Arabic Telegram Group:

اضغط هنا للانضمام إلى مجتمع التليجرام الخاص بنا

مرحبا ايها المتداولين!

سنناقش حول صفقات شراء EURNZD في منشور التحليل الفني هذا. الأطر الزمنية الثلاثة التي سنحللها للعثور على أدلة صعودية ستكون الأطر الزمنية اليومية و H4 و H1 ، ونقوم بشكل رئيسي بهذا النوع من التحليل لأنه إذا حصلنا على أدلة تدعم اتجاهنا في ثلاثة أطر زمنية أو أكثر ، فسوف تقوم بالإعداد أقوى جدًا ، وهذا هو السبب في أنني أفضل دائمًا إجراء تحليل الإطار الزمني المعطي. أولاً ، لنبدأ مع الرسم البياني اليومي.

هل تبحث عن جودة تعليم الفوركس؟

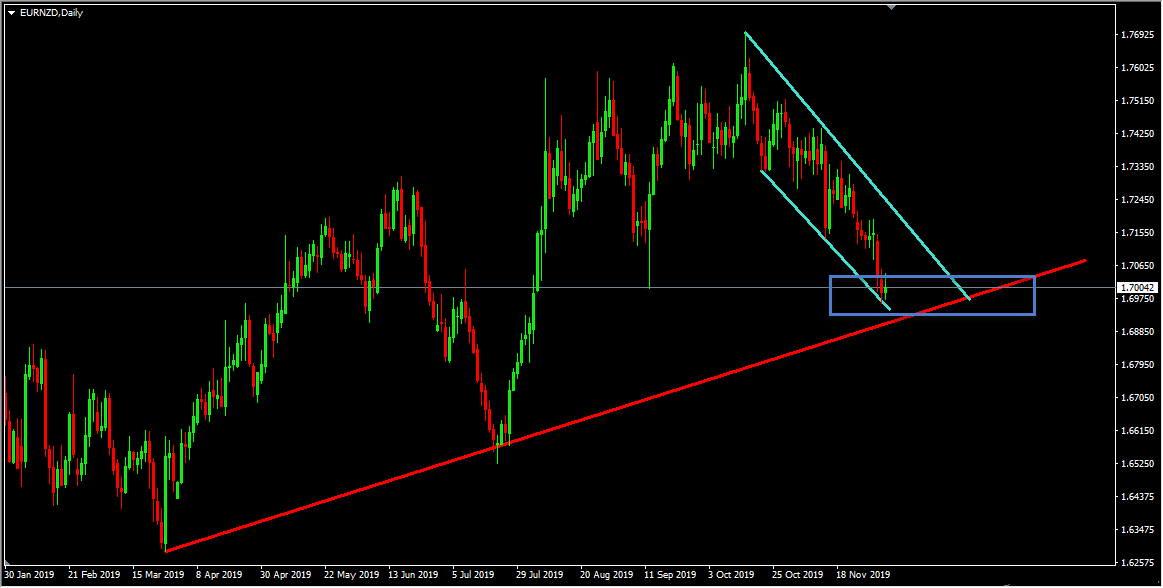

تحليل مخطط EURNZD D1 – القناة الهبوطية وخط الاتجاه الصعودي ومنطقة الدعم المهمة

على الرسم البياني اليومي ، يتحرك السعر داخل قناة هابطة بدأت هذه القناة من أعلى مستوى تشكل في 16 أكتوبر 2019 ومنذ ذلك الحين يحترم السعر هذه القناة ويتحرك داخلها. وصل السعر حاليًا إلى قاع هذه القناة الهابطة ، ولدينا أيضًا خط اتجاه صعودي يتزامن مع قاع هذه القناة وأنشأ منطقة دعم قوية (ملحوظة في مستطيل أزرق). وصل السعر إلى منطقة الدعم هذه وإلى أن تتمسك هذه المنطقة برأيي ، لا يزال هبوطي هنا.

تحليل مخطط EURNZD H4 – خط الاتجاه البديل

بالنظر إلى مخطط H4 ، يمكننا أن نرى أنه يمكننا أن نرى أن السعر قد أنشأ خط اتجاه بديل ويحترمه حتى الآن. لدينا أيضًا خط اتجاه بديل تشكل على مؤشر القوة النسبية أيضًا. وصل السعر الذي كان يتجه نحو الانخفاض إلى هذا الدعم الديناميكي ويتحرك حاليًا صعوديًا على الرسم البياني ومؤشر القوة النسبية. لذلك حتى يستقر السعر فوق هذا الدعم الديناميكي ، قد نبحث عن إعدادات صعودية مع أدلة صعودية من أجل الانضمام إلى المضاربين على الارتفاع.

ملاحظة: تذكر أنه عندما نرسم خطوط الاتجاه وأنماط المخططات الأخرى مثل المثلثات والقنوات وما إلى ذلك ، نريد أن نرى نقطتي لمس على الأقل (يلامس السعر خط الاتجاه). للنظر في خط النمط / الاتجاه صالح.

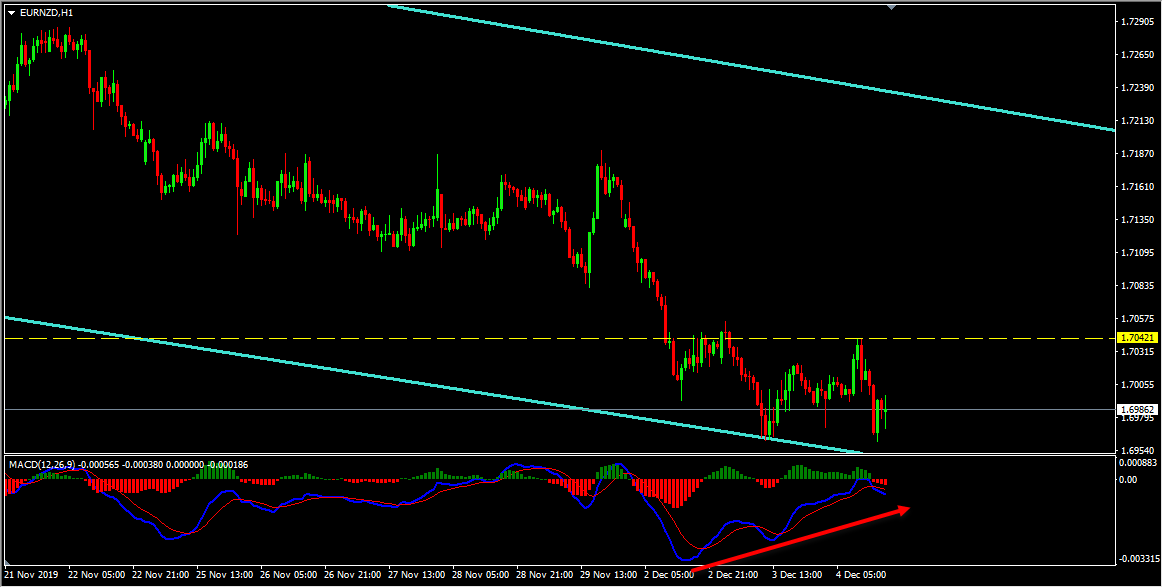

تحليل الرسم البياني EURNZD H1 – التباعد الصعودي

على الرسم البياني H1 ، يوجد تباعد تصاعدي يتشكل على أساس القاع الأول عند 1.69931 ، والقاع الثاني عند 1.69620 والأدنى الثالث عند 1.69608 استنادًا إلى المتوسطات المتحركة لمؤشر MACD. إذا تحرك السعر صعودًا واخترق أعلى مستوى تأرجح أخير عند 1.70421 ، فقد نبحث عن عمليات التراجع والشراء بمزيد من الأدلة الصعودية (أنماط الشموع ، الاختراقات الخاطئة ، كسر خط الاتجاه ، إلخ …).

كيف بالضبط تداول هذه الفرصة؟

هناك استراتيجيات تداول متعددة يمكن استخدامها في هذا الإعداد المحدد. إذا كنت ترغب في معرفة المزيد عن الطريقة التي نتعامل بها مع هذه الإعدادات ، تحقق من انضم إلى أكاديمية التجار الآن

EURNZD

ملخصالتحليل الفني والتنبؤ

تلخيص التحليل الذي أجريناه حتى الآن:

EURNZD D1 (Daily) Chart Analysis:

- قناة هابطة وخط اتجاه صعودي ومنطقة دعم مهمة

EURNZD H4 (4 Hours) Chart Analysis:

- خط الاتجاه البديل

EURNZD H1 (1 Hour) Chart Analysis:

- الاختلاف الصاعد

هل تريد مثل هذه التحليلات؟

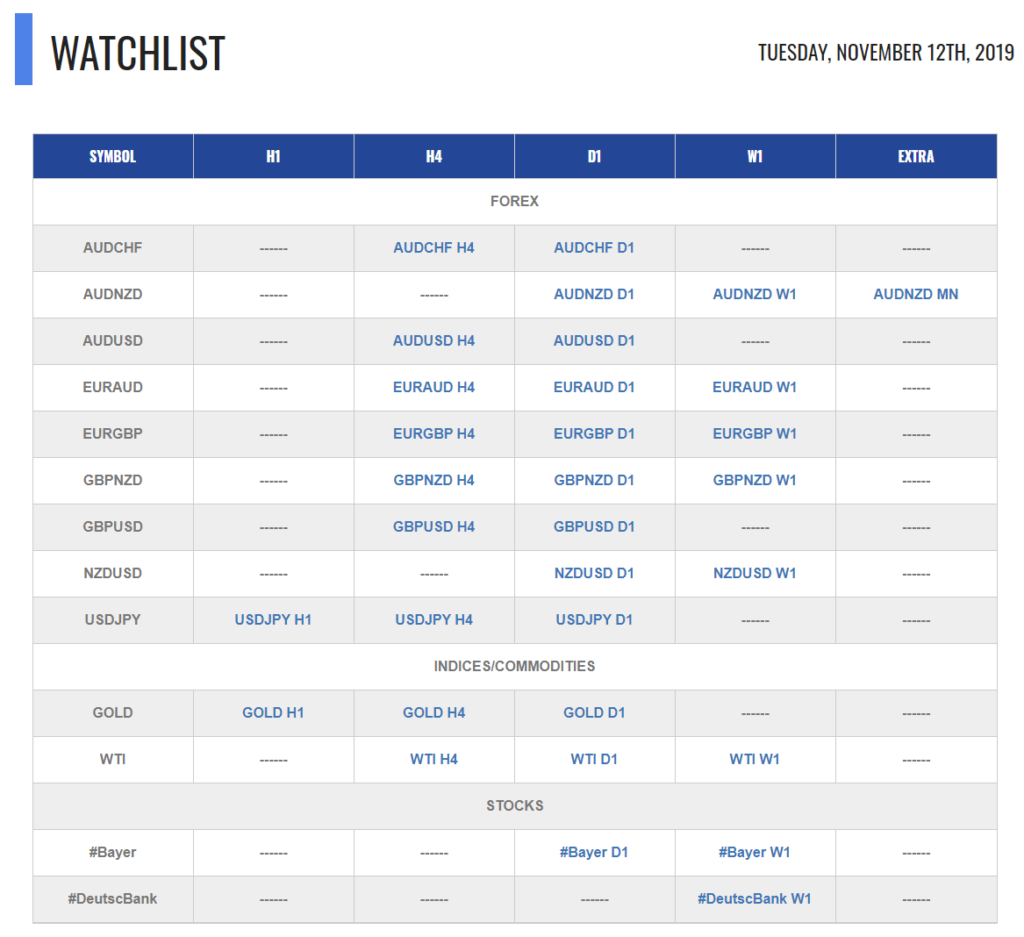

واحصل على قائمة المراقبة الكاملة والتقرير التجاري.

هكذا يبدو التقرير. جدول به أفضل الفرص المتاحة في السوق ، لقطة شاشة خلف كل زوج وإطار زمني (أي شيء باللون الأزرق داخل الجدول قابل للنقر ويؤدي إلى لقطة شاشة) + ملخص بتنسيق النص ، نوع من الإبرازات. وبالطبع غرفة التداول الحية كل يوم:

كما يمكنك الحصول على واحدة من استراتيجياتي مجانا. سوف تجد كل التفاصيل

مع تحياتنا

فلاديمير و اسر البدراوى