Arabic Telegram Group:

اضغط هنا للانضمام إلى مجتمع التليجرام الخاص بنا

مرحبا ايها المتداولين! توقعات الفوركس الأسبوعية بالشرح التفصيلى المكتوب من 8 سبتمبر إلى 13 سبتمبر 2019 هنا.

أواصل مع فريقي دائمًا العمل الجاد من أجلك ونجاحك ، وكما نفعل كل أسبوع ، قمنا بإعداد هديتين رائعتين لك!

توقعات الفوركس الأسبوعية:

وإليك تنسيق الشرح التفصيلى بتوقعات فوركس الأسبوعية الذي أعده فريقي خصيصًا لك.

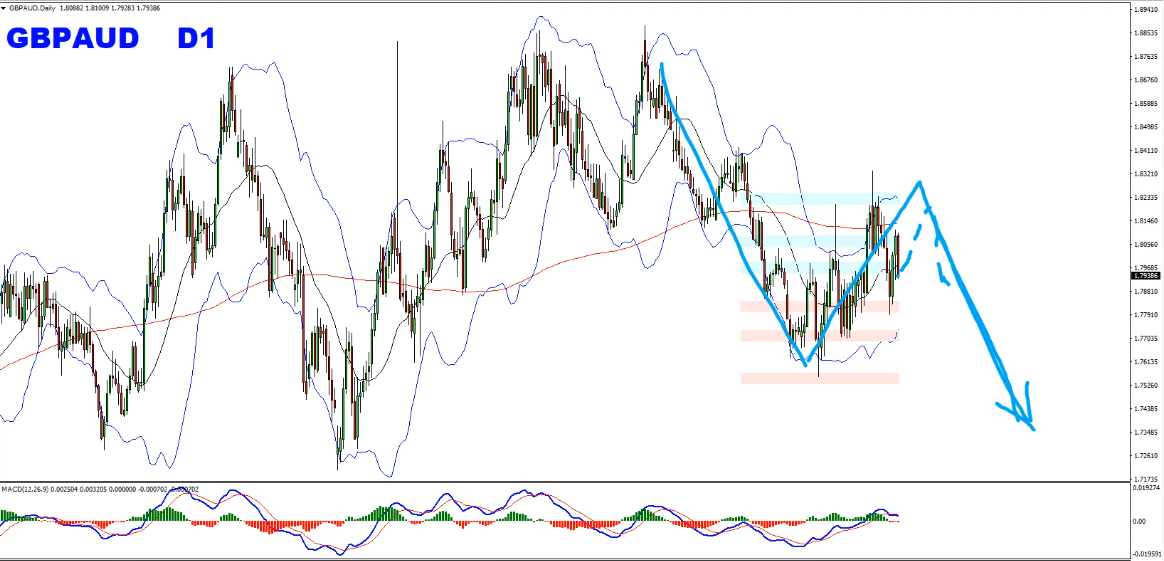

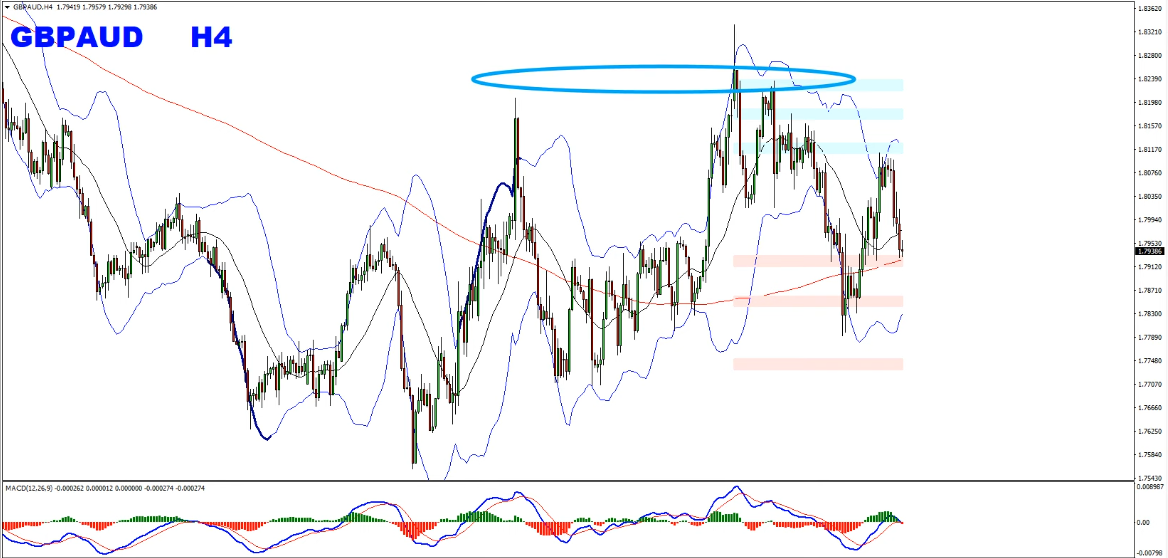

GBPAUD

في هذا الزوج على الرسم البياني اليومي ، كنا نتبع هيكل الزوجي الثلاثي (الدورة الثلاثية لأسفل متبوعًا بالدورة المزدوجة الصعودية) مباشرة إلى منتصف الحركة بأكملها للدورة الثلاثية ، ونتوقع حدوث انعكاسات. من وجهة نظر أقصر أردنا أن نرى حركة السعر تخلق بعض القتال قبل أن تنخفض. خلق السعر المضاعفة الثلاثية كما توقعنا وعلى المدى الأقصر أردنا أن نرى السعر يتجه للأمام والخلف. يتحرك السعر في اتجاه صعودي منخفض ، ولم يتمكن من إنشاء مستوى مرتفع جديد حيث تم حظر السعر من قبل منطقة مقاومة هائلة حول المنطقة النفسية 1.8250 ، مع حجبه عن الاختلاف الهبوطي وبدء التحرك للأسفل.

لذلك ، لم تتغير وجهة نظري الشخصية هنا وما زلت أتوقع استمرار الانخفاض ، فقد نحصل على حركة مباشرة أو قد نشهد بعض القتال ثم قد يتحرك السعر هبوطيًا وأتوقع أن يتطور السعر في الاتجاه الهبوطي. لذلك بيع المسيرات مع الأدلة الهابطة كانت ولا تزال الخطة بالنسبة لنا.

لذلك ، لم تتغير وجهة نظري الشخصية هنا وما زلت أتوقع استمرار الانخفاض ، فقد نحصل على حركة مباشرة أو قد نشهد بعض القتال ثم قد يتحرك السعر هبوطيًا وأتوقع أن يتطور السعر في الاتجاه الهبوطي. لذلك بيع المسيرات مع الأدلة الهابطة كانت ولا تزال الخطة بالنسبة لنا.

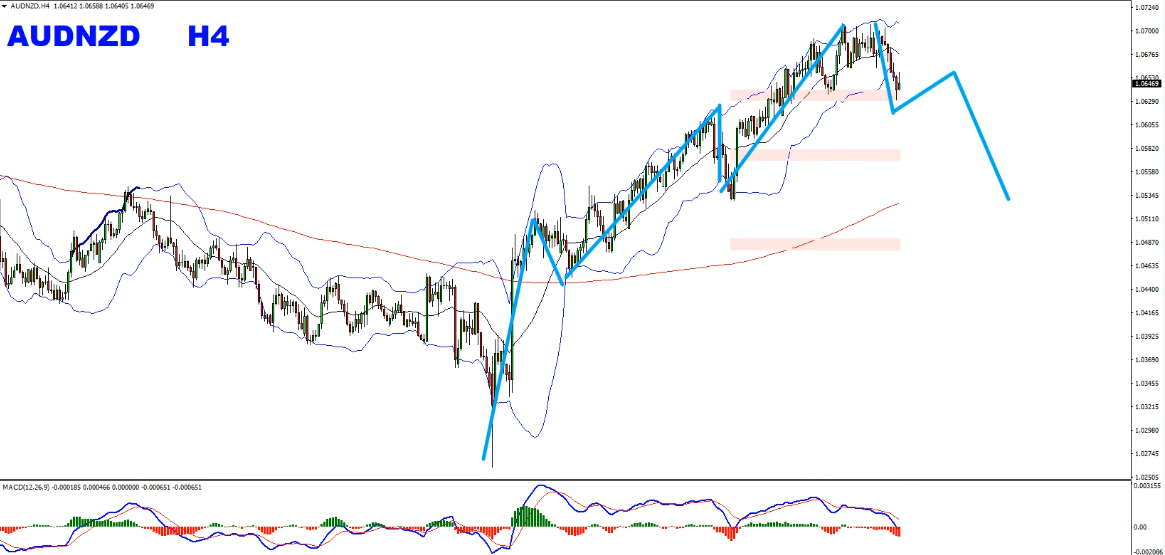

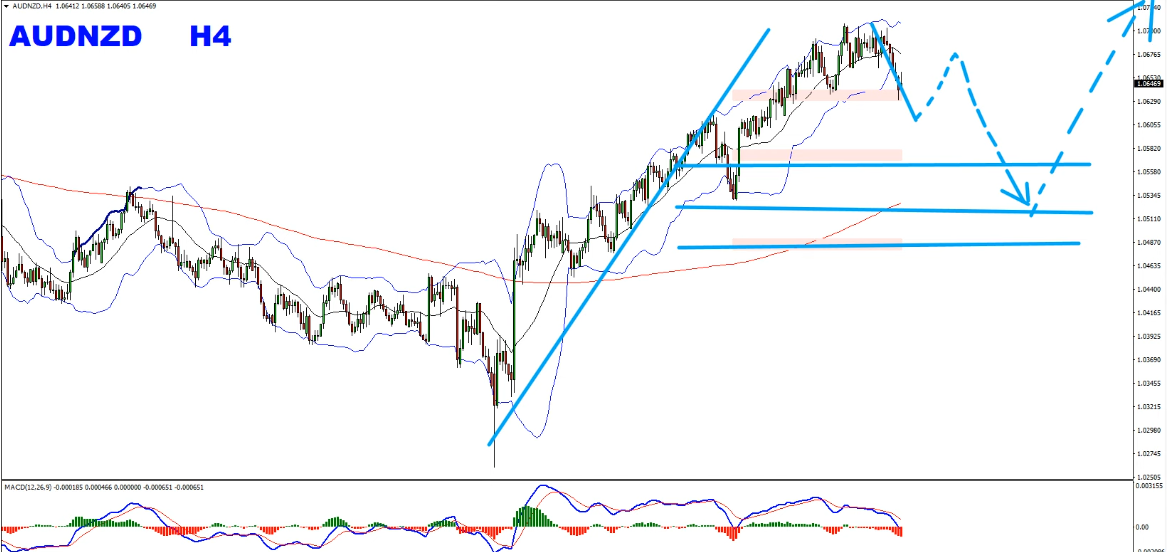

AUDNZD

في هذا الزوج ، كنا نتوقع ارتدادًا صعوديًا واستمرارًا في الاتجاه الصعودي. تحرك السعر بالضبط حسب خطتنا. حاليًا على الرسم البياني اليومي ، لدينا 20 شمعة من البولنجر باند مع بعض الانسداد من الاختلاف الهبوطي في منطقة مقاومة قوية.

في حين أن الرسم البياني H4 هو الذي يجعل الدورة بالنسبة لنا في الوقت الحالي ، يمكننا استخدام الهيكل الذي يتمتع به للاتجاه للاستمتاع بالتصحيح المتوقع. يمكن أن تكون الدورة التصحيحية في موجتين.

في حين أن الرسم البياني H4 هو الذي يجعل الدورة بالنسبة لنا في الوقت الحالي ، يمكننا استخدام الهيكل الذي يتمتع به للاتجاه للاستمتاع بالتصحيح المتوقع. يمكن أن تكون الدورة التصحيحية في موجتين.

لذلك أتوقع الآن أن أقوم بالدورة التصحيحية وفي مثل هذه الهياكل ، قد تتطور في العادة موجتان ، وبمجرد الانتهاء من العودة إلى مناطق fibo للحركة بأكملها ، فإني أتطلع إلى مواصلة عمليات الشراء.

لذلك أتوقع الآن أن أقوم بالدورة التصحيحية وفي مثل هذه الهياكل ، قد تتطور في العادة موجتان ، وبمجرد الانتهاء من العودة إلى مناطق fibo للحركة بأكملها ، فإني أتطلع إلى مواصلة عمليات الشراء.

ما دامت المنطقة الموضحة في لقطة الشاشة أتوقع التصحيح ، فإن 200 MA تتغير ببطء هنا ، لذا فإن الاقتراب من ذلك سيكون حالة رائعة حقًا. من الناحية المثالية ، يجب أن نكون أيضًا قادرين على رؤية الاختلاف الصعودي الخفي لاستمرار الاتجاه وبعد ذلك سنتحول إلى الشراء. وفي الوقت نفسه ، أعتقد أن هذا في وضع دورة تصحيحية على المدى القصير في الوقت الحالي.

ما دامت المنطقة الموضحة في لقطة الشاشة أتوقع التصحيح ، فإن 200 MA تتغير ببطء هنا ، لذا فإن الاقتراب من ذلك سيكون حالة رائعة حقًا. من الناحية المثالية ، يجب أن نكون أيضًا قادرين على رؤية الاختلاف الصعودي الخفي لاستمرار الاتجاه وبعد ذلك سنتحول إلى الشراء. وفي الوقت نفسه ، أعتقد أن هذا في وضع دورة تصحيحية على المدى القصير في الوقت الحالي.

NZDCAD

في هذا الزوج ، كنا نتوقع أن يخلق السعر قاعًا جديدًا ومن المحتمل جدًا أن يشهد بعض الارتداد. لقد وصلنا إلى مستوى منخفض جديد (لقد واصلنا الأمر أكثر) ثم حقق السعر اختراقًا خاطئًا على خط الاتجاه البديل ، فنحن نبني هيكلًا من ثلاثة ارتفاعات أعلى وأدنى سعر أعلى. بعبارة بسيطة أود أن أقول طالما بقيت حركة تصحيح فيبو 61.8 في هذه الحركة ، فإن الفكرة ستكون هنا للبحث عن عمليات الاستعادة وإمكانية استمرار الشراء.

كطريقة تصحيحية للإنحراف الصعودي اليومي الذي يتم تطويره حاليًا وأيضًا إذا نظرنا إلى Bollinger Band ، فنحن في نطاق مستقيم إلى حركة الفرقة التي تم تكرارها ونواجه 20 رحلة على الشمعة في النطاق السفلي مع اختلاف تصاعدي. طالما أن منطقة تصحيح فيبرونات 61.8 ثابتة ، يجب أن نشهد بعض التصحيح الأعمق.

كطريقة تصحيحية للإنحراف الصعودي اليومي الذي يتم تطويره حاليًا وأيضًا إذا نظرنا إلى Bollinger Band ، فنحن في نطاق مستقيم إلى حركة الفرقة التي تم تكرارها ونواجه 20 رحلة على الشمعة في النطاق السفلي مع اختلاف تصاعدي. طالما أن منطقة تصحيح فيبرونات 61.8 ثابتة ، يجب أن نشهد بعض التصحيح الأعمق.

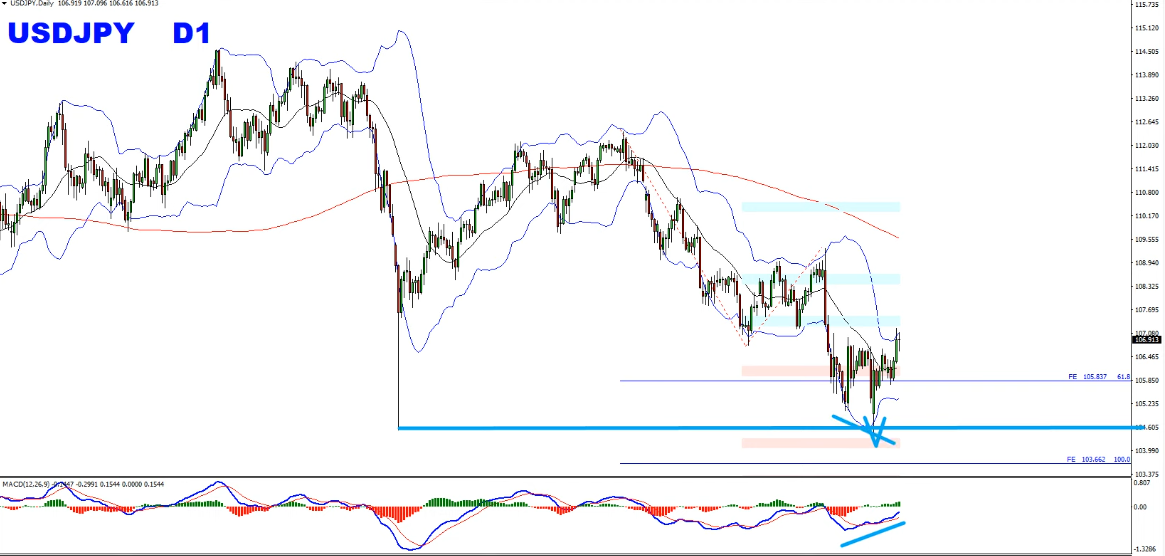

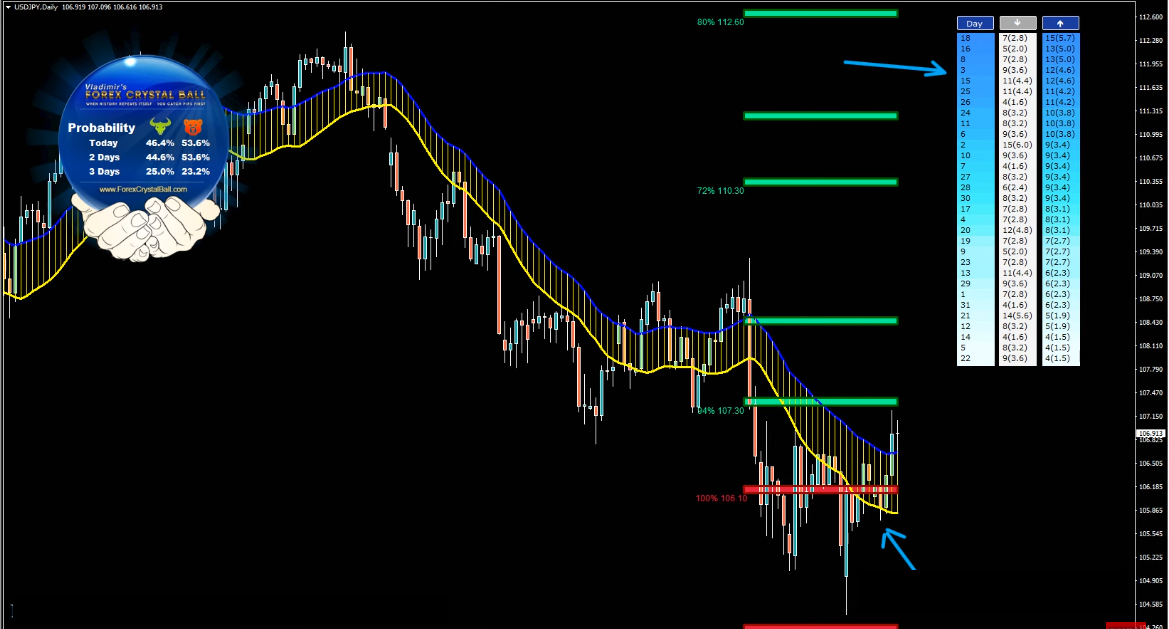

USDJPY

في هذا الزوج كنا نتوقع أن نرى دفع نحو الأسفل أقرب إلى مستوى 100 ٪ فيبو. وصل السعر قريبًا جدًا من هذا المستوى ، وقام بتنظيف القاع السابق بشكل جميل وخلق انحرافًا صعوديًا.

من المحتمل جدًا أن يكون هذا الزوج في دورة تصحيحية ، لذا فإن هناك احتمالية جيدة بأن نشهد توقفًا على المستوى النفسي عند 105 ، وفي حين أن هذا المستوى ثابتًا ، أتوقع أن أرى دورة تصحيحية نحو منطقة 108 ، 109.

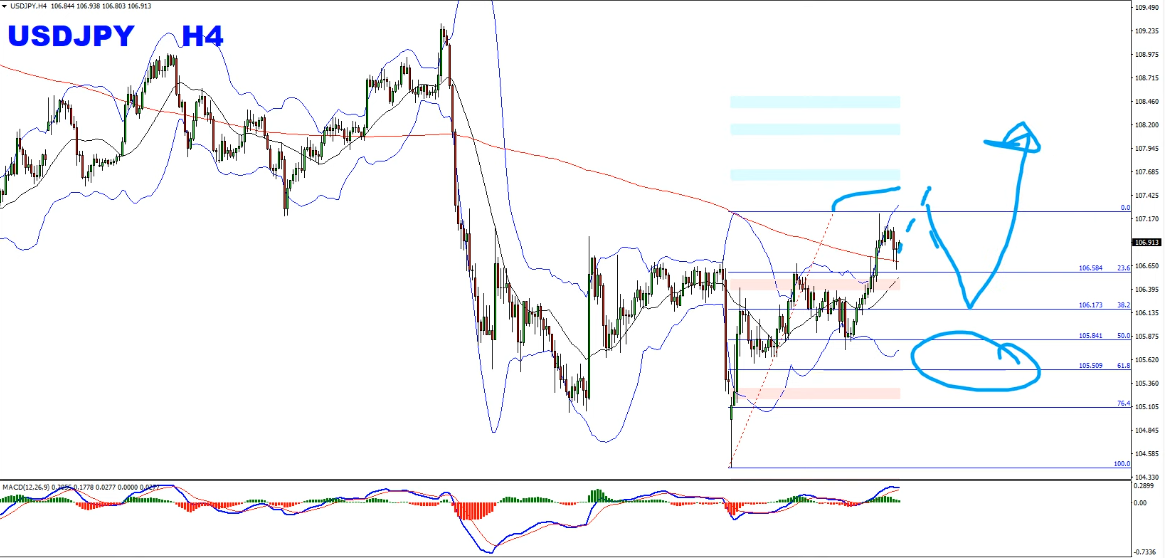

يدعم الرسم البياني H4 هذا الرأي من خلال توفير ثلاثة قمم مرتفعة وثلاثة قيعان أعلى ، مما يجعل الهيكل الصعودي. هذا يجعلني أعتقد أنه من المرجح أن نرى استمرارًا في الاتجاه الأقصر نحو منطقة 108 ، 109.

يدعم الرسم البياني H4 هذا الرأي من خلال توفير ثلاثة قمم مرتفعة وثلاثة قيعان أعلى ، مما يجعل الهيكل الصعودي. هذا يجعلني أعتقد أنه من المرجح أن نرى استمرارًا في الاتجاه الأقصر نحو منطقة 108 ، 109.

استنادًا إلى إحصائيات Crystal Ball ، يمكننا أن نرى أن التلاث هي منطقة قوية للغاية لحمل صعودي. لدينا حركة أولى مع ارتداد ونحن فوق القناة ، والآن يمكننا أن نرى أن القناة تبدأ في الاتجاه الصعودي. كما كان في المرة السابقة ، يجب أن تكون التوقعات هنا هي نفس الموجتين ، يجب أن نواجه موجتين أو على الأقل أي نوع من أنواع النطاق. في الثالث من الشهر ، كان لدينا تعليق جميل في المنطقة الموضحة في لقطة الشاشة وهذا ما يجعلني أعتقد أن هذا الزوج الآن في هيكل تصحيحي صعودي.

استنادًا إلى إحصائيات Crystal Ball ، يمكننا أن نرى أن التلاث هي منطقة قوية للغاية لحمل صعودي. لدينا حركة أولى مع ارتداد ونحن فوق القناة ، والآن يمكننا أن نرى أن القناة تبدأ في الاتجاه الصعودي. كما كان في المرة السابقة ، يجب أن تكون التوقعات هنا هي نفس الموجتين ، يجب أن نواجه موجتين أو على الأقل أي نوع من أنواع النطاق. في الثالث من الشهر ، كان لدينا تعليق جميل في المنطقة الموضحة في لقطة الشاشة وهذا ما يجعلني أعتقد أن هذا الزوج الآن في هيكل تصحيحي صعودي.

طالما أن السعر يحتفظ بحركة 61.8٪ من مستوى فايبوناتشي للشراء ، فإن الأدلة الصعودية يجب أن تكون خطة جيدة هنا.

طالما أن السعر يحتفظ بحركة 61.8٪ من مستوى فايبوناتشي للشراء ، فإن الأدلة الصعودية يجب أن تكون خطة جيدة هنا.

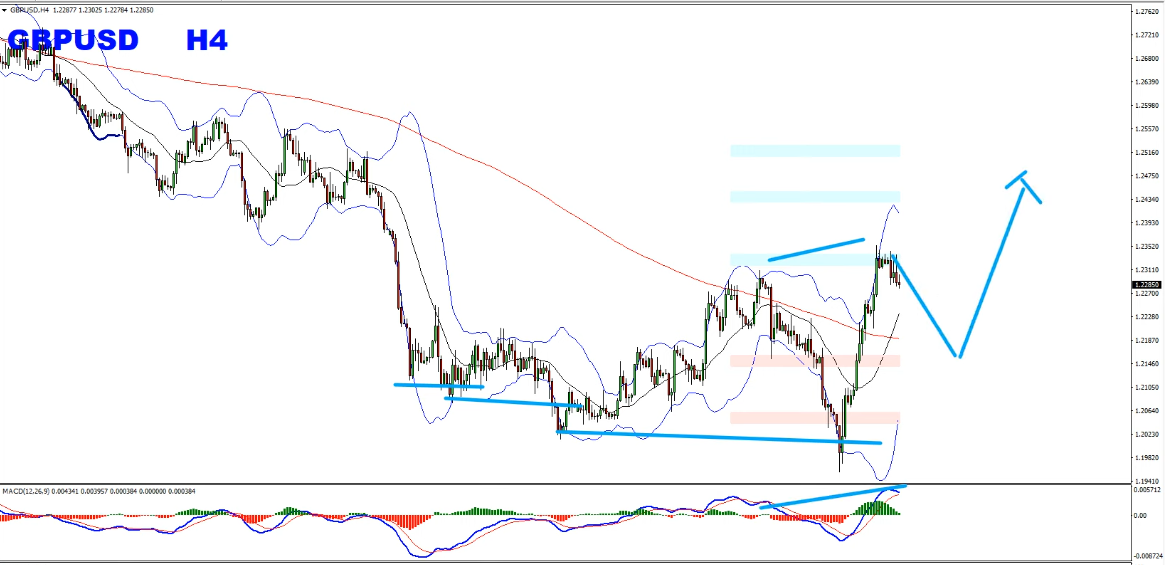

GBPUSD

في هذا الزوج كنا نتوقع أن نرى حركة هبوطية مع تصحيحات من الناحية المثالية للحصول على قاع جديد ، وصلنا إلى ما حدث بقليل تحت المنطقة المثالية ثم انتقلنا إلى أسفل وجعلناها تعمل. لدينا حاليًا دورة خاصة مع تباعد تصاعدي حيث قد تحدث الضلع الأول داخل الوضع التصحيحي الآن وقد يكون الوضع التصحيحي موجتين أو نطاق. حقيقة أن الفوضى الأساسية الحالية التي تحدث في المملكة المتحدة ينبغي أن تساعد الثيران في هذه الحالة. على افتراض أنه لا يوجد أي تغيير مجنون ، وبافتراض أن المحطة الأولى في طريقها للتطور ، يمكننا أن نرى ظروف الاتجاه بوضوح على الرسم البياني H1 لدينا أعلى المستويات المرتفعة والقيعان الأعلى ، لذا يجب أن تكون الخطة التصحيحية والشراء مع الأدلة الصعودية هي الخطة هنا.

إلى جانب الكسر الخاطئ لدينا أيضا التقارب هنا الذي يدعم للدورة التصحيحية. الشيء المهم للغاية هو معرفة أن هذه هي المحطة الأولى في هيكلها وهذا صحيح طالما أننا أعلى من فايبو 61.8 ٪. إذا انخفض السعر إلى ما دون مستوى فيبو 61.8 ٪ في طلقة واحدة ، سيتم إبطال هذه الفكرة. وفي الوقت نفسه أعتقد أننا في الدورة التصحيحية في شكل موجتين أو مجموعة.

ملاحظة: راقب الأخبار الأساسية.

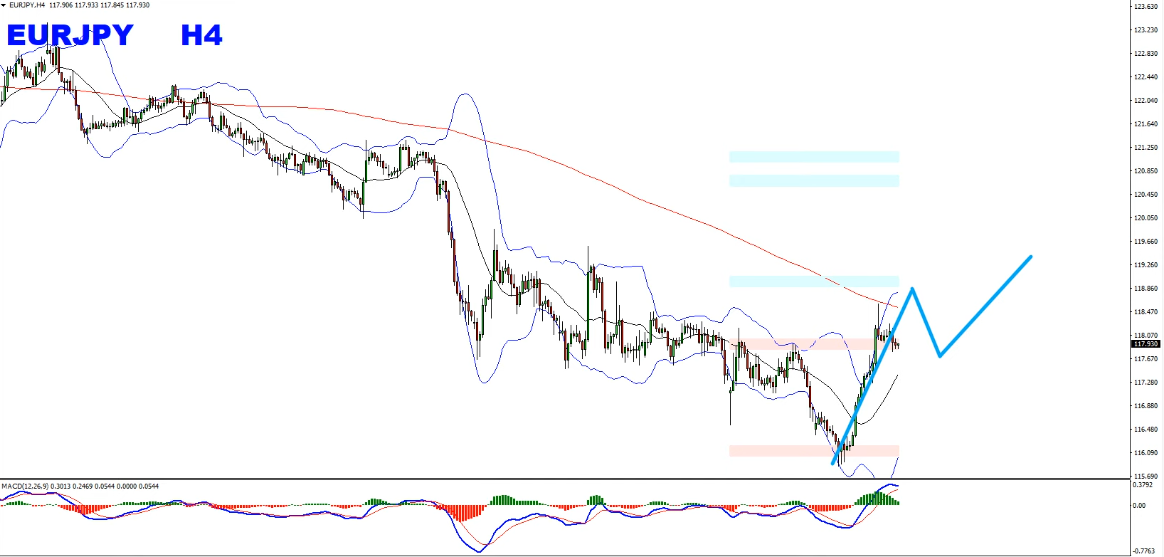

اليورو مقابل الين

في هذا الزوج ، كنا نتوقع أن نشهد دفعًا جديدًا نحو الأسفل ، وصلنا إلى الحد الأدنى حتى وصلنا إلى 117 وأدنى ، ووصلنا إلى أقرب إلى المستوى النفسي 115. الآن نحن في حالة انسداد ، ولدينا انحراف تصاعدي داخل دورة توقعاتي الشخصية هي لدورة تصحيحية في شكل موجتين أو نوع من النطاق.

لذا فإنني أتطلع إلى شراء عمليات الاسترداد مع الأدلة الصعودية في هذا الزوج.

لذا فإنني أتطلع إلى شراء عمليات الاسترداد مع الأدلة الصعودية في هذا الزوج.

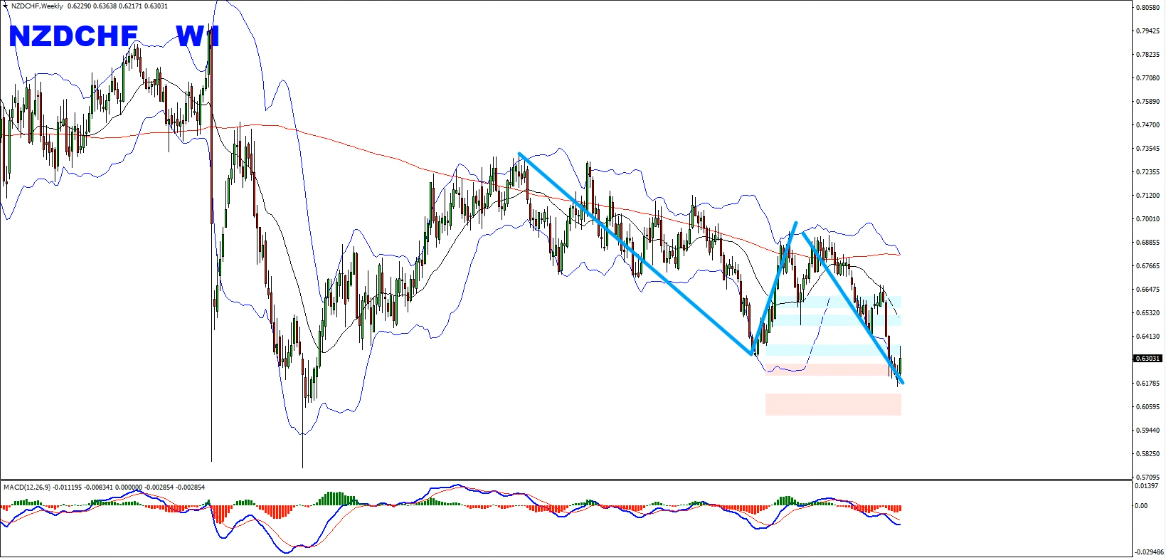

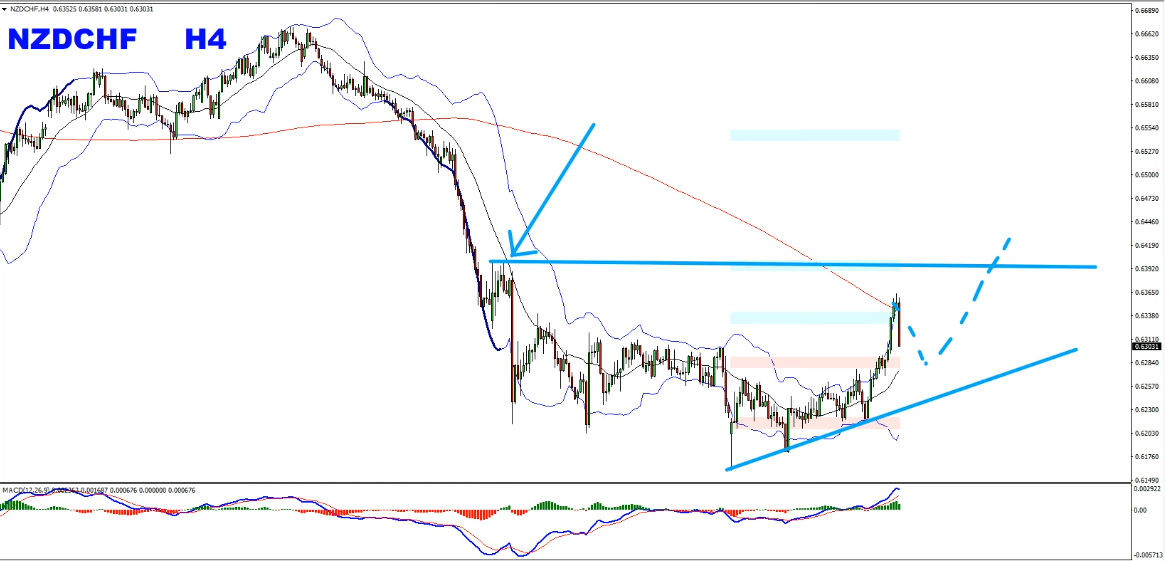

NZDCHF

في هذا الزوج ، كان توقعنا هو أن نرى قاعًا جديدًا وأن الرسم البياني H4 يقوم بإيقافه. على الرسم البياني اليومي ، حصلنا على الحركة الهبوطية التي كانت مسدودة بسبب الاختلاف الصعودي. على مخطط H4 ، أردنا أن نرى الاختلاف تم إنشاؤه من تلقاء نفسه بحيث عملت الخطة بشكل كلاسيكي. على الرسم البياني الأسبوعي في الوقت الحالي ، يبدو أن لدينا دورة موجات مزدوجة محتملة والسعر يحتفظ بمستوى 0.6250 النفسي (تجاوز هذا المستوى قليلاً ولكن تمسك به هناك).

هناك فرصة جيدة لأننا في شكل من أشكال دورة تصحيحية يمكن أن تكون في شكل موجتين أو مجموعة. في الوقت الحالي ، أعتقد أن هذا الزوج يجب أن يقدم دفعة أخرى وسأهدف إلى رؤية السعر يتجه نحو منطقة التخليص المعروضة في الصورة أو حتى من الناحية المثالية أعلى.

سيكون إبطال الفكرة ذلك خط الاتجاه الصعودي ، إذا ذهبنا دون ذلك فسوف أكون محايدًا وننتظر لنرى ما سيحدث بعد ذلك.

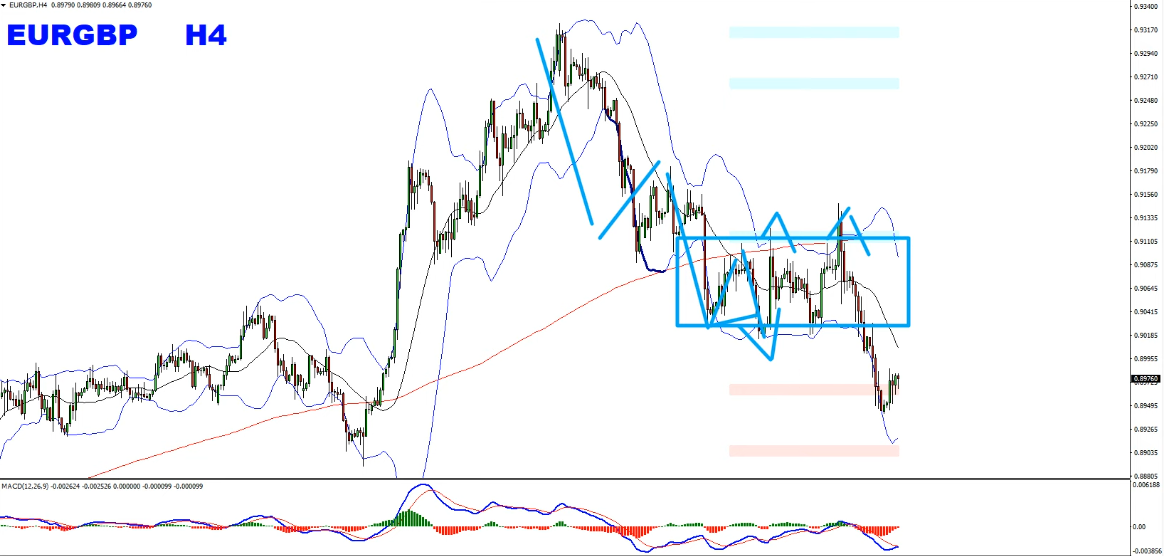

EURGBP

في هذا الزوج أردت رؤية الأمواج والتجمع. حصلنا على الأمواج وبعد ذلك تحولت إلى ثلاث موجات ثم حصلنا على التجمع الصغير (بصراحة كان أصغر مما كنت أتوقع) ولكن في تلك اللحظة حصلنا على دورة تتراوح بعد اختراقات خاطئة في الأعلى والأسفل داخل الثلاثة السفلي أعلى مستوياته ، هيكل أدنى مستوياته المنخفض الذي يجعله ظروف التداول. لهذا السبب ، قمت خلال الأسبوع بإرسال تنبيه بشأن البيع في فيديو التداول اليومي والذي يمكنك العثور عليه داخل قناة youtube الخاصة بي.

نظرًا لأنه لا يوجد أي انسداد مع المرحلة النامية الحالية ، أعتقد أن هناك المزيد لحد ما للذهاب إلى الجانب السلبي ، لذلك فإنني أتطلع إلى بيع المسيرات بأدلة هبوطية. بالمناسبة ، تدعم المحطة الحالية أيضًا فكرة المستويات المرتفعة المنخفضة ، والقيعان الأدنى مما يجعلها فرصة لطيفة للبحث عن بيع المسيرات.

نظرًا لأنه لا يوجد أي انسداد مع المرحلة النامية الحالية ، أعتقد أن هناك المزيد لحد ما للذهاب إلى الجانب السلبي ، لذلك فإنني أتطلع إلى بيع المسيرات بأدلة هبوطية. بالمناسبة ، تدعم المحطة الحالية أيضًا فكرة المستويات المرتفعة المنخفضة ، والقيعان الأدنى مما يجعلها فرصة لطيفة للبحث عن بيع المسيرات.

بالطبع سأحافظ على النظرة الهبوطية بأكملها طالما أننا دون منطقة تصحيح فيبو بنسبة 61.8 ٪ للحركة النامية. بمعنى آخر ، يمكننا القول إنه يجب أن يتناسب مع خط الترند الهابط ، طالما أننا دونه ، فإني أتطلع لبيع الارتفاعات على المدى القصير.

بالطبع سأحافظ على النظرة الهبوطية بأكملها طالما أننا دون منطقة تصحيح فيبو بنسبة 61.8 ٪ للحركة النامية. بمعنى آخر ، يمكننا القول إنه يجب أن يتناسب مع خط الترند الهابط ، طالما أننا دونه ، فإني أتطلع لبيع الارتفاعات على المدى القصير.

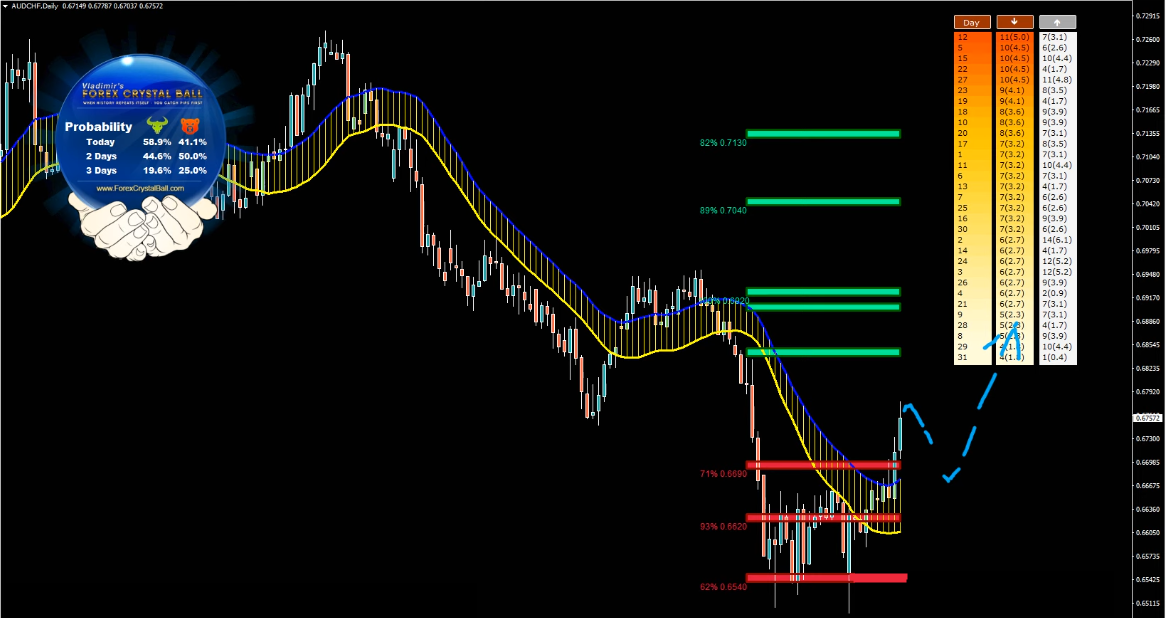

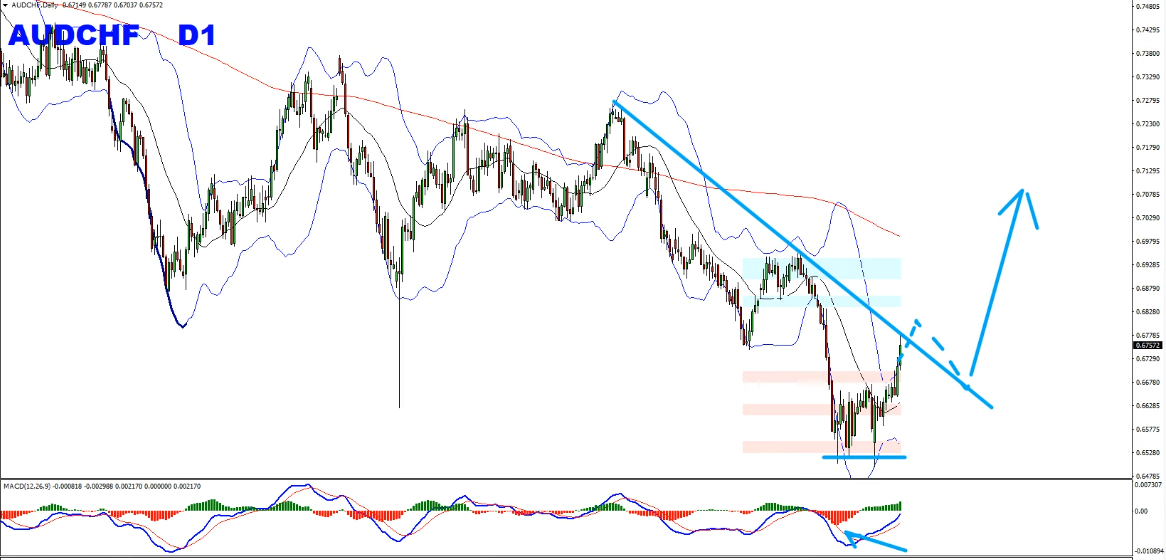

AUDCHF

في هذا الزوج على الرسم البياني الأسبوعي ، لدينا هيكل واضح لركوب الدورات كما هو موضح في لقطة الشاشة.

على الرسم البياني اليومي ، كان لدينا انسداد مع الاختراقات الخاطئة المتطرفة على أدنى المستويات ، مع الحفاظ على المستوى النفسي 0.65. إذا تمكن السعر من الاختراق فوق خط الاتجاه الهبوطي الموضح في الرسم البياني ، فإن الشراء من جديد مع الأدلة الصعودية سيكون أمرًا رائعًا.

على الرسم البياني اليومي ، كان لدينا انسداد مع الاختراقات الخاطئة المتطرفة على أدنى المستويات ، مع الحفاظ على المستوى النفسي 0.65. إذا تمكن السعر من الاختراق فوق خط الاتجاه الهبوطي الموضح في الرسم البياني ، فإن الشراء من جديد مع الأدلة الصعودية سيكون أمرًا رائعًا.

على الرسم البياني H4 ، يرتفع السعر إلى ثلاثة قمم مرتفعة وأدنى سعر وأعتقد أنه يجب أن يجد طريقة لمنع التجمعات حول المنطقة الموضحة في لقطة الشاشة ، وخلق دورة تصحيحية ، ثم سيكون من الجيد البحث عنها مزيد من فرص الشراء.

على الرسم البياني H4 ، يرتفع السعر إلى ثلاثة قمم مرتفعة وأدنى سعر وأعتقد أنه يجب أن يجد طريقة لمنع التجمعات حول المنطقة الموضحة في لقطة الشاشة ، وخلق دورة تصحيحية ، ثم سيكون من الجيد البحث عنها مزيد من فرص الشراء.

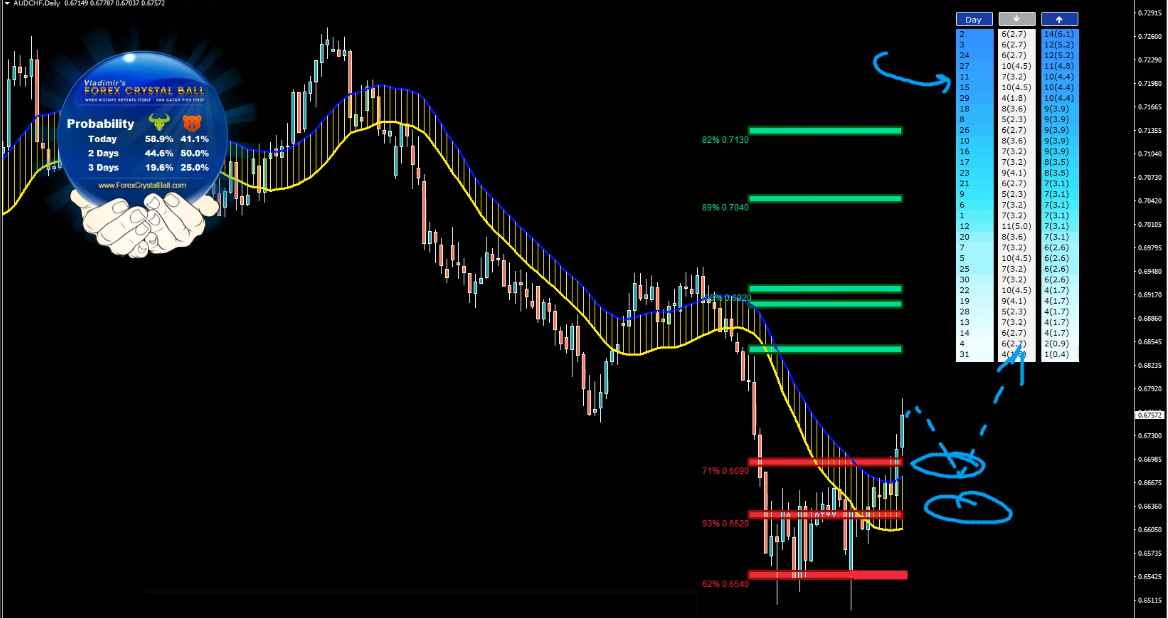

استنادًا إلى إحصائيات Crystal Ball ، يمكننا أن نرى أن الايام من 11 إلى 15 تناسبها تمامًا ، وإذا حصلنا على تصحيح تجاه هذه التواريخ ، فيجب أن تكون عمليات الشراء هي المتابعة مع المناطق الداعمة الموضحة في لقطة الشاشة.

استنادًا إلى إحصائيات Crystal Ball ، يمكننا أن نرى أن الايام من 11 إلى 15 تناسبها تمامًا ، وإذا حصلنا على تصحيح تجاه هذه التواريخ ، فيجب أن تكون عمليات الشراء هي المتابعة مع المناطق الداعمة الموضحة في لقطة الشاشة.

وفقًا للأرقام الهابطة ، بادئ ذي بدء ، يمكننا أن نرى أن القمة هي في المرتبة الخامسة والتي لم تقدم أي أسباب بيع ، وبالتالي فإن الأرقام التالية بعيدة ، وبالتالي يتراجع ويشتري المزيد من المنطقي في تلك الدورة النامية.

وفقًا للأرقام الهابطة ، بادئ ذي بدء ، يمكننا أن نرى أن القمة هي في المرتبة الخامسة والتي لم تقدم أي أسباب بيع ، وبالتالي فإن الأرقام التالية بعيدة ، وبالتالي يتراجع ويشتري المزيد من المنطقي في تلك الدورة النامية.

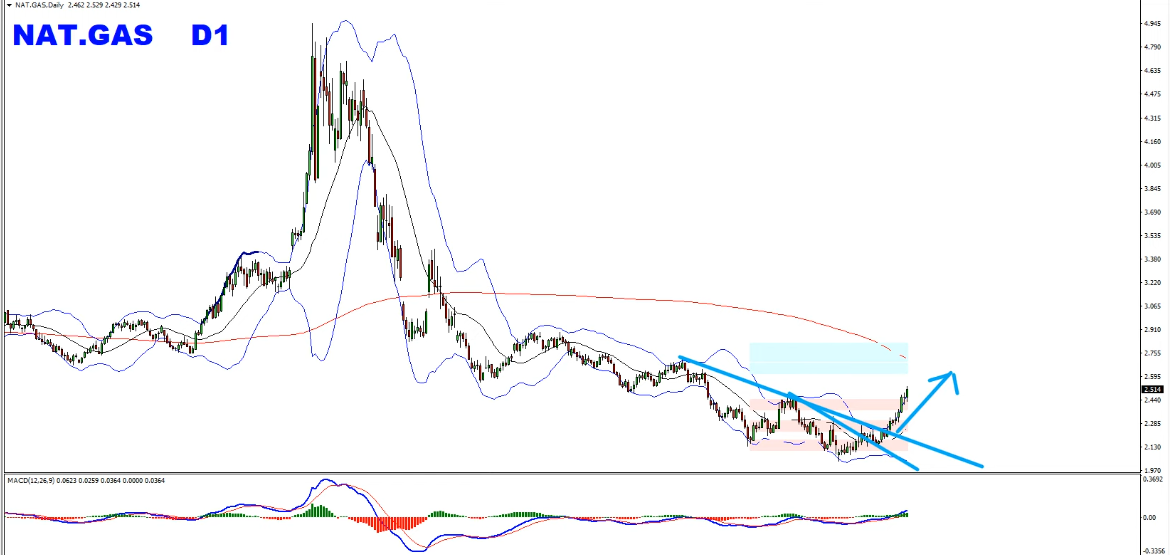

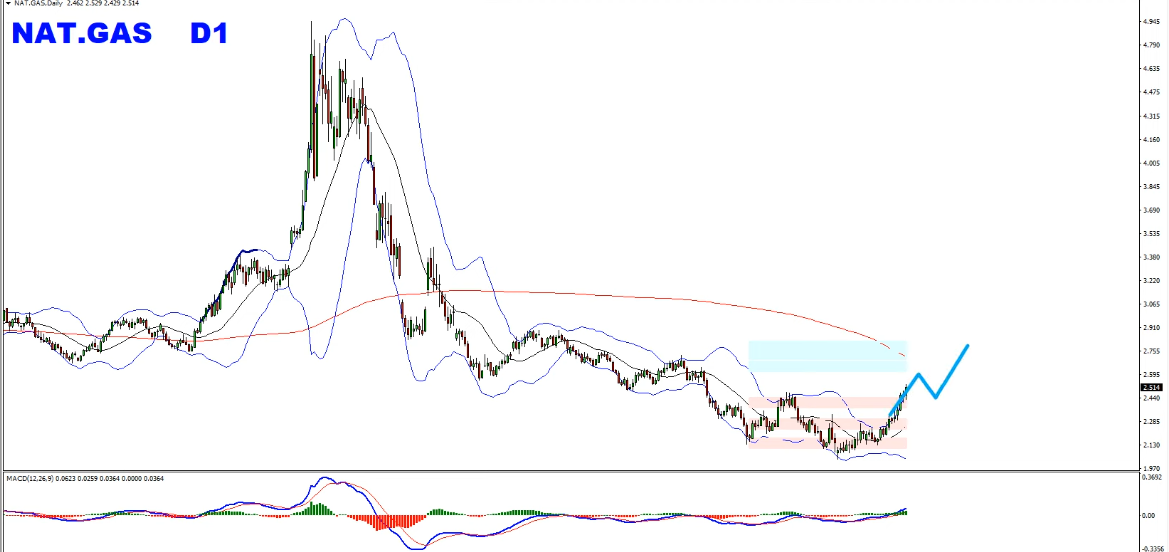

Natural Gas

في هذا ، كنا صعوديين بعد كسر خط الاتجاه الصغير وأردنا أن نرى كسر خط الاتجاه الأكبر للحصول على زخم أقوى. كما يمكنك أن ترى Natural Gal تحولت إلى واحدة من أفضل الصفقات في نهاية اليوم ، لذلك استمتع بأرباحك.

ما زلت أتوقع أن ترتفع ، بالطبع التصحيحات مقبولة لكنني أعتقد أن هناك المزيد في المستقبل.

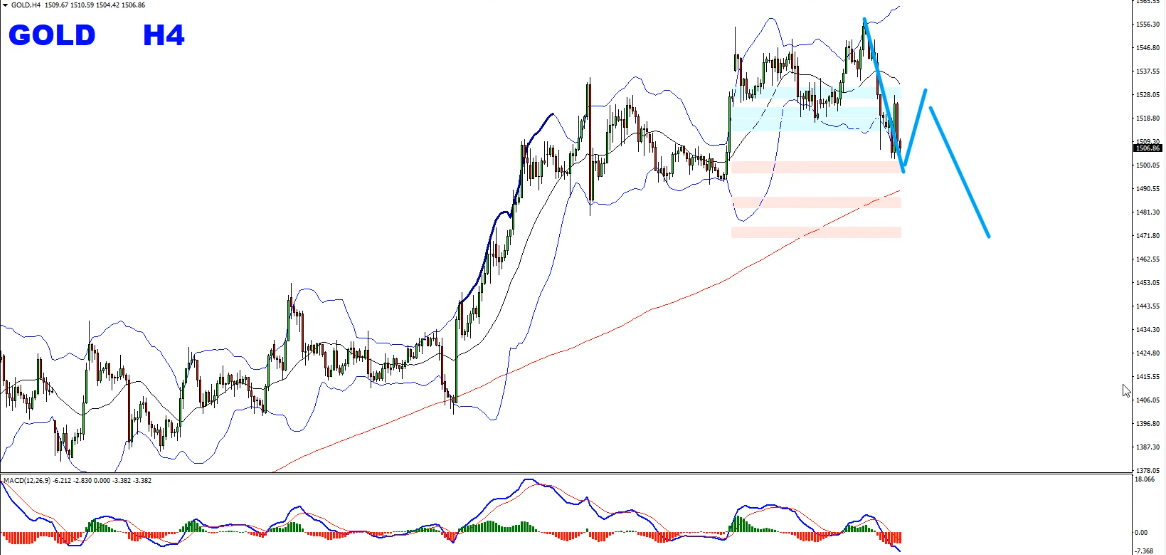

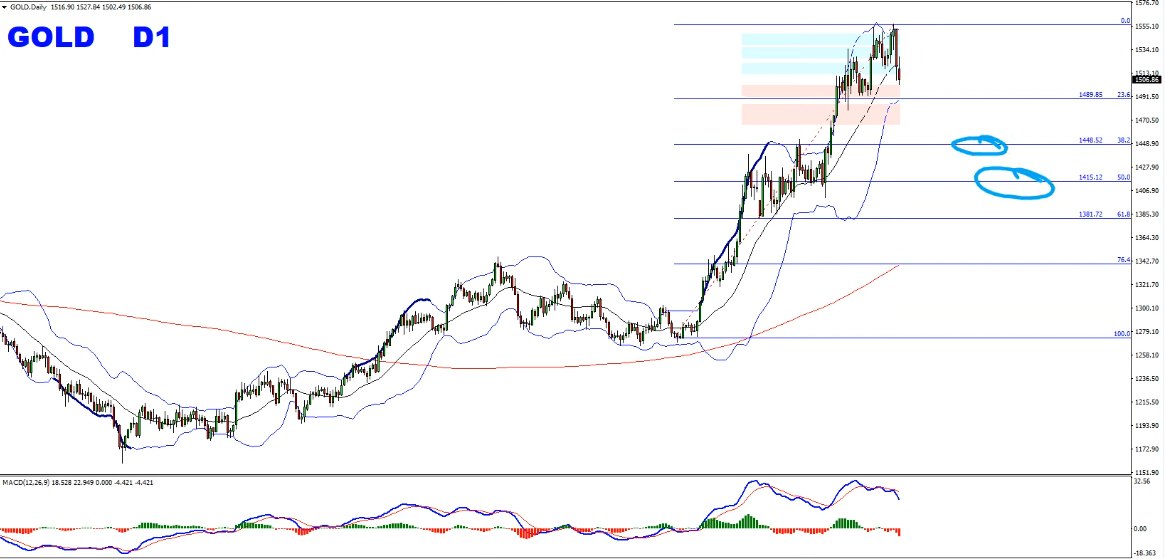

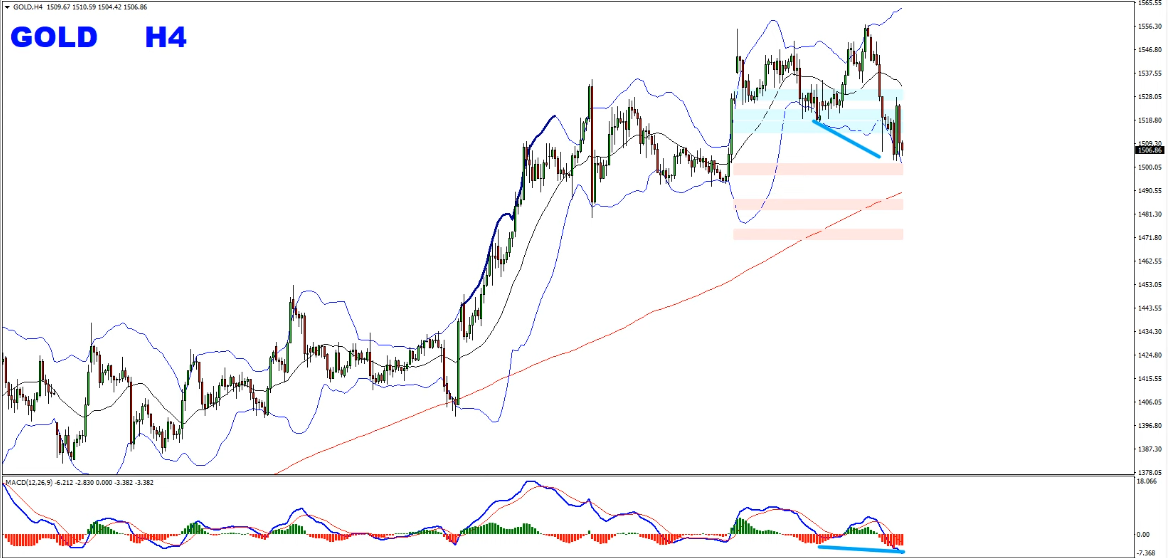

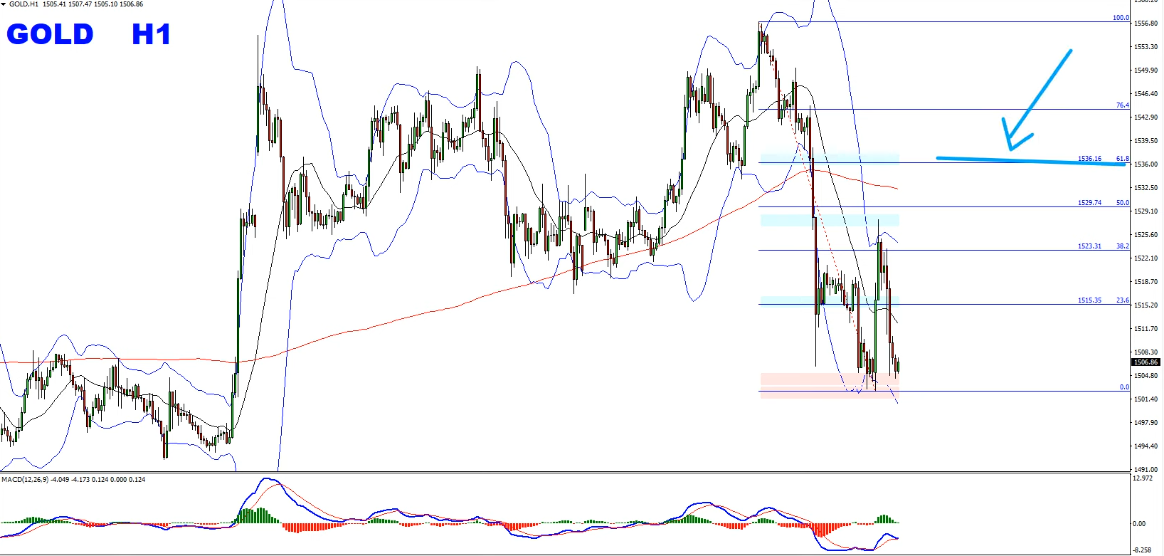

Gold

في الذهب لدينا دورات في الأسبوعية واليومية كما هو موضح في لقطة الشاشة ، لدينا أيضًا استراحة خاطئة في نهاية الدورة الثلاثية وانحراف هبوطي.

أنشأ مخطط H4 مبدأ أدنى المستويات المنخفضة والتقارب الهبوطي.

أنشأ مخطط H4 مبدأ أدنى المستويات المنخفضة والتقارب الهبوطي.

على الرسم البياني للنصف الأول ، أنشأ السعر بنية لاتجاه هبوطي وأي دورة تصحيحية في موجتين أو نطاق سيكون مقبولًا لعمليات البيع. بيع المسيرات مع الأدلة الهابطة ستكون الخطة هنا.

على الرسم البياني للنصف الأول ، أنشأ السعر بنية لاتجاه هبوطي وأي دورة تصحيحية في موجتين أو نطاق سيكون مقبولًا لعمليات البيع. بيع المسيرات مع الأدلة الهابطة ستكون الخطة هنا.

إذا حصلنا على ارتداد طلقة واحدة فوق مستوى فايبو 61.8 ٪ ، فإن فكرة البيع هذه سوف يتم إبطالها.

إلى أن يستقر السعر أدنى مستوى فايبو 61.8٪ ، أتوقع أن يتحرك السعر كما هو موضح في لقطة الشاشة على الرسم البياني H4.

إلى أن يستقر السعر أدنى مستوى فايبو 61.8٪ ، أتوقع أن يتحرك السعر كما هو موضح في لقطة الشاشة على الرسم البياني H4.

بالطبع سيكون من الرائع رؤية السعر ينخفض دون المستوى 1500 النفسي ، وإذا حدث ذلك ، فسنفتح الأبواب للدورة التصحيحية يوميًا ويمكنك أن ترى الأرقام في لقطة الشاشة التي تتراوح بين 1450 إلى 1415.

Dax

في Dax ، كان أحد السيناريوهات التي توقعناها هو تصحيح موجتين في هيكل مزدوج ثلاثي. لم ينجح السعر في الحفاظ على زخم الاستمرارية المباشرة ، كما طور الضلع الثاني في الاتجاه الصعودي الذي يكمل الدورة التصحيحية ونحن نحتفظ هنا بمنطقة مقاومة هائلة وأيضًا نتمسك بخط الاتجاه الهبوطي أيضًا. نريد أن نرى كسر خط الترند الصاعد لبدء البحث عن عمليات البيع التالية.

إذا كسر السعر فوق خط الاتجاه الهبوطي ، فينبغي أن نكون حذرين للغاية مع عمليات البيع المحتملة التالية.

ملاحظة: راقب الأخبار الأساسية.

ندعوك للانضمام إلي في غرف التداول الحية الخاصة بي ، وتحسين التداول الخاص بك معنا.

كما يمكنك الحصول على واحدة من استراتيجياتي مجانا. سوف تجد كل التفاصيل

نتمنى لك أسبوع تداول رائع

فلاديمير ريباكوف و اسر البدراوى