Hi Traders! Trading Experience and resources to do thorough research allowed me to find some really amazing candlestick patterns during the years. In this article I will show exactly how to spot them and how to trade them. Some of these patterns success rate would be up to 90% win ratio if you use it properly and as you know when it comes to Forex trading or trading in general such numbers are simply fantastic!

Make sure to download my FREE E-Books about the Marubozu, Equal Tail and Double Doji candlesticks here

The candlestick patterns that I cover in this article are as follows

Marubozu Candlestick Pattern

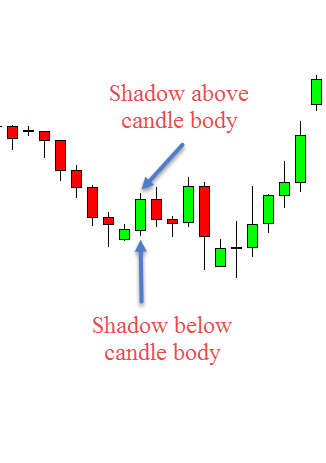

The classical or complete Marubozu candle is represented only by a body, it has no wicks or shadows extending from the top or bottom of the candle. In other words we can say that in a Marubozu candle stick the opening or closing price is equal to the highest or lowest price. We have three types of Marubozu which are as follows:

- Complete Marubozu

- Opening Marubozu

- Closing Marubozu

Let’s have a look at each type.

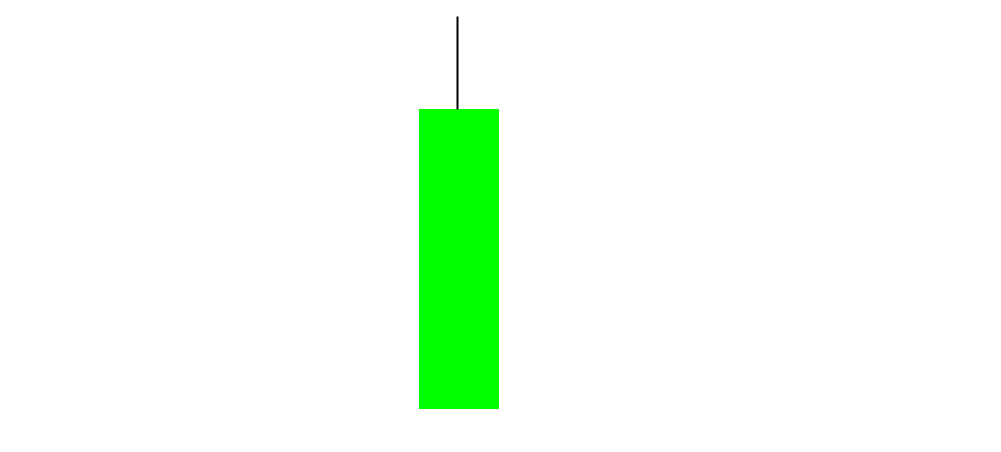

Complete Marubozu – As I already mentioned above, this pattern doesn’t have wigs above or below the body of the candle.

Example of Complete Marubozu

If the candle has wicks only from one side then it falls into another category – either an Opening or Closing Marubozu.

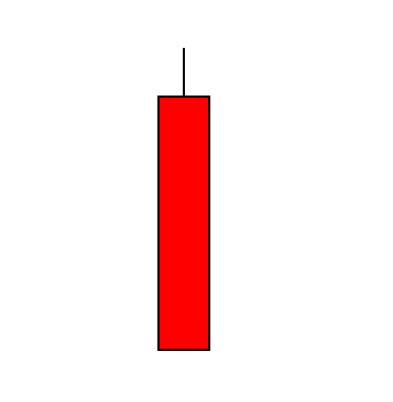

Opening Marubozu

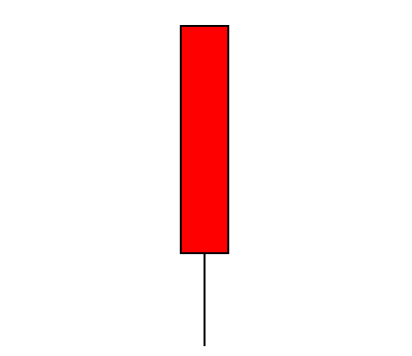

In an Opening Marubozu the open price would be equal to the highest price (if its a bearish candle) or lowest price ( if it is a bullish candle).

Example of Bearish Candle Opening Marubozu

In the above example the bearish candlestick has opened from the upper side of the candlestick and kept falling. There is no shadow above the opening price. This is what we call as a bearish candle Opening Marubozu.

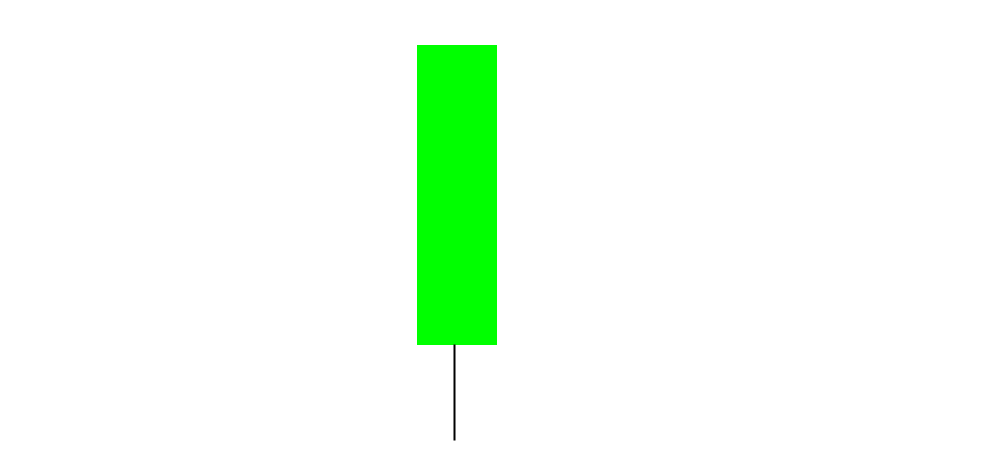

Here is an example of bullish candlestick Opening Marubozu

In the above example the bullish candlestick has opened from the lower side of the candlestick and kept moving higher. There is no shadow below the opening price. This is what we call as a bullish candle Opening Marubozu.

Closing Marubozu

In a Closing Marubozu the close price would be equal to the highest (if its a bullish candle) or lowest price (if it’s a bearish candle).

Example of Bearish Candle Closing Marubozu

In the above example this bearish candlestick has closed with no shadow below the closing price. This is what we call as a bearish candle Closing Marubozu.

Example of Bullish Candle Closing Marubozu

In the above example this bullish candlestick has closed with no shadow above the closing price. This is what we call as a bullish candle Closing Marubozu.

How to read the Marubozu pattern?

It is very simple actually. This pattern foreshadows a reversal in the main trend. It doesn’t matter whether the current trend has been up or down. If you see this pattern it is a good idea to book profits as chances are price is about to reverse but remember the fact that a big reversal won’t happen always after a Marubozu but 80% – 85% of the Marubozu’s would correct at least for few pips. For example if its a daily chart then the correction could be 20 or 30 or 40 pips, if it’s a H4 chart then it could be 15 or 20 pips, if its a H1 chart then it could be 10 or 15 pips.

The Marubozu is a kind of a situation which I call it as a “Big Sale” just imagine a big store announcing a big sale offer, the moment they announces this offer everyone rushes to that shop and buy the stuffs in the sale and after that no body rushes to buy them more so we might see some drops in prices.

Here are some more examples of Marubozu Candlestick pattern

Extra Notes:

- If you have a spike or wig of 1 pip on a H1 chart then it’s ok (if it’s a daily then 2 or 3 pips can also be ignored) we may consider it as a Marubozu.

- The most reliable Marubozu’s are the ones without the wigs or spikes.Example of Marubozu without wigs or spikes

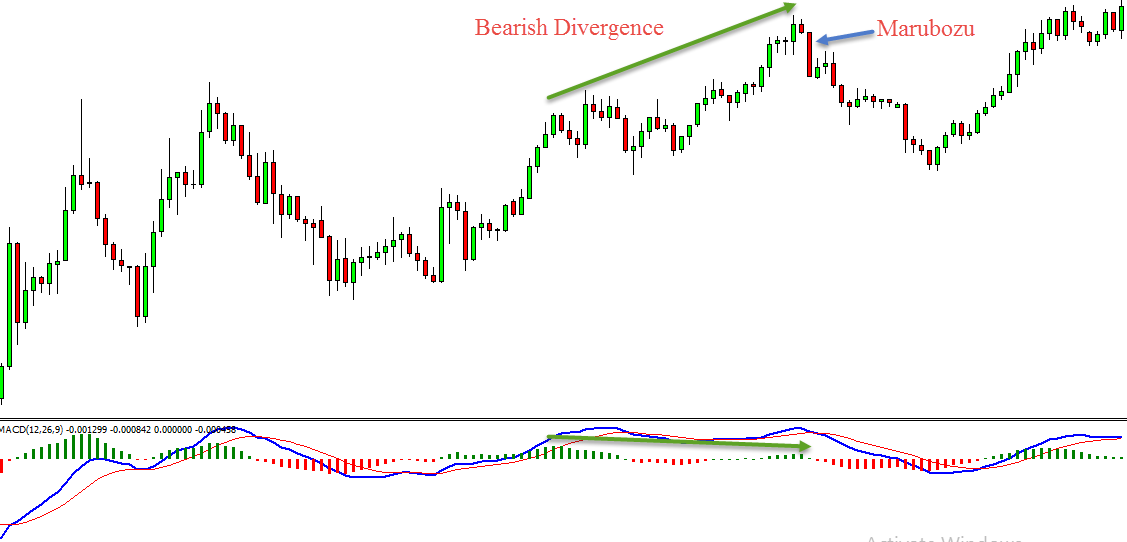

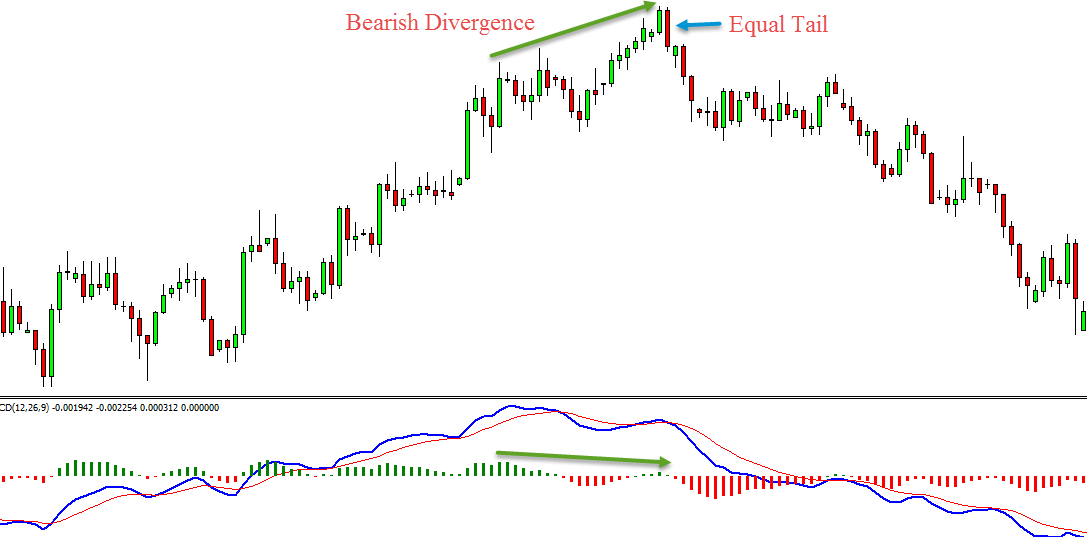

- I personally like to use Marubozu combined with divergence, it is very reliable. (If you want to learn more in-depth insights about divergences, you can benefit greatly from the videos on my channel here while also embarking upon Divergence University for comprehensive divergence education).Example Of Bearish Divergence With Marubozu

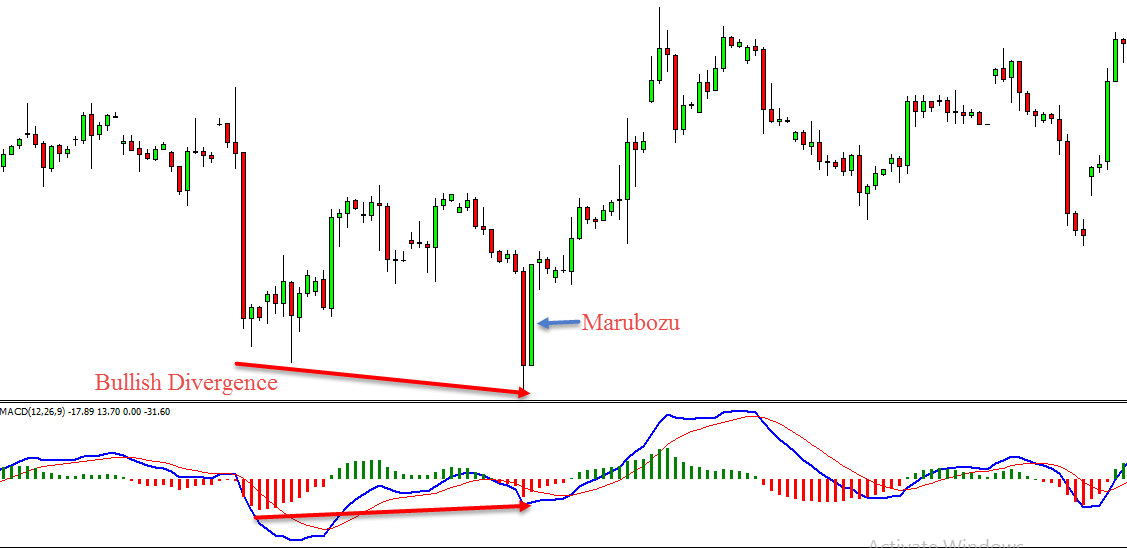

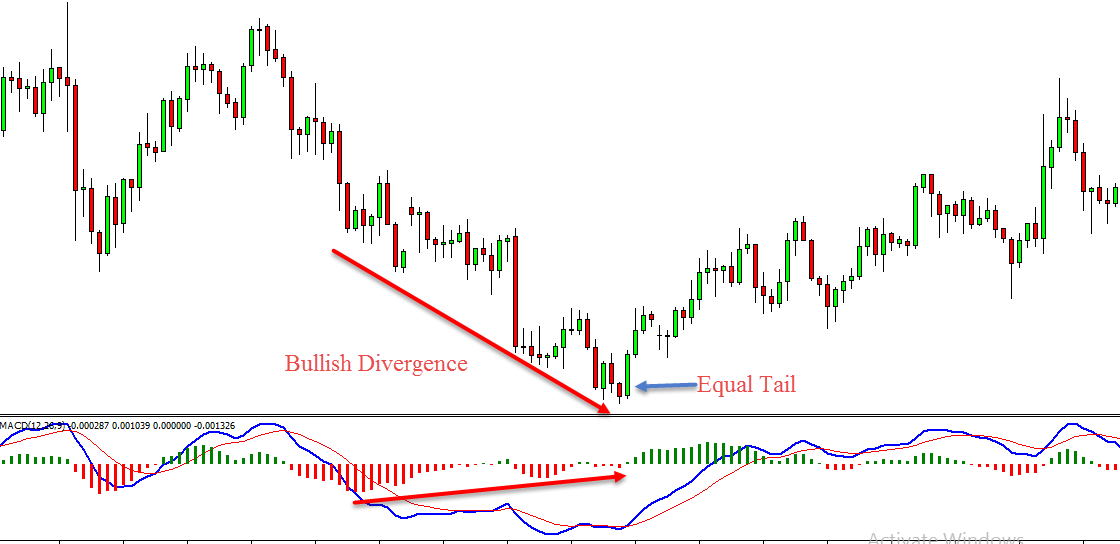

Example Of Bullish Divergence With Marubozu

Example Of Bullish Divergence With Marubozu

- Usually after a Marubozu the price might continue in the same direction for a bit and then we will see a retrace.

Equal Tails Candlestick Pattern

This pattern is existing under the radar of many traders appearing on their charts unnoticed. It is a rare pattern which makes it so powerful. As the name suggests the equal shadows pattern has wigs or shadows on both sides that have pretty much the same size. The equal tail situation means the market is in a healthy condition.

Example of Equal Tail Candlestick Pattern

This equal tail candlestick pattern might appear at any situation but I find it very reliable when it comes in any of the three following situations:

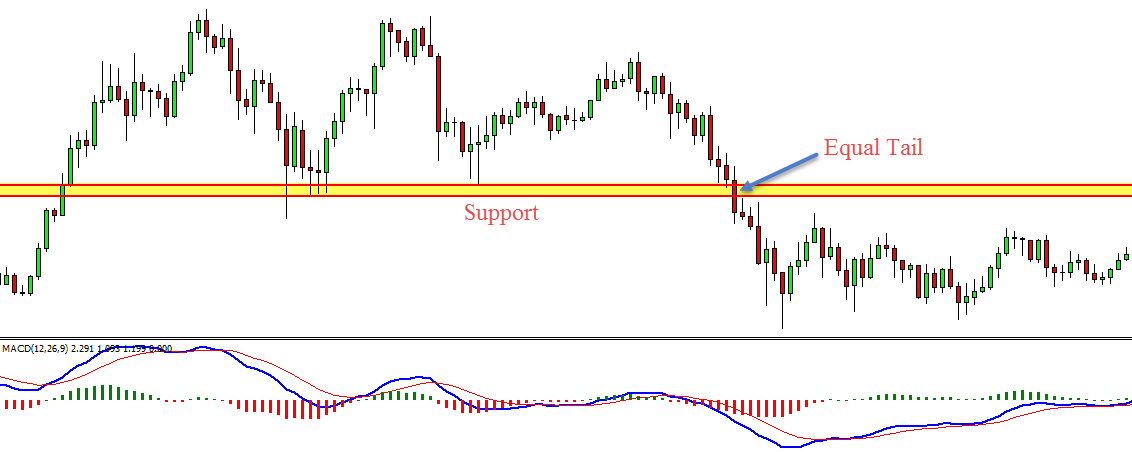

- When an equal tail candlestick appears after the breakout of some resistance (or support) or last high (or low) in such situation most likely the trend will continue.Example of price broke below the support with Equal Tail Candlestick

Example of price broke above the last high with Equal Tail Candlestick

Example of price broke above the last high with Equal Tail Candlestick

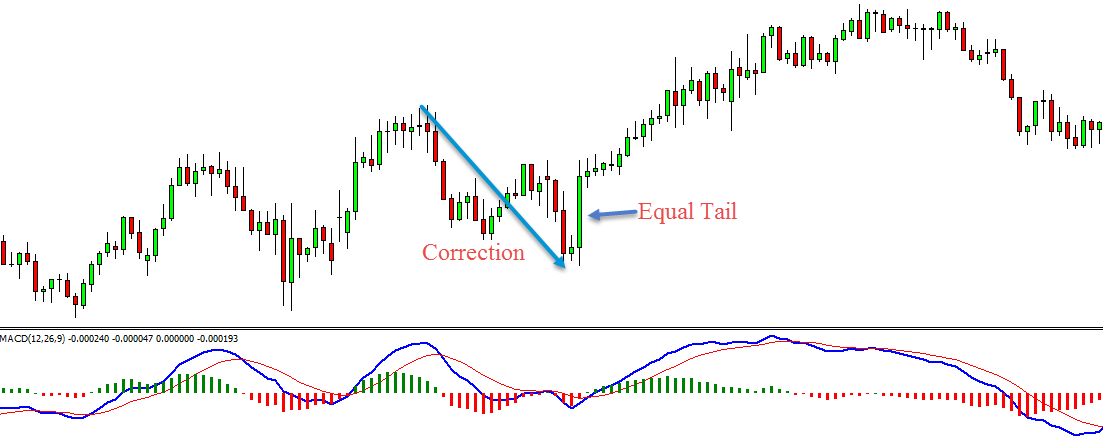

- When an equal tail candlestick appears after a big correction and usually the market will continue on the same direction that this candle points towards.Example of Equal Tail Candlestick after a big correction in an uptrend

Example of Equal Tail Candlestick after a big correction in a downtrend

Example of Equal Tail Candlestick after a big correction in a downtrend

- When an equal tail candlestick appears with divergence, I call this situation as an “U” turn situation and most likely the price will go in the direction of the divergence.

Example Of Bearish Divergence With Equal Tail Candlestick

Example Of Bullish Divergence With Equal Tail Candlestick

Why does the Equal Tail Candlestick pattern appear?

Market starts moving from a certain price and the buyers decide that they want to overpower the market. They initiate a deliberate decrease in prices. This causes the lower shadow to form. After the price is attractive enough, they push the price up. When prices are high enough they calm down and keep the high prices stable. However, it causes a small fall in prices. This is how the upper shadow is formed. This fall in prices attracts other buyers to this specific currency pair, which causes the strong up move to continue.

Here is one more example of Equal Tail Candlestick pattern:

Here are few more examples of Equal Tail Candlestick pattern

Extra Notes:

- It is extremely important for this pattern to appear 1 or maximum 2 candles after the correction or after the trend has ended. If it appears in the middle of the trend it is not reliable.

- You may choose to trade this pattern by itself but as I already mentioned in this article it would be best to trade it in conjunction with other methods to increase the success rate.

- Both the tails doesn’t have to be with the same pips, it could have two or three pips difference.

Double Doji Candlestick pattern

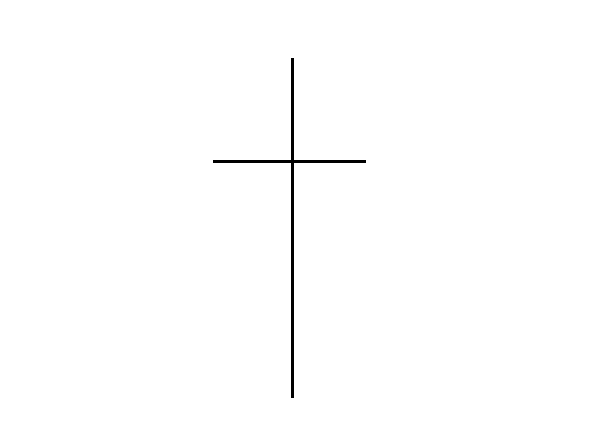

The “Doji” pattern is one of the most incredible patterns among the Japanese candlesticks. For some reason it is not referred to very often. Maybe that explains why it is extensively used by pros. The Doji hints us that the market is in a state of balance of powers: the buyers’ strength has run our, but so is the sellers’. So this is a state of temporary calmness, just before a major move.

Here is an example of Doji Candle Stick pattern

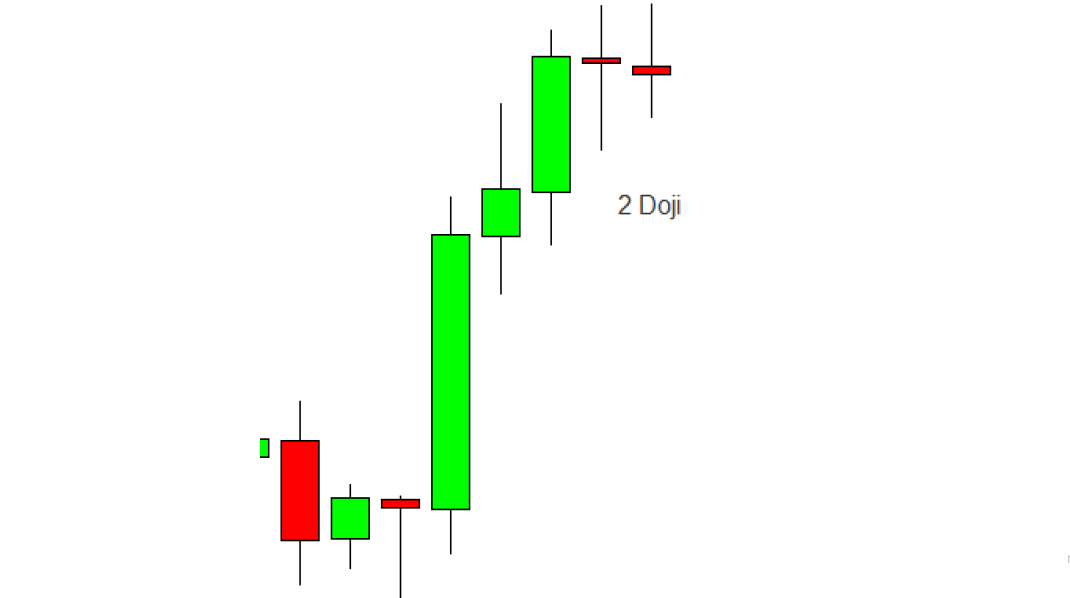

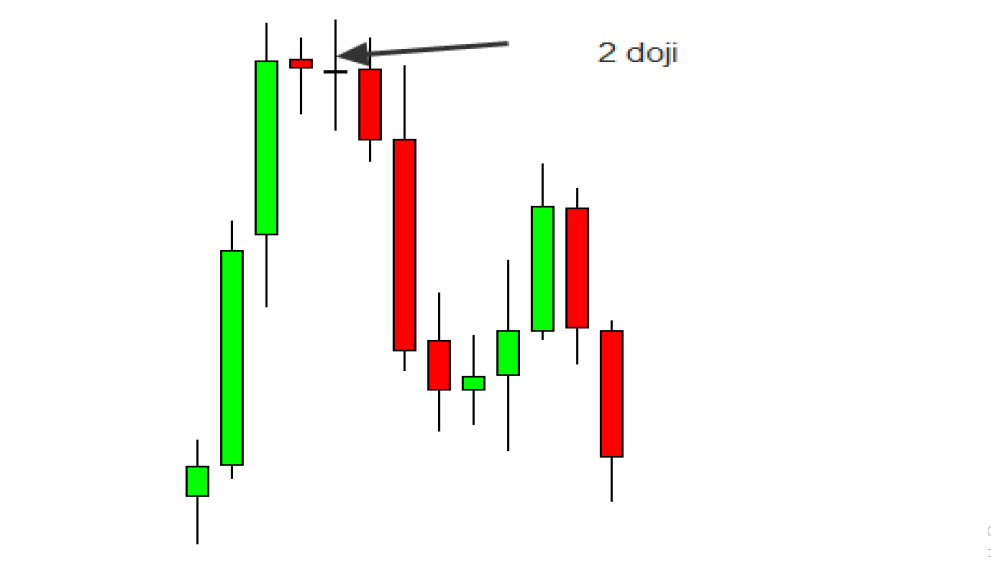

The Doji represents an arm wrestling fight between buyers and sellers, until one of the sides puts down enough force to win. Now imagine what happens when you see not one, but two Dojis! This is a world war between buyers and sellers. After such a war, you are most likely to have a knock-out winner. In other words, after 2 Dojis in a row there is a high probability of a strong move. A move which I’d certainly would like to take part in. That is why the first condition for this strategy is to identify 2 Dojis one after the other. It is preferable that the two Dojis will appear after a clear strong trend, for example an up trend or a down trend.

Here is an example of Double Doji Candle Stick pattern

Here is one more example of Double Doji pattern

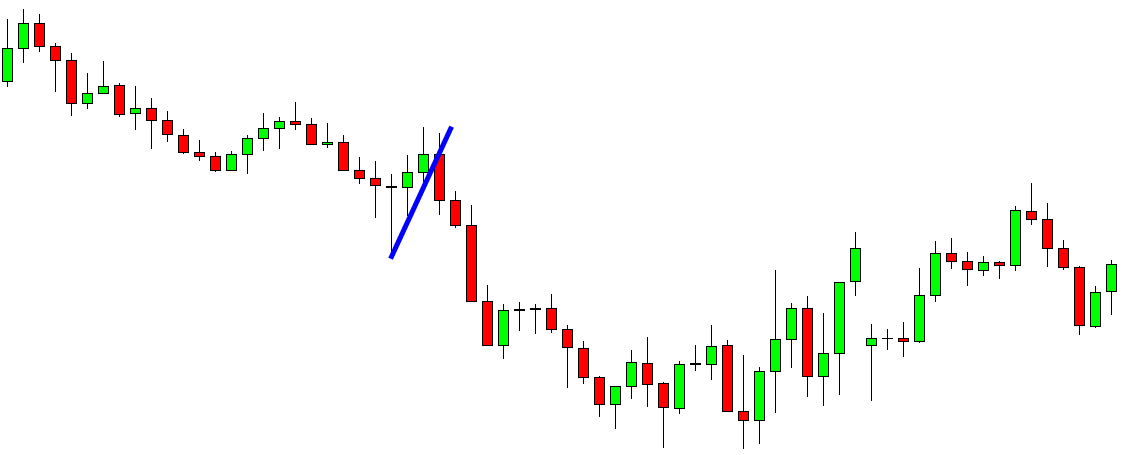

Here are more examples of Double Doji candlestick pattern

Extra Notes

- A candle with a body of just a few pips, 2-4 pips, is considered a Doji.

- Double Doji should come with more confirmations like break of a trend line, resistance or support or a flag pattern or at the end of a correction.

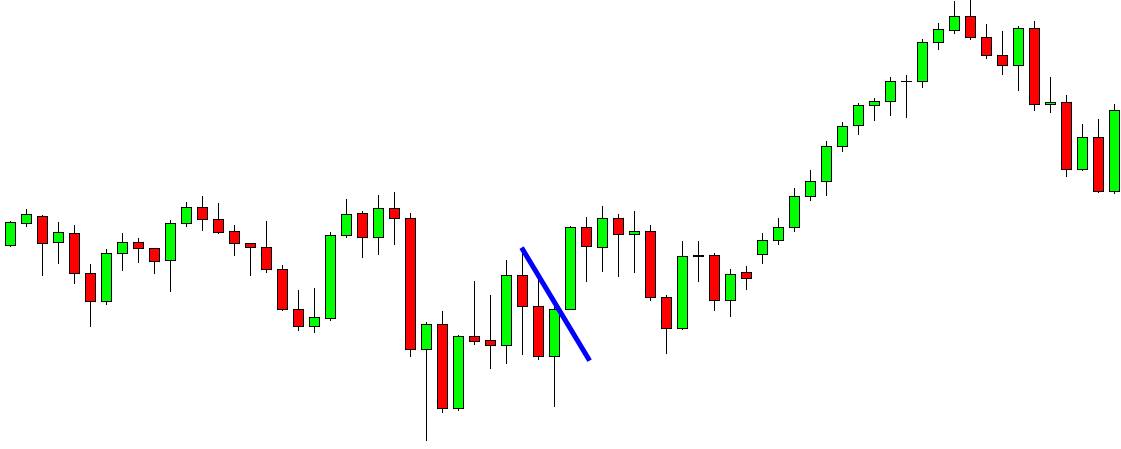

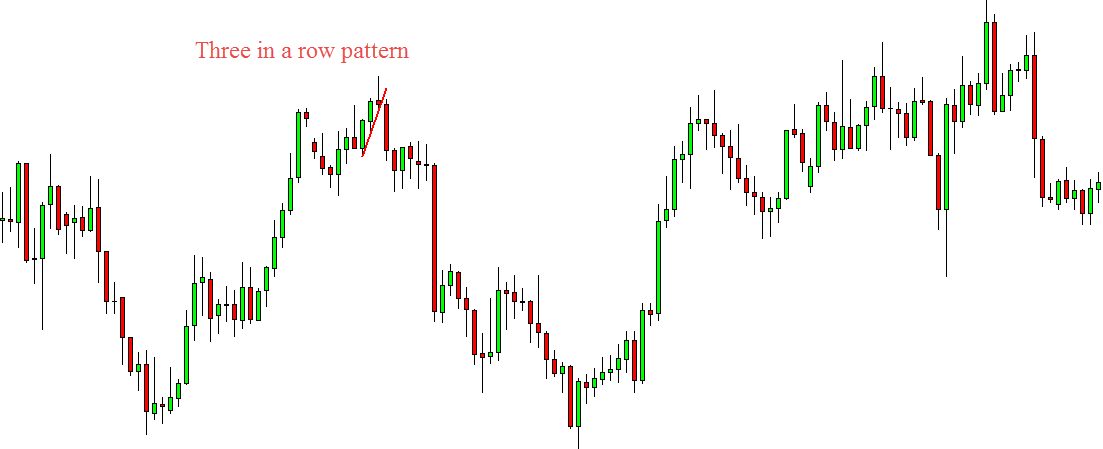

Three In A Row Candlestick Pattern

This is a very reliable candle stick pattern which I find it to be very useful. In this type of pattern I wanted to see three highs or three lows going in the same direction on the same line or on the same spot (one or two pips below).

If it is an uptrend we need to make sure all the lows touch the same line as shown in the example below and look for the break out of the uptrend line.

Here is an example:

If it is a downtrend then look for three tops, also make sure here that the three tops touch the same line, they must be in a row like as shown in the example below. When you have this, then look for the breakout of the downtrend line.

Here is an example

After the three candles, the fourth candle must break below the line if it is an uptrend or if it is a downtrend then the fourth candle must break above the line.

If it breaks down put the stop loss above the last high or if its breaks up put the stop loss below the last low, according to the situation, usually this bring more than 1:1 risk reward ratio. You can close 80% (I personally like 80% for first target, you can use 70% or 60% its up to your choice) of the trade for the first target and leave the remaining 20% for the second target.

Here are more examples of Three In A Row Candlestick Patterns

Example 6

Extra note:

- I use this pattern on H1 chart or timeframes higher than that.

- I never use this pattern on timeframes lower than H1 chart.

So traders, this is what I wanted to share with you all about the Special Candlestick Patterns.

Watch the webinar of 90% Win Ratio Forex Patterns – Special Candlestick Patterns

I invite you to join me in my live trading rooms, on daily basis, and improve your trading with us.

Also you can get one of my strategies free of charge. You will find all the details here

Thank you for your time reading this article.

To your success,

Vladimir Ribakov

Certified Financial Technician

Easy to follow it

Thank you Vlad, finding it too useful