Arabic Telegram Group:

اضغط هنا للانضمام إلى مجتمع التليجرام الخاص بنا

مرحبا ايها المتداولين!

فيما يلي ملخص الأداء الأسبوعي لاستراتيجياتي في 14 فبراير 2020 – من التداولات التي تمت باستخدام استراتيجياتي المتعددة (sRs Trend Rider Pro) و (Forex Triple B 2.0) و (Forex Crystal Ball) و (Divergence University) و (FX Delta)

لقد كان أسبوع تداول جيد. تعد Divergence University الأفضل أداءً هذا الأسبوع حيث حققت أرباحًا بنسبة 1.7٪ ، ثم لدينا Forex Triple B 2.0 بأرباح + 1.6٪ ، و sRs Pro بأرباح + 1.19٪ ، و FX Delta بأرباح + 0.34٪ ، وبعد ذلك لدينا sRs Trend Rider 2.0 التي انتهت بخسارة.

يمكنك الحصول على واحدة من استراتيجياتي مجانا. سوف تجد كل التفاصيل هنا

أدعوك للانضمام إلي في غرف التداول الحية الخاصة بي ، وتحسين التداول الخاص بك معنا.

انضم الي أكاديمية المتداولين الان

ملخص الأداء الأسبوعي

|

Divergence University

|

مجموع النقاط

+36.7

|

العائد على الاستثمار

+1.7%

|

|

Forex Triple B 2.0

|

مجموع النقاط

+149.5

|

العائد على الاستثمار

+1.6%

|

|

sRs PRO

|

مجموع النقاط

+58.8

|

العائد على الاستثمار

+1.19%

|

|

FX Delta (Yordan)

|

مجموع النقاط

+23

|

العائد على الاستثمار

+0.34%

|

|

sRs Trend Rider 2.0

|

مجموع النقاط

-8.3

|

العائد على الاستثمار

-0.04%

|

|

المجموع

|

مجموع النقاط

+259.7

|

العائد على الاستثمار

+4.79%

|

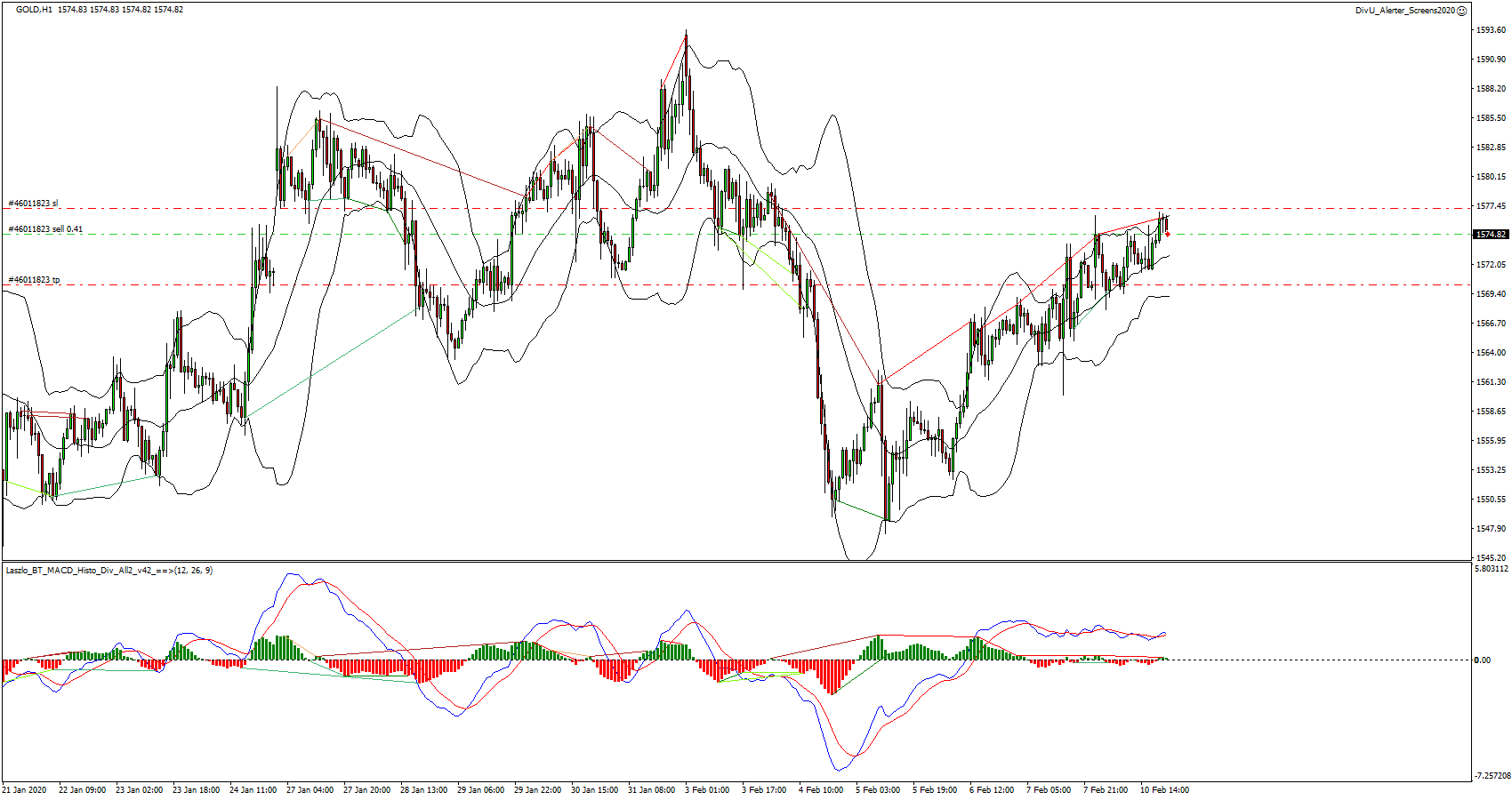

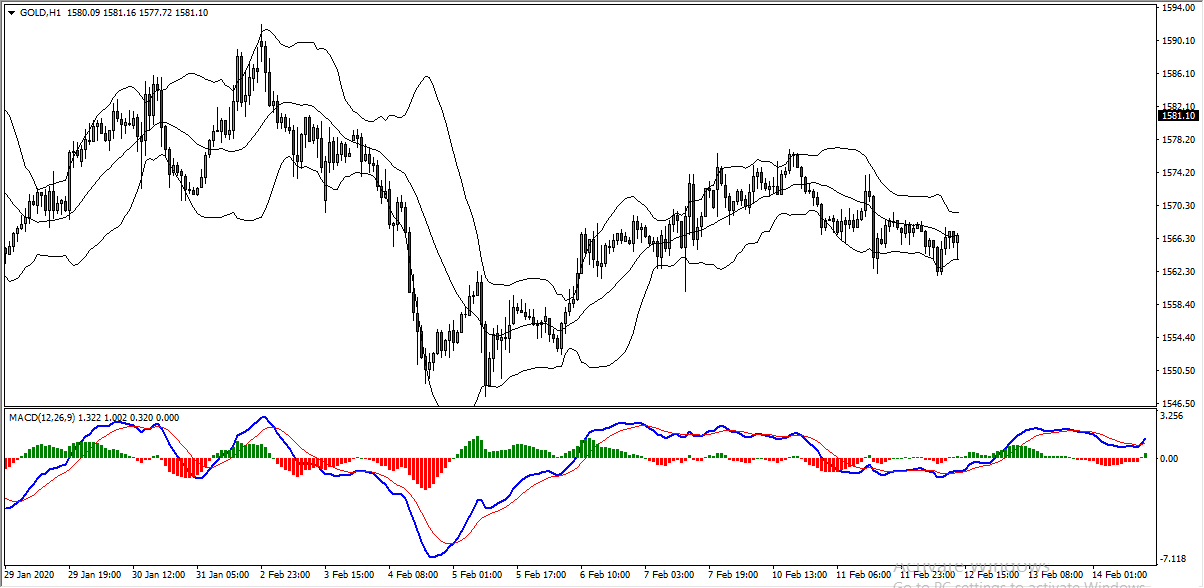

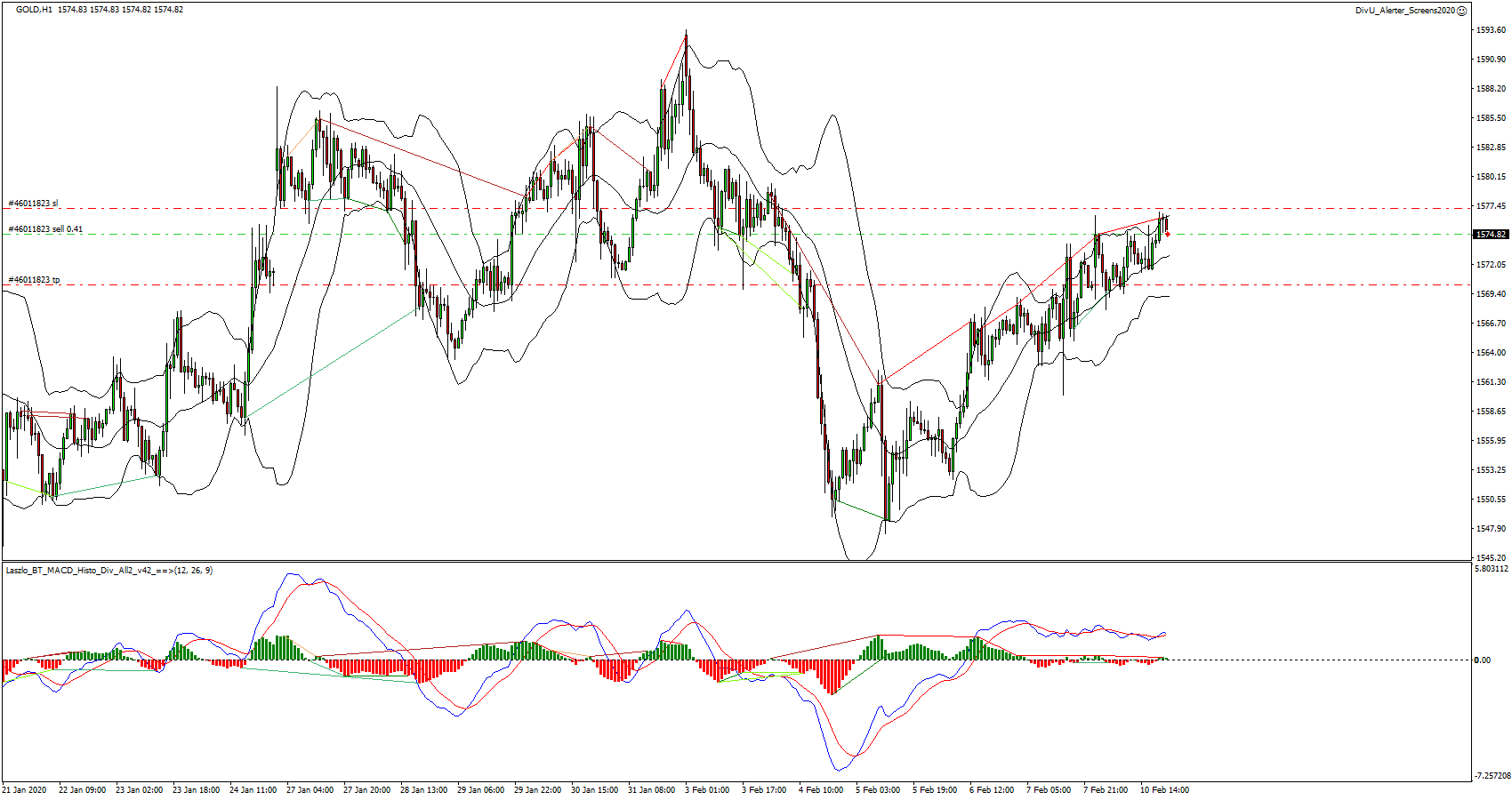

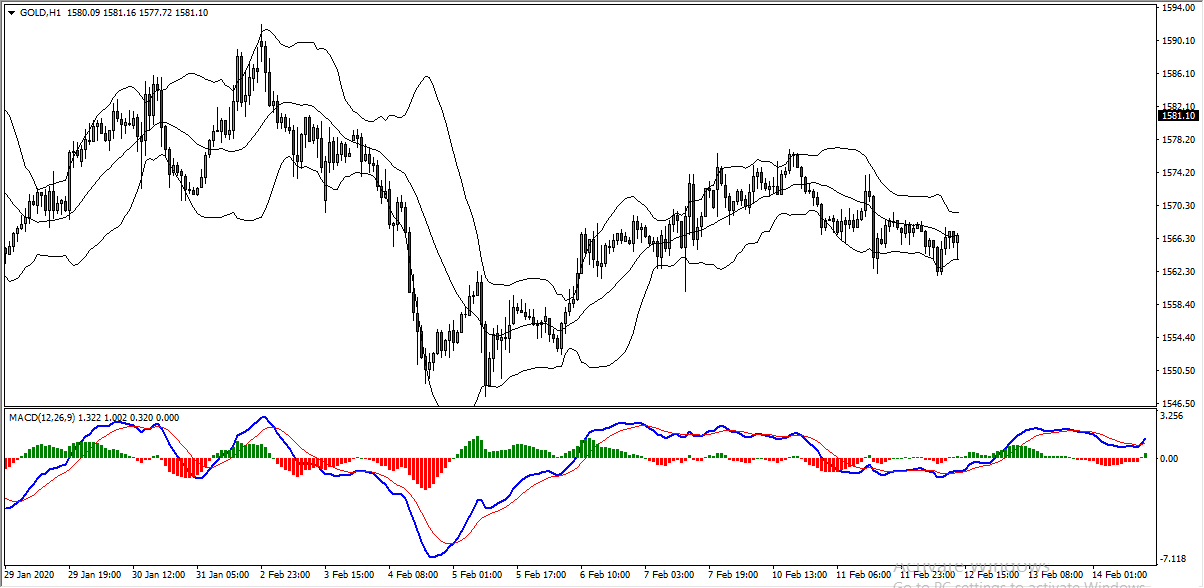

Divergence University

في الذهب ، حققنا زخمًا صعوديًا وأنشأ السعر أعلى مستوياته بين أعلى قمة تشكلت في 6 فبراير 2020 والثاني الذي تشكل في 10 فبراير 2020. في حين كان لدينا أعلى مستويات منخفضة على مؤشر MACD لتشكيل تباعد هبوطي . وبالتالي دخلنا في هذه التجارة على أساس مبدأ التباعد الهابط والسعر تحرك في صالحنا ، انتهت هذه التجارة مع أرباح جيدة تصل إلى مستوى جني الأرباح.

دخول

خروج

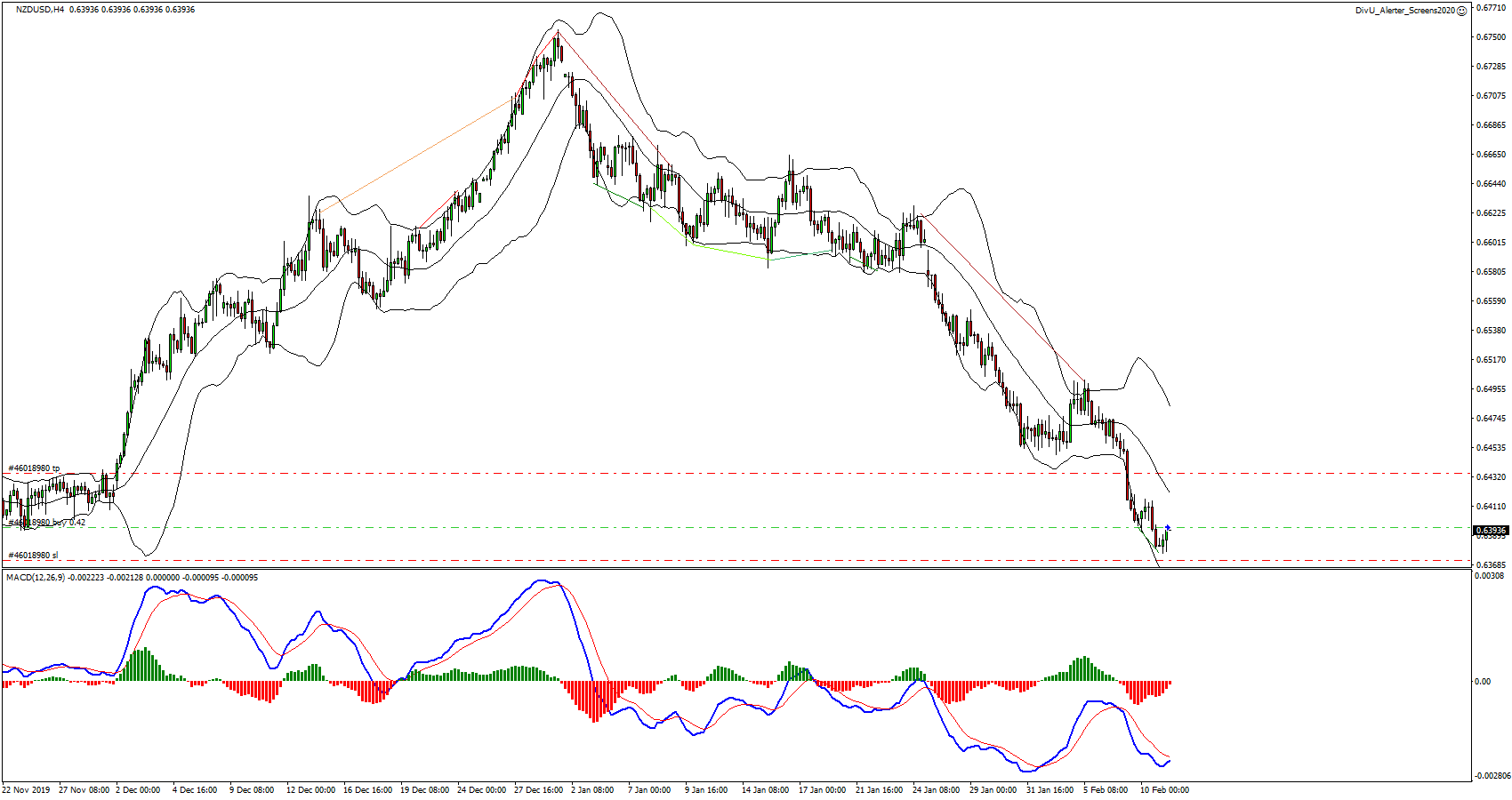

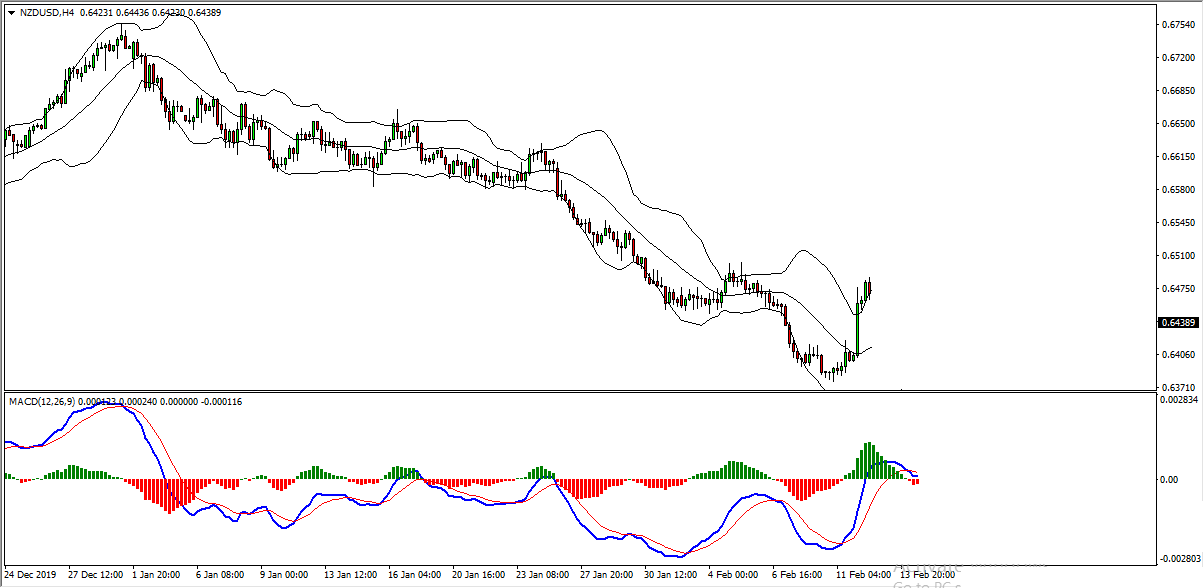

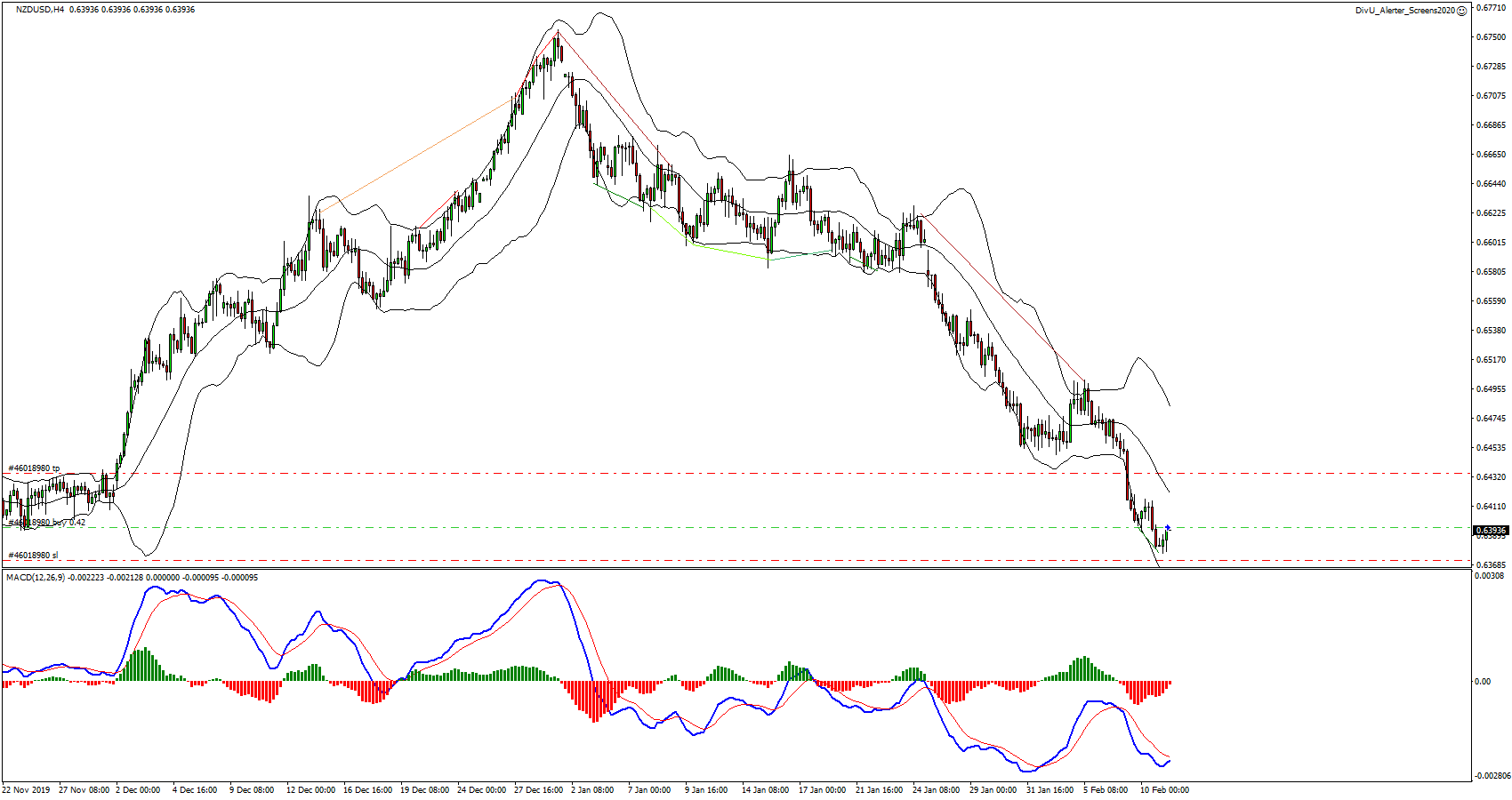

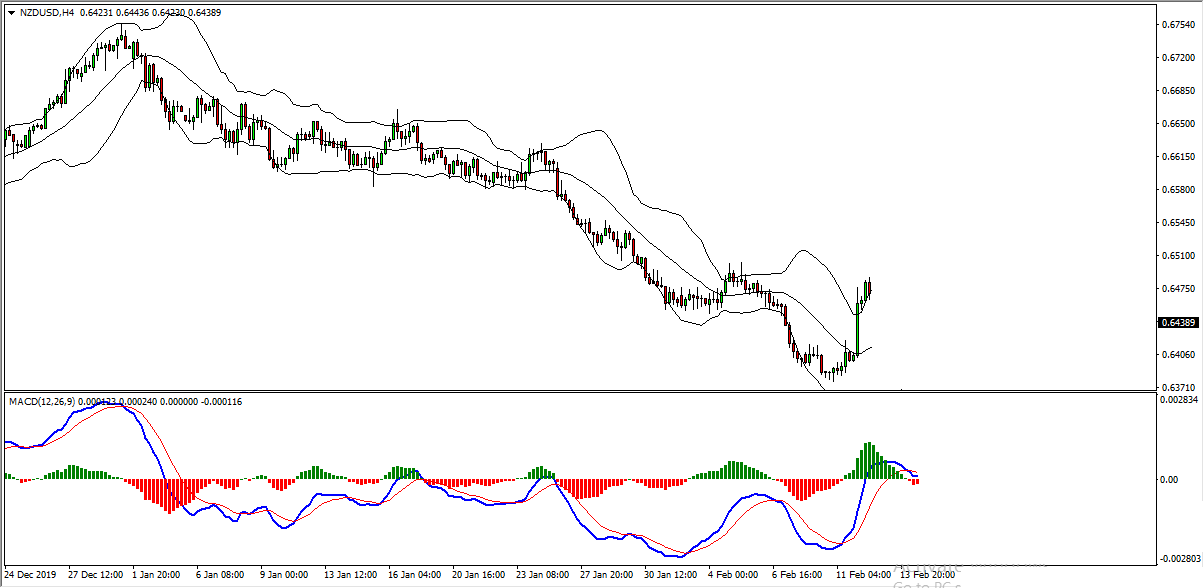

في NZDUSD ، كان السعر يتحرك هبوطيًا ، مما أدى إلى انخفاض أدنى مستوياته بين أدنى مستوياته التي تشكلت في 31 يناير (كانون الثاني) 2020 ، وأدنى مستوى له في 11 فبراير (شباط) 2020. بينما كان لدينا أدنى مستوياته المرتفعة على مؤشر MACD لتشكيل تباعد صعودي. من هنا دخلنا في صفقة الشراء هذه بناءً على مبدأ التباعد الصاعد وتحرك السعر في مصلحتنا لتوفير عوائد رائعة.

دخول

خروج

حصل على نسختك المجانية الآن ، هنا

FOREX TRIPLE B 2.0

في EURJPY ، كان السعر يتحرك صعوديًا عندما أشار Forex Triple B 2.0 إلى أن السعر قد دخل إلى منطقة البيع. كما أوضح لنا Triple B 2.0 أنه لا يوجد اختلاف متباين. من هنا دخلنا في هذه الصفقة وانخفض السعر كما هو متوقع مما يوفر عائدات ممتازة.

دخول

خروج

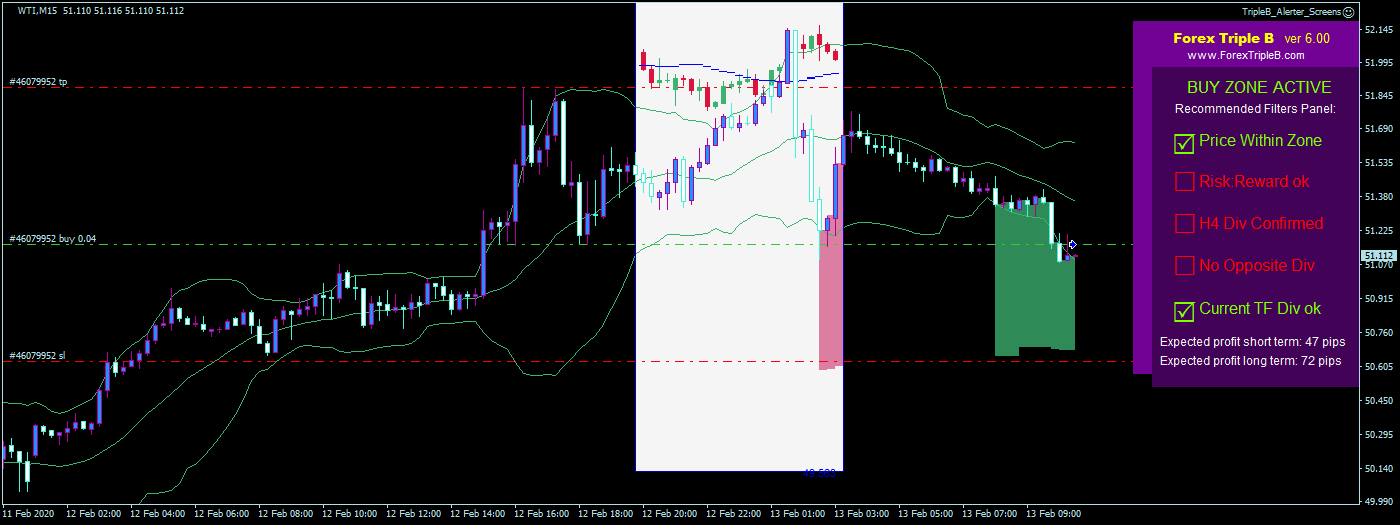

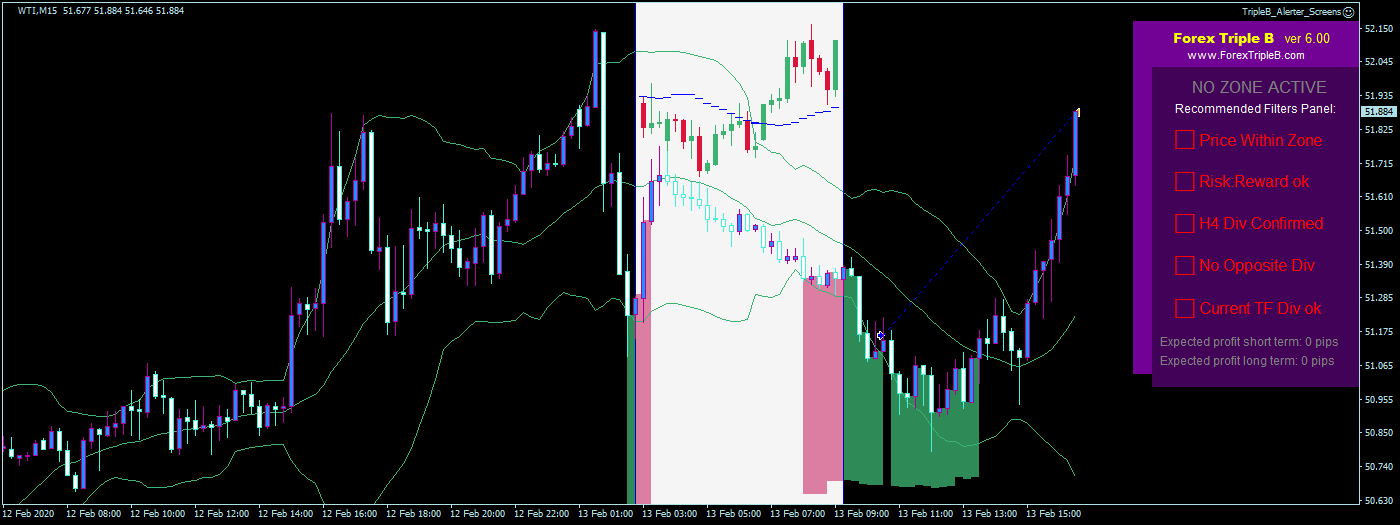

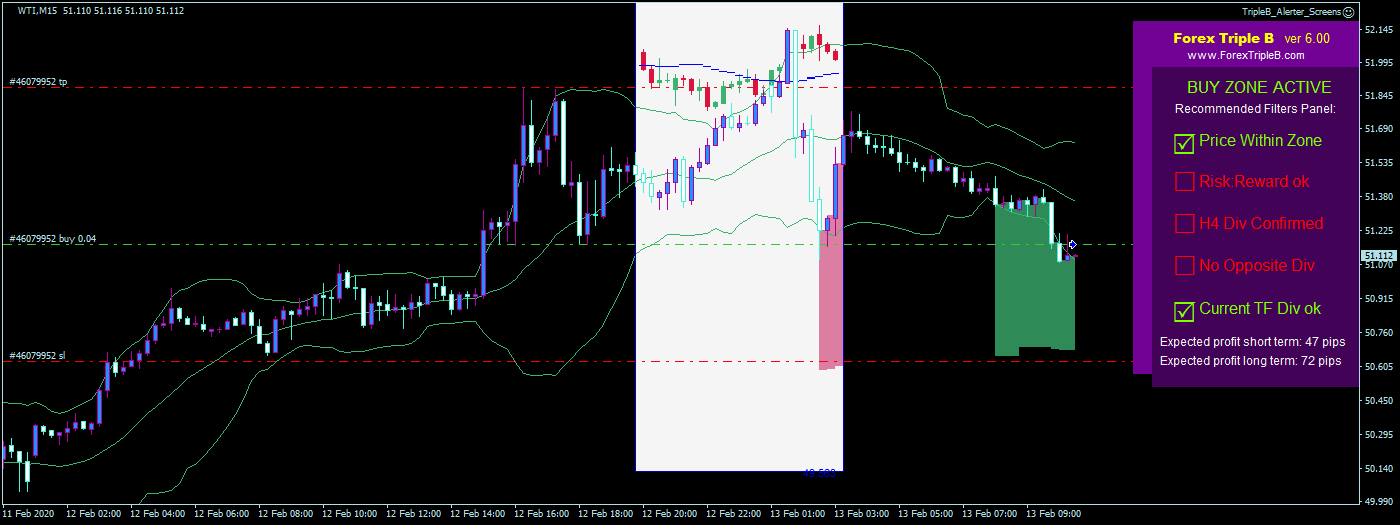

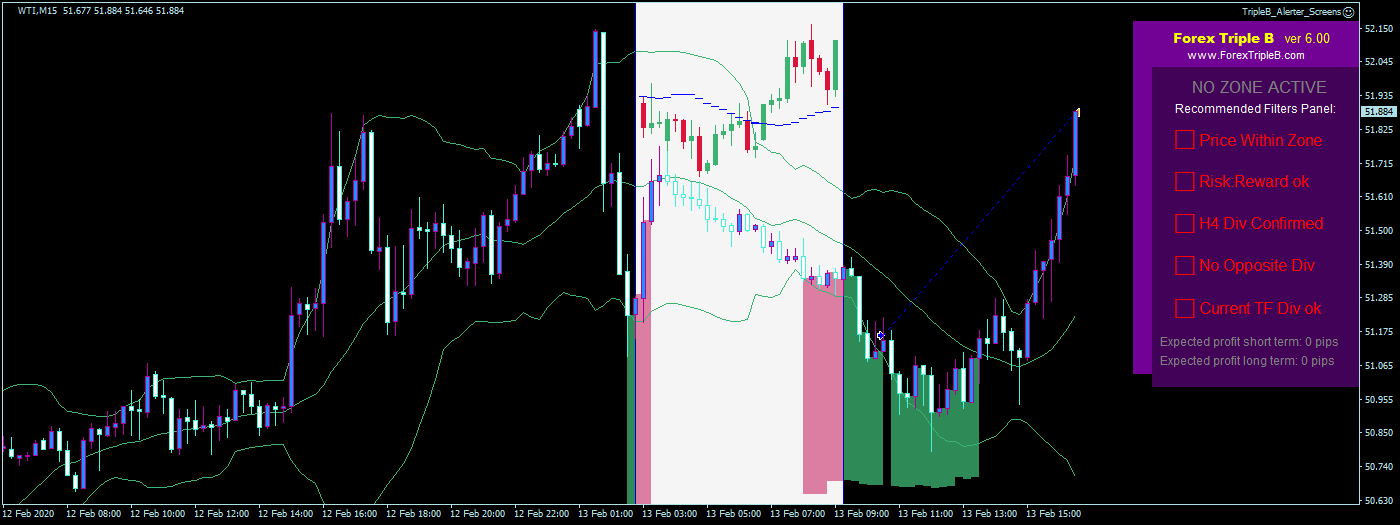

في النفط ، كان السعر يتجه نحو الانخفاض ، وأشار Forex Triple B 2.0 إلى أن السعر دخل منطقة الشراء. كما أوضح لنا Triple B 2.0 أن تباعد الإطار الزمني الحالي على ما يرام. ومن هنا دخلنا في هذه التجارة وارتفع السعر إلى أعلى كما هو متوقع مما يوفر أرباحًا مذهلة.

دخول

خروج

احصل على نسختك المجانية الآن ، من هنا

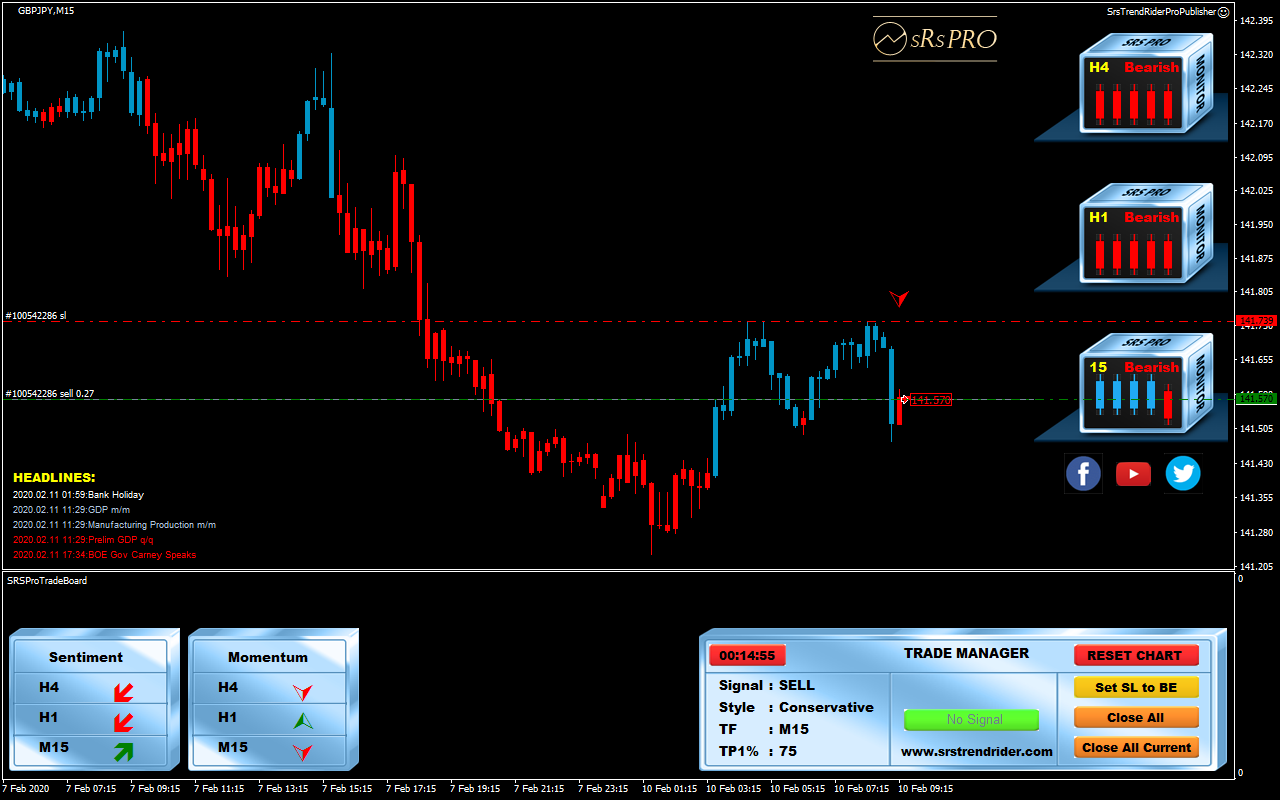

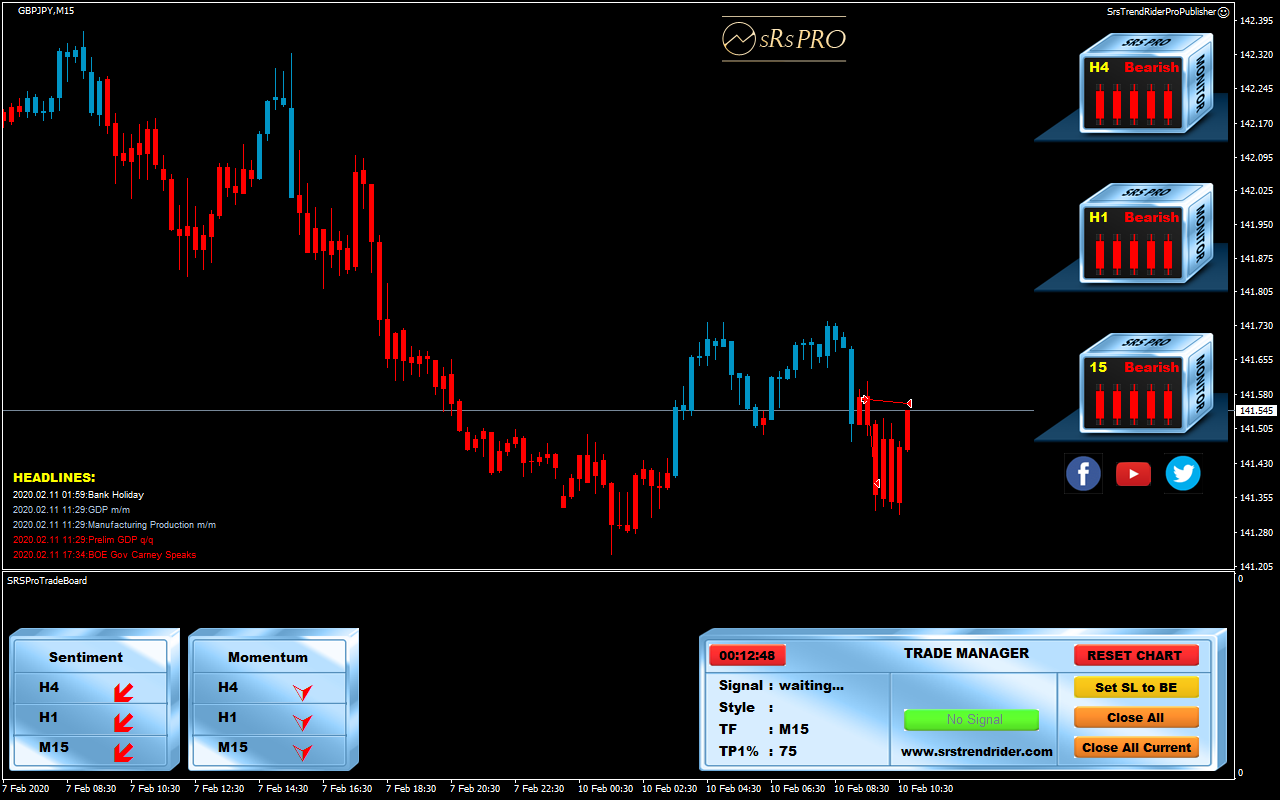

SRS PRO

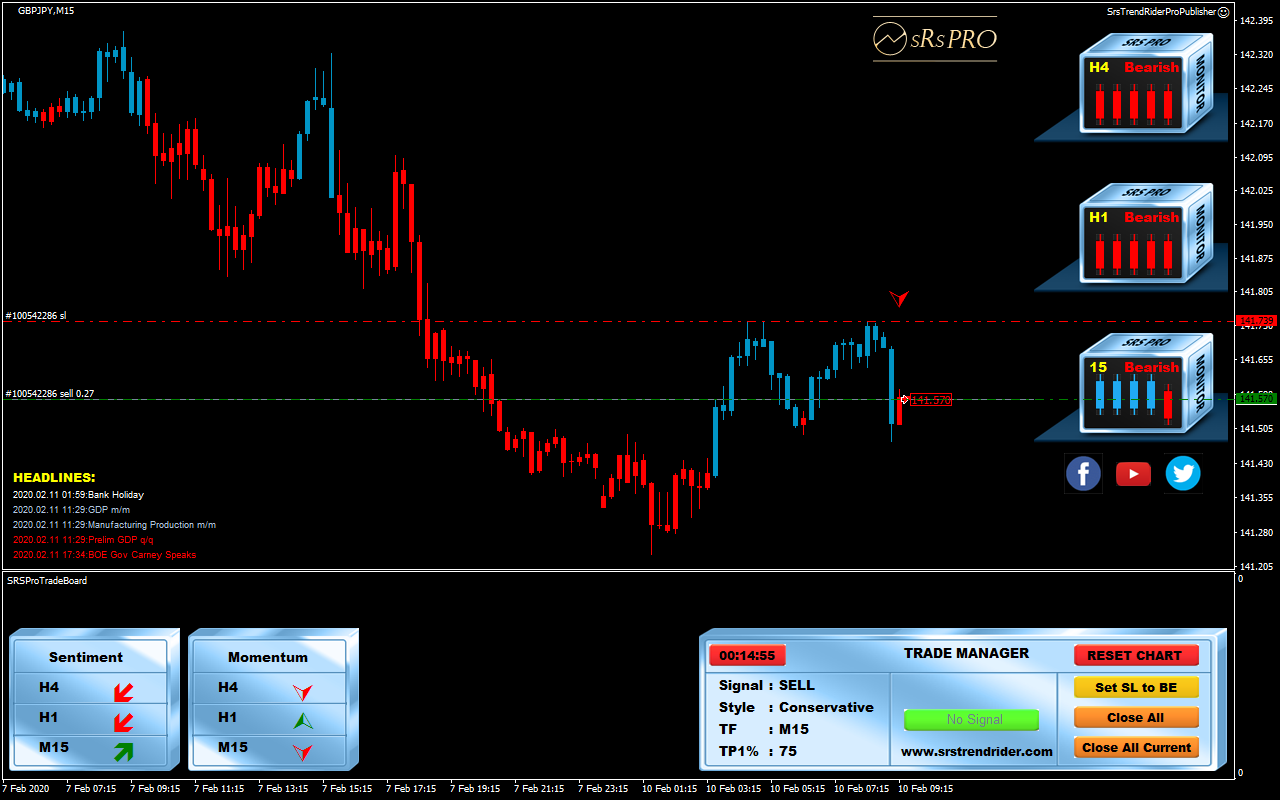

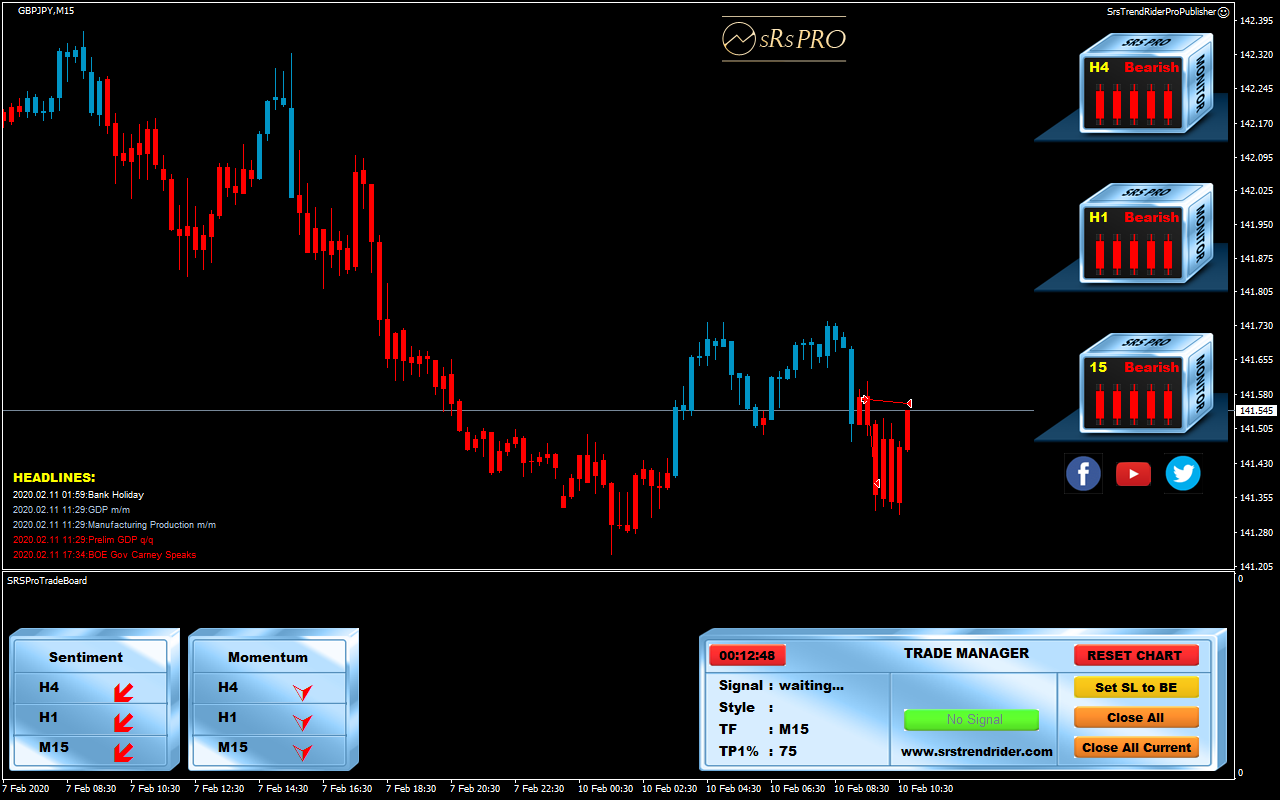

في GBPJPY ، كانت لدينا إشارة بيع متحفظة ، مطابقة إعداد التجارة لجميع القواعد ، حيث كان لدينا 3 من 3 sRs تتوافق البارات (الإطار الزمني الحالي + الإطاران الزمنيان الأعلي) في الاتجاه الهبوطي. 2 من أصل 3 الزخم السهام حمراء. 2 من أصل 3 أسهم الشعور باللون الأحمر. وجدنا بعد ذلك نموذج موجة مزدوجة ودخلنا في عملية البيع هذه مع اختراق خط الاتجاه ، ثم انخفض السعر تمامًا كما توقعنا توفير أرباح جيدة.

دخول

خروج

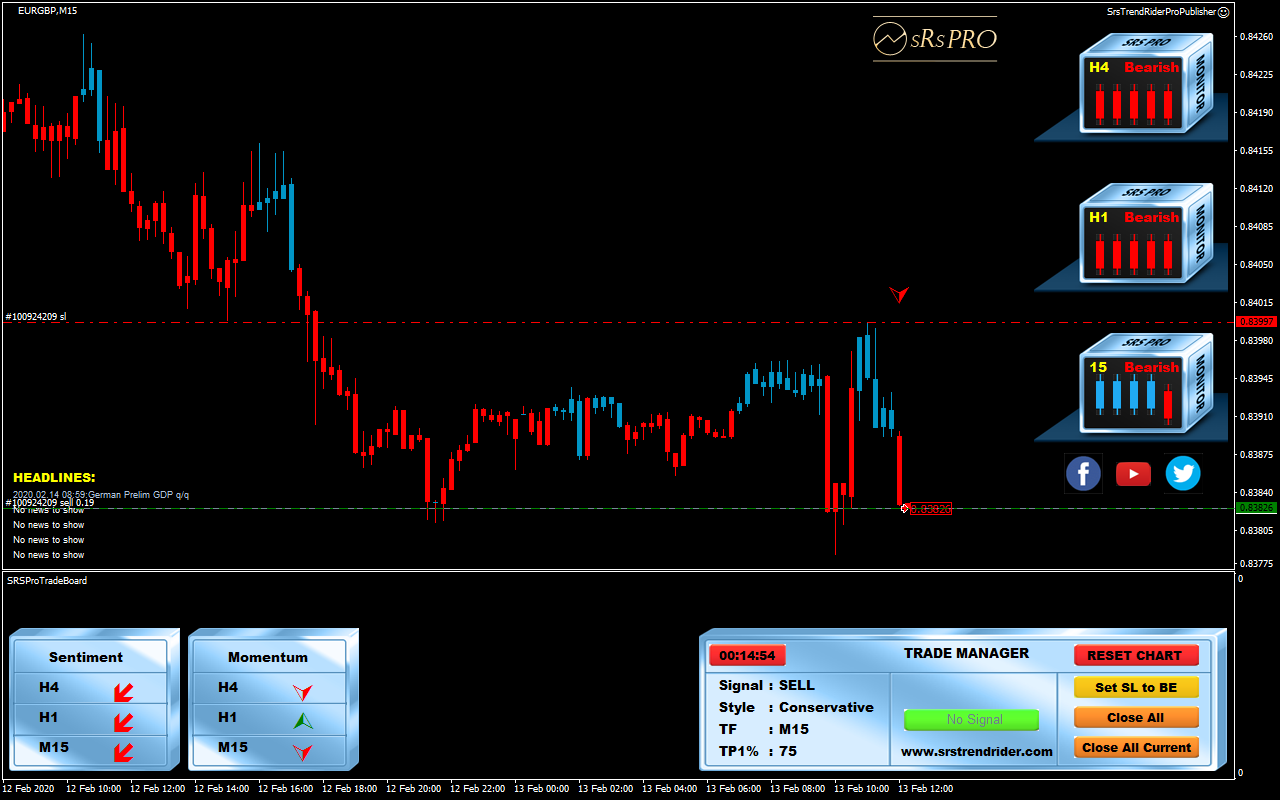

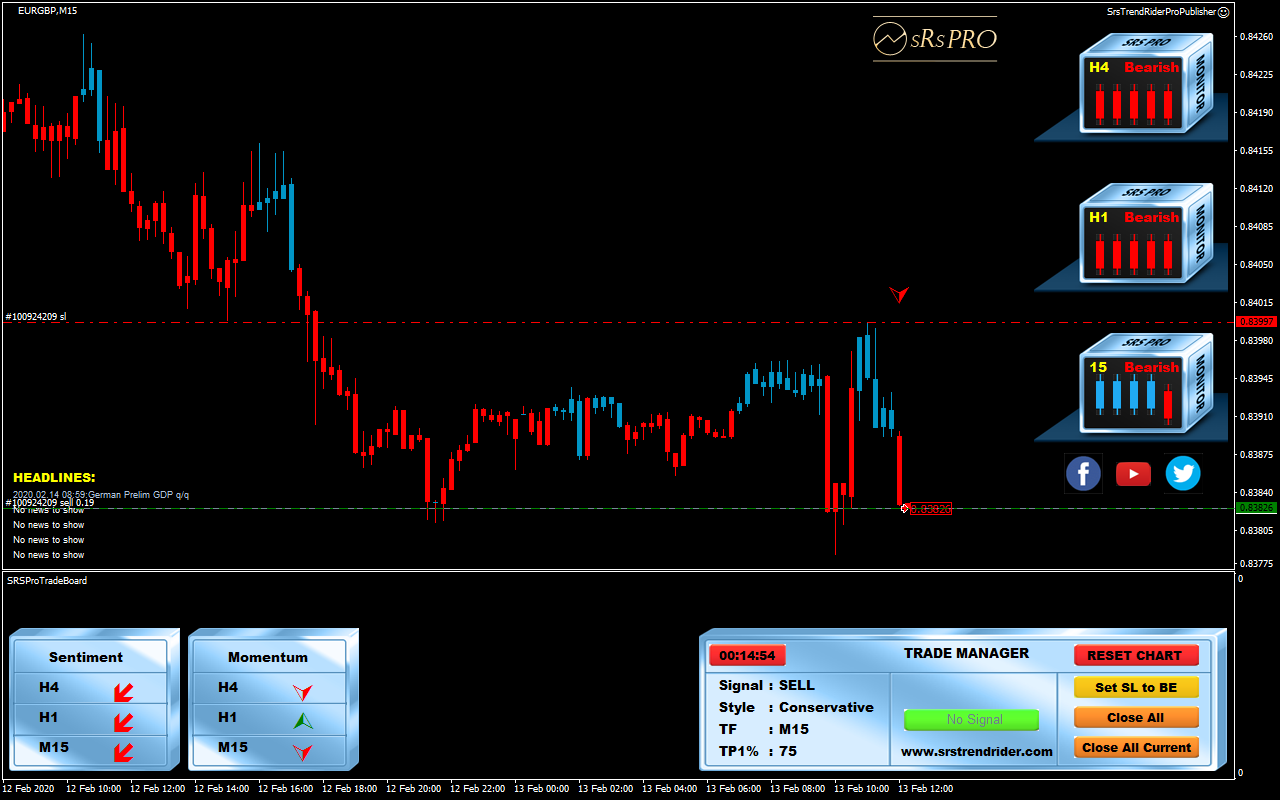

في EURGBP ، كانت لدينا إشارة بيع متحفظة تطابق إعداد التجارة هذا مع جميع القواعد ، حيث كان لدينا 3 من أصل 3 sRs تتوافق البارات (الإطار الزمني الحالي + الإطاران الزمنيان الأعليان) في الاتجاه الهبوطي. 2 من أصل 3 الزخم السهام حمراء. 3 من أصل 3 أسهم الشعور باللون الأحمر. دخلنا بعد ذلك في عملية البيع هذه وتراجع السعر تمامًا كما توقعنا توفير أرباح جيدة.

Entry:

Exit:

احصل على نسختك المجانية الآن ، هناا

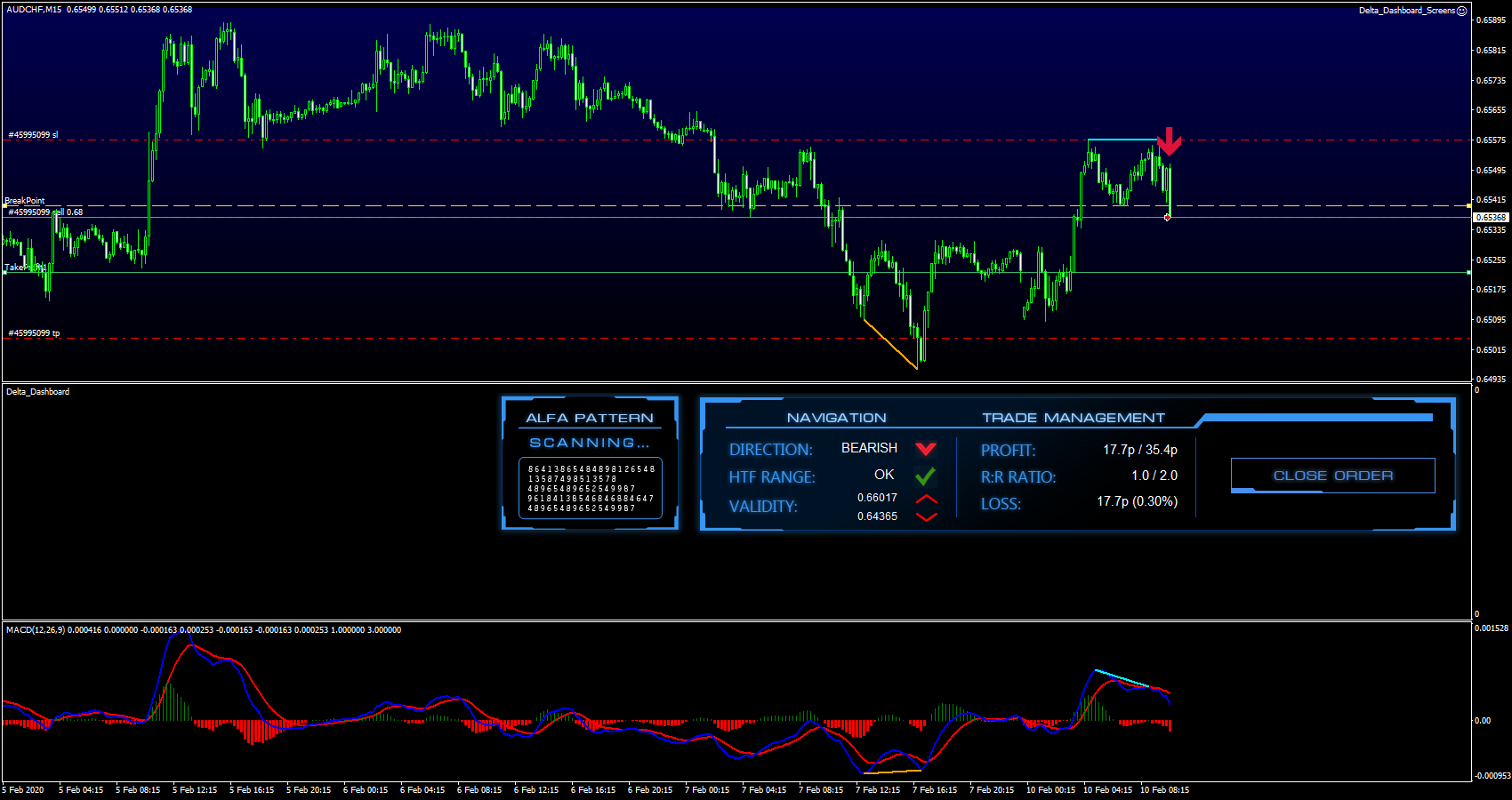

FX Delta (Yordan)

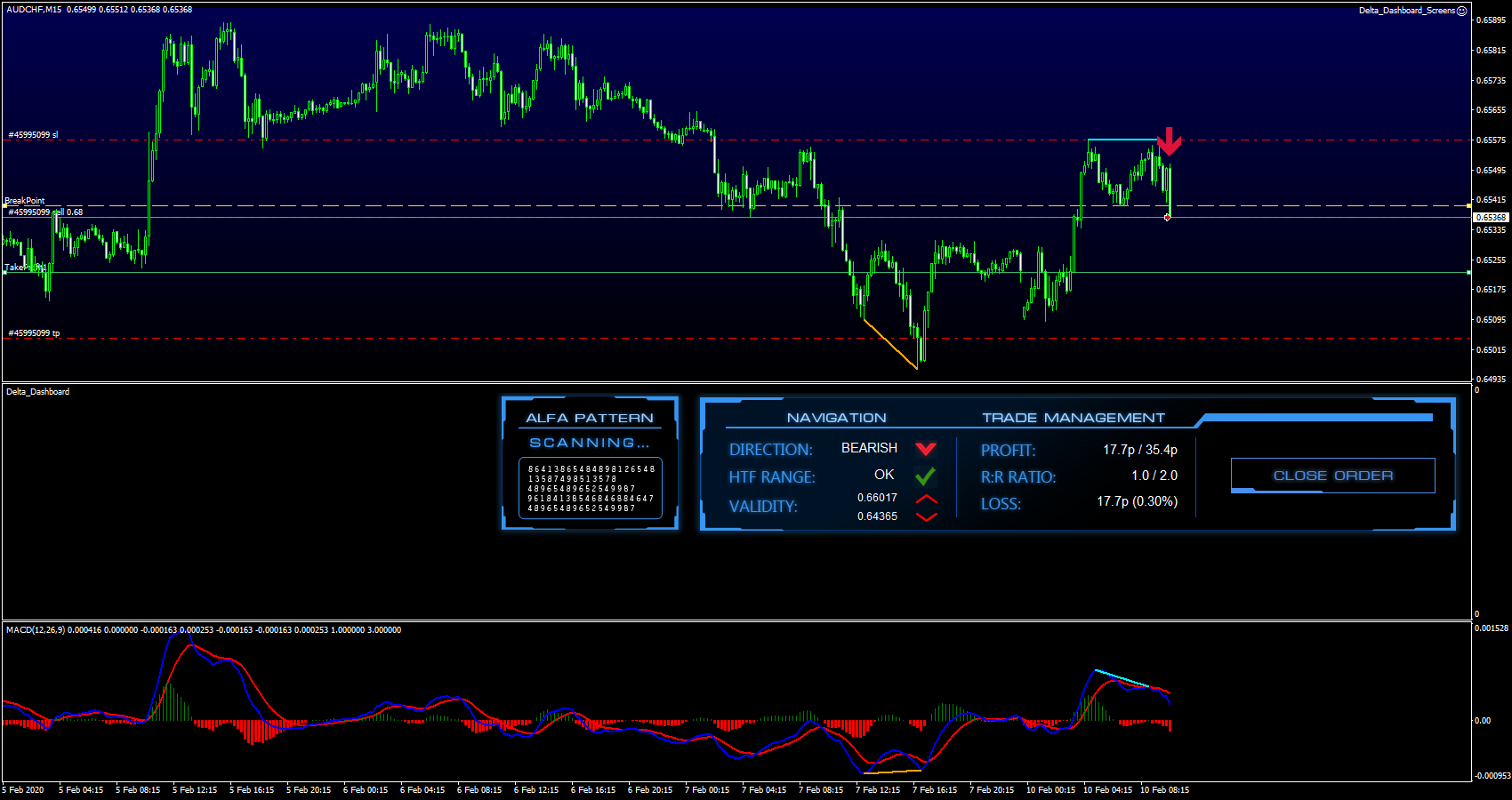

في AUDCHF ، حصلنا على تنبيه بيع من FX Delta. أوضحت FX Delta أن اتجاه السوق هبوطي وأن نطاق HTF على ما يرام وأن مكافأة المخاطرة كانت جيدة أيضًا. وبالتالي دخلنا في هذه الصفقة وتحرك السعر في صالحنا تقديم عوائد لطيفة.

Entry

Exit:

في مؤشر الدولار ، حصلنا على تنبيه شراء من FX Delta. لقد أوضحت FX Delta أن اتجاه السوق صعودي ، وأن نطاق HTF على ما يرام وكانت مكافأة المخاطرة جيدة أيضًا. بالإضافة إلى ذلك ، حصلنا أيضًا على تأكيد نمط ALFA. وبالتالي دخلنا في هذه الصفقة وتحرك السعر في مصلحتنا توفير عوائد جيدة.

Entry

Exit

احصل على نسختك المجانية الآن ، هنا

SRS TREND RIDER 2.0

في GBPAUD ، كان السعر يتحرك صعوديًا هذا عندما حصلنا على تنبيه إعداد بيع قوي من sRs Trend Rider 2.0. كان لدينا نموذج ABCD الذي تشكل ودخلنا هذه التجارة مع كسر خط الاتجاه الصعودي الأخير وتحرك السعر في مصلحتنا توفير عوائد رائعة.

Entry:

Exit:

في EURCAD ، كان السعر يتحرك صعوديًا هذا عندما حصلنا على تنبيه إعداد بيع قوي من sRs Trend Rider 2.0. كان لدينا نموذج ABCD الذي تشكل ودخلنا هذه التجارة مع كسر خط الاتجاه الصعودي الأخير ولكن السعر تحرك في الاتجاه الآخر وانتهت هذه الصفقة بخسارة.

Entry:

Exit:

احصل على نسختك المجانية الآن ، هناا

———————————————————————–

لقد كان أسبوع تداول جيدًا بالنسبة لنا ، على الرغم من تكبدنا لخسارة صغيرة مع إستراتيجية sRs Trend Rider 2.0 ، إلا أنها بالتأكيد لا تذكر لأنها لم تحدث تأثيرًا كبيرًا على النتيجة بأكملها. هذا هو السبب في أن استخدام أكثر من استراتيجية يعد فكرة جيدة لأن الخسائر جزء من أي استراتيجية ولكل نظام فترة أفضل وفترة أسوأ. لهذا السبب يجب علينا دمج التنويع في تداولنا ، هذا الأسبوع هو مثال جيد آخر لذلك.

أنا وفريقي أستخدم أنظمة التداول الخاصة بي يوميًا. إنها مختلفة ويمكن لكل نظام أن يناسب أفضل أنواع المتداولين. يمكنك التحقق من خارطة الطريق الخاصة بي من هنا للعثور على جميع أنظمة التداول الخاصة بي ومعرفة ما يناسبك.

يمكنك أيضًا الحصول على الأنظمة مجانًا بفضل برنامج شراكة الوسطاء المذهلين الذي لدينا.

سوف تجد كل التفاصيل هنا

و لا تفوت فرصة أن أكون جزءًا من ناديي. نحن نتاجر نعيش سويًا يوميًا وأعلمك كل أسراري!

انضم الي أكاديمية المتداولين الان

مع تحياتنا

فلاديمير و اسر البدراوى

Click To Join Our Community Telegram Group