Arabic Telegram Group:

اضغط هنا للانضمام إلى مجتمع التليجرام الخاص بنا

تنويه: هذه ليست نصيحة استثمار. الأداء السابق ليس مؤشرا على النتائج المستقبلية.

مرحبا ايها المتداولين! USDJPY إعداد بيع على أساس الاختلاف -مؤشر MACD . تحليل مفصل لفرصة الشراء هذه كما يلي:

المؤشر المستخدم: MACD

الأداة المستخدمة: توسيع فيبوناتشي

USDJPY

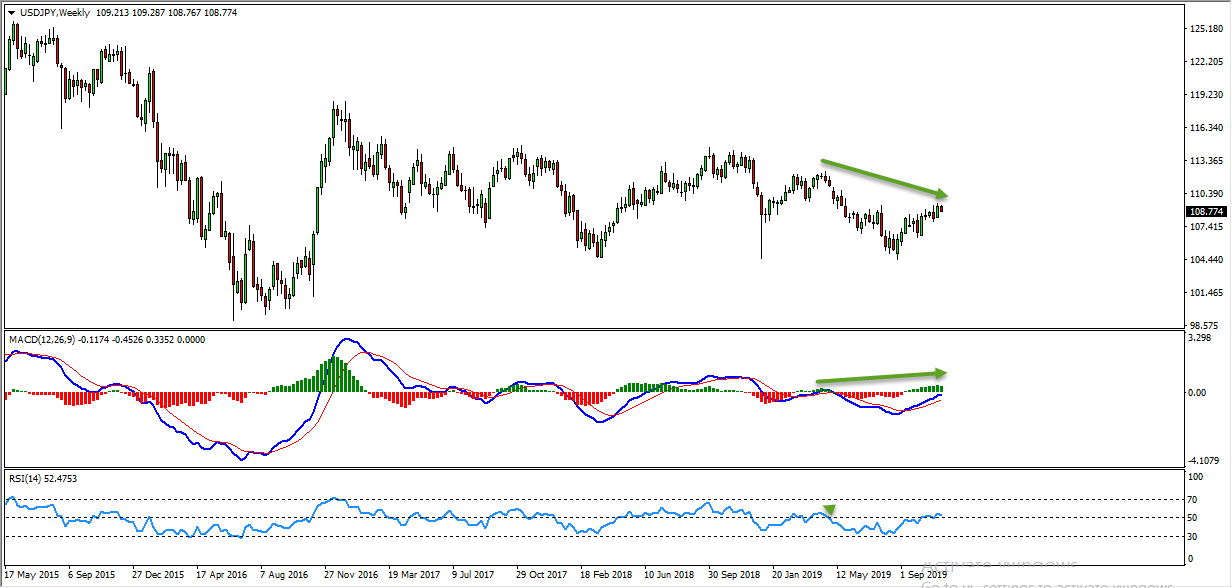

تحليل الرسم البياني الأسبوعي – الاختلاف الهابط المخفي

على الرسم البياني الأسبوعي ، يخلق السعر الذي يتحرك صعوديًا تباعدًا مخفيًا هابطًا استنادًا إلى مؤشر MACD بين أعلى مستوى يتكون عند 112.396 والثاني أعلى مستوى عند 109.486 والذي قد نعتبره دليلًا على الضغط الهبوطي. قد نبحث الآن عن المزيد من الأدلة على الضغط الهبوطي على الأطر الزمنية الدنيا للانضمام إلى الدببة.

USDJPY

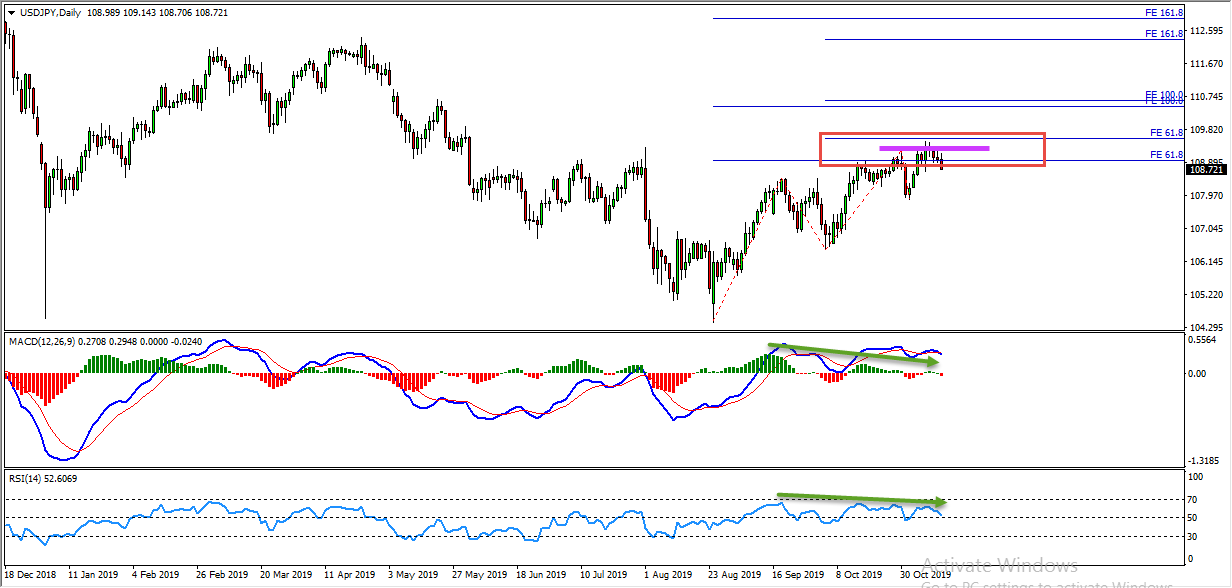

تحليل الرسم البياني اليومي – التباعد الهابط

على الرسم البياني اليومي ، لدينا منطقة مقاومة مهمة تشكلت على أساس توسع فيبوناتشي 61.8٪ للموجة الأولى عند 108.946 وتوسّع فيبوناتشي 61.8٪ للموجة الثانية عند 109.613 ، وقد وصل السعر الذي يتحرك صعوديًا حاليًا هذه المنطقة وتتحرك أقل. بالإضافة إلى ذلك ، لدينا أيضًا اختراق خاطئ للارتفاع عند 109.282 مع وجود تباعد هبوطي تم تشكيله استنادًا إلى مؤشر MACD ومؤشر RSI بين أعلى مستوى عند 108.475 ، والثاني عند 108.897 والثاني عند 109.486. النظر في هذا كدليل على الضغط الهبوطي. قد نبحث الآن عن الإعدادات الهبوطية مع المزيد من الأدلة الهبوطية على الأطر الزمنية المنخفضة من أجل الانضمام إلى الدببة.

USDJPY

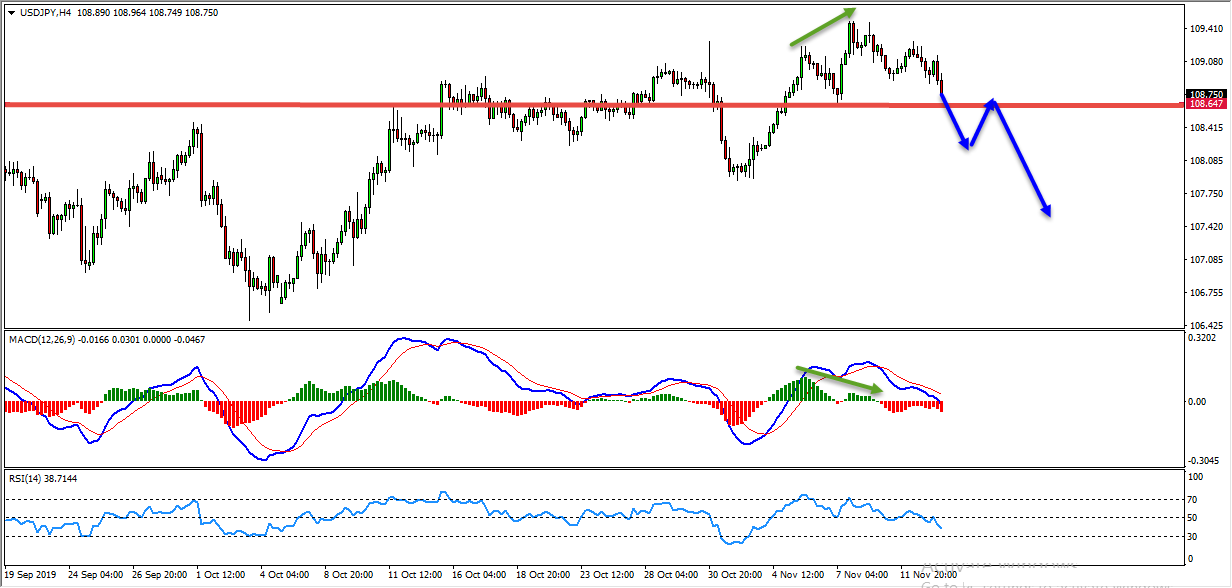

تحليل الرسم البياني H4 – التباعد الهابط

لدينا تباعد هبوطي تم تشكيله على الرسم البياني H4 أيضًا استنادًا إلى مؤشر MACD بين أعلى قمة عند 109.231 والثانية عند 109.481 ، قد نعتبر هذا دليلًا على الضغط الهبوطي. إذا تحرك السعر للأسفل وكسر دون أدنى مستوى عند 108.647 الموضح في الصورة أدناه ، فقد نبدأ بالبحث عن التراجعات ثم نبيع مع المزيد من الأدلة الهابطة (أنماط الشموع ، الاختراقات الخاطئة ، كسر خط الاتجاه ، إلخ …).

خاتمة

مزيج من التباعد الهابط المخفي على الرسم البياني الأسبوعي ، ومنطقة مقاومة مهمة ، وكسر خاطئ مع تباعد هبوطي على الرسم البياني اليومي والتباعد الهابط على الرسم البياني H4 يمكن أن يوفر لنا إعداد تداول جيد للبيع. على الرسم البياني H4 إذا تحرك السعر نحو الأسفل واخترق أدنى مستوى عند 108.647 الموضح في الصورة أعلاه ، فقد نبدأ بعد ذلك بالبحث عن التراجعات ثم نبيع مع المزيد من الأدلة الهبوطية.

نصائح التداول:

ملاحظة: يوصى دائمًا بالبحث عن التأكيدات قبل القفز في أي عملية تداول. إذا لم تكن متأكدًا من كيفية تداول إعداد ، يمكنك استخدام أي إعداد واستراتيجية لديك في ترسانتك للبحث عن التحركات الصعودية والانضمام إلى صفقة الشراء هذه.

لست متأكدًا من كيفية اكتشاف الانعكاسات (الارتداد)؟ لست متأكدًا من كيفية اكتشاف الاختراقات؟

أدعوك للانضمام إلي في غرف التداول الحية الخاصة بي ، وتحسين التداول الخاص بك معنا

كما يمكنك الحصول على واحدة من استراتيجياتي مجانا. سوف تجد كل التفاصيل

مع تحياتنا

فلاديمير و اسر البدراوى