The world’s biggest technology companies drove a rebound in stocks ahead of Apple Inc.’s earnings, with Wall Street also gearing up for Friday’s jobs report.

Equities were poised to halt a two-day slide, with all members of the “Magnificent Seven” cohort of megacaps pushing higher. Wall Street analysts expect the iPhone maker to announce a stock buyback, following the steps of fellow big techs Alphabet Inc. and Meta Platforms Inc. Any news related to artificial-intelligence features could provide additional excitement.

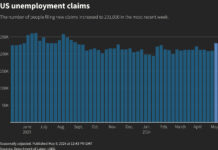

In the run-up to the monthly employment data, data showed US labor costs jumped the most in a year as productivity gains slowed, potentially adding to risks inflation will remain elevated. Economists surveyed by Bloomberg forecast a 240,000 gain in nonfarm payrolls, which would be the slowest pace since November. The figures have topped forecasts in recent months.

The Federal Reserve decided Wednesday to leave the target range for the benchmark rate at 5.25% to 5.5% following a slew of data that pointed to lingering price pressures. Jerome Powell said it’s unlikely that the Fed’s next move would be to raise rates.

S&P 500 futures rose 0.7%. Treasury 10-year yields were little changed at 4.63%. The dollar retreated.

Corporate Highlights:

- Qualcomm Inc., the world’s biggest seller of smartphone processors, gave an upbeat forecast for sales and profit in the current period, suggesting demand for handsets is increasing after a two-year slump.

- Peloton Interactive Inc. said Chief Executive Officer Barry McCarthy is stepping down from the role and the company is planning to cut about 15% of its global workforce.

- MGM Resorts International reported first-quarter sales and earnings that beat analysts’ projections, benefiting from the post-pandemic recovery in Macau and a new partnership with Marriott International Inc. that helped fill hotel rooms.

- Carvana Co. reported stronger earnings with revenue topping expectations as the company digs into its restructuring plan and regains sales momentum.

- DoorDash Inc., the largest food delivery service in the US, offered a disappointing profit forecast for the current quarter as the company invests in expanding its list of non-restaurant partners and improving efficiency.

- Moderna Inc. reported a narrower first-quarter loss than Wall Street had expected, as the biotech giant’s cost-cutting helped offset a steep decline in its Covid business.

- Apollo Global Management Inc. reported higher first-quarter profit as the firm raked in more management fees and originated a record $40 billion of private credit, a key area of growth.

Key events this week:

- Eurozone unemployment, Friday

- US unemployment, nonfarm payrolls, ISM Services, Friday

- Chicago Fed President Austan Goolsbee speaks, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures rose 0.7% as of 8:59 a.m. New York time

- Nasdaq 100 futures rose 0.8%

- Futures on the Dow Jones Industrial Average rose 0.5%

- The Stoxx Europe 600 was little changed

- The MSCI World index rose 0.2%

Currencies

- The Bloomberg Dollar Spot Index fell 0.5%

- The euro fell 0.1% to $1.0701

- The British pound was little changed at $1.2516

- The Japanese yen was little changed at 154.49 per dollar

Cryptocurrencies

- Bitcoin rose 2.2% to $58,542.27

- Ether rose 1.5% to $2,982.74

Bonds

- The yield on 10-year Treasuries was little changed at 4.63%

- Germany’s 10-year yield declined one basis point to 2.57%

- Britain’s 10-year yield declined five basis points to 4.32%

Commodities

- West Texas Intermediate crude rose 0.2% to $79.16 a barrel

- Spot gold fell 1.1% to $2,294.04 an ounce