Hi Traders! EURAUD forecast update and follow up is here. On November 5th I shared this EURAUD Forecast And Technical Analysis post in my blog. In this post, let’s do a recap of this setup and see how it has developed now. If you would like to learn more about the way we trade and the technical analysis we use then check out the Traders Academy Club. Spoiler alert – free memberships are available!

My Idea

“On the H4 chart we had a strong support zone that has formed and the price which is moving lower has broken below this strong support zone and is holding below it, we may consider this as evidence of bearish pressure. Currently this strong support zone acts as a strong resistance zone for us. Also, the ADX indicator gave a bearish signal here as well at the cross of -DI (red line) versus +DI (green line) and the main signal line (silver line) reads value over 25, we may consider this as yet another evidence of bearish pressure. And currently there are no evidences that show this bearish trend is over yet. So until the downtrend line (marked in red) shown in the screenshot below holds my view remains bearish here and I expect the price to continue lower further. Alternatively if we get a valid breakout above this downtrend line then this bearish view will be invalidated”.

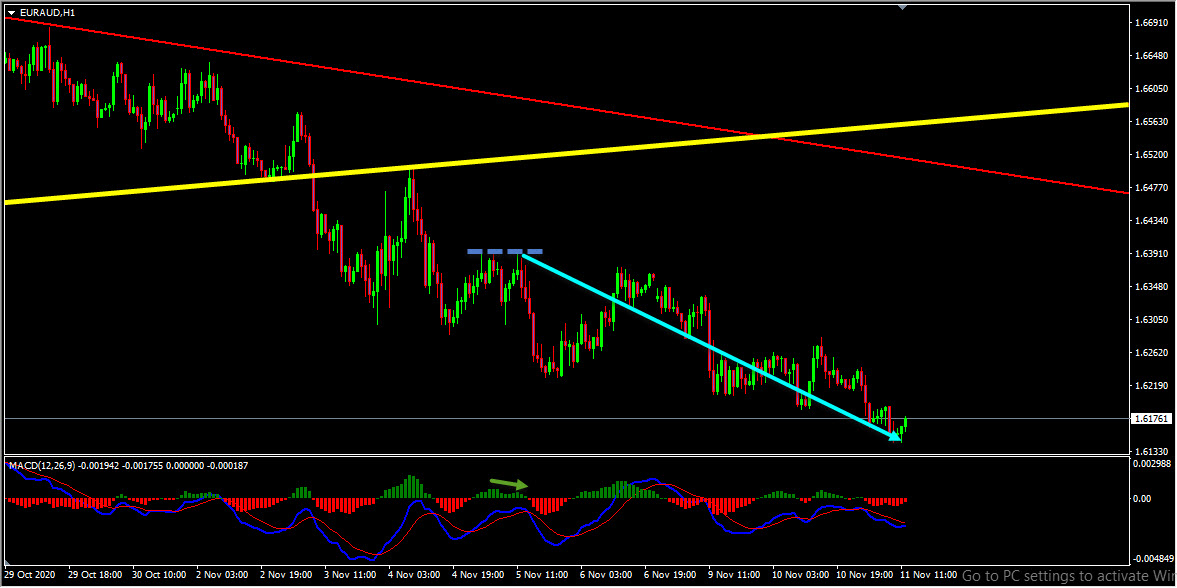

EURAUD H4(4 Hours) Chart Current Scenario

Based on the above – mentioned analysis my view was bearish here and I was expecting the price to continue lower further. The price action followed my analysis exactly as I expected it to and moved lower further delivering around 250 pips move so far. Currently, on the H4 chart, we have a potential bullish divergence that is forming at the moment, this is something that we need to pay attention to. So if you are still involved in the sells then this is a good place to consider managing your trade and secure your profits (cash out or partial cash out or trailing protections or partial hedge, etc.. depending on the strategy that you work with).

Note: If you want to learn about Money Management you can find it here

The market provided us with various facts here supporting this bearish view. On the H1 chart the price created a pullback in the form of double wave to the upside. We had a double top with continuing bearish divergence that has formed based on the histogram of the MACD indicator which we may consider as facts provided by the market supporting the bearish view. Then as you can see in the screenshot below how the price moved lower after that.

So, traders, this is why I wanted to show this example to help you understand how important it is to follow the facts. The facts were supporting the bearish view here and there were no signs against it. When the facts do happen as we expected you can see how the price perfectly moved as per the plan. Because these are the kind of hints the market provides us at majority of the times and it’s our obligation as traders to be able to listen to these things that the market tells us and we should try to make the right actions.

(Note: You can follow us here on Trading View and also on our blog to get similar ideas on a daily basis)

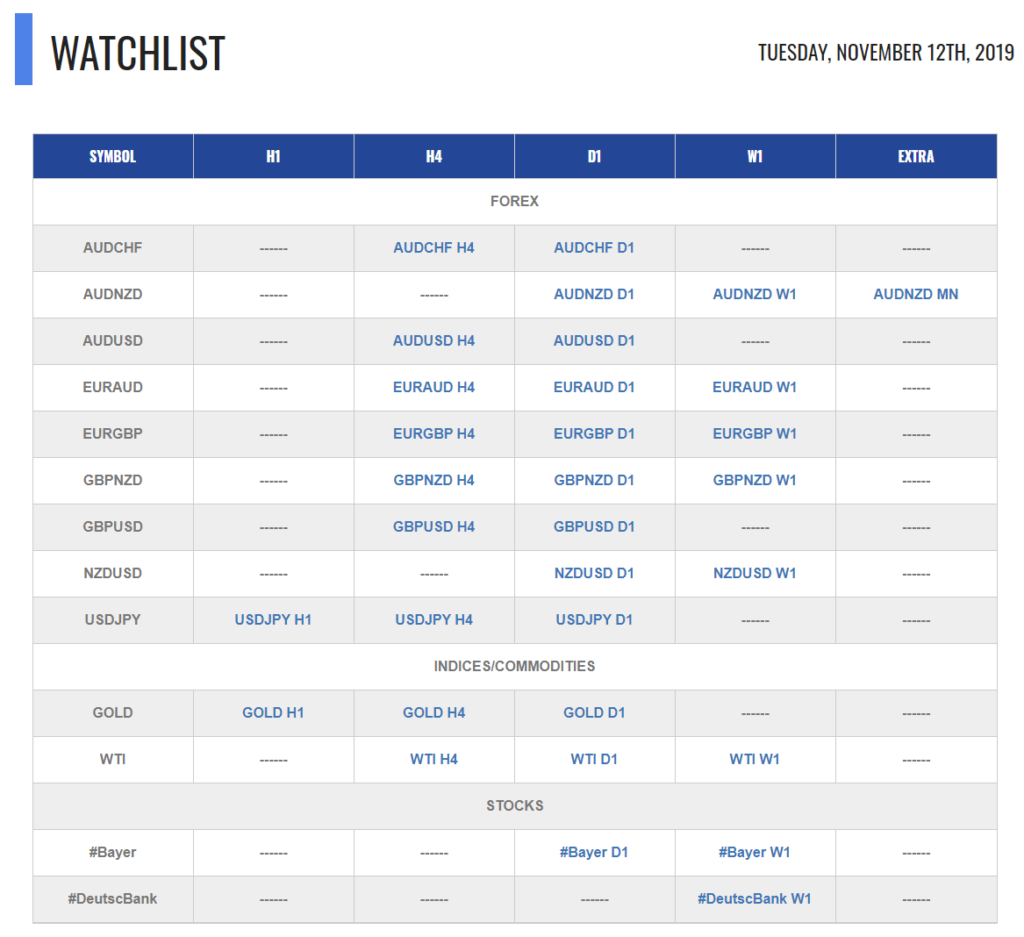

For similar trade ideas and much more join the Traders Academy Club and get access to our complete watch list and trade report.

This is how the report looks like. A table with the hottest market opportunities, screenshot behind every pair and time frame (anything that is in blue inside the table is clickable and leads to a screenshot) + a summary in text format, kind of highlights. And of course Live Market Analysis every single day.

If you have any further questions, don’t hesitate to drop a comment below!

Happy Trading!

Yordan Kuzmanov

Chief Trader at the Traders Academy Club