* British Pound spiked a couple of times against the US dollar, and currently looks set for more gains.

* GBPUSD pair is currently trading above the 1.4250 support area, which is a positive sign.

* Today the UK Goods trade balance released by the National Statistics posted a trade deficit of £-10.290B, less than the forecast of £-10.300B.

* Moreover, the total trade balance posted a trade deficit of £-3.459B, more than the forecast of £-3.000B.

UK Trade Balance

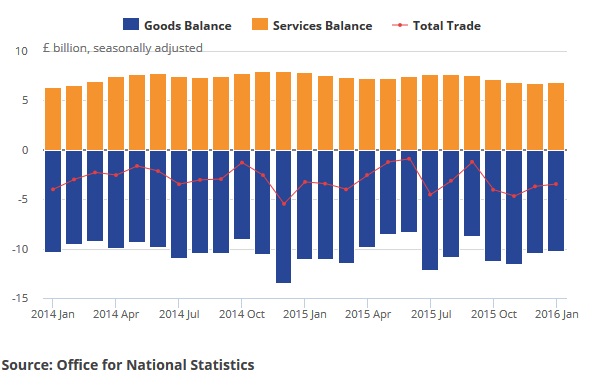

Today, the UK trade balance, which is a balance between exports and imports of goods was released by the National Statistics. The forecast for the total trade balance was slated for a deficit of £-3.000B, but the outcome was disappointing, as the deficit was of £-3.459B.

Moreover, the UK Goods trade balance was better than the forecast, as it posted a trade deficit of £-10.290B, less than the forecast of £-10.300B.

The report stated that UK’s deficit on trade in goods and services was estimated to have been £3.5 billion in January 2016, a narrowing of £0.2 billion from December 2015. The narrowing is attributed to trade in goods where the deficit has narrowed from £10.5 billion in December 2015, to £10.3 billion in January 2016”.

Overall, the data was mixed, but the market sentiment for the British Pound was overall bullish. There was a nice upside reaction, taking the GBPUSD pair higher in the near term.

Technical Analysis – GBPUSD

The GBPUSD pair jaw dropped yesterday around the ECB interest rate decision, but later it recovered sharply and posted gains. The pair broke the 1.4200 resistance area and tested the 1.4300 barrier one.

The pair is currently consolidating gains, and it looks like there is a chance of it gaining bids once again to another bull ride. On the upside, a close above the 1.4300 level could take the pair towards the 1.4350 resistance area.