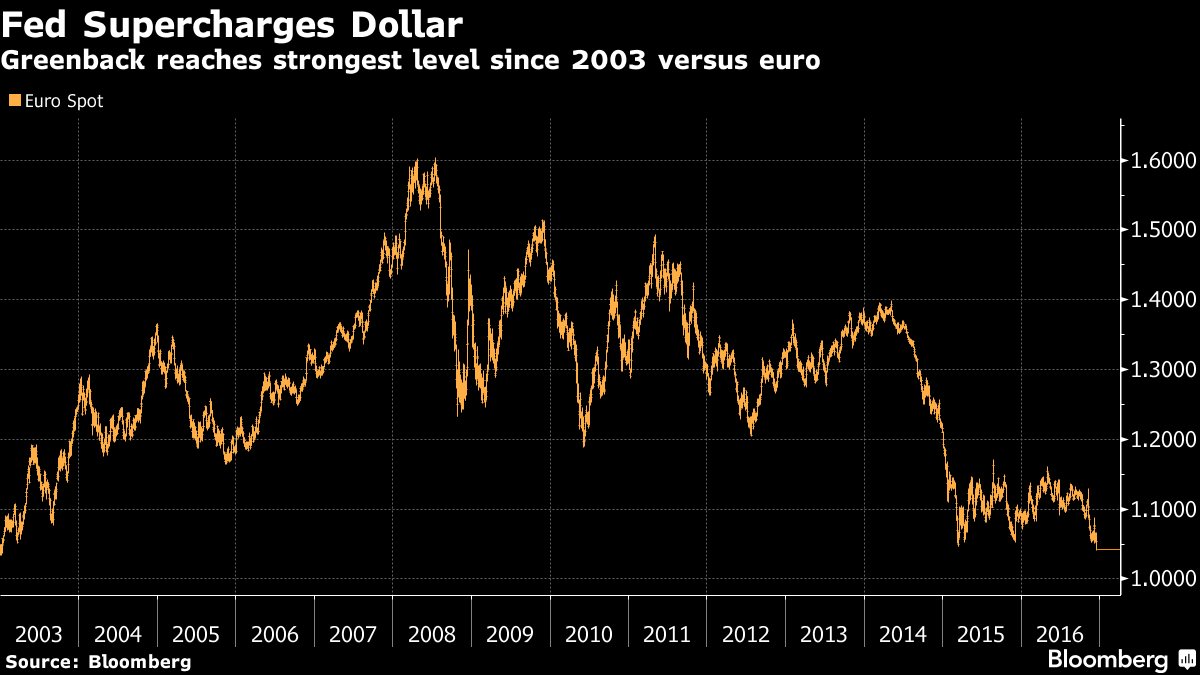

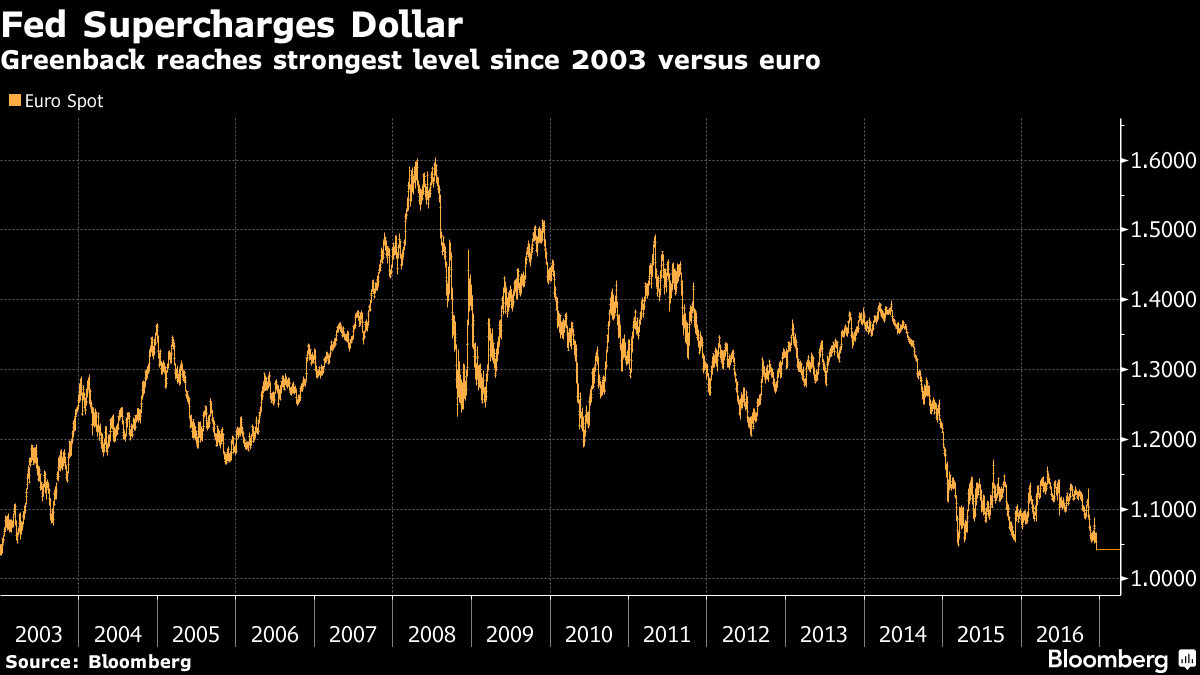

The dollar climbed to the highest level since 2003 against the euro and gold plunged as the prospect of a steeper path for U.S. interest rates filtered through markets. U.S. stocks rebounded from the worst day in two months.

Financial shares led gains in major American equity benchmarks, while rate-sensitive stocks slipped after U.S. 10-year yields reached the highest level in more than two years. The greenback extended its advance against major and emerging-market peers after the Federal Reserve’s first interest-rate hike of 2016 came with a signal of three increases next year. Gold tumbled 2.6 percent to a 10-month low.

The Fed’s move marks a step in what is expected to be a shift away from global central-bank policy dominating financial markets toward what a potential rise in fiscal stimulus. While stocks have rallied and bonds have tumbled since Donald Trump’s election fueled such expectations, the U.S. central bank stands largely alone in actively tightening policy, a stance that’s sent the dollar surging. The Bank of England kept its key rate at a record low Thursday, a week after the European Central Bank extended quantitative easing.

“At the moment it feels like going long dollar is free money, no one loses,” said Stuart Bennett, head of Group-of-10 currency strategy at Banco Santander SA in London. “The market believes it can push for another two to three percent relatively risk-free, a nice Christmas bonus. The market never appears to need a reason to be negative about the euro.”

Stocks

- The S&P 500 Index rose 0.4 percent to 2,262.75 at 9:58 a.m. in New York, rebounding from a 0.8 percent slide sparked by the Fed’s decision.

- Financial shares rose 1.3 percent. Goldman Sachs Group Inc. jumped 1.8 percent to lead the Dow Jones Industrial Average higher by 0.4 percent.

- The Stoxx Europe 600 Index rose 0.6 percent, led by travel providers and banks.

- VStoxx Index declined 7 percent after plumbing the lowest level since September 2014, signaling traders are pulling back from hedging against swings in euro area shares.

Currencies

- The dollar gained 1.1 percent to $1.04242 per euro, the strongest since January 2003. It advanced as much as 1.4 percent against the yen.

- Consumer prices climbed 0.2 percent in November, matching the median estimate of economists, increasing chances the Fed will be able to fulfill three interest-rate increases in 2017

- Britain’s pound fell 0.7 percent against the U.S. currency after the BoE said its inflation target is more attainable than previously predicted.

- The Fed lifted its target for overnight borrowing costs by 25 basis points, or 0.25 percentage point, on Wednesday to a range of 0.5 percent to 0.75 percent. Policy makers expect three rate increases in 2017, up from the two seen in September.

Bonds

- Yields on 10-year Treasury notes rose two basis points to 2.59 percent, after touching their highest level since September 2014.

- German 30-year bund yields climbed 6 basis points to 1.12 percent.

- China’s 10-year sovereign yield surged 22 basis points to 3.45 percent, set for a record increase on a closing basis, as a plunging yuan and hawkish Fed comments damped expectations of monetary easing in China.

Commodities

- Gold for immediate delivery was down 1.1 percent to $1,130.1 an ounce, after touching its lowest price since February. The commodity has lost 14 percent since the end of September.

- West Texas Intermediate crude slipped 1.9 percent to $50.09 a barrel. Libya is preparing this week to ship the first cargo from its largest export terminal in two years.

Source: Bloomberg

Statistically informative

Thank you Vlad for sharing this post with us.

Thanks for sharing, very informative