Arabic Telegram Group:

اضغط هنا للانضمام إلى مجتمع التليجرام الخاص بنا

مرحبا ايها المتداولين! فيما يلي ملخص الأداء الأسبوعي لاستراتيجياتي في 24 يناير 2020 – من التداولات التي تمت باستخدام استراتيجياتي المتعددة (sRs Trend Rider Pro) و (Forex Triple B 2.0) و (Forex Crystal Ball) و (Divergence University) و (FX Delta) :

كان أسبوع تداول معتدل بالنسبة لنا. Forex Triple B 2.0 هو الأفضل أداءً هذا الأسبوع بالإضافة إلى + 1.57٪ من الأرباح ، بعد ذلك لدينا sRs Pro بأرباح + 1.03٪ ثم لدينا FX Delta و sRs Trend Rider 2.0 اللتان انتهتا بخسارة.

ملاحظة: فيما يتعلق Divergence University و Forex Crystal Ball نظرًا لوجود مشكلة فنية في الخادم ، فليس لدينا أي صفقات في هذا الأسبوع.

يمكنك الحصول على واحدة من استراتيجياتي مجانا. سوف تجد كل التفاصيل هنا

أدعوك للانضمام إلي في غرف التداول الحية الخاصة بي ، وتحسين التداول الخاص بك معنا.

انضم الي أكاديمية المتداولين الان

ملخص الأداء الأسبوعي

|

Forex Triple B 2.0

|

مجموع النقاط

+105.8

|

العائد على الاستثمار

+1.57%

|

|

sRs PRO

|

مجموع النقاط

+49.4

|

العائد على الاستثمار

+1.03%

|

|

FX Delta (Yordan)

|

مجموع النقاط

BREAK Even

|

العائد على الاستثمار

-0.79%

|

|

sRs Trend Rider 2.0

|

مجموع النقاط

-146.4

|

العائد على الاستثمار

-0.53%

|

|

المجموع

|

مجموع النقاط

+8.8

|

العائد على الاستثمار

+1.28%

|

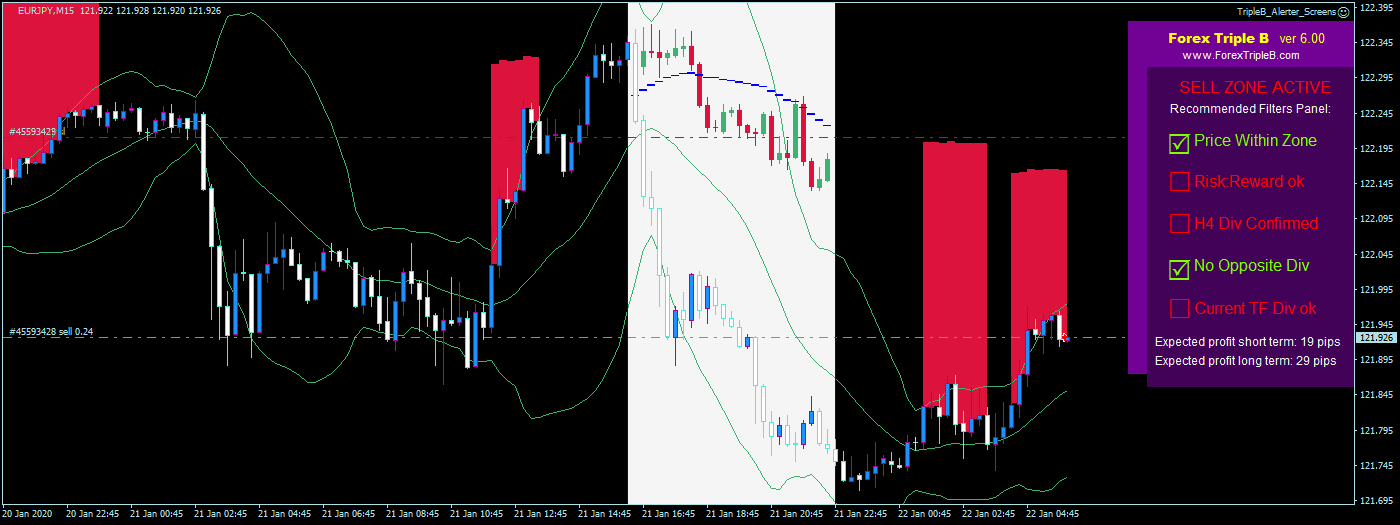

FOREX TRIPLE B 2.0

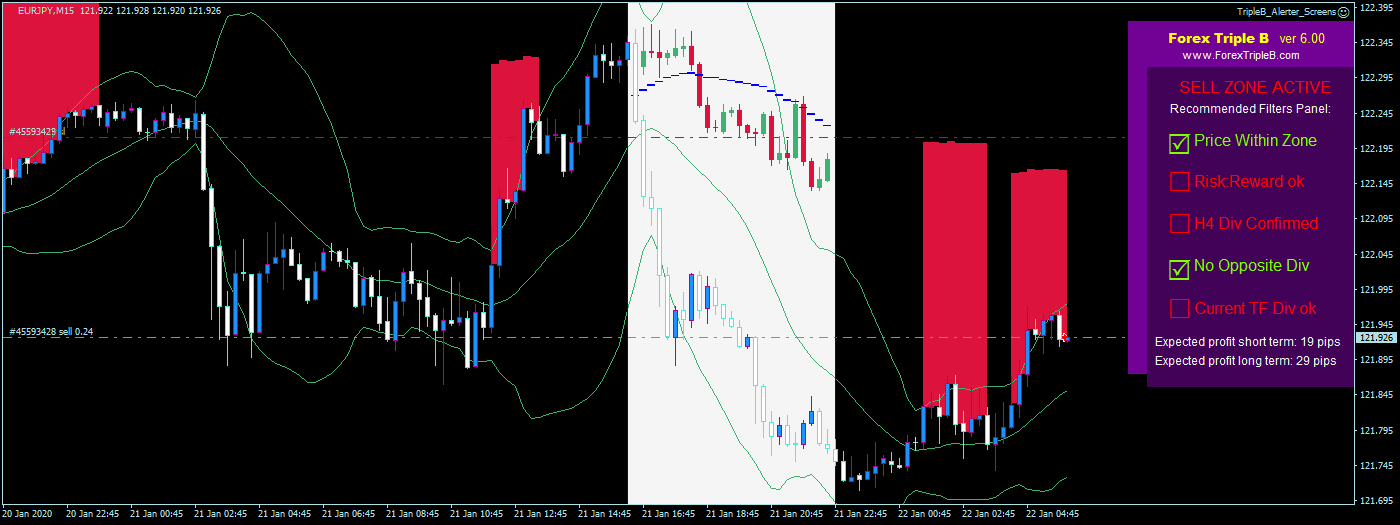

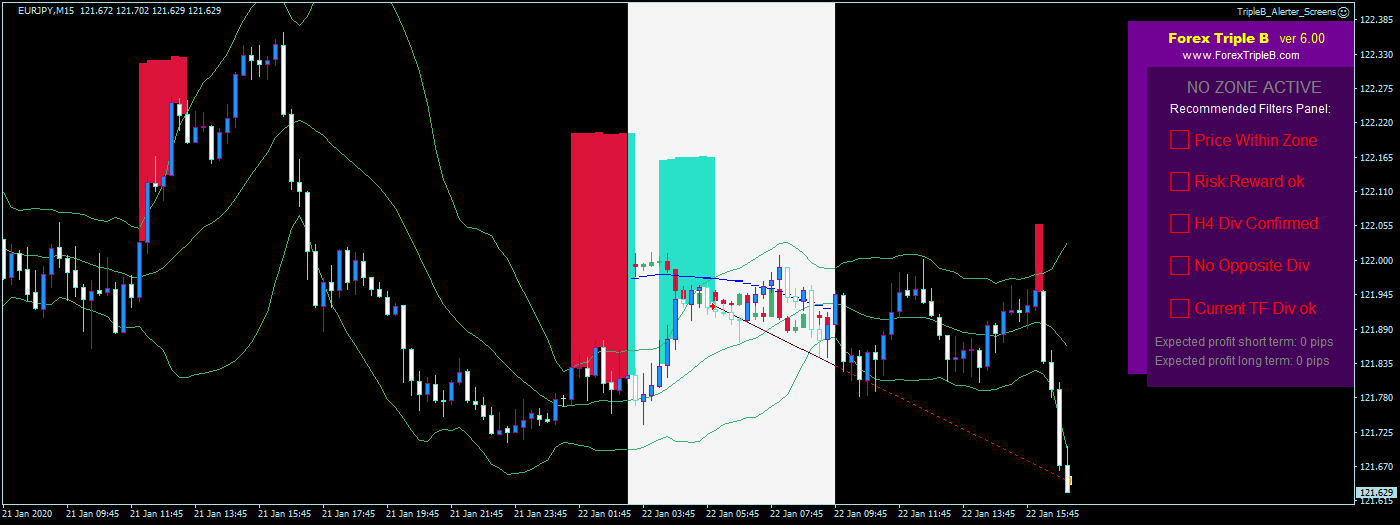

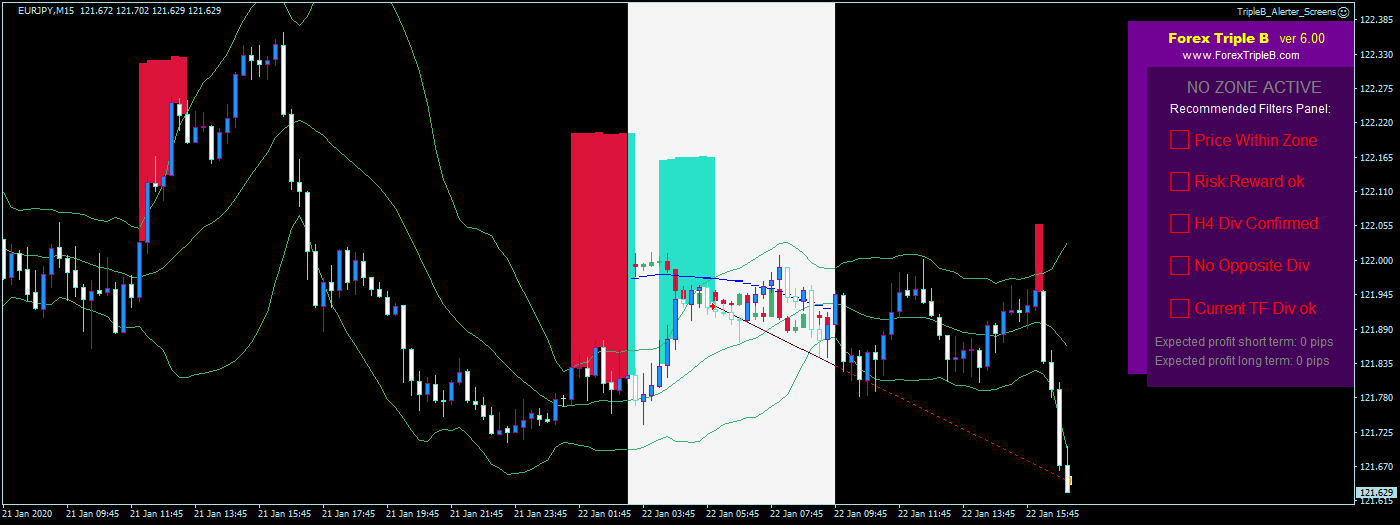

في EURJPY ، كان السعر يتحرك صعوديًا عندما أشار Forex Triple B 2.0 إلى أن السعر قد دخل إلى منطقة البيع. كانت لدينا موجة مزدوجة في الاتجاه الصعودي كما أوضح لنا Triple B 2.0 أنه لا يوجد تباعد معاكس. من هنا دخلنا في هذه الصفقة وانخفض السعر كما هو متوقع ، مما يوفر عائدات رائعة.

دخول

خروج

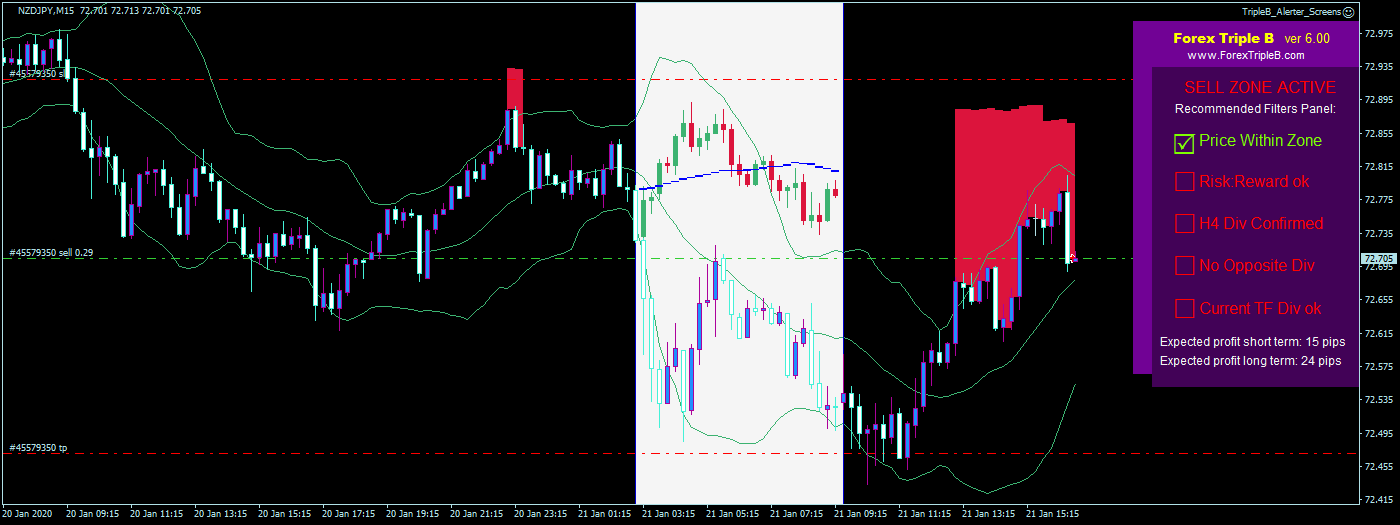

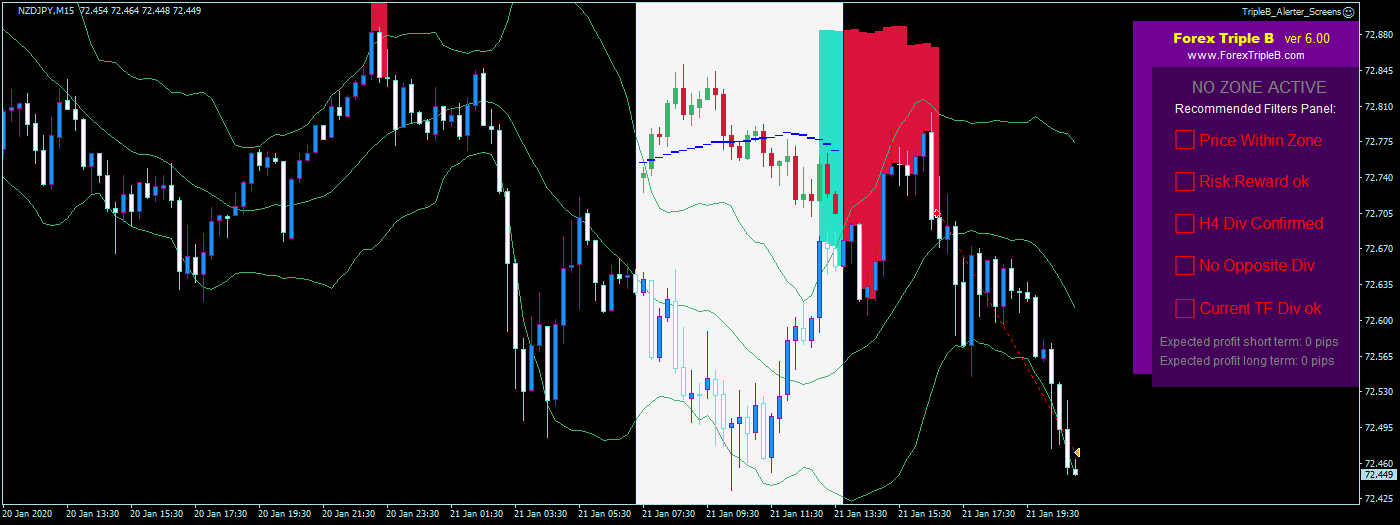

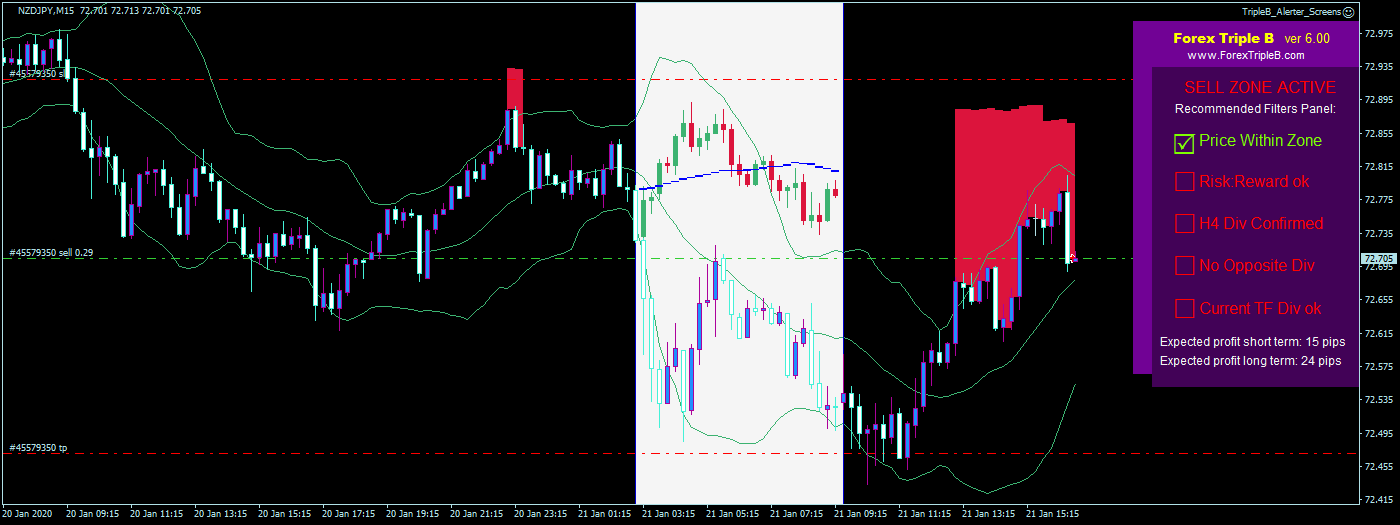

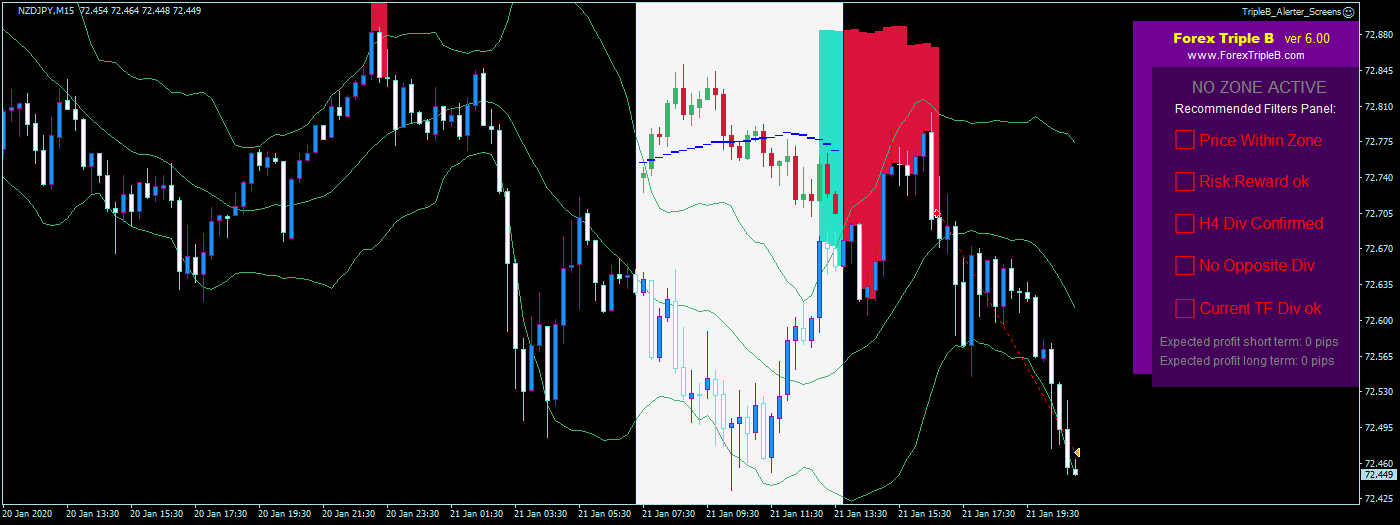

في NZDJPY ، كان السعر يتحرك صعوديًا ، وذلك عندما أشار Forex Triple B 2.0 إلى أن السعر قد دخل إلى منطقة البيع. كانت لدينا موجة مزدوجة في الاتجاه الصعودي ، وبالتالي دخلنا في هذه التجارة والسعر انخفض كما هو متوقع هذه واحدة تحولت إلى تجارة مربحة أخرى بالنسبة لنا.

دخول

خروج

احصل على نسختك المجانية الآن ، من هنا

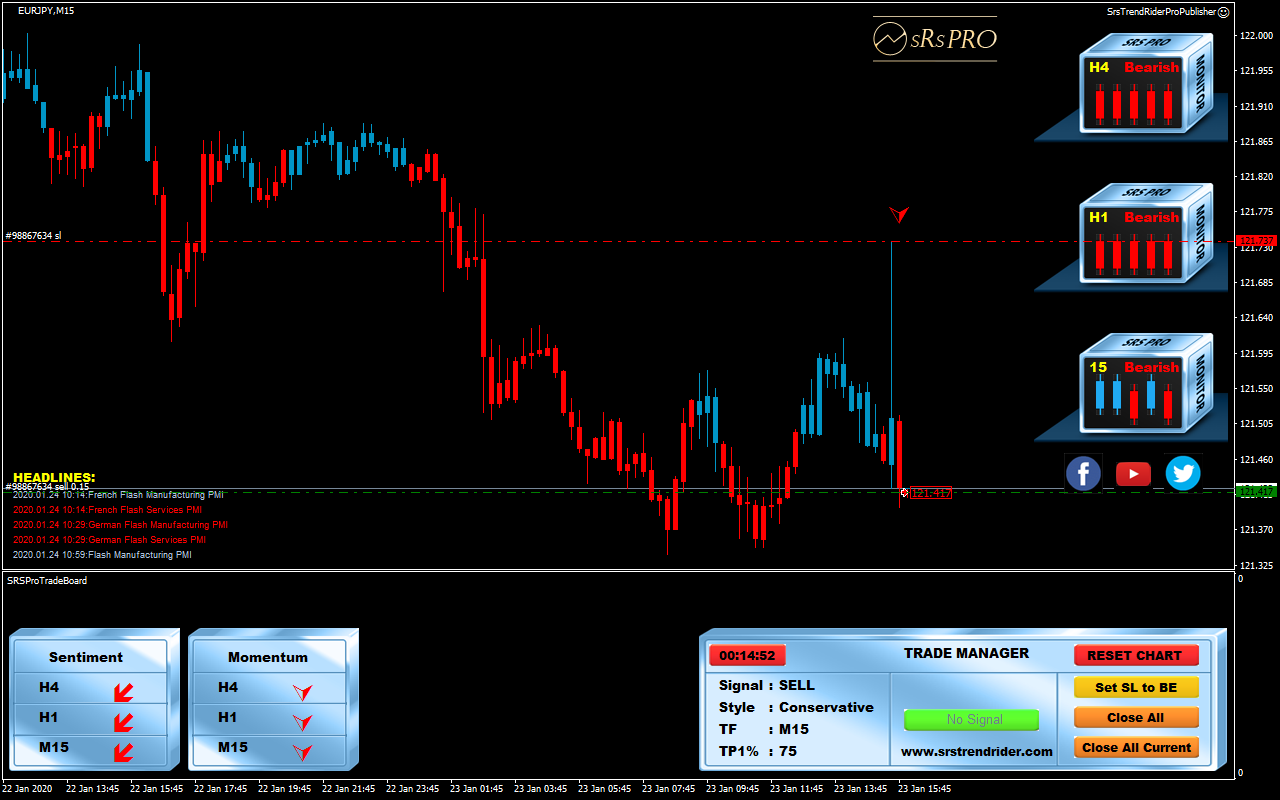

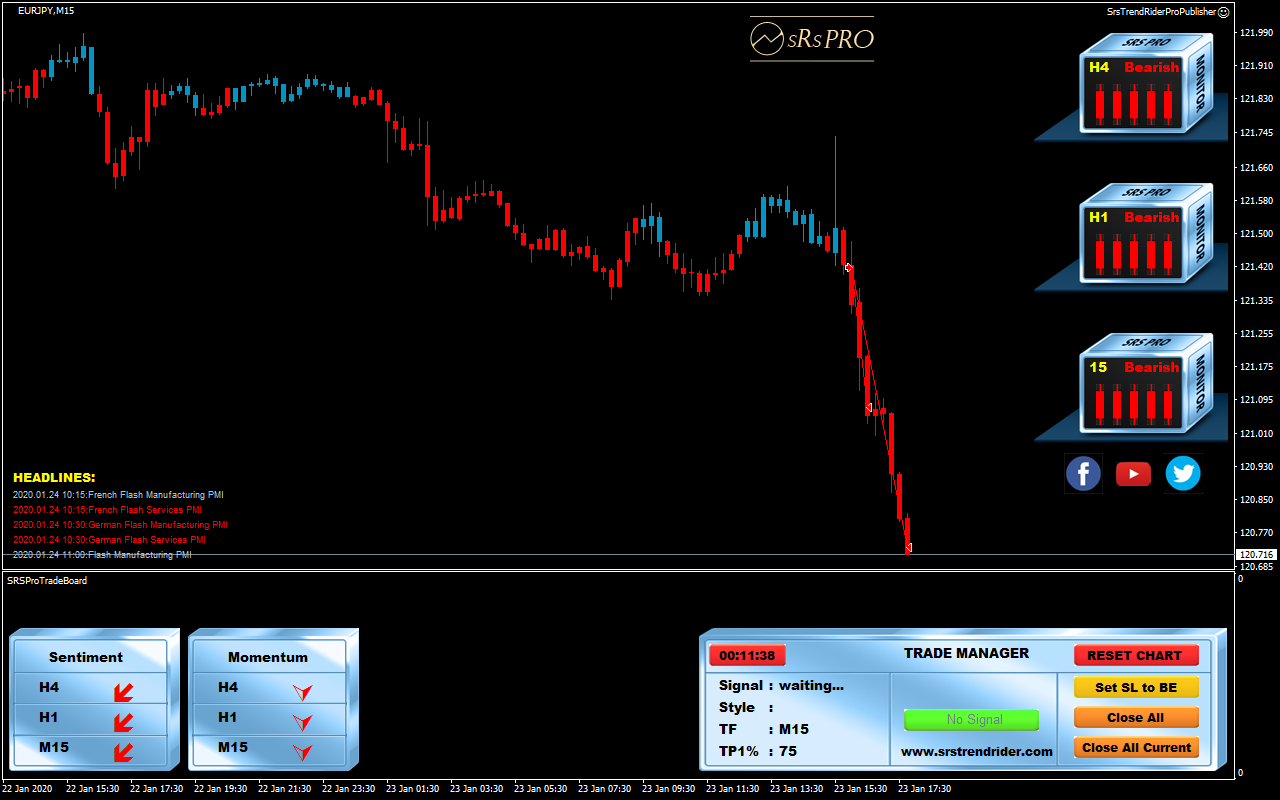

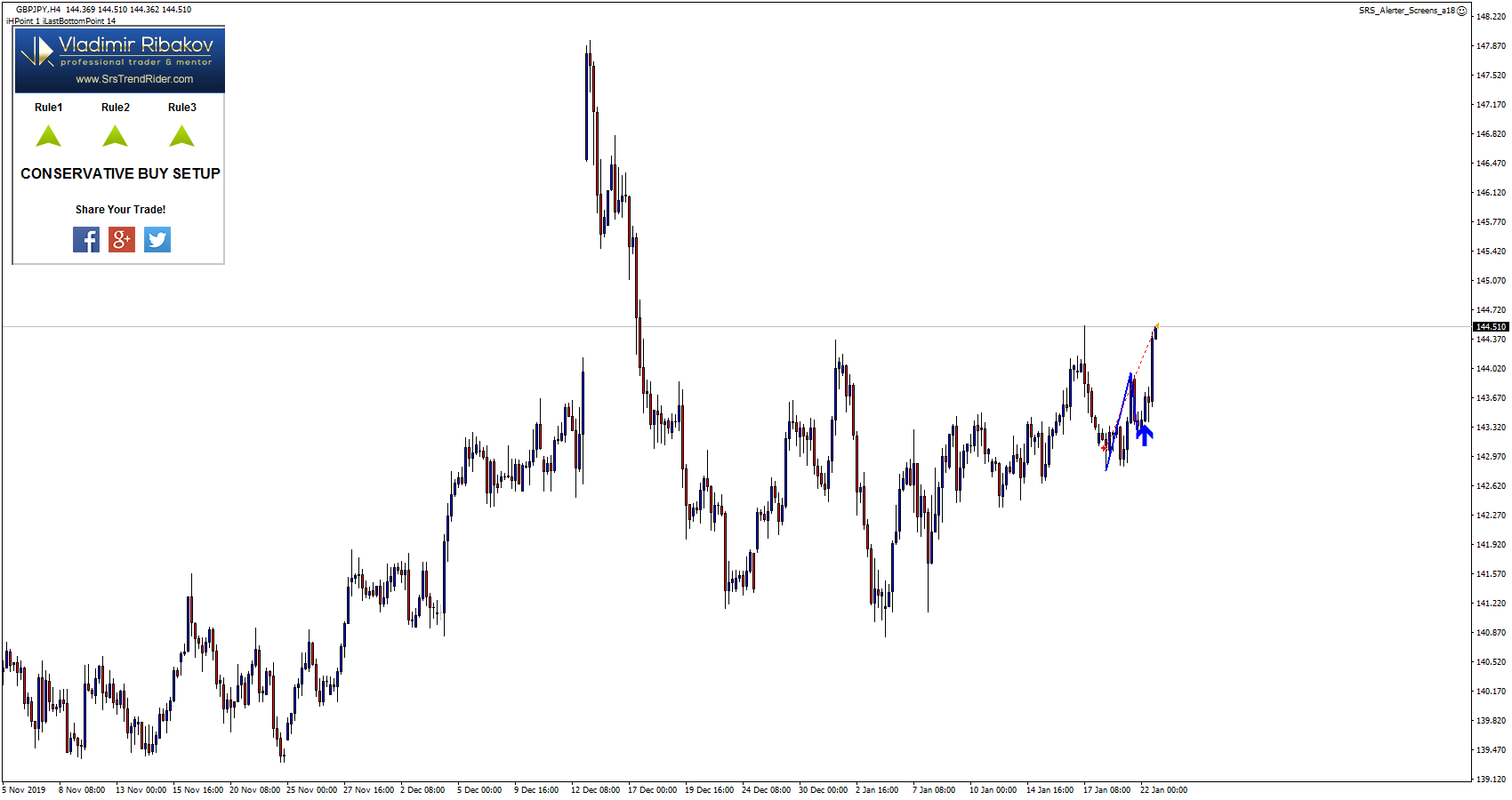

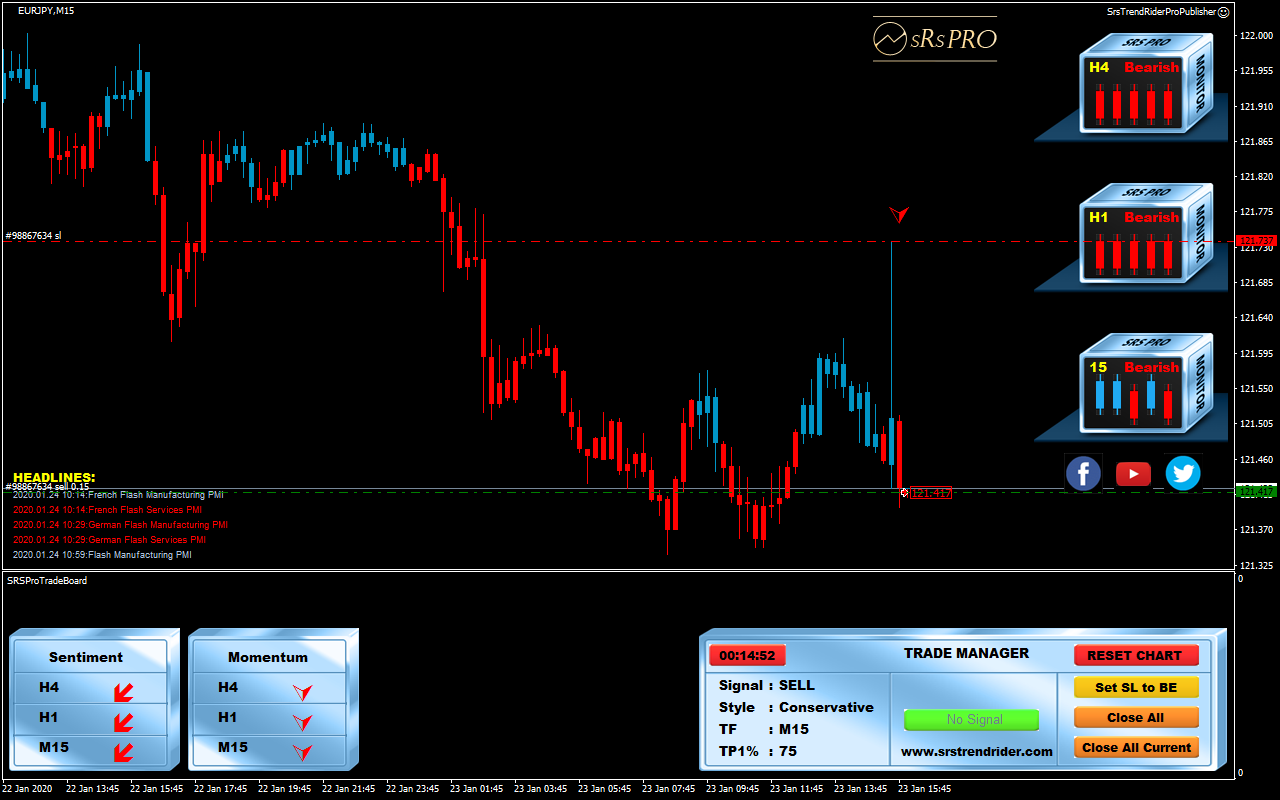

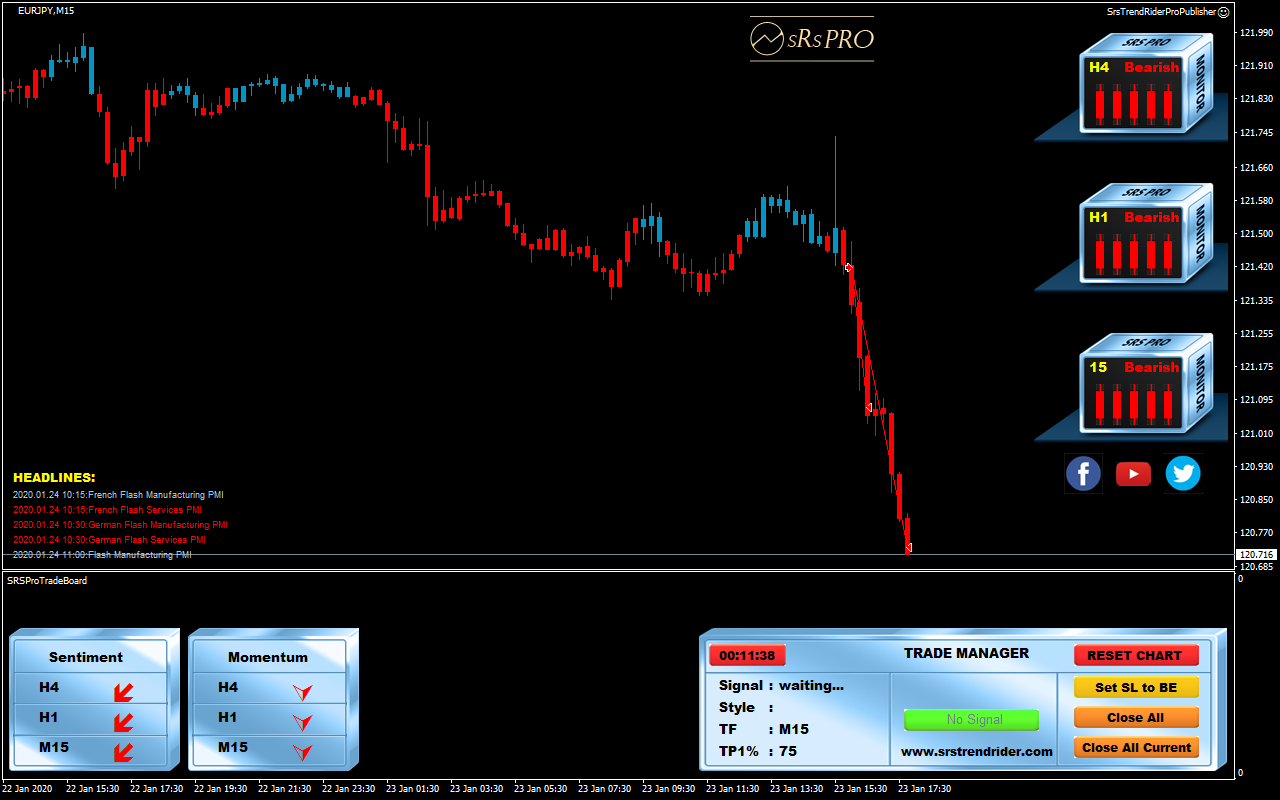

SRS PRO

في زوج العملات EURJPY ، كانت لدينا إشارة بيع متحفظة تطابق إعداد التجارة هذا مع جميع القواعد ، حيث كان لدينا 3 من كل 3 sRs متفق عليها (الإطار الزمني الحالي + الإطاران الزمنيان الأعلى) هبوطي. 3 من أصل 3 الزخم السهام حمراء. 3 من أصل 3 أسهم الشعور باللون الأحمر. وجدنا بعد ذلك نموذج موجة مزدوجة ودخلنا في عملية البيع هذه مع اختراق خط الاتجاه الصعودي الأخير ، ثم انخفض السعر تمامًا كما توقعنا تحقيق ربح جيد يصل إلى مستوى جني الأرباح.

دخول

خروج

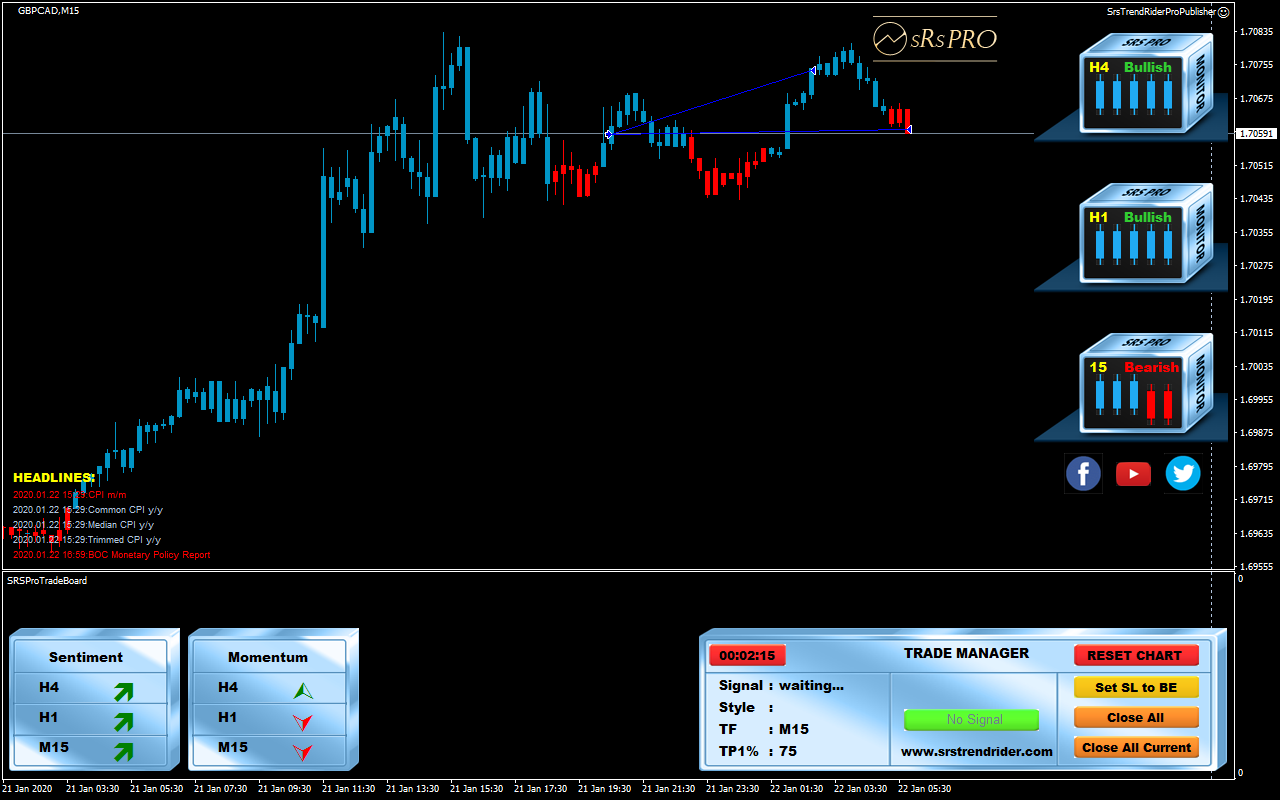

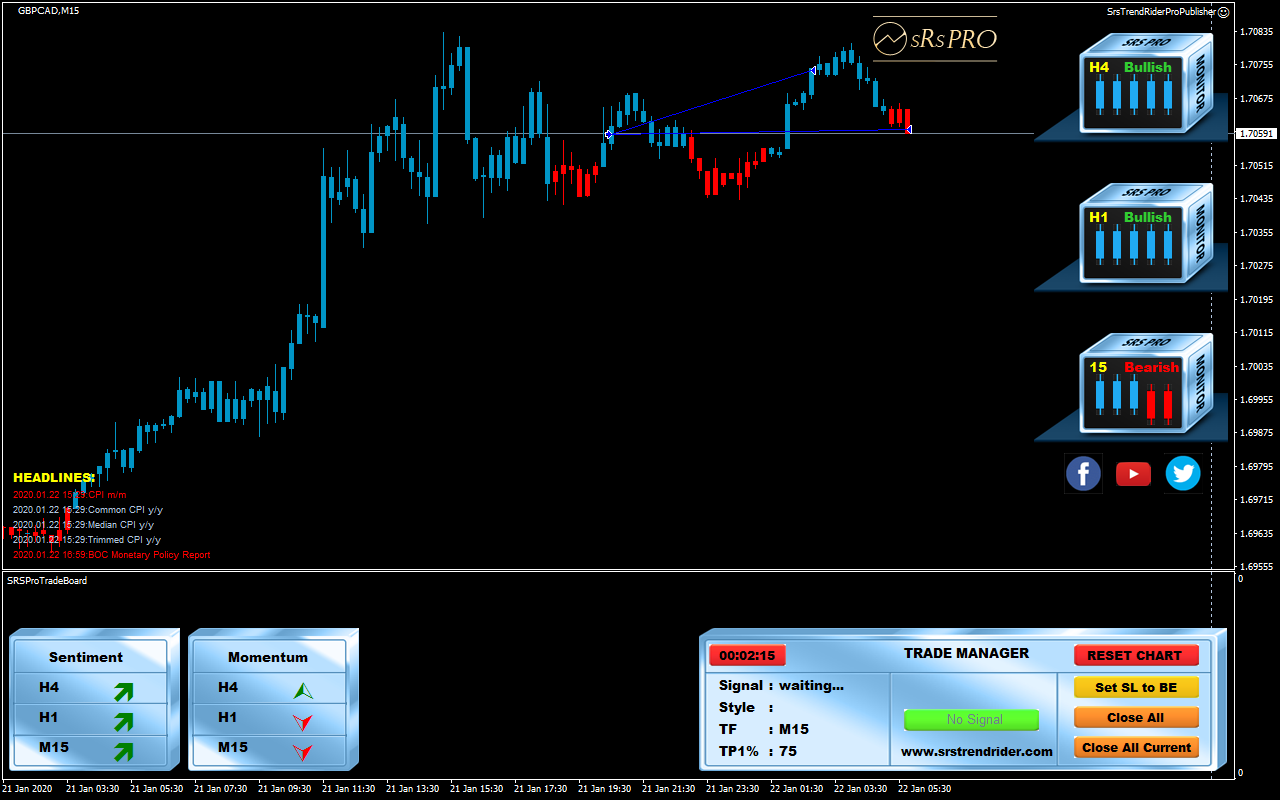

في GBPCAD ، كانت لدينا إشارة شراء محافظة ، حيث يتوافق إعداد التجارة هذا مع جميع القواعد ، نظرًا لأن 3 من 3 sRs متفق عليها (الإطار الزمني الحالي + الإطاران الزمنيان الأعلىان) صعوديان. 2 من أصل 3 الزخم السهام الأخضر. 3 من الأسهم 3 الشعور الأخضر. وجدنا بعد ذلك نموذج موجة مزدوجة ودخلنا في صفقة الشراء هذه مع كسر خط الاتجاه الهبوطي الأحدث ، ارتفع السعر كما توقعنا تمامًا ، وقد وفرت لنا هذه التجارة عائدات جيدة.

دخول

خروج

احصل على نسختك المجانية الآن ، هناا

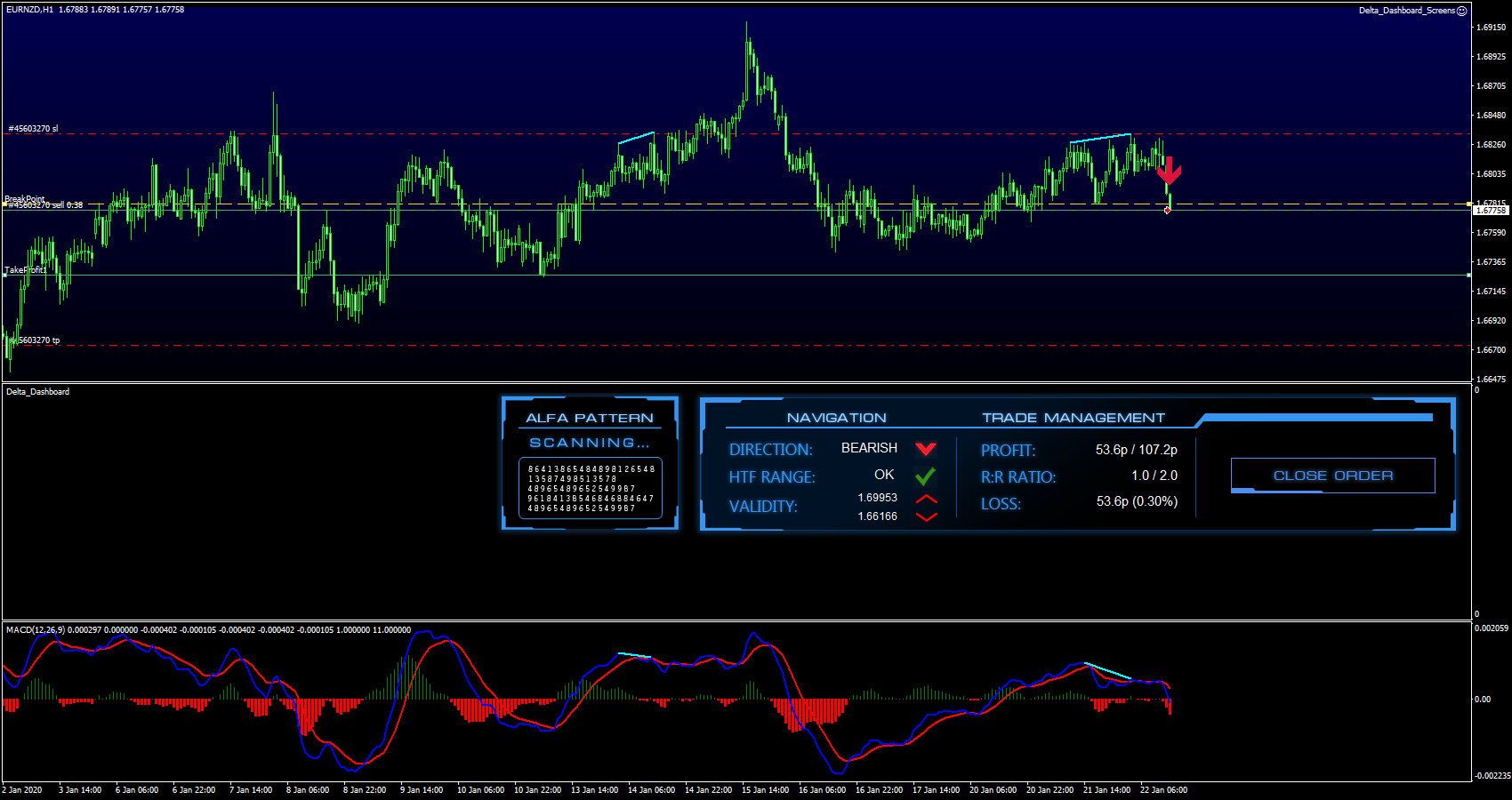

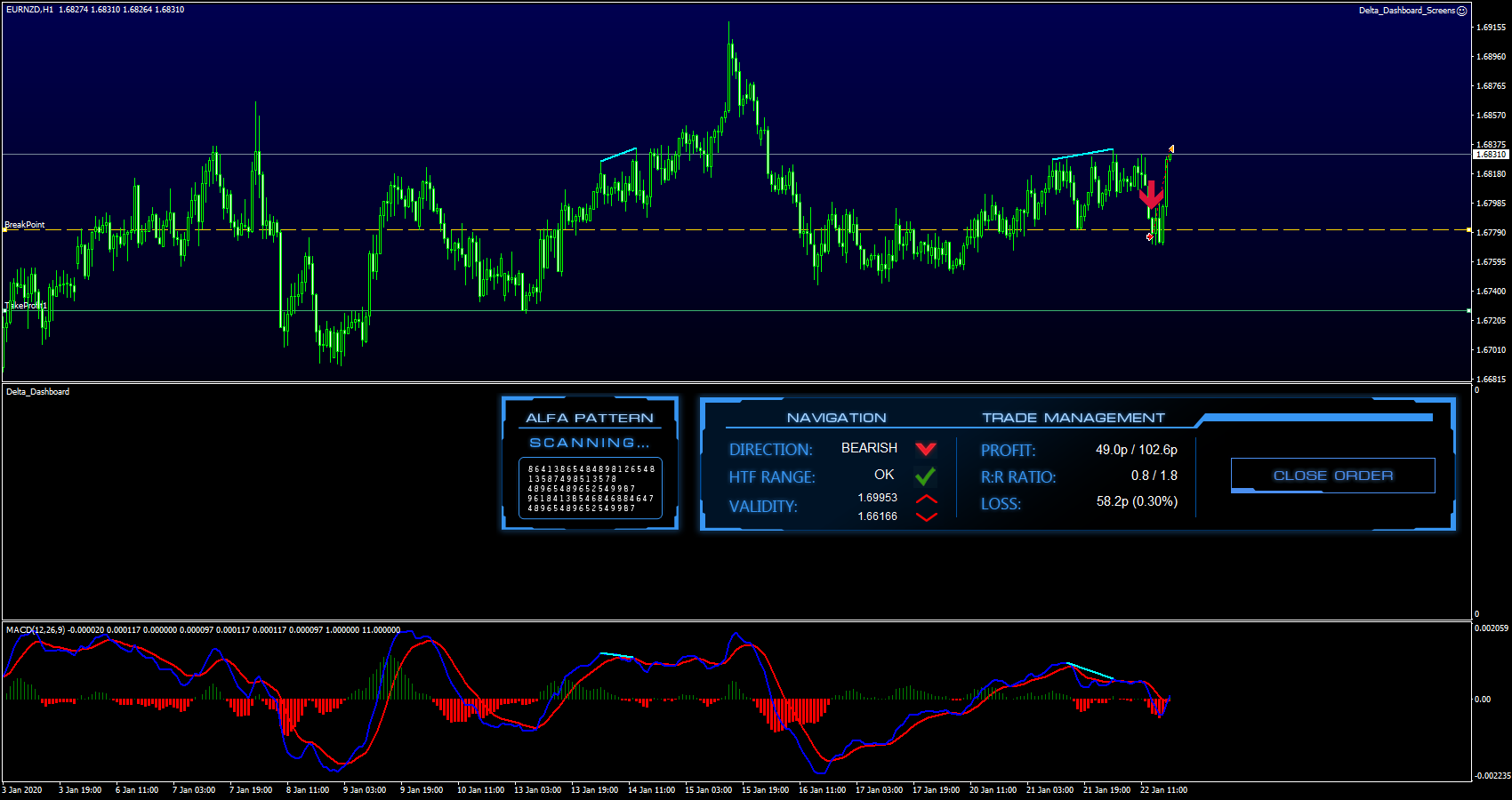

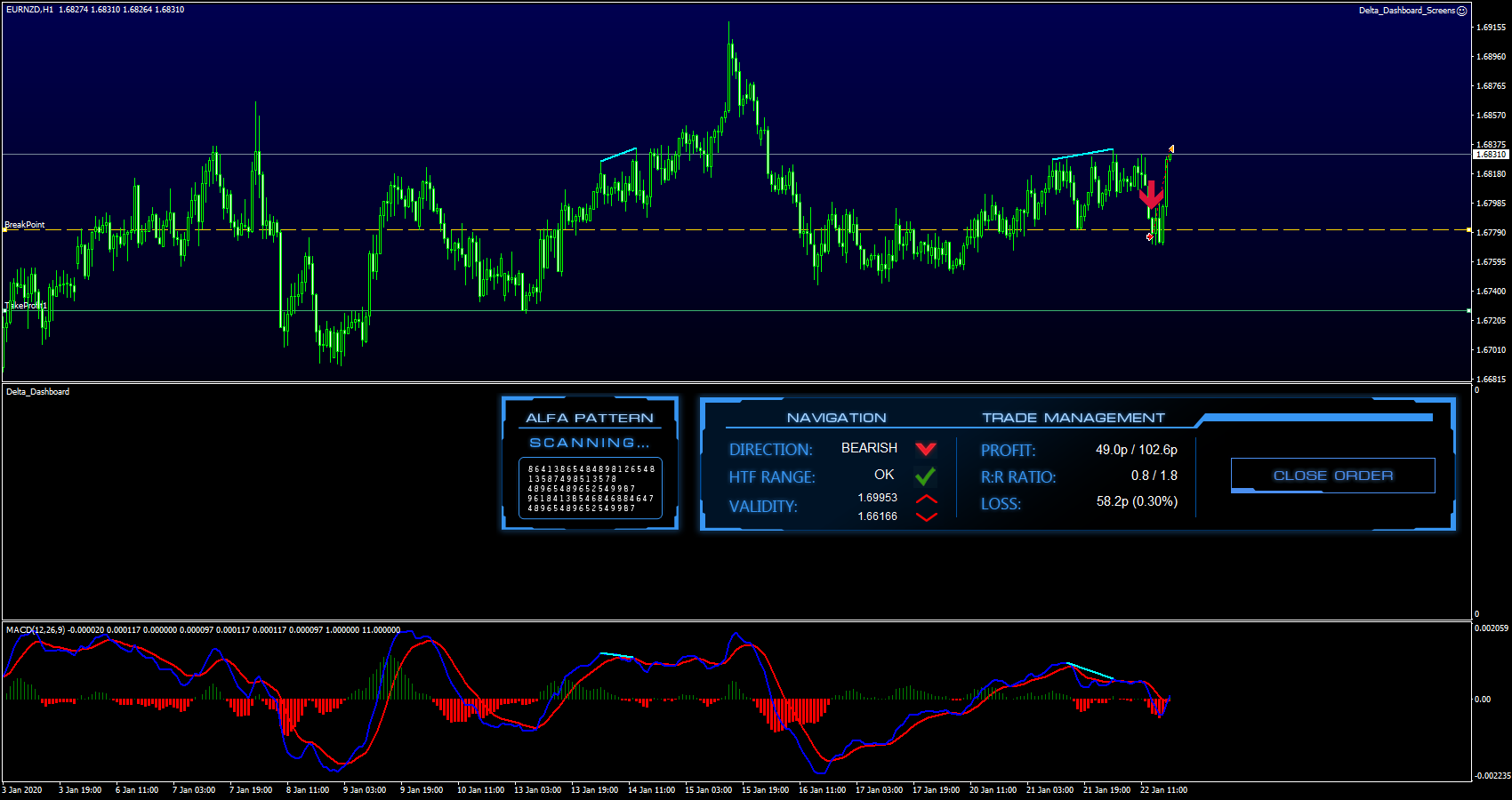

FX Delta (Yordan)

في EURNZD ، حصلنا على تنبيه بيع من FX Delta. أوضحت FX Delta أن اتجاه السوق هبوطي وأن نطاق HTF على ما يرام وأن مكافأة المخاطرة كانت جيدة أيضًا. من هنا دخلنا في هذه الصفقة لكن السعر تحرك في الاتجاه الآخر ، واتضح أن هذا كان تجارة خاسرة بالنسبة لنا.

دخول

خروج

احصل على نسختك المجانية الآن ، هنا

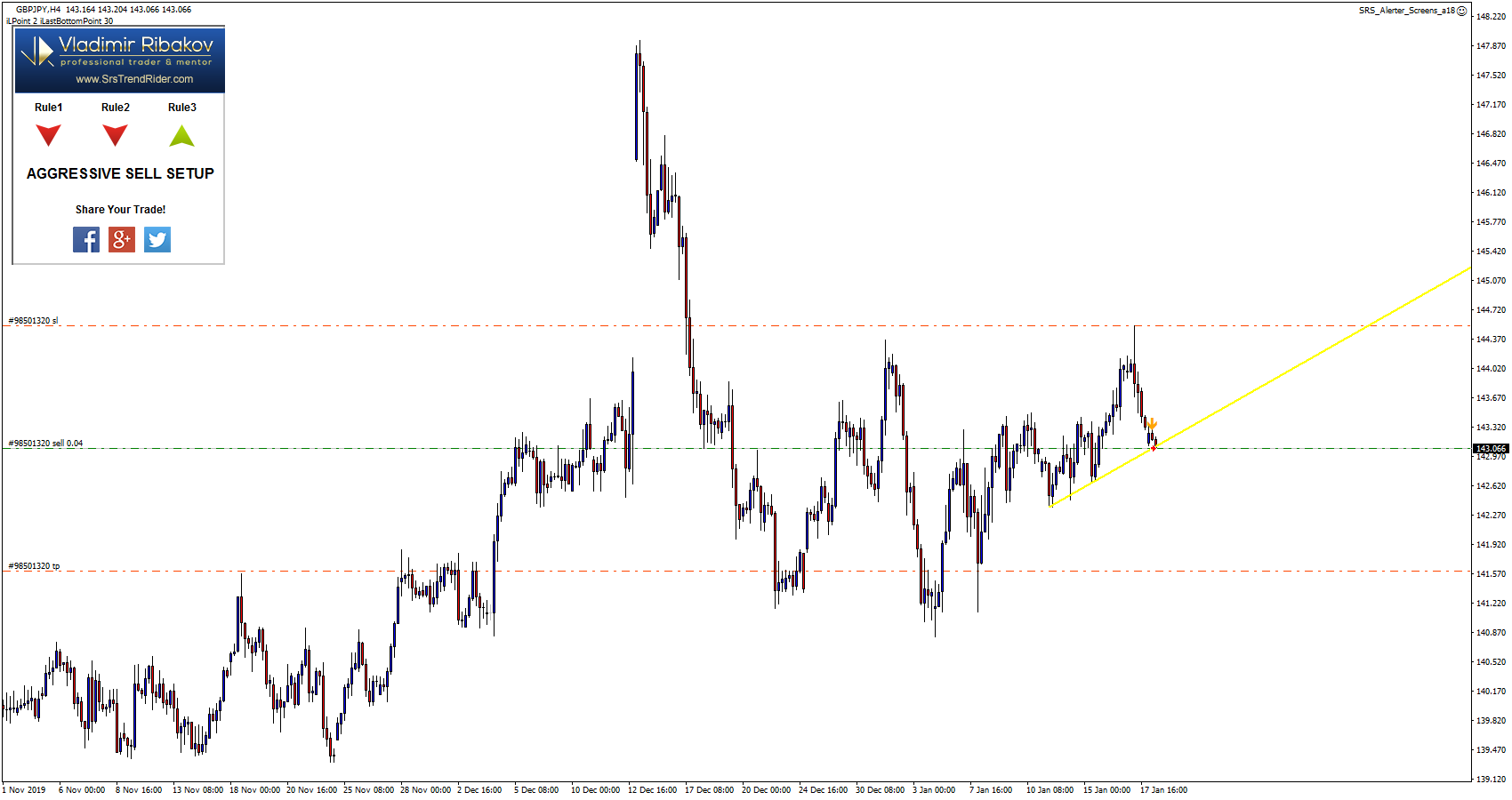

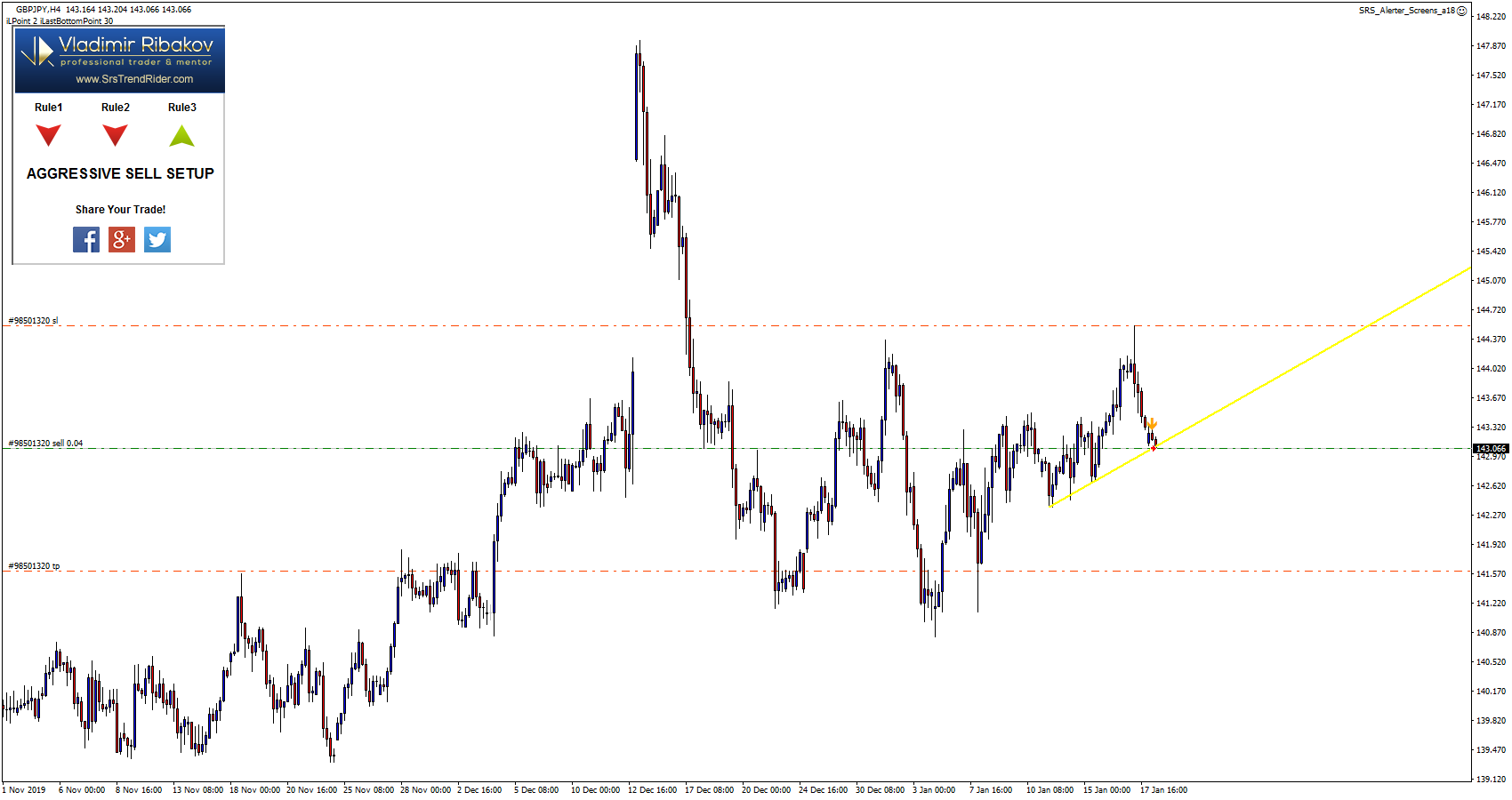

sRs Trend Rider 2.0

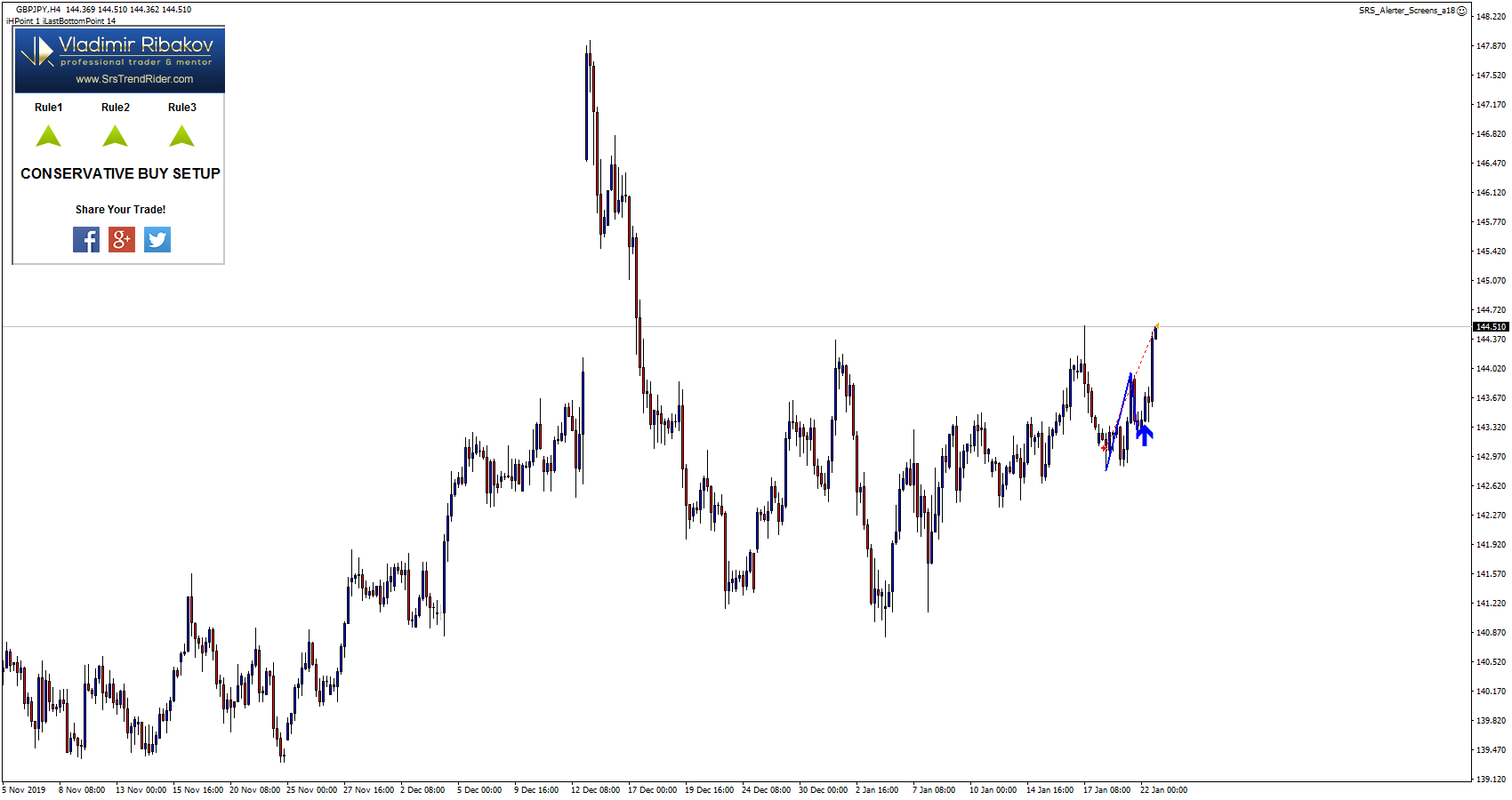

في GBPJPY ، كان السعر يتحرك صعوديًا هذا عندما حصلنا على تنبيه إعداد بيع قوي من sRs Trend Rider 2.0. كان لدينا نموذج ABCD الذي تشكل ودخلنا هذه التجارة مع كسر خط الاتجاه الصعودي الأخير ولكن السعر تحرك في الاتجاه الآخر وانتهت هذه الصفقة بخسارة.

دخول

خروج

احصل على نسختك المجانية الآن ، هناا

——————————————————-

It was a moderate trading week for us, even though we had losses with FX Delta and sRs Trend Rider 2.0 strategy, but on the whole we still managed to end this week on the positive side. This is why using more than one strategy is a good idea because losses are part of any strategy and every system has its best period and worst period. That’s why we must incorporate diversification in our trading, this week is yet another good example for that. Also if you don’t find any good trade setup then don’t force yourself into any trade, its better to stay away until we find a good setup and avoid trading too much.

أنا وفريقي أستخدم أنظمة التداول الخاصة بي يوميًا. إنها مختلفة ويمكن لكل نظام أن يناسب أفضل أنواع المتداولين. يمكنك التحقق من خارطة الطريق الخاصة بي من هنا للعثور على جميع أنظمة التداول الخاصة بي ومعرفة ما يناسبك.

يمكنك أيضًا الحصول على الأنظمة مجانًا بفضل برنامج شراكة الوسطاء المذهلين الذي لدينا.

سوف تجد كل التفاصيل هنا

و لا تفوت فرصة أن أكون جزءًا من ناديي. نحن نتاجر نعيش سويًا يوميًا وأعلمك كل أسراري!

انضم الي أكاديمية المتداولين الان

مع تحياتنا

فلاديمير و اسر البدراوى

Click To Join Our Community Telegram Group