There were few important releases earlier during the yesterday’s European session, including the German industrial production data, Spanish industrial production data, BOE interest rate decision and ECB interest rate decision. However, the main market moving event was the ECB’s press conference.

Draghi Warned

The European central bank yesterday announced the interest rates and decided to keep the rates at 0.25%. The EURUSD pair was seen trading higher after the announcement, and traded as high as 1.3992 during the early part of the ECB press conference. However, later the ECB President Mario Draghi mentioned that the board discussed the possibility of an action at the next meeting in June. This caught the attention of the Euro sellers. The EURUSD pair was down immediately more than 120 pips. Now, the possibility of the central bank to implement fresh monetary increases at the June’s meeting. The Euro was broadly lower against most of its counterparts, including the Australian dollar, British pound, Japanese yen and the New Zealand dollar.

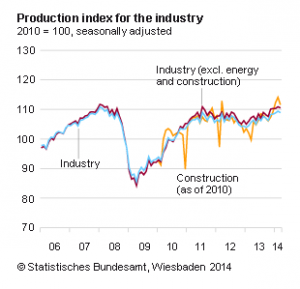

Yesterday during the early part of the London session, the German and Spanish industrial production data were published. The outcome was a negative one, as the German industrial production fell by 0.5%, missing the expectation of a 0.2% rise. The report mentioned that the “production in industry excluding energy and construction was down by 0.4%, and within industry, the production of capital goods showed a decline by 0.2%, the production of intermediate goods by 0.9%”. The outcome was certainly a disappointing one, as the market was not expecting a decline so sharp in the German industrial production. The EURUSD pair was seen trading a touch lower after the release.

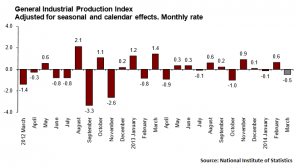

The second one was the Spanish industrial production data. The outcome was again on the disappointing side, as the Spanish annual rate of the Industrial Production Index registered a gain of 0.6%, missing the expectation of 1.7%. Moreover, the previous reading was also revised down from 2.8% to 2.5%. Furthermore, the report mentioned that the Industrial Production Index (IPI) between March and February 2014 stood at –0.5%. This rate was 1.1 points below that registered in February.

On the other hand, the US economic data continued to impress. The US initial jobless claims data was published during the NY session. The report suggested that the jobless claims fell by 26K from the previously revised reading of 345K to 319K. The market was expecting a decline of only 19K this time. So, this also added to the US dollar strength in the short term.

Technically, the EURUSD pair has formed a very awkward looking bearish candle on the daily chart. This suggests that the rejection of the 1.3990 level was very crucial. The pair broke a critical trend line during the press conference to trade higher, but it turned out to be a false one, as the pair traded back below the mentioned trend line. The 200 moving average sits at around the 1.3818 level on the 4 hour chart, which can hold the downside in the pair. On the upside, the 1.3880 might act as a resistance moving ahead.

So, keep an eye on all the important levels friends and trade accordingly.

Get my Daily Market forecast with trade opportunities HERE: Vladimir’s Markets Forecast

Happy Trading Friends!