Arabic Telegram Group:

اضغط هنا للانضمام إلى مجتمع التليجرام الخاص بنا

مرحبا ايها المتداولين! توقعات الفوركس الأسبوعية بالشرح التفصيلى من 17 نوفمبر إلى 22 نوفمبر 2019 هنا.

أواصل مع فريقي دائمًا العمل الجاد من أجلك ونجاحك ، وكما نفعل كل أسبوع ، قمنا بإعداد هديتين رائعتين لك!

توقعات الفوركس الأسبوعية:

وإليك تنسيق الشرح التفصيلى بتوقعات فوركس الأسبوعية الذي أعده فريقي خصيصًا لك.

EURUSD

في هذا الزوج ، لا يزال الرسم البياني الأسبوعي يتعرض لضغط صعودي مع الدورة الهبوطية الثلاثية والتباعد الصعودي الذي هو قيد التشغيل ، وأتوقع الآن أن تحدث دورة تصحيحية في الأمواج أو النطاقين.

السيناريو الأول هنا ، على الرسم البياني اليومي ، قد يكون السعر قد حقق أعلى مستوياته ، وأدنى مستوياته ، ويحترم المنطقة الداعمة ، مما يخلق تباعدًا صعوديًا مخفيًا ، ولدينا أيضًا نموذج شمعة غارق جميل ، وأتوقع أن يستمر السعر في الارتفاع. .

على الرسم البياني H4 كنت أرغب بشكل رئيسي في رؤية ارتفاع آخر من شأنه أن يخلق قمم أعلى ، نمط قيعان أعلى ، يجب أن يكون هذا كافياً لفتح الأبواب للاستمرار.

سيكون إبطال ذلك هو القاع الأحدث الموضح في الصورة أعلاه (الموضحة بالخط الأحمر) إذا كان السعر ينهار دون ذلك ، فسيكون ذلك تمامًا ضد تزامن الدورة والانحراف ، ثم يتعين علينا إعادة التحليل. حتى ذلك الحين لا يزال الضغط صعوديًا وأتوقع مزيدًا من الاستمرارية.

يبني السعر هيكلًا مشبوهًا من أعلى مستوياته وأدنى مستوياته وإذا كان السعر يخلق نوعًا من موجتين ويتكسر أسفل خط الاتجاه الصعودي الأخير كما هو موضح في الصورة أعلاه ، فسيكون ذلك علامة مشبوهة للغاية.

EURNZD

في هذا الزوج على الرسم البياني اليومي ، أتوقع بعض الاستمرارية قليلًا إلى أن نخلق نوعًا من الاختلاف أو على الأقل أتوقع أن يقترب السعر من قاع النطاق ومن ثم قد نبدأ في البحث عن عمليات الشراء باستخدام أدلة صعودية (شمعة أنماط عصا ، فواصل كاذبة ، اندلاع خط الاتجاه الخ …).

حتى ذلك الحين ، قد نشهد دفعًا آخر منخفضًا مع وجود تباعد لتكوين ثم قد نبحث عن عمليات شراء محتملة.

EURCAD

في هذا الزوج على الرسم البياني الأسبوعي ، لدينا دورة هبوطية ثلاثية مع تباعد صعودي وأتوقع أن تحدث دورة تصحيحية الآن.

يتناسب الرسم البياني اليومي بشكل جيد مع إنشاء قمم مرتفعة ونمط قيعان أعلى (حاليًا لدينا قمتان علويتان وأعلى قيعان داخل النموذج التصحيحي ، كما أن الاختلاف الأخير صعوديًا وحالياً فإن عدم التباعد هنا يجعلني أرى وجهة نظر صعودية .

cعلى الرسم البياني H4 ، كسر السعر فوق خط الترند الهابط واكتسب السعر أعلى مستوياته ، ونمط قيعان أعلى ، لذا فإن خطتي هنا هي شراء عمليات الاسترداد مع الأدلة الصعودية (أنماط الشموع ، الاختراقات الكاذبة ، كسر خط الاتجاه ، إلخ …). إذا كسر السعر أسفل خط الاتجاه الصعودي الموضح في الصورة أدناه ، فسيتم إبطال هذه النظرة الصعودية.

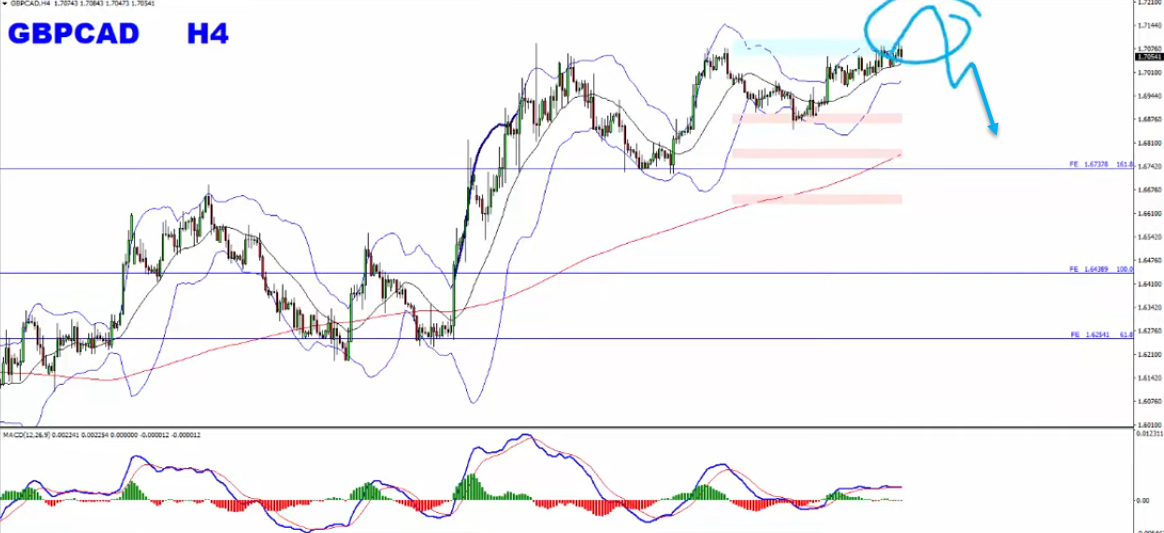

GBPCAD

على الرسم البياني اليومي ، لدينا دورة خاصة محتملة مع وجود منطقة تطهير هائلة بالقرب من 1. و 1.72 منطقة ، ولدينا أيضًا تباعد هبوطي يتطور في الوقت الحالي.

يتباطأ مخطط H4 بشكل كبير ويخلق نوعًا من نمط المثلث (نرى أيضًا مدى خطورة تباطؤه مع وجود نموذج الوتد بداخله).

كلما اقتربنا من منطقة المقاومة المهمة الموضحة في الصورة أدناه ، سأبحث عن الانعكاسات. أفضل طريقة هنا هي الحصول على الاختراقات الخاطئة ، والانخفاضات المنخفضة ، وبعد ذلك قد نتطلع إلى بيع المسيرات بأدلة هبوطية (أنماط الشموع ، الاختراقات الخاطئة ، اندلاع خطوط الاتجاه ، إلخ …). أو بدلاً من ذلك ، قد نبحث عن ثلاثة ارتفاعات منخفضة ، ونمط أدنى مستويات منخفضة ، ثم قد نتطلع إلى بيع الارتفاعات بأدلة هبوطية (أنماط الشموع ، وفواصل خاطئة ، وكسر خط الاتجاه ، إلخ …).

استنادًا إلى إحصائيات Crystal Ball Forex ، يمكننا أن نرى أننا نتجه نحو منطقة مهمة هي 19 و 22 و 24 و 25. هذا الأسبوع والأسبوع التالي قويان للغاية بالنسبة للقمم وقد نواجه تصحيحات محتملة من المنطقة الموضحة في لقطة الشاشة أدناه.

GBPCHF

في هذا الزوج ، يوجد تباعد هبوطي مخفي على الرسم البياني الأسبوعي ولكننا نفتقر إلى التأكيد من اليومية حيث لم ننتهي من الاختلاف. وبالتالي فإن الطريقة التي أرى بها هذا السعر يجب أن تحاول الارتفاع مرة أخرى للحصول على تصريح محتمل (عودة محتملة إلى منطقة البنك). لذلك أعتقد أننا سنرى ارتفاعًا إضافيًا وعندما يكمل هذا الاختلاف ، فقد نبدأ بالبحث عن عمليات بيع بأدلة هبوطية أكثر (أنماط الشموع المكسورة ، فواصل خاطئة ، كسر خط الاتجاه ، إلخ …).

طريقة العمل مع هذا هي رسم خط الترند الهابط كما هو موضح في الصورة أدناه ، ونريد أن نرى السعر يخترق مع زخم صعودي عن طريق خلق أعلى مستويات أعلى ونمط قيعان أعلى.

يقوم مخطط H1 حاليًا بتطوير هيكل صعودي دون أي مشاكل كبيرة ، لذا بمجرد أن يكمل السعر هيكل ثلاثة قمم مرتفعة ، وهو أدنى سعر أعلى ، يمكننا عندئذ البحث عن عمليات الاسترداد والشراء مع المزيد من الأدلة الصعودية (أنماط الشموع ، الاختراقات الكاذبة ، اختراق خط الاتجاه) إلخ…).

AUDUSD

في هذا الزوج ، تظل وجهة نظري الشخصية كما هي للبحث عن عمليات الشراء. الفكرة هنا بسيطة للغاية ، ولدينا مستويات أعلى ، ونمط أدنى مستويات منخفضة قد نبحث عن ارتدادات ، ثم استمرار الاتجاه نحو الأعلى.

على الرسم البياني الأسبوعي ، نتوقع حدوث دورة تصحيحية.

أحد الشواغل التي لدينا هنا هو مستوى منطقة تصحيح فيبوناتشي 61.8٪ عند 0.67695 ، حتى الآن يثبت السعر على هذا المستوى ولكن إذا واصلنا انخفاضه من هنا ، فقد انتهت لعبته للثيران.

يوجد هنا سيناريوهان محتملان ، الأول هو أننا قد نتوقع عودة السعر إلى المنطقة الموضحة في الصورة أدناه مع وجود تباعد تصاعدي لتشكيل ، والتحرك صعوديًا وكسر فوق خط الاتجاه الهبوطي الأخير ، وقد نتوقع استمرارًا أعلى.

أو بدلاً من ذلك ، السيناريو الثاني هو أننا قد نبحث عن ثلاثة قمم مرتفعة ونمط قيعان أعلى مع الكسر فوق خط الاتجاه الهبوطي وبعد ذلك قد نتطلع إلى شراء عمليات الاسترداد مع الأدلة الصعودية (أنماط الشموع المكسورة ، وفواصل خاطئة ، وكسر خط الاتجاه ، إلخ …) ..

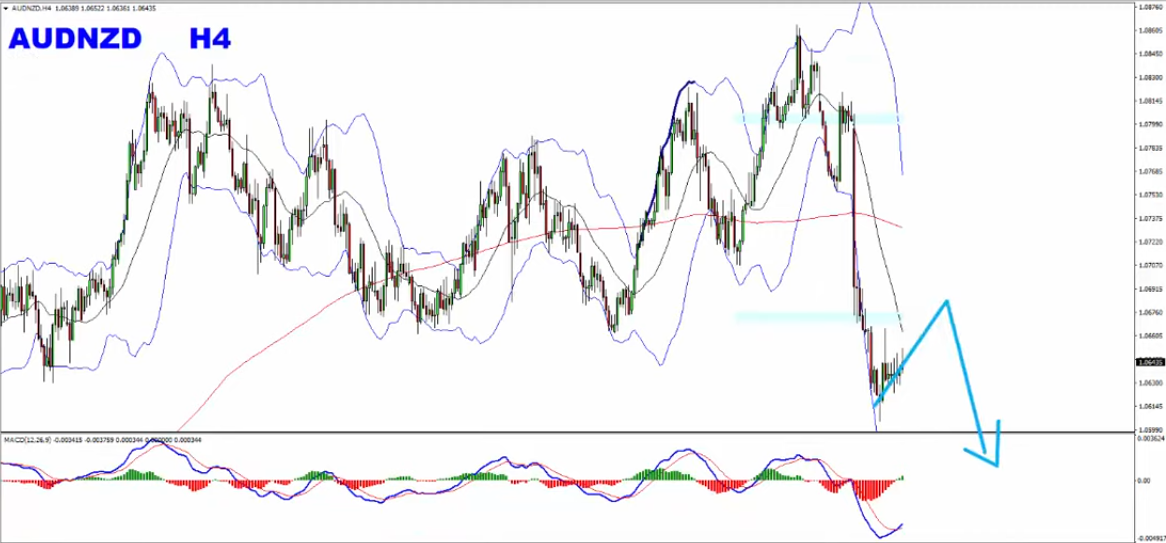

AUDNZD

في هذا الزوج ، يوجد تباعد هبوطي على الرسم البياني الأسبوعي واليومي. لدينا أيضًا دورة ثلاثية في اللعب على الرسم البياني اليومي ، لذلك نحن الآن في الدورة التصحيحية ، لذا فإن خطتي هنا هي بيع المسيرات بأدلة هبوطية (أنماط الشموع ، الاختراقات الخاطئة ، كسر خط الاتجاه ، إلخ …).

لا توجد نقاط انحراف على الرسم البياني اليومي والرسم H4 ، لذا في هذا الزوج ، أرى أن الاتجاه الهبوطي على الأقل على المدى القصير وقد نتطلع إلى بيع الارتفاعات بأدلة هبوطية (أنماط الشموع ، الاختراقات الخاطئة ، كسر خط الاتجاه ، إلخ … ).

NZDUSD

على الرسم البياني اليومي ، كان لدينا ثلاثة ارتفاعات أعلى ونمط قيعان أعلى ، ثم حصلنا على التصحيح باختلاف تصاعدي مخفي وأعتقد أن هذا يتطور في المرحلة التالية. إلى أن لا يغير النمط اليومي من نمطه (وهذا يخلق تباعدًا هبوطيًا وهبوطًا أدنى) ، فإن رأيي لا يزال صعوديًا.

قد نرى السعر ينمو في الساق كما هو موضح في الصورة أدناه.

أو بدلاً من ذلك ، قد يتحرك السعر داخل النطاق. هذا أو على العكس من وجهة نظري لا يزال صعودي هنا.

سيناريو مثالي هنا هو إذا كان السعر قد خلق قمة أخرى على الرسم البياني H4 والتي من شأنها أن تشكل نمطًا صعوديًا من ثلاثة قمم مرتفعة ، وأدنى مستويات أعلى ، وإذا حدث ذلك فسيكون هذا تأكيدًا جيدًا لنا.

cإذا تحرك السعر للأسفل وكسر أسفل خط الاتجاه الصعودي الموضح في لقطة الشاشة ، فسيتم إلغاء هذا العرض الصعودي.

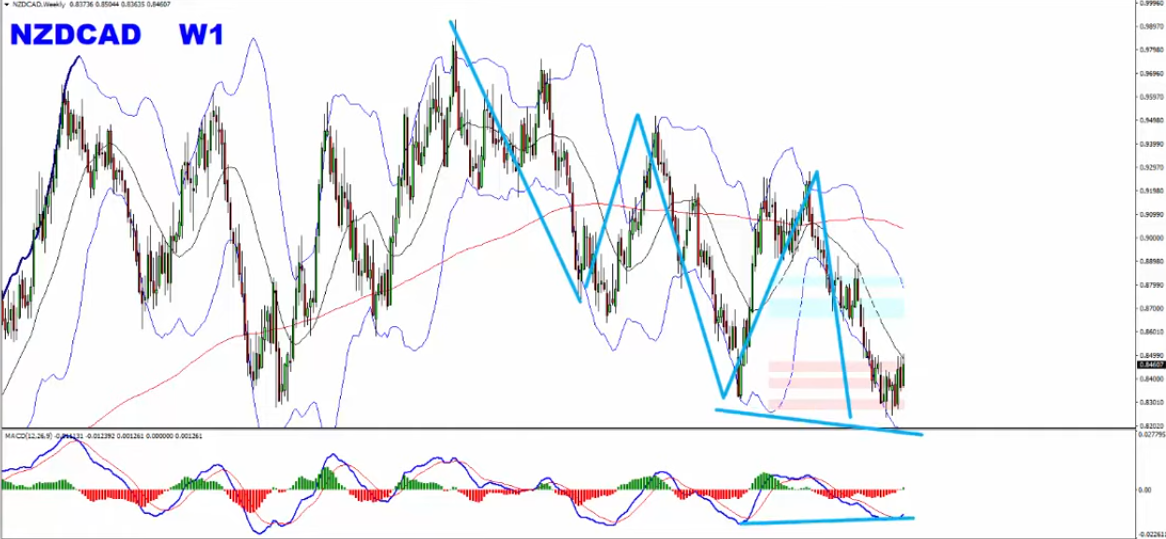

NZDCAD

في هذا الزوج على الرسم البياني الأسبوعي ، لدينا دورة ثلاثية مع تباعد صعودي على مؤشر المتوسطات المتحركة لمؤشر الماكد.

على الرسم البياني اليومي ، حقق السعر أعلى مستوياته ونمط قيعان أعلى وأعتقد أن عمليات الشراء التي تتم مع أدلة صعودية (أنماط الشموع المكسورة وفواصل خاطئة وكسر خط الاتجاه وما إلى ذلك) ستكون هي الخطة الصحيحة هنا.

سيكون إلغاء هذا السيناريو هو كسر خط الاتجاه الصعودي الموضح في الصورة أدناه.

USDCHF

على الرسم البياني اليومي ، أنشأ السعر نمطًا صعوديًا من أعلى مستوياته الثلاثة ، وأدنى مستوياته متبوعة بتصحيح النطاق ، لذلك أعتقد أننا يجب أن نرى انخفاضًا آخر مع وجود تباعد تصاعدي لتشكيل ومن المنطقة الموضحة في لقطة الشاشة ، فقد نتمكن من ذلك ابحث عن عمليات الشراء باستخدام الأدلة الصعودية (أنماط الشموع ، الاختراقات الخاطئة ، كسر خط الاتجاه ، الخ …).

cعلى الرسم البياني H4 ، قد نتوقع أن يخلق السعر قاعًا جديدًا مع تشكيل تباعد صعودي ، ثم إذا كسر السعر فوق خط الاتجاه الهبوطي الموضح في الصورة ، فقد نبدأ في البحث عن عمليات شراء بمزيد من الأدلة الصعودية (أنماط الشموع ، الاختراقات الخاطئة) ، خط الاتجاه اندلاع الخ …).

بناءً على إحصائيات Forex Crystal Ball ، لدينا يومين مهمين ، حيث يمكنك أن ترى نهاية الشهر فترة قوية. لذلك إذا وصلنا إلى هناك ، فسيكون ذلك فرصة محتملة جيدة للمشترين.

Gold

في الذهب ، أتوقع استمرارًا في الانخفاض ، حصلنا على التصحيح وأريد أن تتطور المحطة الثانية ، واخترق أدنى خط الاتجاه الصعودي الأخير ، وبعد ذلك قد نتوقع دفع هبوطي ممكن.

وجهة نظري هنا هابطة وأتوقع مزيدًا من الانخفاض. ستكون خطة البيع هنا هي بيع المسيرات بأدلة هبوطية (أنماط الشموع المكسورة ، الاختراقات الخاطئة ، كسر خط الاتجاه ، الخ …).

وجهة نظري هنا هابطة وأتوقع مزيدًا من الانخفاض. ستكون خطة البيع هنا هي بيع المسيرات بأدلة هبوطية (أنماط الشموع المكسورة ، الاختراقات الخاطئة ، كسر خط الاتجاه ، الخ …).

NASDAQ

على الرسم البياني اليومي ، طور السعر 20 شمعة على البولنجر باند ، ولدينا أيضًا قمم ضخمة وانحراف هبوطي وتباطؤ كلاسيكي.

بشكل أساسي ، لدينا تباعد محتمل من شهري وأسبوعي و H4 (لدينا أيضًا الكثير من الاستراحات الخاطئة على H4). ما أريد رؤيته هنا هو كسر خط الترند الصاعد الموضح في الصورة أدناه ، وإنشاء قيعان منخفضة ثم قد نتطلع إلى بيع المسيرات بأدلة هبوطية (أنماط الشموع المكسورة ، وفواصل خاطئة ، وكسر خط الاتجاه ، إلخ …).

أو بدلاً من ذلك ، قد نبحث عن ثلاثة قيعان منخفضة ونمط قمم منخفضة ثم قد نتطلع إلى بيع الارتفاعات بأدلة هبوطية (أنماط الشموع المكسورة وفواصل خاطئة وكسر خط الاتجاه وما إلى ذلك …).

أو بدلاً من ذلك ، قد نبحث عن ثلاثة قيعان منخفضة ونمط قمم منخفضة ثم قد نتطلع إلى بيع الارتفاعات بأدلة هبوطية (أنماط الشموع المكسورة وفواصل خاطئة وكسر خط الاتجاه وما إلى ذلك …).

ندعوك للانضمام إلي في غرف التداول الحية الخاصة بي ، وتحسين التداول الخاص بك معنا.

كما يمكنك الحصول على واحدة من استراتيجياتي مجانا. سوف تجد كل التفاصيل هنا

نتمنى لك أسبوع تداول رائع

فلاديمير ريباكوف و اسر البدراوى