Go to FOREX FOR ADVANCED – COMPLETE GUIDE

Dear Reader,

If you were looking for forex education, you can stop now, because you have found the right place to start your forex journey. Internet is full of scammers and self-proclaimed gurus who are trying to teach other people how to trade but the outcome is a lot of disappointment and frustration for the student. I’m not even going to mentioned all the money lost because of such people and websites. This is why I have decided to put together everything one would need to know in order to start trading forex. In this section of my blog i will show you first of all the basics of forex trading and then some of the more advanced techniques, methods and tools that i use on daily basis in my trading. So let’s get to it:

Lesson 1 – Forex 101

What is Forex?

As per definition according to Investopedia, Forex is ‘the foreign exchange market is the “place” where currencies are traded. Currencies are important to most people around the world, whether they realize it or not, because currencies need to be exchanged in order to conduct foreign trade and business. If you are living in the U.S. and want to buy cheese from France, either you or the company that you buy the cheese from has to pay the French for the cheese in euros (EUR). This means that the U.S. importer would have to exchange the equivalent value of U.S. dollars (USD) into euros. The same goes for traveling. A French tourist in Egypt can’t pay in euros to see the pyramids because it’s not the locally accepted currency. As such, the tourist has to exchange the euros for the local currency, in this case the Egyptian pound, at the current exchange rate.’

Who Trades Forex?

Institutions, Banks, Governments, Retail (home based) Traders, Hedge Funds and Private Companies. Almost everybody is involved in the currency exchange market.

How To Trade Forex?

Let’s look at this question from the point of view of a Retail Trader. The basic idea of trading forex is pretty simple – buy when price is low and sell when price is high. To illustrate it a bit clearer think about purchasing a house. You want to sell your property when the prices are high and respectively, you want to buy a house when prices are low.

Why To Trade Forex?

There are many reasons why so many people prefer trading forex. Here is a list that covers the main ones:

- Market is Open 24/5 – you can trade forex Monday through Friday, 24 hours a day

- Leverage – in simple words leverage allows you to control (and trade) a lot bigger capital than your initial investment. For example you deposit $1000 and your broker offers leverage of 100:1. This means that you can buy and sell currencies worth $100,000 ($1000 x 100 leverage = $100,000 tradeable capital)

- Enormous Liquidity – daily turnover in the forex market is estimated at $3.98 trillion. In other words, it is very unlikely that you will find yourself stuck with a positions.

- Low Trading Cost – there are two main ways to pay your broker for its services. Usually brokers charge the so called Spread or Fixed Commission, in rare cases both.

- Low Minimum Deposit – we are happy to be living in times when you can participate in the forex market with as little as $25 initial deposit (possible but not recommended to start with this little)

When To Trade Forex?

Forex market is open 24 hours a day, 5 days a week (6 if we count Sunday evenings) So it is entirely up to you to decide when you will participate. However you should keep in mind that there are specific hours and periods when the market will be more volatile than others.

Lesson 2 – BEFORE TRADING

Trader’s Expectations

As a rookie trader it is important to stay away from some of the common misconceptions people have about trading. Let me say it out loud now, before you even started. Most likely you won’t lay down on the beach all day long, sipping cocktails while trading for living. It is not impossible for you to achieve it one day BUT there is a long road ahead of you before you get there. Trading takes practice, discipline and consistency. Day after day, week after week, month after month.

Another unlikely scenario is that you will become a millionaire overnight or even over a month. You must be an optimist but also a realist. Most people feel the ground in the beginning with small deposits – $500 or $1000 or $5000. Don’t expect to make 100% return monthly. It is unrealistic and extremely risky.

I think the point that i’m trying to express here is that forex is like any other business. You must invest in it (time, effort and money) and slowly grow your profits.

Types of Traders & Analysis

Traders:

I have described the types of traders in my book What Type Of Trader Are You?

The “Day Traders”

Those traders perform several trades throughout a trading day. They usually try to locate opportunities during the one day period. It could be anything between 1-10 opportunities per day (of course every traders with his or her own trading style). A typical day trader invests 3-4 hours a day in trading. They usually like to examine charts of 15 minute to 1 hour time frames.

The “Scalpers”

Those are traders who try to capture several pips here and there, on every trade they enter. This type of trader looks for trades in the more relaxed hours of the day, when a trading range develops (although there are some who look for strong movements instead). Scalpers usually go for the highest possible success rate, as close as possible to 100%. That enables them to risk more than the potential gain, and still come out highly profitable.

A typical scalper might work around 3 hours a day. Scalpers usually like to examine charts of 1 minute to 15 minutes time frames. Trade sizes are usually large because the small pip count of the gains (say 5 pips) need to be reflected in high $$ amounts in the account.

The “Swing Traders”

The majority of traders belong to this group. Swing traders typically hold a trade from several hours to several days. They look at charts of 1 hour to 4 hours typically. Many of these traders are not professionals who make a living out of trading, but rather view it as an alternative or supplemental income source, or a second job alongside their day job. Many utilize technical analysis but stay tuned to the fundamental (economic) side of trading.

The “Investors”

These are quite a rare breed in the world of Forex, as they’re mostly into stocks. Long term investors locate trades on higher time frames such as a daily or weekly chart. Their goal is to locate a large trend and join it. This type of traders can hold a trade for several months, until it reaches their long-term price target.

The “Automated Robots Users”

These Forex traders either purchase ready-made robots to trade for them, or develop their own robots. Because the robot is doing all the work automatically, this type of trader enjoys much more freedom and some devote their free time to look for more trading strategies that will increase gains.

Now that you understand the various types of traders that can be found in the world of Forex trading, it’s time to find out to which group you belong.

Analysis:

There are two main types of analysis – Fundamental and Technical.

Technical Analysis – The theory behind this type of analysis expects history to repeat itself. What technical analysts do is look for repeating patterns on the chart which are expected to repeat themselves in the future.

Fundamental Analysis – As the name suggests, fundamental analysts rely heavily on the real data before making a decision. Real data for example could be interest rates, inflation, quantitative easings or the general situation of country’s economy.

Setting up a Trade-station

Having a trade-station dedicated to trading might sound too much at the moment but if you are serious about it, it is highly recommended that you have your own place where you conduct business.

Yes – business – trading is as serious as starting your own small company. Don’t fall into the trap of neglecting and underestimating the seriousness of this new initiative of yours.

I always like to give the example when you are trying to analyze the markets on the dining table while your dog is trying to catch your cat, kids are painting on the walls and the wife is making delicious dinner.

It doesn’t sound like the perfect working environment, does it? I’m not saying do it now, before you even know what forex is, i’m just saying keep this thought in mind.

That being said i think we can move on to the next subject – the MT4 platform.

Lesson 3 – MT4 PLATFORM

Majority of retail traders around the world use the MT4 Platform. For one reason or another it is the most commonly used platform across home based traders. I’m not going to go into details here but instead you can go ahead and read this great tutorial on MT4 from Jean Folger.

Jean has divided the tutorial into a few categories:

Beginner’s Guide To MetaTrader 4: Installation

Beginner’s Guide To MetaTrader 4: Basic Navigation

Beginner’s Guide To MetaTrader 4: Setting up a Trade

Beginner’s Guide To MetaTrader 4: Advanced Features

Beginner’s Guide To MetaTrader 4: Tips and Tricks

Beginner’s Guide To MetaTrader 4: Conclusion

Lesson 4 – Japanese Candlesticks

Assuming that you have went through the MT4 guide from last chapter, you should already know that MT4 could represent the price on the chart in three ways – Bars, Candlesticks and Line. I will leave the bar chart and line chart for the moment and would focus on the Japanese candlesticks.

This type of charting is probably the most used form and of course there is a reason behind it. I have written two books on the subject (Secret Meaning Of Japanese Candlesticks Part 1 and Part 2), which you can read for free here.

Here is a sneak preview from the first book:

“Dear Trader,

It has been a long time since I’ve started investigating one of the most interesting, exciting and challenging subject in Forex technical trading – Japanese Candlesticks.

I’ve studied every possible angle about these candlesticks, but no one has told me the real secrets on the market. One of my trading mentors, the person who’ve changed the way I think and behave has told me: “when you understand the secrets of Japanese Candlesticks, you will understand everything about the market” I’ve asked him to elaborate about these secrets, but he refused. He told me I should first explore it myself. I’ve decided to take this one step forward and started to investigate this thoroughly.

After years of observation, trading, experimenting, losses and profits I’ve realized it. After I’ve realized it I decided to write down all my insights to make sure I will never dare to forget this. A written word will never be forgotten. Today I allow myself to take it even further and, unlike my mentor, I’ve decided to share with you the hidden secret of Japanese Candlesticks…”

Read & Download for FREE – Secret Meaning of Japanese Candlesticks Part 1

Read & Download for FREE – Secret Meaning of Japanese Candlesticks Part 2

Read & Download for FREE – The Secret of the Double Doji

Lesson 5 – SUPPORT/RESISTANCE LEVELS & TREND LINES

Support / Resistance

In this chapter we will go through the Support/Resistance zones. They are key part of trading and absolutely mandatory material for every trader to know and understand. Below you can see examples and detailed explanation but i want you to remember that Support and Resistance is the same thing.

It only depends whether the price is above the “zone” or below it. So if the price is falling near strong level, which holded it in the past numerous times it is called Support. Opposite to that if the price is climbing higher and there is strong level ahead it is called Resistance.

Important – Keep in mind that the Support (and Resistance) zone is never a line, it is rather a zone or range.

Definition of Support and Resistance:

Support – a level or zone is a level which the price couldn’t break through, many times, in the past and bounced off of. The more “touching” points you can find on such level, the stronger the zone is. We call such zones “support” when the price is above the level.

Resistance – a level or zone which the price couldn’t break through, many times, in the past and bounced off of. The more “touching” points you can find on such level, the stronger the zone is. We call such zones “resistance” when the price is below the level.

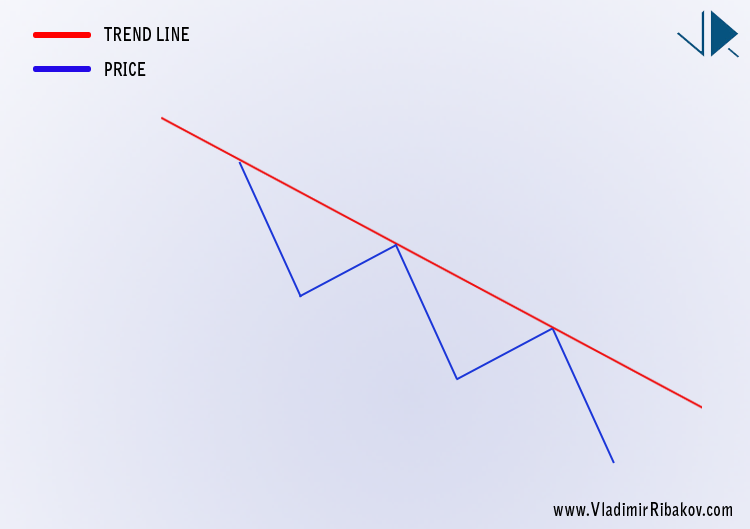

Trend Lines

Now that you know what Support and Resistance are, we can move on to Trend Lines. Exactly as S/R levels we use trend lines to determine potential stiff zones to which the price reacts. The only difference here is that S/R zones are horizontal and Trend Lines (TL) are vertical or as how some call them Dynamic Support & Resistance.

Up Trend Line Example

Down Trend Line Example

Conclusion:

Many traders use the Support/Resistance levels and Trend Lines in different manners in order to help their trading. How you are going to use them is entirely up to you just remember as a rule of the thumb that we can rely on S/R or TL once there were at least 3 touching points. The more the better.

You should also remember that once a stiff area was broken, regardless up or down, you can expect the price to continue in the direction of the break.

Lesson 6 – CHOOSING A STRATEGY

In this lesson I’d like to go over some of the factors you should consider when selecting a trading system.

- Emotions & Psychology

- Free Time for Trading

- Reading Strategy’s Performance Statistics

There are thousands if not millions of strategies, both paid and free, that you can find on the internet and offline. Some are more complex than the others but generally all strategies derive from three basic categories: Trend, Counter the Trend and Range.

Trend – system that look for entries in already established trend

Counter the Trend – the idea here is to look for an entry in the opposite direction of the trend

Range – these strategies focus on trading inside ranges

Now that you know the basics let’s move on and investigate in details the three elements I mentioned before.

Emotions & Psychology

It is really important to choose a trading strategy that suits your personality and mindset. There are pure technical systems which take the subjectivity out of the equation. These types of trading plans are perfect for beginners, where following the rules is all it takes – if condition #1 is met, move forward to conditions #2, then #3 and so on until you actually enter a trade. Next you follow the exit rules in the same manner – if X happens do this, if Y happens do that. Simple as it sounds.

On the other hand, there are trading systems which involve subjectivity in the process of analyzing.I’d recommend these to the more advanced traders since there is a lot of room for different interpretations of the exactly same situation. As a result, this could put a lot of pressure on the trader and eventually mistakes start occurring, which leads to poor performance in the long run.

So whatever you do and choose, try and practice, then practice some more until you are confident that this specific strategy doesn’t put you on the edge. The trader should be calm and comfortable when trading.

Free Time for Trading

Another extremely important factor is the time that you are willing to dedicate to the charts. Here you need to consider your daily routine – dog walking, taking kids to school, work, gym etc. Have a clear idea of when and for how long you are going to trade. How many days per week? Once you figure it out, you can focus on looking for a trading strategy that suits your lifestyle.

Reading Strategy’s Performance Statistics

Now that you have in mind when you are going to trade, for how long, and what type of strategy you are looking for, you should know how to assess a given trading system. Depending on the source of where you are going to get your system, there might be various statistics provided. I’m not going to go over all of them but rather cover the most important ones in my opinion.

Success Rate – it shows the percentage of winning trades. Example: 54 winning trades out of 100 would mean Success Rate of 54%

Risk : Reward Ratio – risk versus the reward in a given trade. If your potential risk is $10 and the potential reward is $20 it means you have a risk:reward ration of 1:2. General rule: the higher the reward versus the risk, the lower the success rate will be. Which doesn’t necessarily mean a losing strategy. In reality you will have for example 60 losing trade of $10 versus 40 winning trades of 20$ which is success rate of only 40% but if we crunch some numbers you see that:

(40 x $20) – (60 x $10) = + $20

It is up to you to find the strategy which is balanced and gives you the comfort when trading. You don’t want to be using a strategy that will stress you out all the time.

Average Winning Trade – shows the average winning trade in currency or pips. For example $156 / 79 pips

Average Losing Trade – shows the average losing trade in currency or pips.

Average Position Holding Time – shows the average holding time of an open position. For scalping strategies that could be anywhere from 1 minutes (or less) to 10-15 minutes. For longer term trading the average time a position is open could be a few hours or couple of days. This is also important because some people love the action and prefer to be actively involved all the time. Others can’t bare to have an open position for 5 days. It is just too much stress for them. I suggest you to start with something in the middle. Scalping could be very stressful just like long term trading.