U.S. stock futures fell and bonds rallied as the economic threat of restrictions to control the new variant outweighed optimism about the efficacy of vaccines.

Contracts on both the S&P 500 and Nasdaq 100 retreated after the gauges ended higher Wednesday. Travel companies and airlines declined in premarket trading, while drugmakers including Pfizer Inc. rose. CVS Health Corp. jumped after saying it would buy back shares and raise dividends. Treasuries rallied alongside government bonds across Europe.

The cost to contain the omicron strain is being tallied up amid mounting concern it will crimp the economic rebound. New work-from-home guidance in the U.K. could cost the country’s economy £2 billion ($2.6 billion) a month, according to Bloomberg Economics. A study found omicron is 4.2 times more transmissible than the delta variant in its early stages.

“Ultimately the issue from a health perspective is that even if Omicron does prove to be less severe — which the initial indications so far have pointed to — a rise in transmissibility could offset that,” said a team of Deutsche Bank strategists including Jim Reid. That could mean that more people are in the hospital, “even if a lower proportion of them are severely affected.”

The global equity rally faces further potential road bumps ahead from U.S. consumer inflation numbers this week and a Federal Reserve meeting next week that may provide clues on the pace of tapering and interest rate increases.

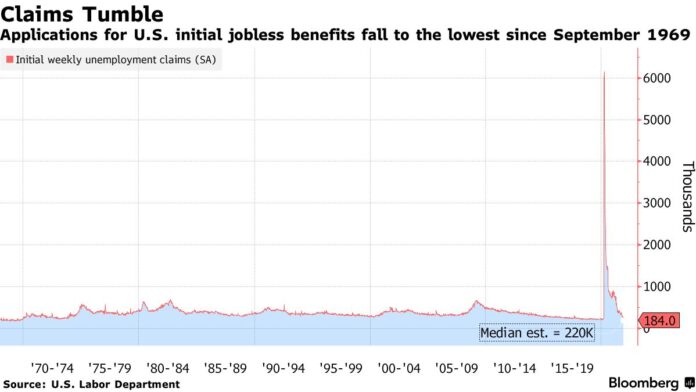

The dollar stayed higher Thursday after a report showed applications for U.S. state unemployment benefits declined to the lowest level since 1969. However, economists flagged difficulties in seasonal adjustments to arrive at that figure. On an unadjusted basis, initial claims climbed.

“From a Fed perspective the question is, what about the participation rate? If everything else looks good in terms of employment, can monetary policy bring back that participation rate? I’m skeptical there,” said Glenn Hubbard, dean emeritus and economics professor at Columbia Business School, on Bloomberg TV. “I think the labor market is in great shape. It is time for the Fed to adjust.”

In Europe, stocks reversed earlier gains to trade slightly lower. Among individual moves, Electricite de France SA fell with the government considering a cap on regulated power tariffs to help curb soaring electricity prices. Meanwhile, UniCredit SpA rose after saying it will return at least 16 billion euros ($18.1 billion) to shareholders by 2024.

In Asia, China Evergrande Group and Kaisa Group Holdings Ltd. officially defaulted on their dollar debt, while the People’s Bank of China raised its foreign currency reserve requirement ratio for a second time this year after the yuan climbed to the highest since 2018.

Here are some key events to watch this week:

- Federal Reserve Bank of Minneapolis President Neel Kashkari speaks Thursday

- U.S. CPI Friday

Some of the main moves in markets:

Stocks

- Futures on the S&P 500 fell 0.3% as of 9:16 a.m. New York time

- Futures on the Nasdaq 100 fell 0.3%

- Futures on the Dow Jones Industrial Average fell 0.3%

- The Stoxx Europe 600 fell 0.1%

- The MSCI World index was little changed

Currencies

- The Bloomberg Dollar Spot Index rose 0.2%

- The euro fell 0.3% to $1.1311

- The British pound was little changed at $1.3199

- The Japanese yen rose 0.2% to 113.43 per dollar

Bonds

- The yield on 10-year Treasuries declined three basis points to 1.49%

- Germany’s 10-year yield declined four basis points to -0.35%

- Britain’s 10-year yield declined four basis points to 0.73%

Commodities

- West Texas Intermediate crude fell 0.9% to $71.70 a barrel

- Gold futures fell 0.5% to $1,777.30 an ounce