Global stocks fell Monday, striking a more cautious note after Wall Street’s powerful second-quarter rally lost steam at the end of last week.

Chemical and construction firms paced declines in Europe, while banking stocks outperformed. Among the biggest individual movers, Sartorius AG slumped 15% after issuing a bigger-than-expected profit warning. In Asia, disappointed hopes for further stimulus pushed down Chinese tech companies.

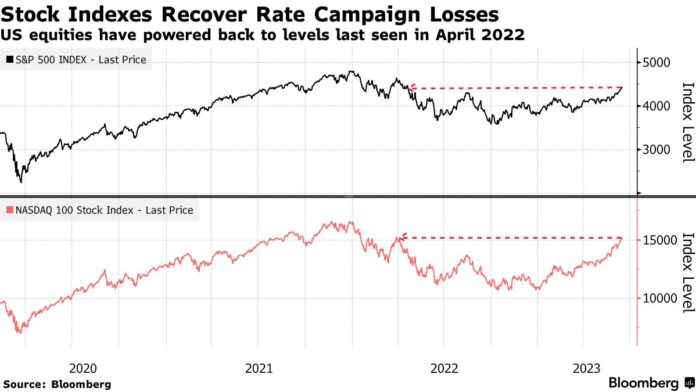

Wall Street’s rally has now erased more than a year of Fed-induced losses, with stocks, volatility and the dollar shaking off the impact of 10 rate hikes. But with the path of rates increasingly uncertain, traders are vacillating between the lure of the rally and concerns it’s exhausted and the market has become overbought.

Despite the pressure of an $4.2 trillion options expiry at the end of last week, the S&P 500 index capped a fifth straight week of gains and is now higher than it was the day the Federal Reserve kicked off its campaign.

In its latest meeting last week, Fed kept interest rates unchanged but warned of more tightening ahead. In the past, pausing rate hikes for three months after such a run of interest rate hikes has boosted stock prices.

US stock and bond markets are closed Monday for a holiday. Futures contracts on the S&P 500 and Nasdaq 100 traded little changed.

Looking ahead, Fed Chair Jerome Powell will give his semi-annual report to Congress on Wednesday. Federal Reserve Bank of St. Louis President James Bullard and his counterparts in New York and Chicago are among this week’s speakers.

The S&P 500 index posted its mildest reaction on FOMC day in two years. Though it was the first in 11 meetings where policymakers held rates, they also lifted forecasts for higher borrowing costs of 5.6% in 2023, implying two additional quarter-point rate hikes or one half-point increase before the end of the year.

“Markets are still pricing in a lower path of interest rates compared to the Federal Reserve’s dot plot,” said Janet Mui, head of market analysis at RBC Brewin Dolphin. “While we are close to peak rates, it is uncertain how long rates will stay high. Markets have a more dovish lens on that.”

Meanwhile, Chinese tech companies fell with Alibaba Group Holding Ltd, JD.com Inc. and Baidu Inc. all tumbling more than 3% to drag the Hang Seng Tech index as much as 2.9% lower.

Reports covering China’s State Council meeting on Friday, chaired by Premier Li Qiang, were light on details about any potential stimulus or timing. The lack of tangible evidence for support adds to worries over a slowing economy, unnerving investors who had bid up Chinese equities last week in the hope of a sweeping package.

Key events this week:

- US Juneteenth holiday, Monday

- China loan prime rates, Tuesday

- US housing starts, Tuesday

- Federal Reserve Bank of St. Louis President James Bullard speaks, Tuesday

- New York Fed President John Williams speaks, Tuesday

- Federal Reserve Chair Jerome Powell delivers semi-annual congressional testimony before the House Financial Services Committee, Wednesday

- Federal Reserve Bank of Chicago President Austan Goolsbee speaks, Wednesday

- Eurozone consumer confidence, Thursday

- Rate decisions in UK, Switzerland, Indonesia, Norway, Mexico, Philippines, Turkey, Thursday

- US Conference Board leading index, initial jobless claims, current account, existing home sales, Thursday

- Federal Reserve Chair Jerome Powell delivers semi-annual testimony to Congress before the Senate Banking Committee, Thursday

- Cleveland Fed’s Loretta Mester speaks, Thursday

- Eurozone S&P Global Eurozone Manufacturing PMI, S&P Global Eurozone Services PMI, Friday

- Japan CPI, Friday

- UK S&P Global / CIPS UK Manufacturing PMI, Friday

- US S&P Global Manufacturing PMI, Friday

- Federal Reserve Bank of St. Louis President James Bullard speaks, Friday

Some of the main moves in markets:

Stocks

- The Stoxx Europe 600 fell 0.5% as of 10:21 a.m. London time

- S&P 500 futures were little changed

- Nasdaq 100 futures were little changed

- Futures on the Dow Jones Industrial Average fell 0.1%

- The MSCI Asia Pacific Index fell 0.6%

- The MSCI Emerging Markets Index fell 0.7%

Currencies

- The Bloomberg Dollar Spot Index rose 0.1%

- The euro was little changed at $1.0927

- The Japanese yen was little changed at 141.89 per dollar

- The offshore yuan fell 0.4% to 7.1577 per dollar

- The British pound was little changed at $1.2811

Cryptocurrencies

- Bitcoin fell 0.4% to $26,379.34

- Ether fell 0.5% to $1,721.04

Bonds

- Germany’s 10-year yield advanced two basis points to 2.50%

- Britain’s 10-year yield advanced four basis points to 4.45%

Commodities

- Brent crude fell 0.3% to $76.41 a barrel

- Spot gold fell 0.1% to $1,955.79 an ounce