Stocks dropped from a record as traders assessed the latest round of economic data amid growing concern that more shutdowns will be necessary to contain a fast-spreading pandemic.

Most major groups in the S&P 500 fell, with consumer-discretionary, industrial and commodity shares leading losses. The dollar climbed. Home Depot Inc. sank after the retailer posted weaker-than-expected results in the second quarter. Chinese stocks listed in the U.S. faced another wave of selling as authorities in Beijing ramped up their crackdown on some of the nation’s largest companies. Alibaba Group Holding Ltd., Baidu Inc. and JD.com Inc. slumped at least 2.5%.

U.S. homebuilder sentiment sank to a 13-month low in August amid high costs as well as continuing supply shortages. American retail sales fell in July by more than forecast, reflecting a steady shift in spending toward services and indicating consumers may be growing more price conscious as inflation picks up. While factory production strengthened the most in four months, manufacturers continued to face higher input prices and a near record number of job vacancies.

Investors are looking to next week’s Jackson Hole symposium for an update on Federal Reserve policy. Tuesday’s appearance by Chair Jerome Powell at a town hall for educators may be used as an opportunity to prime the market for what’s coming.

“We’re essentially in a bit of a holding period ahead of Jackson Hole,” wrote Craig Erlam, senior market analyst at Oanda Europe. “While there is a fair amount of data releases this week, some of which may carry a little more weight than others, it’s all about the Fed in these markets at the minute, and that’s unlikely to change unless the delta situation gets dramatically worse.”

Here are some events to watch this week:

- Reserve Bank of New Zealand policy decision and briefing by Governor Adrian Orr Wednesday

- FOMC minutes released Wednesday

- Bank Indonesia rate decision and Governor Perry Warjiyo briefing Thursday

Some of the main moves in markets:

Stocks

- The S&P 500 fell 0.6% as of 10:38 a.m. New York time

- The Nasdaq 100 fell 0.8%

- The Dow Jones Industrial Average fell 0.8%

- The Stoxx Europe 600 was little changed

- The MSCI World index fell 0.7%

Currencies

- The Bloomberg Dollar Spot Index rose 0.5%

- The euro fell 0.5% to $1.1721

- The British pound fell 0.7% to $1.3750

- The Japanese yen fell 0.3% to 109.57 per dollar

Bonds

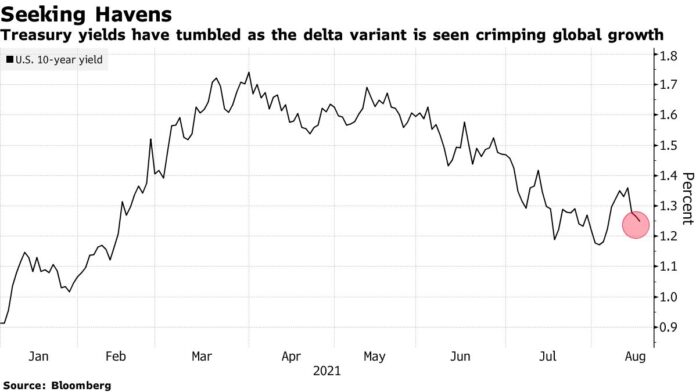

- The yield on 10-year Treasuries was little changed at 1.26%

- Germany’s 10-year yield was little changed at -0.47%

- Britain’s 10-year yield was little changed at 0.57%

Commodities

- West Texas Intermediate crude was little changed

- Gold futures fell 0.2% to $1,787 an ounce