Stocks posted small moves as risk appetite cooled from last week’s rally. The yen weakened after the Bank of Japan made its first unscheduled bond purchases in months.

Market activity was subdued on Monday, with investors taking a pause from the buying that sent the Nasdaq 100 Index up more than 2% last week. The S&P 500 was little changed, while still heading toward its fifth consecutive month of gains — the longest winning run since August 2021.

It’s the start of another busy week of earnings, with Apple Inc. and Amazon.com Inc. among those reporting in the coming days. Heineken NV dropped as much as 7.2% after the Dutch brewer reduced its earnings forecast. There’s also key economic data on the way that may provide clues on the outlook for interest rates, including US July non-farm payrolls numbers due Friday, a day after a policy decision from the Bank of England.

“The narrative that markets will be focused on is if it’s going to be a soft landing or not,” said Vivek Paul, senior portfolio strategist at BlackRock Investment Institute. “We’ll learn more about that once the upcoming data indicate if rapidly cooling inflation is indeed the start of a broader trend or it continues to be volatile.”

The yen dropped against the dollar after the Bank of Japan announced unscheduled bond-purchase operations to buy debt. The BOJ was seeking to contain a selloff after it said Friday it will allow yields to rise above a 0.5% cap.

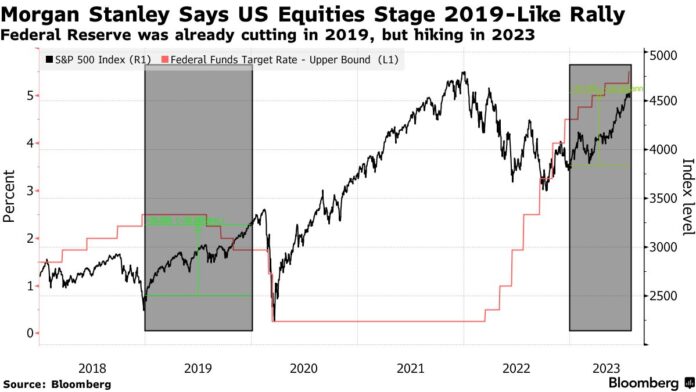

This year’s advance on Wall Street suggests that US equities are tracking the same path they did in 2019, which was one of the best years for the S&P 500 over the past decade, according to Morgan Stanley strategist Michael Wilson. The benchmark is set to close out a fifth month of gains, the longest such winning streak since August 2021.

“The data we have today suggests to us that we are in a policy-driven, late-cycle rally,” Wilson, a staunch equities bear, wrote in a note. The latest example of such a period occurred in 2019 when the Federal Reserve paused and then cut rates and its balance sheet expanded toward the end of the year. “These developments fostered a robust rally in equities that was driven almost exclusively by multiple and not earnings, as has been the case this year.”

Japan remains a focus for traders. On Friday, BOJ Governor Kazuo Ueda said the central bank would allow 10-year bond yields to rise above a ceiling it now calls a point of reference. That potentially paves the way for a future normalization of policy that has implications for a wide range of global assets heavily exposed to Japanese money.

On Monday, with yields spiking to a fresh nine-year high in morning trading, the BOJ announced that it would buy the equivalent of more than $2 billion in bonds at market rates. The 10-year yield dropped back below 0.6% and the yen reversed an advance against the dollar. It was the first such unscheduled operation by the BOJ since February.

“We had the BOJ today making sure yields remained capped,” said Jane Foley, head of currency strategy at Rabobank. “They clearly don’t want yields rising too much, so today’s action drove home the point it was perhaps more of a technical adjustment than a change in policy.”

Key events this week:

- Australia RBA rate decision, Tuesday

- Eurozone S&P Global Eurozone Manufacturing PMI, unemployment, Tuesday

- UK S&P Global/CIPS UK Manufacturing PMI, Tuesday

- US construction spending, ISM Manufacturing, job openings, light vehicle sales, Tuesday

- China Caixin Services PMI, Thursday

- Eurozone S&P Global Eurozone Services PMI, PPI, Thursday

- UK BOE rate decision, Thursday

- US initial jobless claims, productivity, factory orders, ISM Services, Thursday

- Eurozone retail sales, Friday

- US unemployment rate, non-farm payrolls, Friday

Some of the main moves in markets:

Stocks

- The S&P 500 rose 0.1% as of 9:30 a.m. New York time

- The Nasdaq 100 rose 0.2%

- The Dow Jones Industrial Average was little changed

- The Stoxx Europe 600 rose 0.2%

- The MSCI World index rose 0.1%

Currencies

- The Bloomberg Dollar Spot Index rose 0.1%

- The euro was little changed at $1.1024

- The British pound fell 0.1% to $1.2835

- The Japanese yen fell 1% to 142.51 per dollar

Cryptocurrencies

- Bitcoin rose 0.6% to $29,434.07

- Ether rose 0.2% to $1,870.07

Bonds

- The yield on 10-year Treasuries advanced two basis points to 3.97%

- Germany’s 10-year yield advanced two basis points to 2.51%

- Britain’s 10-year yield was little changed at 4.33%

Commodities

- West Texas Intermediate crude rose 0.7% to $81.14 a barrel

- Gold futures rose 0.2% to $2,004.10 an ounce