Arabic Telegram Group:

اضغط هنا للانضمام إلى مجتمع التليجرام الخاص بنا

مرحبا ايها المتداولين! توقعات الفوركس الأسبوعية بالشرح التفصيلى المكتوب من 18 اغسطس إلى 23 اغسطس 2019 هنا. أواصل مع فريقي دائمًا العمل الجاد من أجلك ونجاحك ، وكما نفعل كل أسبوع ، قمنا بإعداد هديتين رائعتين لك!

توقعات فوركس الأسبوعية:

وإليك تنسيق الشرح التفصيلى بتوقعات فوركس الأسبوعية الذي أعده فريقي خصيصًا لك.

- 1 GBPAUD

- 2 AUDNZD

- 3 NZDCAD

- 4 في هذا الزوج ، كانت خطتنا من الأسبوع السابق هي البحث عن الإعدادات الهبوطية ، وحصلنا على القليل من الارتفاع ونحن الآن في استمرار.

- 5 USDJPY

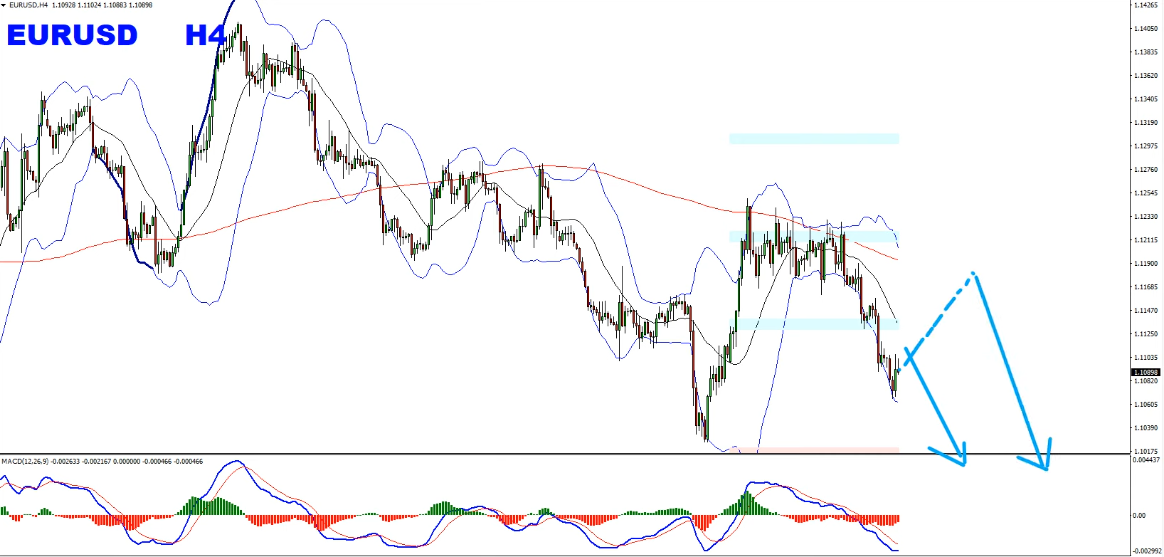

- 6 EURUSD

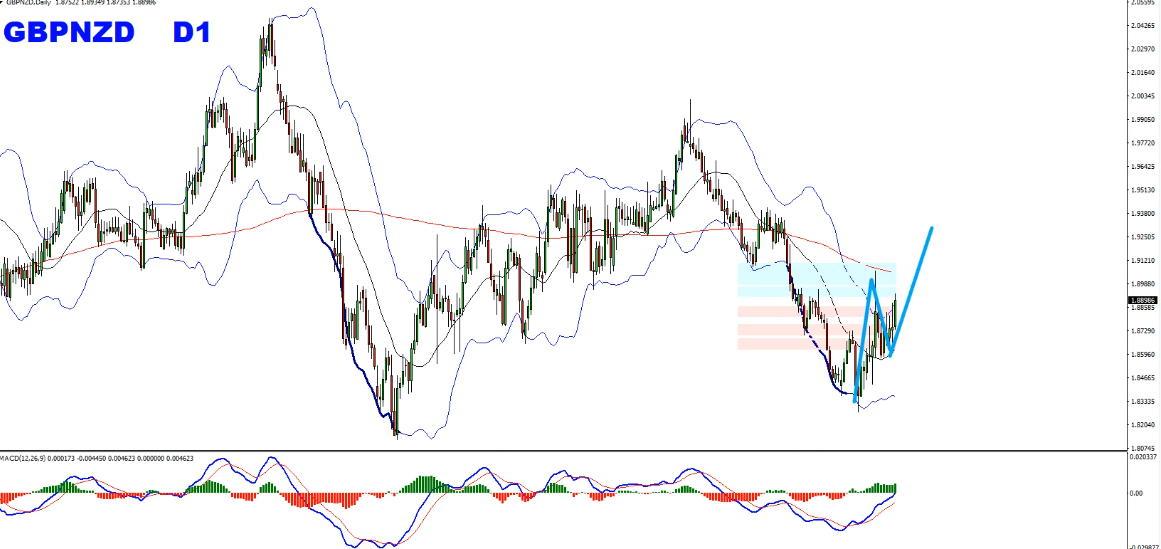

- 7 GBPNZD

- 8 GBPUSD

- 9 CADJPY

- 10 EURJPY

- 11 NZDCHF

- 12 NZDUSD

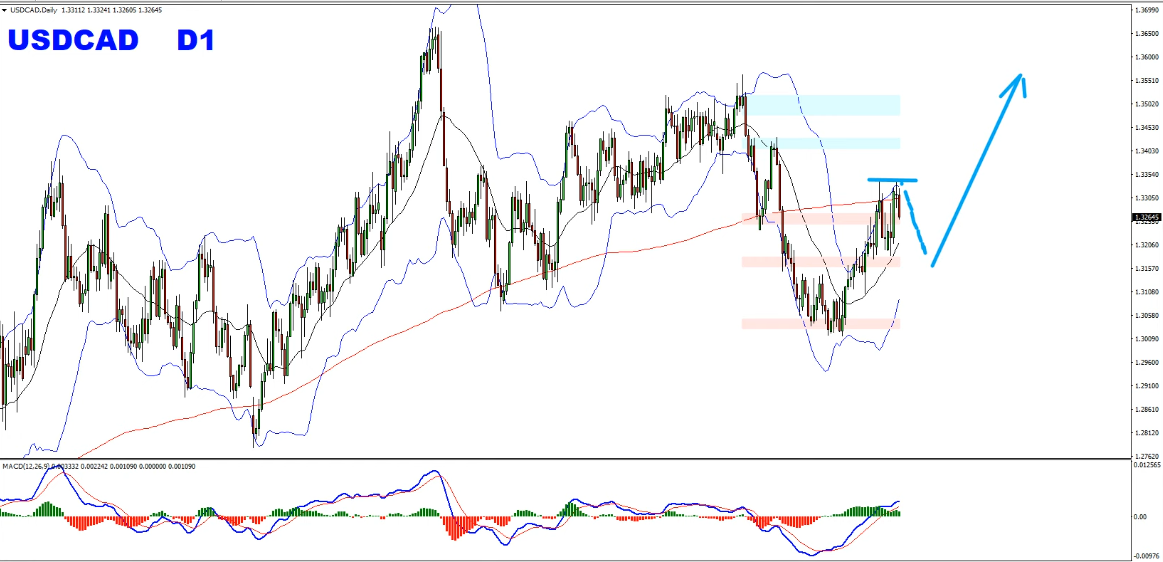

- 13 USDCAD

- 14 EURGBP

- 15 GBPCAD

- 16 Natural Gas

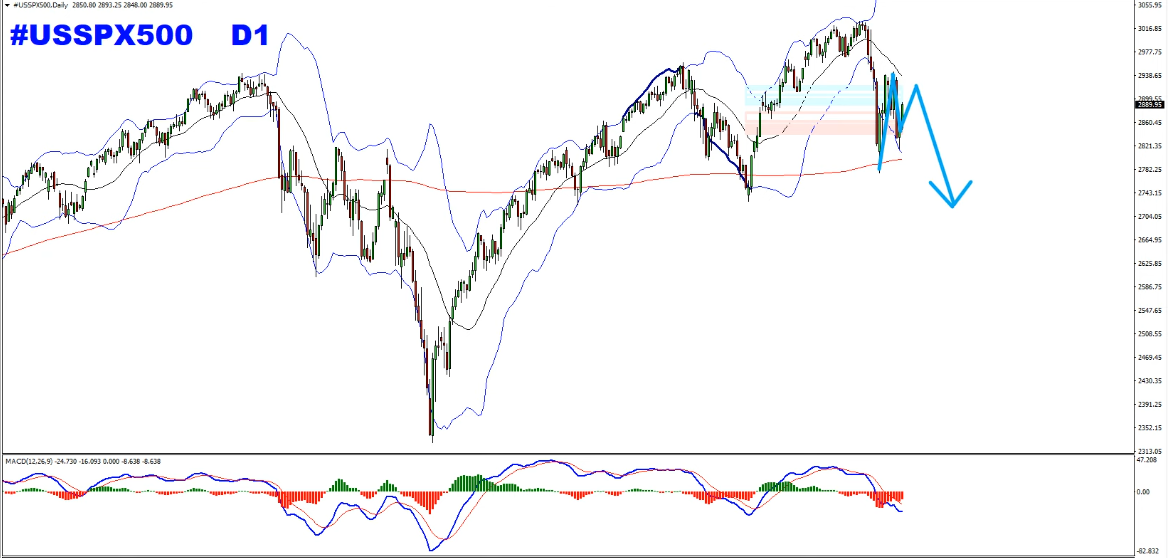

- 17 S&P 500

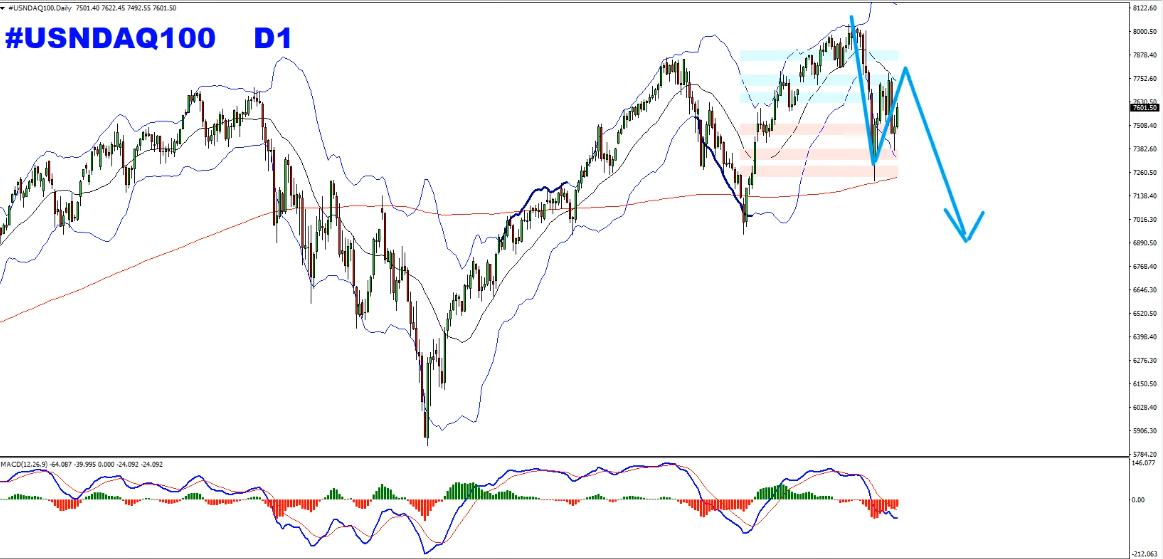

- 18 NASDAQ

- 19 Dax

- 20 Lou Vuitton

GBPAUD

على الرسم البياني اليومي بعد أول حركة ثلاثية ، يكون السعر في وضع دورة تصحيحية. كان توقعنا ولا يزال موجتين إلى الاتجاه الصعودي أو بعض الحركة داخل النطاق. هذا أو في الاتجاه المعاكس على المدى القصير ، قد نبحث عن الانخفاضات والارتفاعات ، على المدى الطويل قد نشهد الارتفاع ، ثم قد نبحث عن عمليات بيع محتملة. يعتبر كلا السيناريوهين مقبولين تمامًا (اعتمادًا على نمط التداول الذي يناسبك) وحالياً ما زال اللعب هو المدى القصير الذي يجعل الدفع أعلى. على المدى الطويل ، قد نتوقع أن يرتفع السعر أعلى إلى أعلى مستوى معروض في لقطة الشاشة ومن ثم قد نبدأ في البحث عن فرص البيع مع أدلة هبوطية نتوقع أن تبدأ بعض الحركة الهبوطية. يتبع السعر خطتنا من الأسبوع السابق وتظل هذه الخطة دون تغيير. تذكر على المدى الطويل أننا نهدف إلى استعادة 50 ٪ من الدورة الثلاثية الأسبوعية.

يتبع السعر خطتنا من الأسبوع السابق وتظل هذه الخطة دون تغيير. تذكر على المدى الطويل أننا نهدف إلى استعادة 50 ٪ من الدورة الثلاثية الأسبوعية.

AUDNZD

في هذا الزوج ، كانت وجهة نظرنا صعودية بعد كسر خط الاتجاه اليومي والفكرة هي البحث عن عمليات الاسترداد وشراء الإعدادات على الرسم البياني H4. حصلنا على ارتداد على الرسم البياني H4 مع خلق السعر تباعدًا تصاعديًا مخفيًا ثم استمرارًا جميلًا في الاتجاه الصعودي. على افتراض أن هذا قد يكون الضلع الأول من الرسم البياني H4 ، فقد نمضي صعودًا إلى المنطقة الليفية 61.8 وهي 1.06110.

على افتراض أن هذه هي الموجة الأولى اليومية كما هو موضح في لقطة الشاشة.

على افتراض أن هذه هي الموجة الأولى اليومية كما هو موضح في لقطة الشاشة.

ثم مخطط H4 هو المخطط الذي سيكمل الدورة التصحيحية في شكل موجتين.

ثم مخطط H4 هو المخطط الذي سيكمل الدورة التصحيحية في شكل موجتين.

أو بدلا من ذلك في شكل رانج.

هذا أو في الاتجاه الآخر حول وجهة النظر لا يزال صعودي. لأولئك منكم الذين يشتركون في عمليات الشراء ، قم بإدارة صفقاتك وتأكد من صرفها عندما يعطيك السوق أسبابًا لذلك. بالنسبة لأولئك منكم الذين لا يركبون ، فإن عمليات الاستعادة هي الشيء الصحيح الذي يجب فعله هنا وتبقى رأيي صعوديًا ، وقد أتوقع تراجعًا ثم ارتفع السعر.

هذا أو في الاتجاه الآخر حول وجهة النظر لا يزال صعودي. لأولئك منكم الذين يشتركون في عمليات الشراء ، قم بإدارة صفقاتك وتأكد من صرفها عندما يعطيك السوق أسبابًا لذلك. بالنسبة لأولئك منكم الذين لا يركبون ، فإن عمليات الاستعادة هي الشيء الصحيح الذي يجب فعله هنا وتبقى رأيي صعوديًا ، وقد أتوقع تراجعًا ثم ارتفع السعر.

NZDCAD

في هذا الزوج ، كانت خطتنا من الأسبوع السابق هي البحث عن الإعدادات الهبوطية ، وحصلنا على القليل من الارتفاع ونحن الآن في استمرار.

أعتقد أن هذا يتطلب المزيد على الأقل حتى تكمل اليومية الاختلاف الصعودي.

لذلك كانت وجهة نظري الشخصية لهذا الزوج وما زالت هبوطية ، وأتوقع أن يستمر السعر في الانخفاض.

USDJPY

في هذا الزوج ، كانت توقعاتي من الأسبوع السابق هي البحث عن استمرارية منخفضة إلى مستوى التكرار بنسبة 100٪ بعد عمليات الاسترداد. لقد تحركنا للأسفل ثم وصلنا إلى انسداد في شكل تباعد صاعد ، مما يعني أننا نتوقع نوعًا من القتال ، بمجرد الانتهاء من ذلك ، قد نبحث عن استمرار محتمل أقل.

سيكون مستوى الإلغاء هو المقاومة الديناميكية وأعتقد أن السعر يجب أن يتحرك باستمرار داخل القناة المعروضة في لقطة الشاشة.

سيكون مستوى الإلغاء هو المقاومة الديناميكية وأعتقد أن السعر يجب أن يتحرك باستمرار داخل القناة المعروضة في لقطة الشاشة.

EURUSD

في هذا الزوج ، كنت أتوقع أن نشهد مرحلة ثانية لتطويرها ، وإذا كانت ستفعل ذلك ، مما يخلق تباعدًا هبوطيًا ، فقد نبدأ بعد ذلك بالبحث عن عمليات البيع. لم ينجح السعر أبدًا في توفير مستوى جديد جديد من الاختلاف. تمكن السعر من الإبقاء على أعلى مستوياته في منطقة المقاومة مع تباطؤ وبدأ التحرك في وقت سابق. لذلك بمجرد كسر النموذج المصغر الموضح في لقطة الشاشة (كنت أرغب شخصيًا في رؤية الكسر في الاتجاه الصعودي لإكمال تجمع صعودي وهبوطًا) حدث إعادة الاختبار واستمر السعر حاليًا في الانخفاض.

لا تزال وجهة نظري الشخصية هبوطية وأتوقع استمرارًا محتملاً أقل ، فقد نرى بعض التصحيحات أو استمرارًا مستمرًا. قد يكون بيع الارتفاعات بأدلة هبوطية بمثابة خطة جيدة لهذا الزوج.

GBPNZD

في هذا الزوج ، يكون السعر في وضع تصحيحي ، لذلك قد نتوقع موجتين أو نطاق. الثمن هو تطوير الأمواج اثنين.

قد يحدث الاستردادات ولكن وجهة نظري الشخصية لا تتغير هنا وأظل متفائلاً.

قد يحدث الاستردادات ولكن وجهة نظري الشخصية لا تتغير هنا وأظل متفائلاً.

GBPUSD

في هذا الزوج ، تحرك السعر إلى منطقة 1.20 ثم كما هو موضح في الأسبوع السابق ، قد نواجه بعض التراجعات. أعتقد حاليًا أن هناك حشد مؤقت يحدث قبل الاستمرار. نظرًا لحقيقة أن هناك تباعدًا صعوديًا في اللعب وأن السعر يرتد من منطقة 1.20 ، لن أفاجأ إذا جاء الوضع التصحيحي للعب قبل المزيد من البيع.

على المدى القصير طالما أن خط الاتجاه الموضح في لقطة الشاشة قد نشهد ارتفاعًا في الأسعار ، لكن الارتفاع عمومًا على المدى الطويل مع الأدلة الهبوطية سيكون بمثابة خطة بيع جيدة أخرى.

على المدى القصير طالما أن خط الاتجاه الموضح في لقطة الشاشة قد نشهد ارتفاعًا في الأسعار ، لكن الارتفاع عمومًا على المدى الطويل مع الأدلة الهبوطية سيكون بمثابة خطة بيع جيدة أخرى.

ضع في اعتبارك أن يخلق H4 الاختلاف الهبوطي الخفي ، يجب على H4 توفير تباعد نهائي ومن ثم سيكون مكانًا جيدًا للبدء في البحث عن عمليات البيع. من الناحية المثالية بمجرد مسح السعر لمناطق التصفية ، يمكننا بعد ذلك مناقشة عمليات البيع مع أدلة هبوطية.

CADJPY

في هذا الزوج ، كنا نتوقع انخفاضًا جديدًا حيث يقاتل حاليًا منطقة 80 ، وحصلنا على الارتفاع وفوراً التحرك ، ثم حصلنا على انسداد في نفس المنطقة بتباعد صعودي. لذلك نحن الآن في مرحلة تصحيحية مما يعني أن السعر قد يخلق موجتين وبيع.

أو بدلاً من ذلك ، قد يتحرك السعر داخل النطاق الموضح في لقطة الشاشة ومن ثم قد نحصل على عمليات بيع محتملة. هذا أو في الاتجاه المعاكس ، أنا شخصياً أعتقد أن هذا ما زال هابطًا.

على الرسم البياني اليومي ، يتحرك السعر داخل قناة ما ، وبالتالي فإن ترقب واستمرار البيع سيكون توقعاتي الشخصية مع هذا الزوج.

على الرسم البياني اليومي ، يتحرك السعر داخل قناة ما ، وبالتالي فإن ترقب واستمرار البيع سيكون توقعاتي الشخصية مع هذا الزوج.

EURJPY

في هذا الزوج ، كانت خطتنا من الأسبوع السابق هي بيع الارتفاعات وقد تم وضع هذه الخطة بشكل مثالي. ليس لدينا أي علامات على تغيير الاتجاه إلى جانب الاختلاف المحتمل ، لذلك تظل وجهة نظري هبوطية هنا. قد نواجه دورة تصحيحية هنا قبل البيع.

أو قد نواجه حركة صغيرة في الاتجاه الصعودي كما هو موضح في لقطة الشاشة ومن ثم قد يتحرك السعر هبوطيًا ، هذا أو في الاتجاه المعاكس ، يبقى الاتجاه الهبوطي على المدى الطويل.

ملاحظة: راقب الأخبار الأساسية.

NZDCHF

في هذا الزوج بيع ، كانت الارتفاعات ولا تزال الخطة ، لم يتغير شيء عن الأسبوع السابق. لذلك قد نبحث عن الارتفاعات ونواصل البيع ، قد نتوقع استمرارًا مباشرًا أو قد نحصل أيضًا على تصحيح أعمق ، كلا السيناريوهين ممكنان. أتوقع انخفاضًا جديدًا حتى ينحصر الاختلاف الصعودي في الهيكل. بيع المسيرات مع الأدلة الهابطة ستبقى الخطة هنا.

NZDUSD

في هذا الزوج ، كانت خطتنا ولا تزال تبيع المسيرات. يمكن أن يستمر السعر بشكل مستقيم دون أي عمليات استعادة أو قد يحاول السعر إنشاء ساق أخرى ثم التحرك أقل.

ملاحظة: تظل الخطة كما هي بالنسبة لـ NZDJPY. ضع في اعتبارك الآن أنه يوجد الكثير من الزيلنديين الجدد الذين لا نرغب في كشفهم جميعًا في مكان واحد. لذا كن انتقائيًا واختر الأدوات التي تمنحك أفضل الإعدادات ، ولا تعرض نفسك أكثر من اللازم.

USDCAD

في هذا الزوج على الرسم البياني H4 ، أردنا أن نرى الأمواج تتشكل وتصل إلى منطقة مهمة للغاية ثم تستمر. وصلنا إلى الأمواج ، وصل السعر إلى المنطقة المهمة ، ثم وصلنا إلى الارتفاع وفقًا لخطتنا. حاليا نحن نواجه تباطؤ مع القمة المزدوجة ، وهذا يظهر على الرسم البياني اليومي أيضا.

لذلك يمكن أن تكون H4 تصحيحية قليلاً قبل حدوث مزيد من الاستمرارية.

لذلك يمكن أن تكون H4 تصحيحية قليلاً قبل حدوث مزيد من الاستمرارية.

شخصيا قد أتوقع أن يستمر السعر في شكل موجتين.

أو بدلاً من ذلك ، أتوقع ثبات السعر داخل النطاق وقد نتطلع بعد ذلك إلى مواصلة الشراء.

EURGBP

في هذا الزوج ، كانت خطتنا من الأسبوع السابق هي البحث عن ارتداد مع فرصة شراء. بدأت عملية الاستعادة هذه بمجرد أن حصلنا على اختراق خاطئ مع اختلاف كبير. لذلك من وجهة نظري الشخصية ، يجب أن نتعرض الآن إلى نوع من الدورة التصحيحية ، بمجرد أن يؤدي الاختلاف الصعودي إلى التغلب على هذه الفرصة ستصبح فرصة شراء.

وفي الوقت نفسه ، سأركز على تقليل هاتين الأمواج ، وعندها فقط سأبحث عن المزيد من فرص الشراء.

وفي الوقت نفسه ، سأركز على تقليل هاتين الأمواج ، وعندها فقط سأبحث عن المزيد من فرص الشراء.

GBPCAD

على الرسم البياني اليومي ، لدينا دورة خاصة ولدينا كسر خاطئ مع وجود تباعد صعودي في اللعب.

تم كسر خط الاتجاه ، ومن المحتمل جدًا أن يتم تطوير الضلع التصحيحي الأول على الرسم البياني H4 ، ونواجه أيضًا أعلى سعر له وأدنى سعر له. إن مخطط H1 هو الذي يجعله يبدو كدورة كما هو موضح في لقطة الشاشة. توقعاتي الشخصية هي البحث عن موجتين للأسفل ثم مواصلة الشراء.

أو ربما نتوقع أن يتحرك السعر داخل أي نوع من النطاق ثم الاستمرار المحتمل في الاتجاه الصعودي.

أو ربما نتوقع أن يتحرك السعر داخل أي نوع من النطاق ثم الاستمرار المحتمل في الاتجاه الصعودي.

هذا أو في الاتجاه المعاكس نحو التراجع للأسفل مع الأدلة الصعودية يجب أن تكون فرصة فنية كبيرة. إذا انخفض السعر في ساق واحدة على التوالي دون منطقة تصحيح فيبونات بنسبة 61.8٪ ، فسيكون ذلك علامة تحذير على أن المضاربين على الارتفاع أضعف مما يبدو عليهم هنا ، لذلك لا تتعجل.

هذا أو في الاتجاه المعاكس نحو التراجع للأسفل مع الأدلة الصعودية يجب أن تكون فرصة فنية كبيرة. إذا انخفض السعر في ساق واحدة على التوالي دون منطقة تصحيح فيبونات بنسبة 61.8٪ ، فسيكون ذلك علامة تحذير على أن المضاربين على الارتفاع أضعف مما يبدو عليهم هنا ، لذلك لا تتعجل.

Natural Gas

بعد الدورة الثلاثية على الرسم البياني الأسبوعي ، أردنا أن نرى اختراق لخط الاتجاه على الرسم البياني اليومي ، وتم كسر خط الاتجاه الصغير ولكن لم يتم كسر خط الاتجاه الكبير بعد. إذا تمكن السعر من الاستمرار في الانتظار ، فأعتقد أن هذا قد يوفر فرصة شراء كبيرة.

S&P 500

في هذه الخطة كانت خطتنا من الأسبوع السابق إذا كان السعر ثابتًا دون مستوى 61.8 فيبو ، فسيظل هذا تحت ضغط هبوطي. لا يزال السعر ثابتًا دون مستوى 61.8 وما زالت وجهة نظري الشخصية هبوطية.

NASDAQ

إنه نفس الشيء في بورصة ناسداك ، وجهة نظري متشابهة للغاية ، وأعتقد أن هذا تحت ضغط هبوطي.

Dax

في Dax كانت خطتنا من الأسبوع السابق هي البحث عن الارتفاعات والبيع. لقد حصلنا على الارتفاع وعمليات البيع التي تتوقف حاليًا مع بعض الاختلافات الصعودية ولكن بشكل أساسي لدينا ثلاثة قمم منخفضة ، أدنى مستويات منخفضة وهذا يعني أن أي رأي تصحيحي يجب أن يستمر ويوفر فرص البيع. يمكن أن تكون الدورة التصحيحية هنا على شكل موجتين

أو بدلا من ذلك في شكل نطاف / رانج.

أو بدلا من ذلك في شكل نطاف / رانج.

هذا أو على العكس من ذلك ، لا يزال بيع التجمعات هو الخطة بالنسبة لنا. إذا كنت تقوم بالفعل ببيع عمليات البيع ، فهذا مكان جيد للاستفادة من النقود جزئيًا أو كل التجارة.

هذا أو على العكس من ذلك ، لا يزال بيع التجمعات هو الخطة بالنسبة لنا. إذا كنت تقوم بالفعل ببيع عمليات البيع ، فهذا مكان جيد للاستفادة من النقود جزئيًا أو كل التجارة.

Lou Vuitton

في هذا توقعنا أن يتطور السعر في المرحلة الثانية ، فالسعر يتحرك تمامًا وفقًا لخطتنا ويدفع كثيرًا. هذا مكان رائع لأخذ المال أو حتى إذا كان جزئياً يتمتع بالأرباح.

ندعوك للانضمام إلي في غرف التداول الحية الخاصة بي ، وتحسين التداول الخاص بك معنا.

كما يمكنك الحصول على واحدة من استراتيجياتي مجانا. سوف تجد كل التفاصيل

نتمنى لك أسبوع تداول رائع

فلاديمير ريباكوف و اسر البدراوى