Defined as an unforeseeable event, Black Swan events are characterized as anomalous events that may have catastrophic consequences. To expand, black swan events are distinguished by their detrimental impacts, astronomical infrequencies, and far-reaching insistence on how the events should have been deemed predictable in retrospect.

The term, black swan, was popularized by a former Wall Street trader, writer, and finance professor known as Nassim Nicholas Taleb who had publicized the idea of this event in his book published in 2007 known as The Black Swan.

Taleb had contended that due to the inexplicable rarity of these events that they are impossible to predict yet always a possibility, therefore, contingency plans should be put forth to help parry their cataclysmic effects.

Following the 2008 financial crisis, Taleb later levied the concepts of these events to solidify his stance that should a system be permitted to fail then that system is reinforced against prospective black swan events. Contrarily, Taleb also insisted that should a system be propped up to divert risk then the system itself becomes more susceptible to the ruinous effects of black swan events.

According to Taleb, due to the rareness of these events, standardized methods of probability prediction, such as normal distribution, cannot be effectively extrapolated since there is a considerable deficiency of large populations and historical events concerning black swan events.

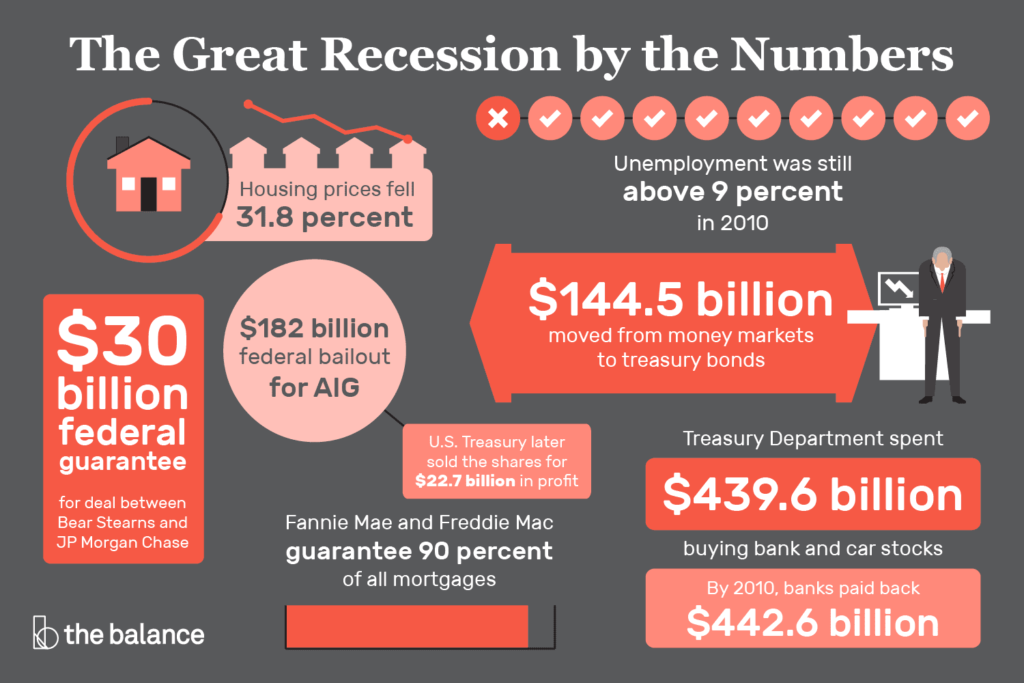

Past examples of black swan events include the U.S. housing market crash that occurred during the wake of the 2008 financial crisis, the hyperinflation of Zimbabwe where inflation rates peaked at 79.6 billion percent and the dot-com bubble of 2001 where a multitude of technology companies became crippled as a byproduct of significantly inflated valuations.

A more recent example includes the Long-Term Capital Management (LTCM) hedge fund that was crushed into non-being in 1998 due to an unforeseen ripple effect generated by the debt default of the Russian government.

While black swans are chronicled as historically significant events that have observers ardent to solve, as a whole, they bring us no closer to predicting them.