Arabic Telegram Group:

اضغط هنا للانضمام إلى مجتمع التليجرام الخاص بنا

مرحبا ايها المتداولين!

تحديث ومتابعة إعداد بيع NZDCHF هنا. في التاسع من كانون الثاني (يناير) ، شاركت هذه الفكرة التجارية “التحليل الفني – NZDCHF Sell Trade Idea” هذه الفكرة دفعتنا بشكل مثير للدهشة وقمنا بجمع أرباح جيدة معها. وفقًا للسيناريو الحالي ، لا توجد أدلة ضد المضاربين على الانخفاض في هذا الزوج ويبدو أن المضاربين على الانخفاض سيستمرون في الاتجاه الهبوطي. لذلك حتى نحصل على أي دليل معاكس وجهة نظري لا يزال هابط هنا. كالمعتاد ، سأجري تحليل الإطار الزمني المتعدد وسأوضح الأدلة التي تدعم وجهة النظر الهبوطية هذه.

فوت هذه الفرصة؟

لا تفوت فرصةتداول مرة أخرى! انضم إلى قناة Telegram المجانية –

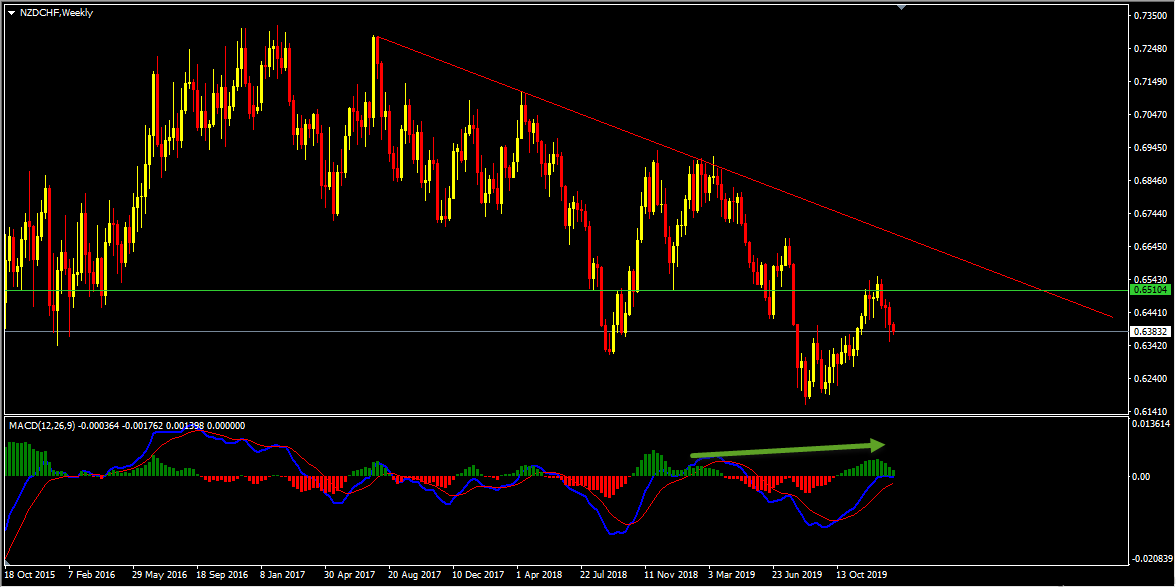

تحليل NZDCHF W1 (أسبوعي) – خط الاتجاه الهبوطي ، التباعد الخفي الهابط

على الرسم البياني الأسبوعي ، لدينا خط الاتجاه الهبوطي الذي تشكل بمثابة مقاومة ديناميكية بالنسبة لنا والثبات دون ذلك. إلى أن يظل السعر أدنى هذه المقاومة الديناميكية ، فإن رأيي يظل هابطًا. بالإضافة إلى ذلك ، لدينا أيضًا تباعد هبوطي خفي تشكل بين أعلى سعر عند 0.66699 والثاني عند 0.65510 استنادًا إلى مؤشر MACD ، فقد نعتبر هذا دليلًا على الضغط الهبوطي. قد نبحث الآن عن المزيد من الأدلة على الضغط الهبوطي على الأطر الزمنية الدنيا للانضمام إلى الدببة.

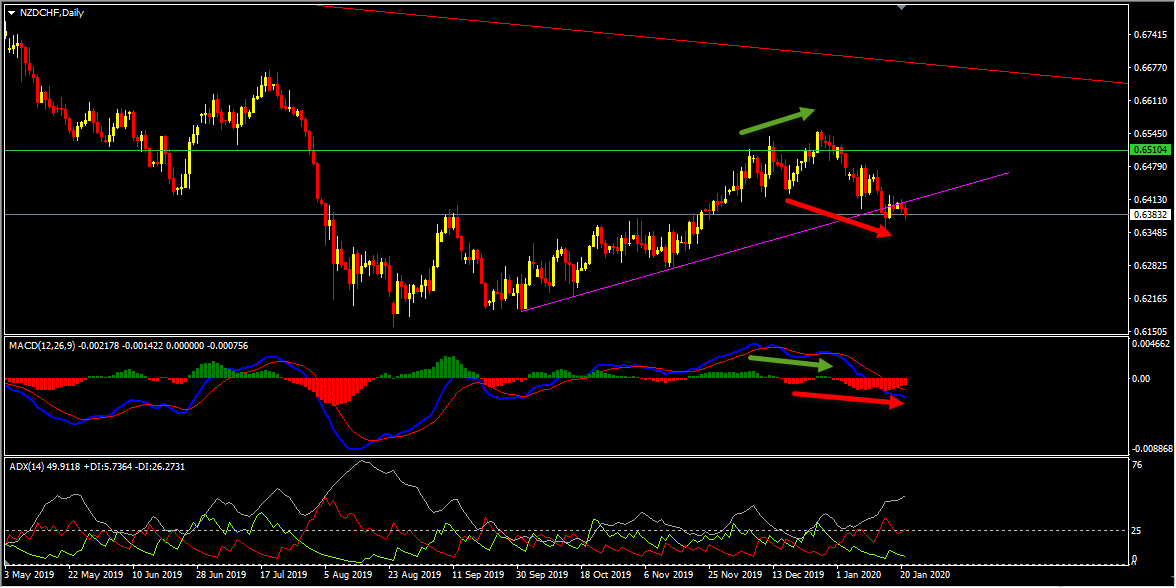

تحليل NZDCHF D1 (يوميًا) – التقارب الهبوطي ، اختراق خط الاتجاه الصعودي ، مؤشر ADX

على الرسم البياني اليومي ، أنشأ السعر إعدادًا كلاسيكيًا ، كان لدينا تباعد هبوطي ، ثم تحرك السعر هبوطيًا وخلق أدنى مستوياته وبالتالي شكّل تقاربًا هبوطيًا بالنسبة لنا ، وقد نعتبر هذا دليلًا على الضغط الهبوطي. وفقًا لسيناريو الكتاب ، قد نتوقع الآن حدوث عمليات انسحاب ، ويبدو أن التراجع يحدث حاليًا. بالإضافة إلى ذلك ، أعطى مؤشر ADX إشارة هبوطية عند تقاطع -DI (خط أحمر) مقابل + DI (خط أخضر) وخط الإشارة الرئيسي (الخط الفضي) يقرأ القيمة أكثر من 25. وبالتالي فإن الخلاصة هنا هي أن يحتوي الرسم البياني اليومي على أدلة تدعم وجهة النظر الهبوطية.

NZDCHF H4 Chart Analysis – نموذج الاتجاه الهابط ، التباعد الخفي الهابط

على الرسم البياني H4 ، خلق السعر الذي كان يتحرك هبوطًا نمط اتجاه هبوطي عمومًا وفقًا لسيناريو الكتاب ، وقد نتوقع الآن حدوث تصحيحات محتملة ، في الوقت الحالي يحدث التصحيح الذي كنا نبحث عنه. بالإضافة إلى ذلك ، لدينا أيضًا تباعد هبوطي مخفي تشكل بين أعلى مستوى عند 0.64716 والثاني عند 0.64201 استنادًا إلى مؤشر MACD والذي قد نعتبره دليلًا على الضغط الهبوطي. قد نبحث الآن عن الإعدادات الهبوطية مع المزيد من الأدلة الهبوطية (أنماط الشموع ، الاختراقات الخاطئة ، كسر خط الاتجاه ، إلخ …) من أجل البدء في البحث عن عمليات البيع.

أدعوك للانضمام إلي في غرف التداول الحية الخاصة بي ، وتحسين التداول الخاص بك معنا.

انضم الي أكاديمية المتداولين الان

كما يمكنك الحصول على واحدة من استراتيجياتي مجانا. سوف تجد كل التفاصيل هنا

مع تحياتنا

فلاديمير و اسر البدراوى