The key fundamental events December 2nd 2016 by Investing.com:

1. November jobs report in focus

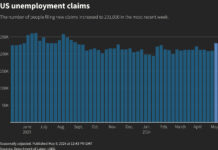

The Labor Department is scheduled to release data on nonfarm payrolls (NFP) at 8:30AM ET (13:30GMT) in what will be Friday’s main market event.

Expectations are for the report to confirm the continued strength of the U.S. labor market.

The consensus forecast is that Friday’s report will show the economy created 175,000 jobsin November, up from 161,000 in October.

The unemployment rate is expected to hold steady at 4.9% and average earnings are expected to increase by 0.2%.

2. Dollar holds steady ahead of NFP, rate hikes eyed

The dollar slipped slightly lower against the other major currencies on Friday, as investors remained cautious ahead of the release of key U.S. employment data later in the day, although overall optimism over the strength of the economy still lent support.

As of 4:54AM ET (9:54GMT), the U.S. dollar index, which measures the greenback’s strength against a trade-weighted basket of six major currencies, was down just 0.02% at 101.00.

Friday’s data is expected to confirm a solid U.S. labor market and cement expectations for the Federal Reserve (Fed) to proceed with policy normalization at the December 13-14 meeting, supporting the American currency.

With expectations for a rate hike in December already baked into markets, the data could adjust bets for the second increase in 2017. According to Investing.com’s Fed Rate Monitor Tool, Fed fund futures were pricing in a 60.7% chance of another 25 basis point hike in June.

3. Oil slips after 15% jump

Investors took profits in crude on Friday after an aggressive agreement among major oil producers to cut production and tackle the global supply glut earlier in the week sparked a two-day rally that pushed black gold up nearly 15%.

West Texas Intermediate oil was trading flat, on track for weekly gains of around 10%.

U.S. crude oil futures lost 0.82% to $50.64 at 4:55AM ET (9:55GMT), while Brent oil fell 0.98% to $53.41.

4. European stocks jittery ahead of Italian referendum

European stocks traded down on Friday with nerves on edge as Italian citizens are set to vote on December 4 in a referendum on whether to overhaul their national constitution, which is designed to help Prime Minister Matteo Renzi implement badly needed economic reforms.

However, Italy was widely expected to reject the constitutional reforms with markets concerned that the defeat would cause a political upheaval in Europe’s third largest economy, including Renzi’s possible resignation and dissolution of the government.

Many market players are concerned that a “no” vote could pave the way the anti-euro Five Star movement to gain power in the government, which could cause a selloff in the Italian stock market, particularly in the country’s banks, and the single currency.

5. ECB expected to extend QE program

Investors in the euro were also looking ahead to the European Central Bank’s (ECB) monetary policy decision in the coming week.

According to a Reuters’ poll released on Friday, the ECB was expected to extend its QE program by six months.

A move at next Thursday’s ECB meeting may help multiply the impact of the stimulus on the euro’s exchange rate, especially since the U.S. Federal Reserve is widely expected to raise interest rates a week later, boosting the dollar.

Source: Investing.com

(Title edited)

good info as usual

This is really useful to us 🙂

Very informative piece of news