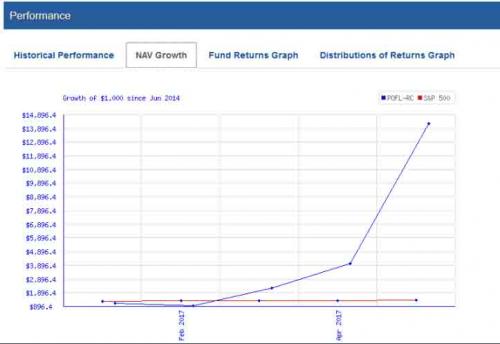

Cryptocurrency Hedge Fund Returns 2,129% YTD. We’ll preface this post by saying we have never heard of the Alternative Money Fund – which “Specializes in Returning Freedom and Value” – and very well may never hear of it again, however it is notable for two things: i) it is a “hedge fund” invested entirely in cryptocurrencies and ii) it has allegedly generated a 2,129% return YTD, making it the best performer in hedgeco’s ranking of asset managers YTD.

The “fund’s” own description is similar to what one would find in any traditional asset manager, with one exception of course: it does not invest in traditional securities at all, only cryptos:

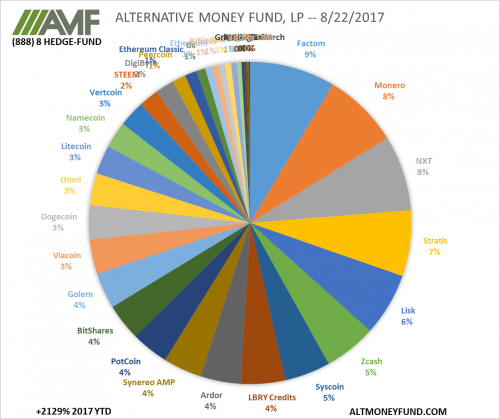

- 30 or so names in the portfolio

- discretionary, not systematic

- technically driven bottom-up, primary.

- fundamental research, secondary

- performance not directly correlated to the price of bitcoin. Good addition for Bitcoin holders.

It also writes that it is “committed to provide exceptional returns through an actively managed portfolio of blockchain assets. With the emergence of Bitcoin, Altcoins and this exciting new technology has created a new asset class for investors.” The fund also notes that its “trading strategy does NOT use leverage or margin. Returns are reported monthly and capital accounts may be increased or redeemed each month.”

So far so good; when one reads further in, some “lingo” red flags start to emerge:

The volatility associated with the cryptographic verification and game theoretic equilibrium, these blockchain-based digital assets create valuable opportunities in an actively traded portfolio.

Hmm, “cryptographic verification and game theoretic equilibrium” may sound exciting but it’s what one would say when scrambling for sophisticated words to sound intelligent, in other words what Fed presidents do every single day.

Reading through the full presentation reveals much more such language (which probably would be a sufficient red flag) although the most remarkable feature of the fund, as noted, is its performance.

Through August, the fund claims to be up 2,129%. That puts it at the top of hedgeco.net’s 2017 league table.

Its holdings

Back to the red flags: this is how the fund defines its marketing:

- Marketing is done by word of mouth, internet, hedge fund databases, 3rd party marketers, and other sources.

- Distribution of the marketing material will be done by face-to-face meetings with potential investors and funds. Mail-outs, business cards and phone calls to friends and family and others will also be done.

- We are not planning on getting too aggressive with this plan, more organic growth is desired.

- The managing member very active on: Facebook, Angellist, Instagram, Medium, Twitter, and more

- Customized email from altmoneyfund.com, business cards, etc.

- Returns will be posted on the Hedgefund Indices

Red flags aside, we wonder how long before many more such “hedge funds” crop up, all having generated returns (whether real or fabricated) that traditional hedge funds can only dreams of, and how long before the more naive elements in the investing community rush to flood them with capital in hopes of “getting rich quick” with 4 digit annual returns, creating yet another ponzi active asset manager bubble even as traditional long/short and numerous other legacy investors, struggling to outperform the S&P, slowly disappear?

The fund’s “presentation materials” for those curious are below, and the good news for the overly gullible: as the fund notes, “currently there are no fees for the first

$500k under management”

Hi Vlad

Thanks for this article, I would be interested in articles on Crypto ETFs. Or your advice and knowledge on the best way to invest in Cryptos

“currently there are no fees for the first

$500k under management” thats a good news :.)

Thanks for the valuable post