Welcome traders, Vladimir Ribakov here from Home Trader Club with this week’s Forex Weekly Forecast. In today’s analysis, I’ll keep it short, clear, and straight to the point, focusing on key technical levels and trading setups for the week ahead.

As always, a big thanks to our partners at Eight Cap for supporting our community. If you’re interested in accessing all the exclusive offers and projects we’ve built with Eight Cap, you’ll find the details in the description below the video.

- 1 Watch the Full Weekly Forecast Video

- 2 Explore My Free Mentorship Program

- 3 EUR/USD – Bearish Continuation Below Key Resistance

- 4 EURAUD – Potential Breakout from Daily Range

- 5 GOLD (XAU/USD) – Watch for a False Break and Reversal Setup

- 6 NZD/USD – Bearish Momentum Continues

- 7 S&P 500 – Tariff News Breaks Structure

- 8 Pro Trading Tip

- 9 Join the Home Trader Club

Watch the Full Weekly Forecast Video

Watch the Full Weekly Forecast Video

Don’t forget to Like, Comment, and Subscribe for more weekly plans and real-time insights.

Explore My Free Mentorship Program

As an Internationally Certified Financial Technician (CFTe, IFTA) and former private capital hedge fund trader, I have successfully mentored numerous students who are now thriving in the trading world. Students who learned with me, are now full-time traders, work in the trading industry, run their own capital firms or are fully funded traders by private companies, develop automated trading solutions and manage others’ capitals. I am a very proud mentor and I am proud of the success stories I’ve helped create, and for a limited time, I’m offering my mentorship program for free through a partnership with Eight Cap broker. Join Eight Cap, become an active trader, and choose the offer that suits you best –

For more details, visit: Home Trader Club Mentorship Program

I’m excited to work with you and help you reach your desired level of success!

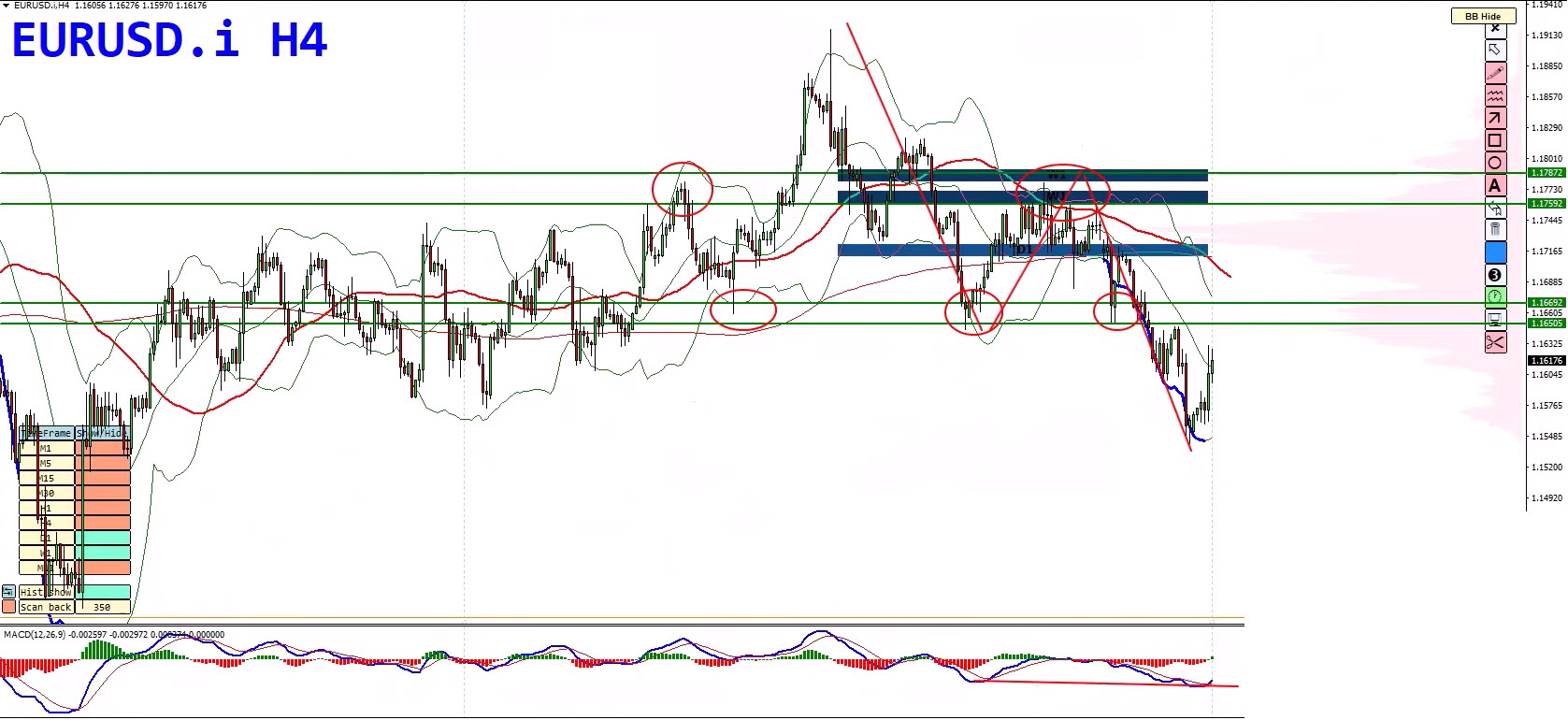

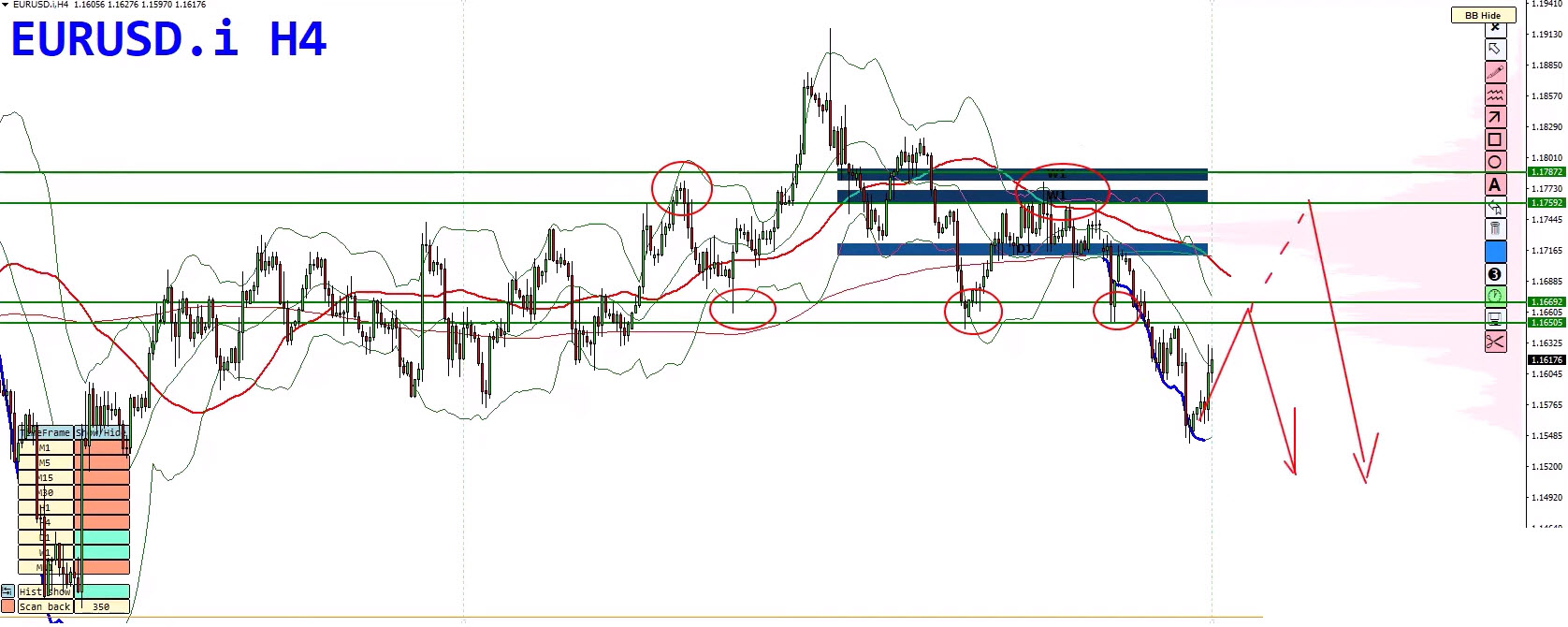

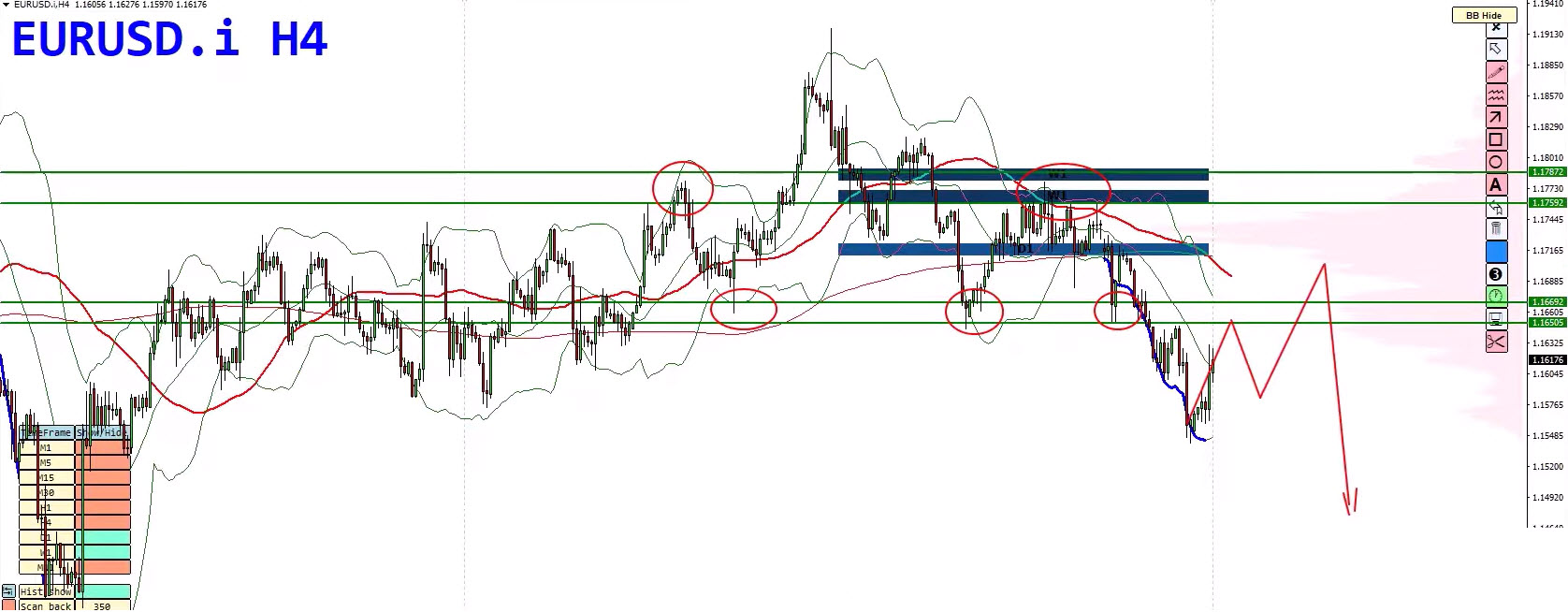

EUR/USD – Bearish Continuation Below Key Resistance

Last week, EUR/USD broke below its trendline support, confirming the bearish structure we’ve been monitoring. The pair continues to print lower highs and lower lows, showing no clear signs of reversal yet.

Currently, the previously broken support is acting as resistance, creating a supply zone where sellers are likely to step in. As long as this area holds, my plan is to sell the rallies.

📊 Trading Plan:

-

Watch for a possible AB=CD pattern or small corrective climb followed by rejection.

-

Look for bearish hidden divergence (lower highs on price vs. higher highs on MACD).

-

A break below the volume profile balance zone would further confirm the bearish outlook.

🧭 Bias: Bearish

🎯 Key Resistance Zone: 1.0750–1.0800

🎯 Target Zones: 1.0600, 1.0500

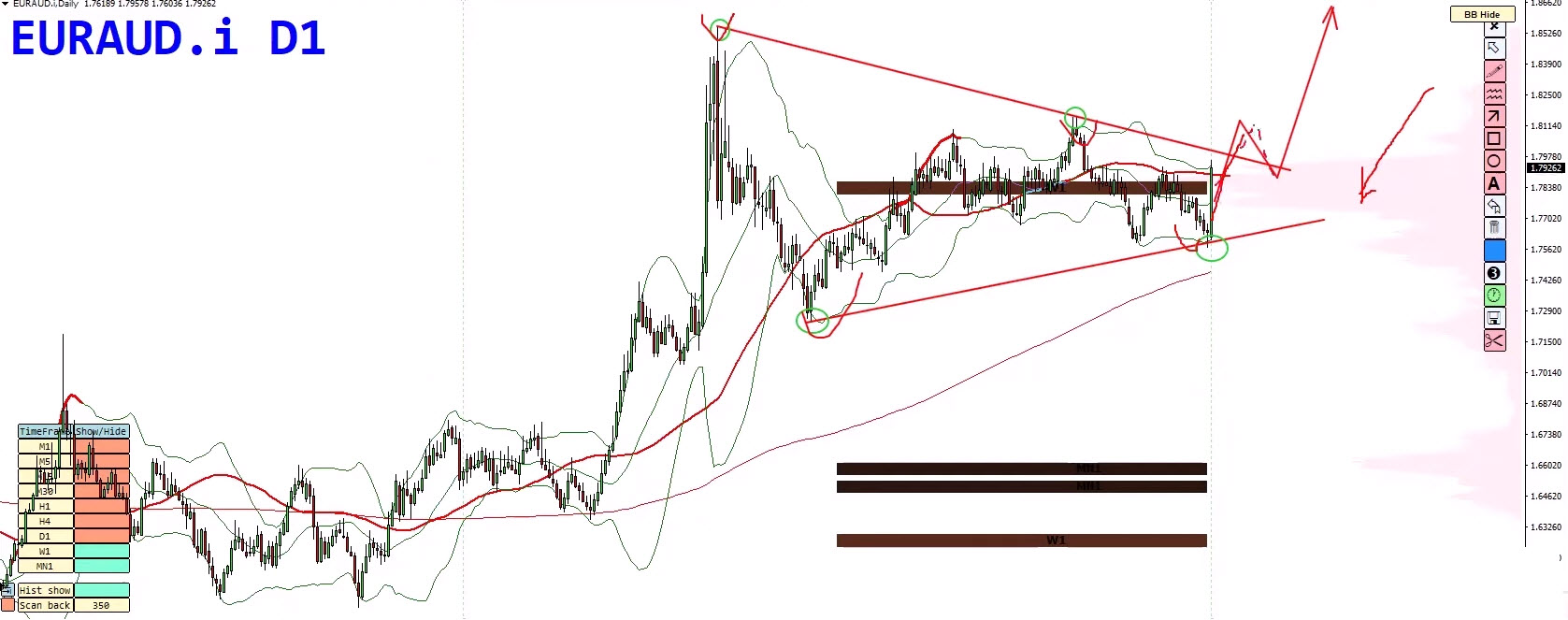

EURAUD – Potential Breakout from Daily Range

The EUR/AUD is forming a clean daily range, testing the upper boundary multiple times. The structure shows four touches on resistance — an indication of potential breakout pressure building up.

If the price breaks above the range and positions itself above the volume profile balance zone, I will look for retraces and bullish continuation setups.

📊 Trading Plan:

-

Wait for a confirmed breakout and rejection from the top zone.

-

Look for MACD momentum confirmation and candle structure pointing upward.

🧭 Bias: Bullish (upon breakout)

🎯 Key Resistance: 1.6380–1.6420

🎯 Targets: 1.6600, 1.6750

GOLD (XAU/USD) – Watch for a False Break and Reversal Setup

Gold has rallied strongly above the psychological $4,000 level, but this move could be nearing exhaustion. I expect another potential high to form soon.

What I’m watching for is a false breakout scenario — higher highs on the chart but lower highs on the MACD, signaling a bearish divergence. This would hint at a possible reversal or corrective phase.

📊 Trading Plan:

-

Watch for a failed breakout above $4,000–$4,020.

-

A break below the rising trendline could trigger a sell opportunity.

-

As long as the new peak holds, the sellers may step in aggressively.

🧭 Bias: Bearish Reversal Potential

🎯 Resistance Zone: $4,000–$4,050

🎯 Target Zones: $3,930, $3,880

NZD/USD – Bearish Momentum Continues

The New Zealand Dollar remains under strong bearish pressure, maintaining its lower highs and lower lows pattern. While the 4-hour chart shows a slight slowdown, the daily trend remains bearish.

The key observation here is that broken supports have turned into resistances, providing ideal areas to look for short entries.

📊 Trading Plan:

-

Wait for price to retrace into resistance zones around 0.5950–0.6000.

-

Look for rejection candles and confirmation signals before entering shorts.

-

Avoid entering early to prevent getting caught in temporary rallies.

🧭 Bias: Bearish

🎯 Resistance Zones: 0.5950–0.6000

🎯 Target Zones: 0.5850, 0.5800

S&P 500 – Tariff News Breaks Structure

The S&P 500 reacted sharply to last week’s tariff news on Chinese minerals, shaking global markets — including indices and cryptocurrencies. The rising trendline is now broken, signaling potential weakness.

The broken support and last swing high now act as resistance and supply zones. I’ll be watching for retraces into this area for shorting opportunities, as long as the price stays below the dynamic resistance indicated by the volume profile.

📊 Trading Plan:

-

Watch resistance levels at 6650–6660 (key balance area).

-

Look for rejection signs and continuation to the downside.

🧭 Bias: Bearish

🎯 Resistance Zone: 6650–6660

🎯 Target Zones: 6550, 6480

Pro Trading Tip

Pro Trading Tip

Every forecast above is paired with two scenarios. Why? Because great trading is not about being right — it’s about being ready. Let the market confirm the bias. Use your system, manage risk, and execute only when the structure and confirmation align.

Join the Home Trader Club

Join the Home Trader Club

Want to access the tools, systems, and real-time education we use daily?

With Eight Cap Broker’s support, you can now enjoy up to one full year of access to the Home Trader Club — including:

-

All professional trading systems

-

Exclusive mentoring sessions

-

Real-time trade ideas and setups

-

Full access to our course library and trading marketplace

Wishing you a profitable week ahead!

Vladimir Ribakov

Internationally Certified Financial Technician

Home Trader Club