على الرسم البياني عند مستوى 58.65 بين أعلى مستوى في 22 نوفمبر والارتفاع الحالي.

WTI Crude Oil H4 (4 hours) Chart

دعم RSI ، نمط القناة الصعودية

علاوة على ذلك ، يتم تحديد نمط قناة (الاتجاه الصعودي) الصعودي من خلال ربط أدنى مستويات التأرجح من بداية الاتجاه الصعودي الذي بدأ في بداية أكتوبر 2019 وتوقع هذا الخط عند أعلى المستويات المتأرجحة.

تذكر أنه عندما نرسم خطوط الاتجاه وأنماط المخططات الأخرى مثل المثلثات والقنوات وما إلى ذلك ، نريد أن نرى نقطتي لمس على الأقل (السعر يلامس خط الاتجاه). للنظر في خط النمط / الاتجاه صالح.

يحتفظ مؤشر القوة النسبية 50 أيضًا حتى الآن والذي نعتبره منطقة دعم من المؤشر. الاختراق أدناه يجب أن يؤكد وجود هبوطي محتمل.

كيف تتداول إعداد النفط الخام (WTI) هذا؟

هناك نوعان من السيناريوهات المحتملة هنا. إما أن نرى السعر يتجه صعوديًا نحو منطقة 59.50 أو يدفع أقل من سعر السوق الحالي. في كلتا الحالتين يجب أن نطبق تأكيدات إضافية قبل الدخول في الصفقة (إذا تم توفير الإعداد). إذا كنت ترغب في معرفة كيف نتداول بالضبط مثل هذه الإعدادات ، تحقق من Traders Academy Club.انضم إلى أكاديمية التجار الآن

نصائح التداول:

يوصى دائمًا بالبحث عن التأكيدات قبل القفز في أي عملية تداول. إذا لم تكن متأكدًا من كيفية تداول إعداد ، يمكنك استخدام أي إعداد واستراتيجية لديك في ترسانتك للبحث عن التحركات الصعودية والانضمام إلى صفقة الشراء هذه.

لست متأكدًا من كيفية اكتشاف الانعكاسات (الارتداد)؟ لست متأكدًا من كيفية اكتشاف الاختراقات؟

أدعوك للانضمام إلي في غرف التداول الحية الخاصة بي ، وتحسين التداول الخاص بك معنا

كما يمكنك الحصول على واحدة من استراتيجياتي مجانا. سوف تجد كل التفاصيل

مع تحياتنا

فلاديمير و اسر البدراوى