This past few weeks are turning out to be a nightmare for the British pound traders. Last week, we highlighted the possibility of more declines in the British pound if the fear sets in. The same happened as the British pound tumbled during the last few days. The most important thing to note here is that the GBPUSD pair opened the week with a massive gap lower, and failed to close the gap level till today. The reason for this bearish tone on the British pound is the Scottish Independence fear which is causing nervousness in the market. The investors are closing their positions in the GBPUSD pair, which is causing sharp downside in the pair. More and more selling pressure might emerge until some relief is on the cards.

UK Industrial Production

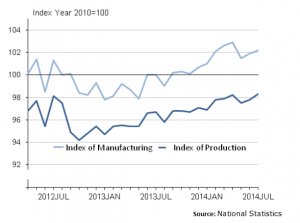

Yesterday, the UK Industrial Production was released by the National Statistics. The forecast was of a rise of 1.3% between July 2013 and July 2014. However, the outcome was on the higher side, as the UK production output increased by 1.7% between July 2013 and July 2014. In terms on monthly change i.e. between June 2014 and July 2014 the UK production output jumped by 0.5%. The outcome was definitely on the positive side.

The British pound spiked 15 pips higher against the US dollar, but there was no momentum, and the pair traded lower again.

UK Manufacturing Production

At the same time the UK manufacturing production data was released. The forecast was of a rise of 2.2% between July 2013 and July 2014. The outcome was in line with the expectation, as the UK manufacturing production increased by 2.2% between July 2013 and July 2014. In terms on monthly change i.e. between June 2014 and July 2014 the UK manufacturing production rose by 0.3%.

The GBPUSD pair managed to hold the 1.6060 support area. There was no heavy downside, as the positive outcome helped the currency to some extent.

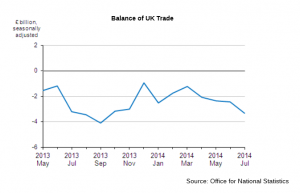

The only negative news was from the UK trade balance data, which was also released by the National Statistics. The report mentioned that the UK’s deficit on trade in goods and services was estimated to have been £3.3 billion in July 2014, compared with £2.5 billion in June 2014. This was a bit on the higher side.

NIESR GDP Estimate

There was one more important release during the US session yesterday. The NIESR GDP Estimate was released by the National Institute of Economic and Social Research. The outcome was a bit positive, as the UK GDP is estimated to be around 0.6%, as the previous reading was revised down from 0.6% to 0.5%.

Technically, the GBPUSD pair broke all important support levels including the 1.6250 area. So, this has opened the doors for a test of the 1.60 level in the short term. And, if the momentum continues, then there is a chance that the pair might even break the 1.60 support area. On the upside, the 1.6180-1.6200 is a resistance zone moving ahead.

So, keep an eye on all the important levels friends and trade accordingly.

Get my Daily Market forecast with trade opportunities HERE: Vladimir’s Markets Forecast