Arabic Telegram Group:

اضغط هنا للانضمام إلى مجتمع التليجرام الخاص بنا

مرحبا ايها المتداولين!

يبدو أن السوق يتماسك منذ بداية الأسبوع ، على الأقل على غالبية الأدوات التي نتبعها. الدولار الاسترالي / الين الياباني من بين الأزواج الموجودة حاليًا في وضع التصحيح ، مما يشكل مثلثًا متماثلًا على الرسم البياني H4. الإعدادات اليومية / سلخ فروة الرأس المدفوعة بالفعل بناءً على FX Delta ، ولكن الغرض من هذه المقالة هو تحديد طريقة العرض على المدى الطويل استنادًا إلى التحليل الفني.

AUD/JPY D1 (Daily) chart

خط الاتجاه الهابط ، ونموذج ABCD ، وتوسع فيبوناتشي

عند إجراء تحليل من أعلى إلى أسفل ، بدءًا من مخطط D1 ، نجد خط اتجاه هبوطي من أعلى المستويات في 83.90 – ديسمبر 2018 و 80.70 على التوالي في نهاية أبريل 2019.

يتطابق مستوى المقاومة الرئيسي في المنطقة بين 76.15 و 75.40 مع خط الاتجاه الهابط والمكان الذي قابل فيه السعر كلاهما. كانت النتيجة الرفض الفوري تقريبًا وسيطر البائعون على دفع السعر دون مستوى 75.40.

فاتتك عن هذه الفكرة؟

لا تفوت فرصة التجارة مرة أخرى! انضم إلى قناة Telegram المجانية –

نظرًا لأن الزوج في اتجاه هبوطي ، يجب علينا أيضًا متابعة الأنماط التصحيحية. نجد نموذج ABCD الصعودي ، باستخدام أداة Fibonacci Expansion ، التي تقيس الساقين الصعوديتين ابتداءً من نهاية أغسطس 2019 عند 69.90 للنقطة الثانية عند 75.50 ، وهو أعلى ارتفاع في الضلع الأول والنقطة الثالثة في بداية أكتوبر 2019 في 71.70.

أخيرًا وليس آخرًا ، خط الاتجاه الصعودي الأخضر. يختبر الزوج حاليًا هذا الدعم الديناميكي ويستقر حتى الآن فوقه.

AUD/JPY H4 (4 hours) chart

مثلث متماثل ، 3 مستويات نقطة محورية رئيسية

بعد الاتجاه الهبوطي القوي من بداية الشهر ، بدءًا من 75.60 ، وجد الزوج الدعم عند خط الاتجاه الصعودي الذي ذكرناه أعلاه. بدأ التوحيد وننظر حاليًا في نمط مثلث متماثل. الاختراق تحت نمط المثلث هذا يعني أيضًا اختراق أسفل خط الاتجاه الصعودي (الخط الأزرق) ، مما سيكون تأكيدًا جيدًا للضغط الهبوطي وعمليات البيع المحتملة.

عند تطبيق النقاط المحورية على المخطط ، فإننا نكتشف ثلاث مناطق تتركز فيها النقاط المحورية المتعددة (من الرسوم البيانية اليومية والأسبوعية والشهرية).

يمثل المستطيل الأخضر المنطقة الواقعة بين 74.30 إلى 74.15. المحور الأسبوعي – المقاومة 1 ، المحور اليومي – المقاومة 1 و 2 تشكل هذه المنطقة. في الواقع ، يمكننا استخدام هذه المنطقة كمنطقة إبطال لإعداد التداول الهبوطي.

أدناه ، يوجد في منتصف المثلث المتماثل 4 محاور تشكل النطاق بين 73.90 إلى 73.75 ، مع وضع علامة مستطيل رمادي على لقطة الشاشة.

في الأسفل ، لدينا دعم رئيسي آخر من 73.55 إلى 73.35 ، باللون البرتقالي.

يجب أن نولي اهتمامًا وثيقًا لمستويات الدعم والمقاومة هذه عندما تظهر الاختراقات (الاختراق في أي من الاتجاهين) جنبًا إلى جنب مع حركة السعر التي ستشكل خلال فترات الاستراحة.

هل تريد مثل هذه التحليلات؟

انضم إلى أكاديمية التجار الآن واحصل على قائمة المراقبة الكاملة والتقرير التجاري.

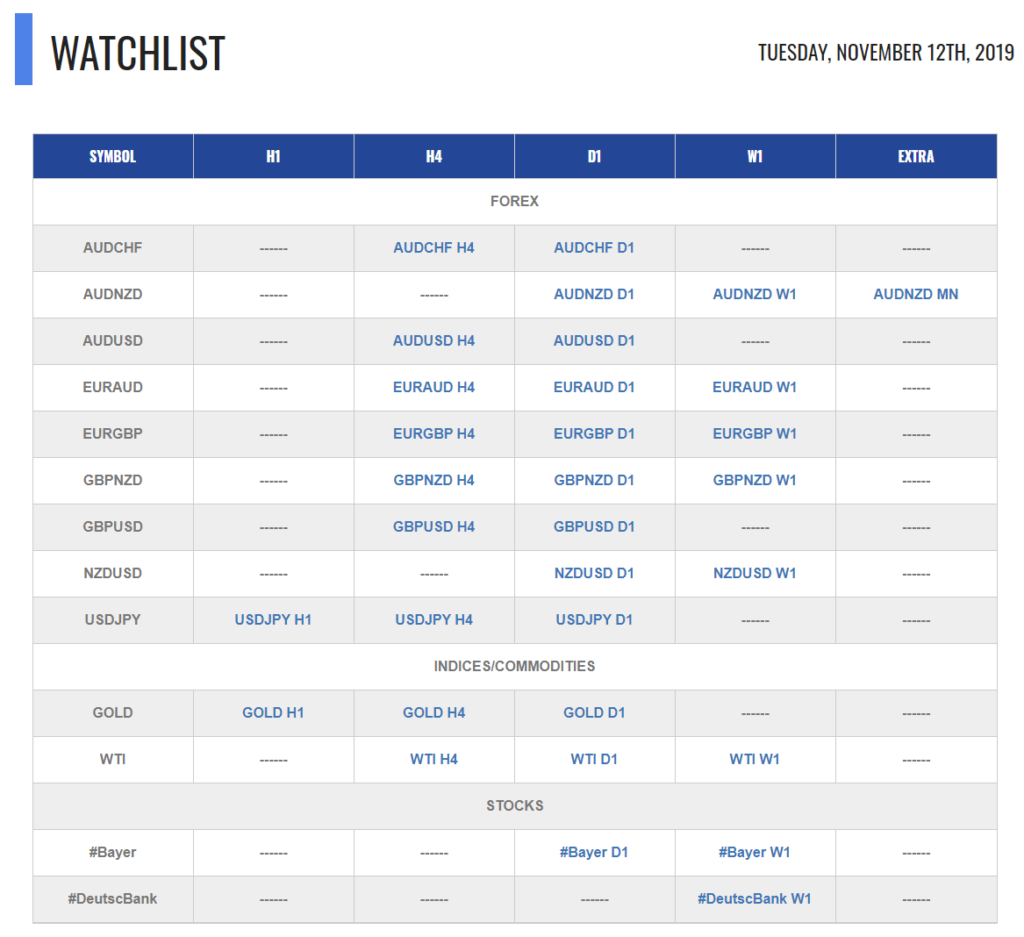

هكذا يبدو التقرير. جدول به أفضل الفرص المتاحة في السوق ، لقطة شاشة خلف كل زوج وإطار زمني (أي شيء باللون الأزرق داخل الجدول قابل للنقر ويؤدي إلى لقطة شاشة) + ملخص بتنسيق النص ، نوع من الإبرازات. وبالطبع غرفة التداول الحية كل يوم:

نصائح التداول:

يوصى دائمًا بالبحث عن التأكيدات قبل القفز في أي عملية تداول. إذا لم تكن متأكدًا من كيفية تداول إعداد ، يمكنك استخدام أي إعداد واستراتيجية لديك في ترسانتك للبحث عن التحركات الصعودية والانضمام إلى صفقة الشراء هذه.

لست متأكدًا من كيفية اكتشاف الانعكاسات (الارتداد)؟ لست متأكدًا من كيفية اكتشاف الاختراقات؟

أدعوك للانضمام إلي في غرف التداول الحية الخاصة بي ، وتحسين التداول الخاص بك معنا

كما يمكنك الحصول على واحدة من استراتيجياتي مجانا. سوف تجد كل التفاصيل

مع تحياتنا

فلاديمير و اسر البدراوى