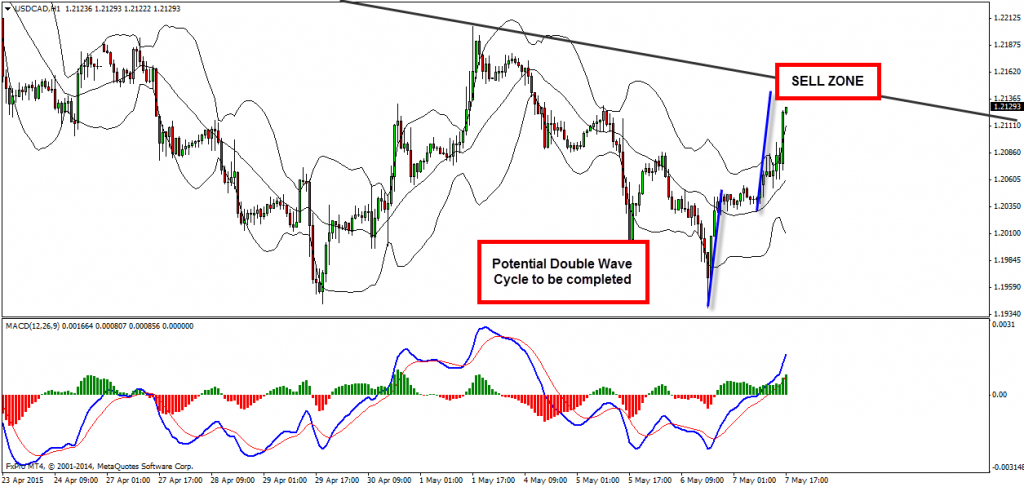

Technically the pair might drop one more time in order to complete a divergence on the daily chart. I think we should be looking for sell setup if one appears. Don’t try to force it, if the price doesn’t go as expected. I remind you that this week is full of fundamental events so we should be trading extremely careful and with extra attention, if trading at all. The plan is simple. There is a down trend line coming from the tops on the H1 chart which coincides with a potential double wave duplication. If the pair makes a stop around 1.2140-50 level and creates a divergence on the lower time frames we can look for a sell. Protecting that last high created and the trend line (trend line must hold for this setup to be valid) we can have a pretty nice Risk:Reward Ratio for this trade.

Technical Analysis Overview:

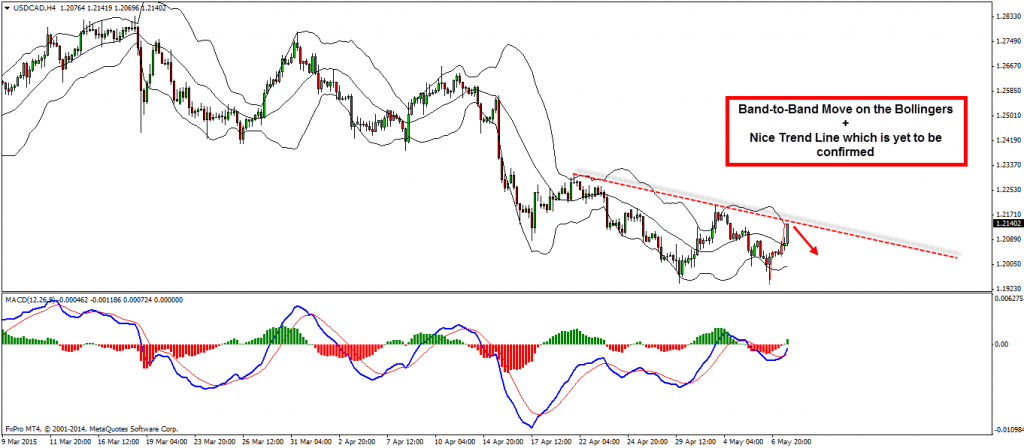

H4 – down trend line, band-to-band move

H1 – potential double wave move up

Entry:

M15 – If the price respects the down trend line well seen on the H1/H4 charts, makes a stop and forms bearish divergence near the 1.2140-50 level we can go for a short trade, covering the last high created and the down trend line.

Target 1: H1 20 MA

Target 2: 1.1970

Stop Loss: above last high created and the down trend line

Video Explanation:

Yours,

Vladimi

– See more at: http://vladimirribakov.com/forex-education/sell-rallies-in-usdcad/#sthash.uknVAqeD.dpuf