* Euro is struggling to hold ground against the US Dollar, and despite positive numbers in the Euro Zone today there were no upsides.

* EURUSD is trading near 1.1300 level, which is acting as a hurdle for buyers.

* Euro Area Gross Domestic Product released by the Eurostat posted an increase of 0.3% in Q4 2015, more than the forecast of 0%.

* German Gross Domestic Product released by the Statistisches Bundesamt Deutschland posted an increase of 0.3% in Q4 2015, as forecasted.

Euro Area GDP

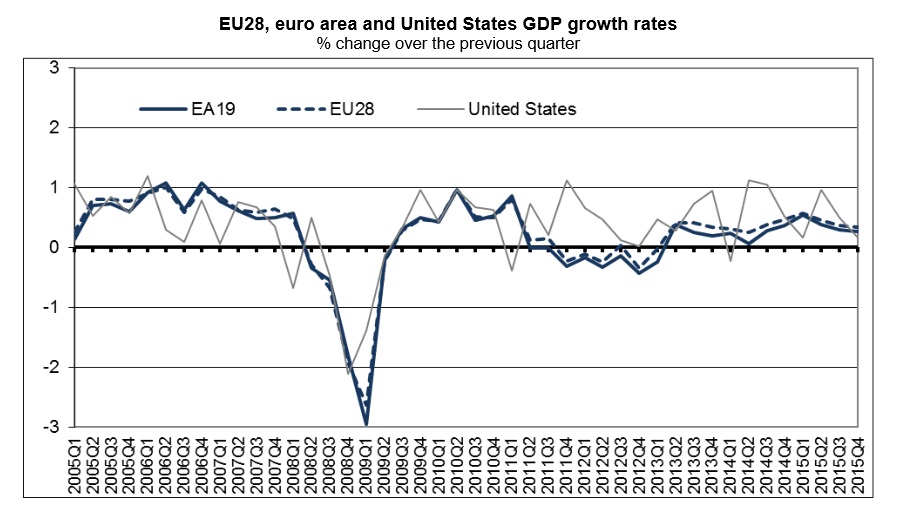

Today, there were many economic releases lined up in the Euro Area, including the Euro Area GDP, German GDP, German CPI and others. The most impressive one was the Gross Domestic Product, which is a measure of the total value of all goods and services produced by the Eurozone was released by the Eurostat.

The market was expecting no change in the GDP in Q4 2015, compared with the preceding quarter. However, the result was above the forecast, as the Euro Area Gross Domestic Product posted an increase of 0.3% in Q4 2015.

When we consider the yearly change, the Euro Area Gross Domestic Product rose 1.5%, just as the market expected. The report stated that “Seasonally adjusted GDP rose by 0.3% in both the euroarea (EA19) and the EU28 during the fourth quarter of 2015, compared with the previous quarter, according to a flash estimate published by Eurostat, the statistical office of the European Union. In the third quarter of 2015, GDP grew by 0.3% and 0.4% respectively“.

Overall, the report was positive, and should have helped the Euro. However, there was hardly any upside reaction in the EURUSD pair, as the market sentiment was not in favor of the Euro bulls.

Technical Analysis – EURUSD

The EURUSD pair was seen trading below the 1.1300 area, which is acting as a major for more gains. If buyers manage to clear it, then there is a chance of change in the market sentiment for the Euro. On the

downside, the most important support is seen around the 1.1250-40 area. Overall, we need to keep an eye on a close above the 1.1300-20 resistance area for the next moves in the Euro.

Yours,

Vladimir