Equity markets weakened and US Treasury yields rose as investors weighed the potential for policy action by Chinese regulators to address mounting financial and property risks.

US stocks slipped after erasing a premarket gain on initially reassuring developments from China. Treasury yields ticked higher, with the policy sensitive two-year extending an advance into the fourth day to trade at 4.95%.

Investors sitting on record first-half gains are having to contend with central bankers warning they are in no rush to cut interest rates.

“The timing of the first rate cut will begin to dominate the direction of US yields,” said Ian Lyngen, a rates strategist at BMO Capital Markets. “That will not be today’s story however, and instead we anticipate Treasuries will be in wait and see mode ahead of tomorrow’s retail sales print.”

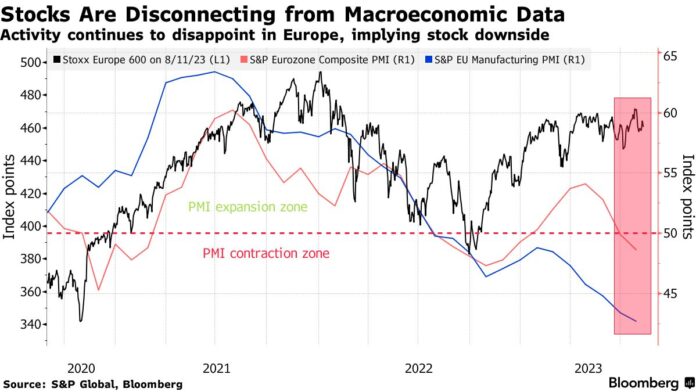

At the same time, China faces a stuttering economic recovery and worsening property slump, while global stock market valuations are starting to look unjustifiably high.

Updates from China unnerved markets on Monday. The country’s banking regulator announced it would set up a task force to examine risks at private-wealth manager Zhongzhi Enterprise Group Co., which missed payments on investment products sold to high-net worth clients.

Meanwhile, Country Garden Holdings Co. is seeking to extend a maturing bond for the first time and halted trading in local notes. The company, once China’s biggest developer, has emerged as the latest flashpoint of the country’s property woes.

“The more days that go by without a comprehensive fiscal stimulus plan the more clear it becomes there will not be one,” Brad Bechtel a Jefferies strategist said of China’s central bank. “The big bazooka is not coming.”

Focus later this week will be on minutes of the Federal Reserve’s latest policy meeting as traders seek clues on the central bank’s next move. Investors who’d bet on a pivot to easier policy this year are having to adjust their bets as officials signal they will keep interest rates higher for longer.

In emerging markets, Argentina’s already-distressed debt sagged after a populist who vowed to burn down the central bank won surprisingly strong support in a primary vote.

The offshore yuan fell to its weakest level since November while the US dollar strengthened.

Corporate Highlights:

- US Steel Corp. surged 27% after the company rejected a $7.25 billion takeover offer from peer Cleveland-Cliffs Inc. and said it will instead start a review of its strategic options.

- Tesla Inc. slipped 3.2%, triggering a selloff for other producers of electric vehicles, after it rolled out a new round of price cuts in China.

Key events this week:

- China medium-term lending, retail sales, industrial production, fixed-asset investment, FX net settlement, Tuesday

- Japan industrial production, GDP, Tuesday

- UK jobless claims, unemployment, Tuesday

- US retail sales, empire manufacturing, business inventories, cross-border investment, Tuesday

- Reserve Bank of Australia policy minutes, Tuesday

- Federal Reserve Bank of Minneapolis President Neel Kashkari speaks, Tuesday

- China property prices, Wednesday

- Eurozone industrial production, GDP, Wednesday

- UK CPI, Wednesday

- US FOMC minutes, housing starts, industrial production, Wednesday

- US initial jobless claims, US Conf. Board leading index, Thursday

- Eurozone CPI, Friday

Some of the main moves in markets:

Stocks

- The S&P 500 fell 0.1% as of 9:35 a.m. New York time

- The Nasdaq 100 fell 0.2%

- The Dow Jones Industrial Average was little changed

- The Stoxx Europe 600 fell 0.1%

- The MSCI World index fell 0.6%

Currencies

- The Bloomberg Dollar Spot Index rose 0.4%

- The euro fell 0.6% to $1.0886

- The British pound fell 0.5% to $1.2635

- The Japanese yen fell 0.3% to 145.42 per dollar

Cryptocurrencies

- Bitcoin fell 0.3% to $29,320.43

- Ether fell 0.5% to $1,843.79

Bonds

- The yield on 10-year Treasuries advanced four basis points to 4.20%

- Germany’s 10-year yield was little changed at 2.63%

- Britain’s 10-year yield advanced three basis points to 4.55%

Commodities

- West Texas Intermediate crude fell 0.7% to $82.63 a barrel

- Gold futures fell 0.4% to $1,938.40 an ounce