Arabic Telegram Group:

اضغط هنا للانضمام إلى مجتمع التليجرام الخاص بنا

تنويه: هذه ليست نصيحة استثمار. الأداء السابق ليس مؤشرا على النتائج المستقبلية.

مرحبا ايها المتداولين! USDCAD فرصة بيع على المدى القصير . تحليل مفصل لفرصة الشراء هذه كما يلي:

المؤشر المستخدم: MACD

USDCAD

تحليل الرسم البياني اليومي – خطوط الاختلاف الهبوطي المخفي المحتمل وخط التريند الهبوطى

على الرسم البياني اليومي ، لدينا خطان للاتجاه الهبوطي يتكونان والسعر الذي يتحرك صعوديًا يقترب حاليًا من هذه المقاومة الديناميكية ، إذا لم نحصل على اختراق صحيح هنا ، فقد نتوقع بعد ذلك أن يحترم السعر خطوط الاتجاه هذه ويتحرك هبوطيًا مرة أخرى. بالإضافة إلى ذلك ، لدينا أيضًا تباعد مخفي هبوطي محتمل تشكل على أساس رسم بياني MACD بين أعلى ارتفاع تم تشكيله في 10 أكتوبر 2019 والثاني أعلى في 13 نوفمبر 2019 والذي قد نعتبره دليلًا على الضغط الهبوطي. قد نبحث الآن عن المزيد من الأدلة (أنماط الشموع ، فواصل خاطئة ، كسر خط الاتجاه ، الخ …) للضغط الهبوطي على الأطر الزمنية المنخفضة من أجل الانضمام إلى المضاربين على الانخفاض.

USDCAD

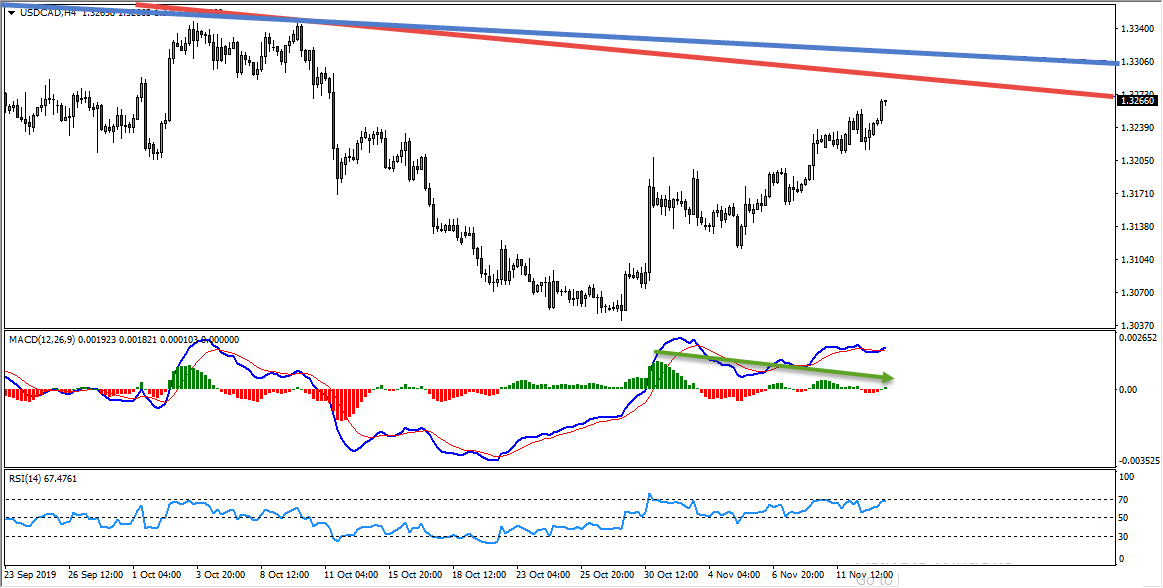

تحليل الرسم البياني H4 – التباعد الهابط

على الرسم البياني H4 لدينا تباعد هبوطي يتشكل بناءً على مؤشر MACD بين أول قمة في 30 أكتوبر 2019 ، والثاني أعلى مستوى في 8 نوفمبر 2019 ، وأعلى ارتفاع في 13 نوفمبر 2019 ، قد نعتبر هذا دليلًا على وجود ضغط هبوطي . قد نبحث الآن عن الإعدادات الهبوطية مع المزيد من الأدلة الهبوطية على الأطر الزمنية المنخفضة من أجل الانضمام إلى الدببة.

USDCAD

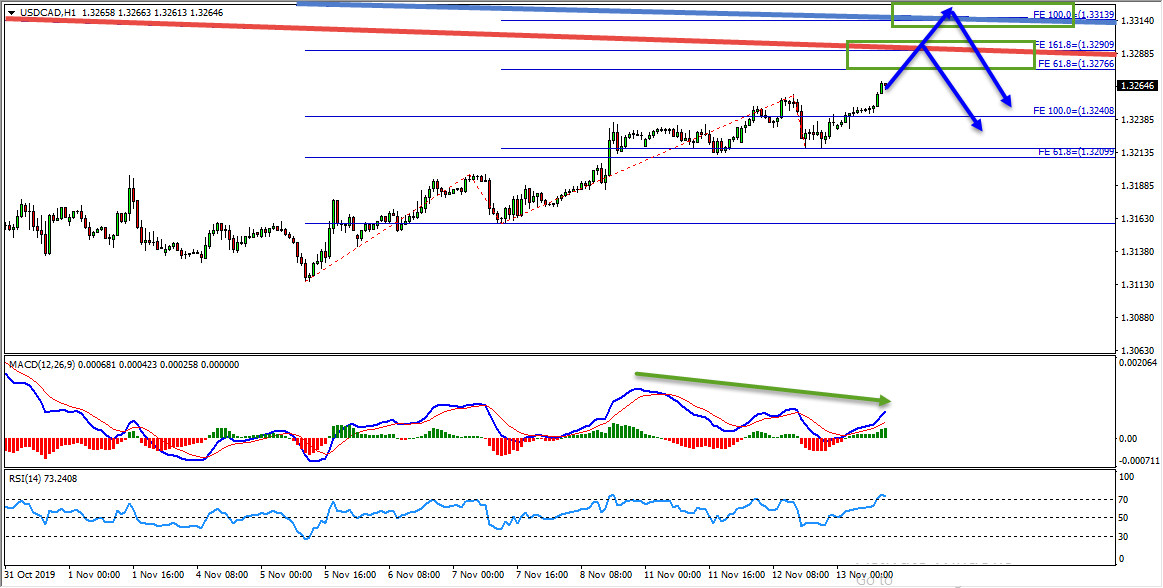

تحليل الرسم البياني H1 – اثنين من مناطق المقاومة الهامة

على الرسم البياني H1 لدينا منطقتان مهمتان للمقاومة تشكلتا على أساس خطوط الاتجاه الهبوطي في الرسم البياني اليومي ومستويات توسع فيبوناتشي للموجات التي لدينا. لدينا أيضًا تباعد هبوطي تم تشكيله بناءً على المتوسط المتحرك MACD والذي قد نعتبره دليلًا على الضغط الهبوطي. بمجرد أن يصل السعر إلى منطقة المقاومة الأولى التي يتم تشكيلها على أساس توسع فيبوناتشي بنسبة 161.8٪ للموجة الأولى عند 1.32909 ، ومستوى توسع فيبوناتشي 61.8٪ للموجة الثانية عند 1.32766 وخط الاتجاه الهبوطي اليومي ، فقد نبحث عن إعدادات هبوطية مع المزيد من الأدلة الهبوطية (أنماط الشموع ، فواصل خاطئة ، اندلاع خط الاتجاه ، الخ …) من أجل البدء في البحث عن عمليات البيع على المدى القصير. بدلاً من ذلك ، إذا تحرك السعر صعوديًا ، فالمنطقة التالية للبحث عن الإعدادات الهبوطية مع الأدلة الهابطة (أنماط الشموع ، الاختراقات الخاطئة ، كسر خط الاتجاه ، إلخ …) للانضمام إلى عمليات البيع على المدى القصير ، فإن منطقة المقاومة الثانية التي يتم تشكيلها بناءً على توسع فيبوناتشي 100٪ للموجة الثانية عند 1.33139 وخط الاتجاه الهبوطي اليومي.

نصائح التداول:

يوصى دائمًا بالبحث عن التأكيدات قبل القفز في أي عملية تداول. إذا لم تكن متأكدًا من كيفية تداول إعداد ، يمكنك استخدام أي إعداد واستراتيجية لديك في ترسانتك للبحث عن التحركات الصعودية والانضمام إلى صفقة الشراء هذه.

لست متأكدًا من كيفية اكتشاف الانعكاسات (الارتداد)؟ لست متأكدًا من كيفية اكتشاف الاختراقات؟

أدعوك للانضمام إلي في غرف التداول الحية الخاصة بي ، وتحسين التداول الخاص بك معنا

كما يمكنك الحصول على واحدة من استراتيجياتي مجانا. سوف تجد كل التفاصيل

مع تحياتنا

فلاديمير و اسر البدراوى