Arabic Telegram Group:

اضغط هنا للانضمام إلى مجتمع التليجرام الخاص بنا

مرحبا ايها المتداولين!

أشارككم اليوم فكرة إعداد بيع AUDCHF. كما أفعل مع كل اعداد ، أقوم بتحليل الأطر الزمنية المتعددة وابحث عن جميع الأدلة الممكنة التي تدعم وجهة نظري بشأن الإطار الزمني للتداول الحالي واثنين من الأطر الزمنية العليا. سنبدأ تحليلنا من أعلى إطار زمني الآن.

AUDCHF تحليل الرسم البياني الأسبوعي (W1) – الاختلاف الهبوطي المخفي وكسر خط الاتجاه لمؤشر القوة النسبية

على الرسم البياني الأسبوعي فإن أول دليل على أننا نرى ما يدعم وجهة نظرنا الهبوطية هو التباعد الخفي الهابط الذي خلقه السعر بين أعلى قمة تأرجحة عند 0.72731 في 14 أبريل 2019 وأعلى ارتفاع تأرجح عند 0.68883 في 3 نوفمبر 2019 بناءً على مؤشر الماكد المدرج التكراري. الدليل التالي الذي يمكن أن نجده موجود على مؤشر القوة النسبية حيث يمكننا أن نرى اختراق لخط الاتجاه الصعودي والذي قد نعتبره دليلاً آخر على الضغط الهبوطي. لذا ، دعونا الآن ننتقل إلى إطار زمني واحد أقل ونبحث عن الأدلة المحتملة التي تدعم وجهة نظرنا.

AUDCHF

تحليل الرسم البياني اليومي (D1) – الاختلاف الهبوطي وكسر خط الاتجاه الصعودي

على الرسم البياني اليومي ، فإن الاختلاف الأخير الذي حدث بيننا هو تباعد منتظم هبوطي ، ثم تحرك السعر هبوطيًا وكسر أسفل خط الاتجاه الصعودي الجيد الذي كان السعر يحترمه حتى الآن. بعد الاختراق ، يثبت السعر أدنى هذه المقاومة الديناميكية وإلى أن يثبت هذا الاختراق أن وجهة نظري لا تزال هابطة. يدعم الإطار الزمني الأسبوعي واليومي وجهة نظرنا الهبوطية مع الأدلة المحتملة ، والآن يتيح الانتقال إلى إطار زمني واحد أقل ومعرفة ما إذا كنا نستطيع العثور على الأدلة التي تتوافق مع وجهة نظرنا.

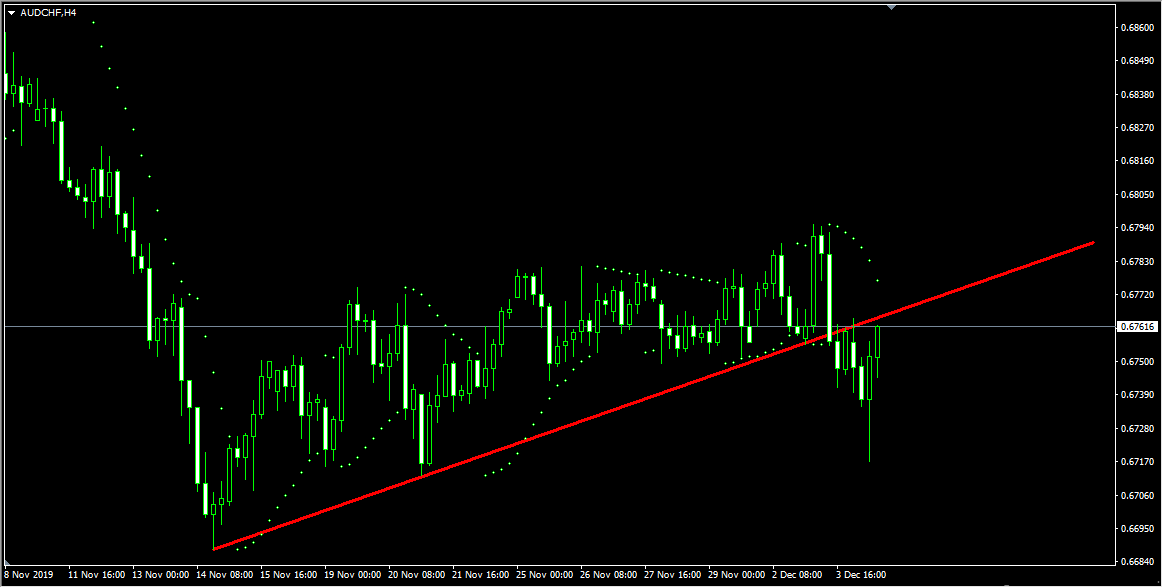

AUDCHF H4 تحليل الرسم البياني – كسر خط الاتجاه و SAR

لدينا اختراق لخط الاتجاه الصعودي على الرسم البياني H4 أيضًا ، مما يجعل وجهة نظرنا الهبوطية أقوى جدًا لأن لدينا اختراق لخط الاتجاه في جميع الأطر الزمنية الثلاثة (اختراق خط الاتجاه الصعودي W1 ، وخط كسر الاتجاه العلوي D1 وكسر خط الاتجاه العلوي H4). استنادًا إلى السعر Parabolic SAR ، توجد نقاط أعلى من السعر والتي قد نعتبرها دليل على الاتجاه الهبوطي.

لذا فإن جميع الأدلة التي حصلنا عليها بناءً على تحليل الإطار الزمني المعطي على الأطر الزمنية W1 و D1 و H4 تلمحنا إلى نفس الشيء الذي ربما سيطرت عليه الدببة الآن وقد نبحث الآن عن إعدادات هبوطية مع أدلة هبوطية ، فواصل خاطئة ، كسر خط الاتجاه ، الخ …) من أجل البدء في البحث عن عمليات البيع.

ملخص التحليل الفني والتنبؤ

تلخيص التحليل الذي أجريناه حتى الآن:

- تباعد مخفي هبوطي وكسر خط الاتجاه لمؤشر القوة النسبية

الرسم البياني اليومي AUDCHF :

الاختلاف الهابط وخط الاتجاه الصاعد

الرسم البياني AUDCHF H4 ساعات

كسر خط ومكافئ SAR

نصائح التداول:

يوصى دائمًا بالبحث عن التأكيدات قبل القفز في أي عملية تداول. إذا لم تكن متأكدًا من كيفية تداول إعداد ، يمكنك استخدام أي إعداد واستراتيجية لديك في ترسانتك للبحث عن التحركات الصعودية والانضمام إلى صفقة الشراء هذه.

لست متأكدًا من كيفية اكتشاف الانعكاسات (الارتداد)؟ لست متأكدًا من كيفية اكتشاف الاختراقات؟

أدعوك للانضمام إلي في غرف التداول الحية الخاصة بي ، وتحسين التداول الخاص بك معنا

كما يمكنك الحصول على واحدة من استراتيجياتي مجانا. سوف تجد كل التفاصيل

مع تحياتنا

فلاديمير و اسر البدراوى