Unbeknownst too many prospective investors would be the advantageous opportunities are that provided through the participation of United Kingdom forex trading.

Compared to other demographics across the globe, such as the United States and Australia, forex trading in Europe and the United Kingdom provide a greater scope of advantages that aren’t otherwise met.

Advantages such as increased competition, tax-free trading, and reduced paperwork are such measures that we will further address throughout this brief publication where we touch upon the many advantages and need-to-know insights regarding forex trading as a European and UK-based trader.

Reduced Trade Taxations

Uncle Sam has long been known to thwart US traders of their hard-earned trading profits.

Residents of the United Kingdom, on the other hand, are uniquely positioned to enjoy the benefits of a predominately tax-free trading atmosphere.

Now, before we dive in any further, it is important that you consult with a tax professional before trading forex in the United Kingdom that way you are thoroughly educated regarding the trading laws for your respective jurisdictions.

Moving forward, the annual tax year of the United Kingdom is from April 6th of the current year to April 5th of the subsequent year while a personal allowance on income generated through forex trading that is not subject to taxation is £12,500.

You see, under UK law, forex trading is classified as spread betting.

Given, that the majority of retail investors that take on the foreign exchange markets lose their money, Old Blighty appears to have given investors a tax break, a rare luxury without a doubt.

Now, as a whole, traders tend to be classified as one of two entities for forex trading taxation.

Part-time investors who conduct spread betting, in this case, forex trading, as a secondary source of income are seen as tax-free whereas full-time traders where forex trading contributes to their primary source of income are liable to pay income tax.

Rendering reduced trade taxations, being a UK-based forex trader is not the only advantage stemming from their citizenship.

Increased Competition

Being a well-known focal point for ambitious forex traders, the United Kingdom forex trading arena is chock-full of competitive forex brokerages that prop up the advantages of UK citizenship.

Home to an abundant sum of online trading brokerages, the competition is so fierce in the United Kingdom that traders significantly benefit from the increased competition through a myriad of facets such as increased affordability, more platform advantages, free yet enriched educational resources, and an overall more trader-focused trading environment.

Reduced Transaction Costs

Generally, forex trading costs are rendered in a few different formats.

Formats such as commission fees, fixed spreads, and account holding fees tend to be the most commonly incurred fees for forex day traders.

However, given the increased competition, competing brokers based out of the UK tend to slash their rates, mitigate transaction fees through zero-commission or zero-spread trading accounts, or by removing processing fees for incoming and outgoing transactions.

Leverage Warning

While UK residents are in the best position to enjoy the luxuries of their citizenship with regards to trading advantages, one downside would include the increased leverage availability that can be seen as high as 1:500.

While leverage trading can significantly increase your returns the risk associated with the incorrect application of leverage can not only severely deplete an investor’s account but cause financial ruin that can without preamble evolve into bankruptcy.

The amplification of trading gains and losses is magnified through leverage and given that the United Kingdom is a vast trading playground for hundreds of thousands of investors these risks should be known and deeply considered.

Regulation

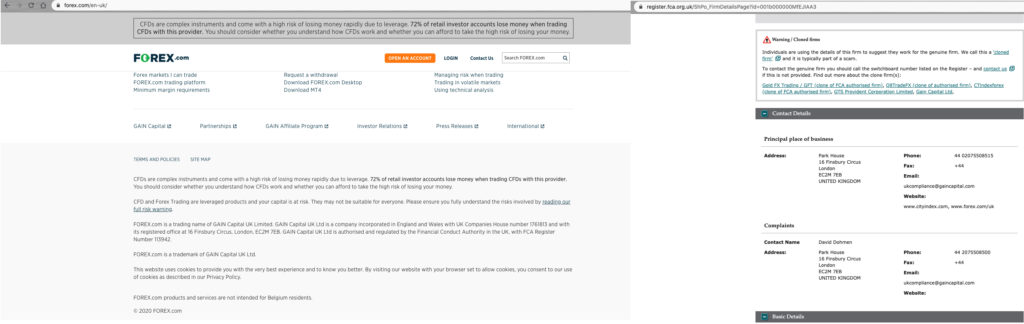

Under the Financial Conduct Authority (FCA), forex trading is legal in the United Kingdom.

Established in 2012 and operating as an independent body, the FCA’s main priority is to protect the UK and European traders against fraudulent and unfair trading practices.

Therefore, you must ensure that before you invest and trade with a brokerage that you verify that the broker is regulated by the Financial Conduct Authority.

You see, many illicit and fraudulent scam brokerages have pawned off fake FCA license numbers as their own in the delicate and deceptive attempt to appear more credible than they truly are.

As a result of this truth, you must verify a broker’s regulation directly through the Financial Conduct Authority, which can be performed below.

FCA Services Register – https://register.fca.org.uk/

From there, make sure that the corporate entities match but more importantly make sure that the domain of the website is the SAME as the brokerage URL you are visiting.

Here’s a quick example.

Developing a Forex Trading Plan

United Kingdom forex trading presents many advantages unavailable to traders from other nations but just because investors have more advantages available to them does not mean they should cut corners when formulating a forex trading plan.

If you are uncertain where to begin then just know that there are a variety of free resources available for you, such as a regulated brokerage page, which shows you verified and regulated trading entities specific to your jurisdiction.

Additionally, we have reviewed the top service providers in the industry and their performance results which can be seen here.

For investors who aren’t sure where to get started or how to begin with their forex trading venture, just know that you can always leave a comment below or drop an email to support@vladimirribakov.com.

Last but not least, we always recommend traders increase their foundation of knowledge for trading through the processing of educational materials, such as the free eBooks created by Certified Financial Technician and forex mentor Vladimir Ribakov.

As a whole, forex trading possesses significant risk but if you approach trading with a level-head, a solid game plan, and with regulated brokerages then you too can prosper and secure financial security not only for yourself but more importantly those around you.