Global stocks tumbled Thursday while bonds and oil soared as Russian President Vladimir Putin’s decision to order a military attack on Ukraine cast a pall over global markets.

The S&P 500 slid 1.7%, the Dow Jones Industrial Average opened 2.1% lower in correction territory, and the tech-heavy Nasdaq 100 fell 1.4%, putting it at risk of a bear market. The Stoxx 600 Europe index shed 3.2% and Asian equities fell to the lowest since 2020. Russian shares slumped the most on record after a trading suspension ended.

Russian military vehicles breached the Kyiv region from Belarus to the north, Ukrainian officials said, after tanks reportedly rolled earlier into Ukraine from Crimea. Putin said Russia doesn’t plan to “occupy” its neighbor but that action was necessary after the U.S. and its allies crossed Russia’s “red line” by expanding the NATO alliance.

Western powers condemned the military incursion and vowed to step up penalties on Russia — President Joe Biden said the U.S. and its allies will impose “severe sanctions.” European leaders are planning sanctions that will target Russian banks. The government in Kyiv called it a “full-scale invasion” as it declared martial law and called for international support including harsher penalties on Russia.

“The invasion is a worse scenario than some investors anticipated. That’s why we are seeing the negative reaction,” said Keith Lerner, chief market strategist at Truist Advisory Services. “It caught some investors off-guard.”

Crude and European natural gas surged on possible risks to Russian energy exports, with Brent futures trading as high as $105 a barrel and benchmark West Texas Intermediate crossing $100.

The flight to safety saw the U.S. 10-year Treasury yield tumble 10 basis points to under 1.9%. Gold hit the highest since September 2020. And the CBOE Volitility Index, or so-called fear gauge, climbed higher.

The dollar and yen jumped, while the euro and commodity-linked currencies retreated. The ruble reached a record low versus the greenback and the Bank of Russia said it will conduct foreign-exchange interventions.

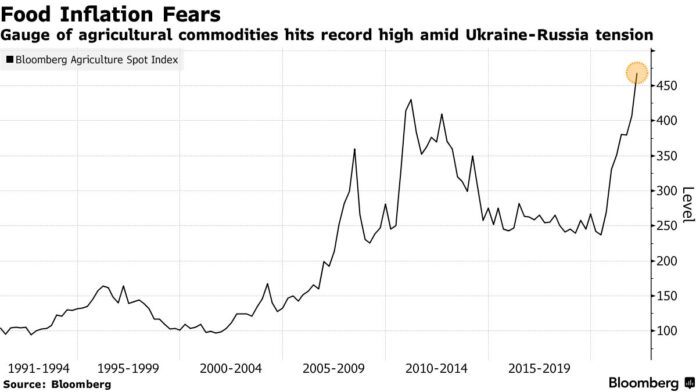

The cost of raw materials and food ballooned on worries that flows will be disrupted by the unfolding crisis. Ukraine is a major grain exporter and sanctions could isolate Russia, a commodity powerhouse. Natural gas in Europe rose as much as 42% while metals also spiked, piling on inflationary pressures.

“Oil and particularly gas prices will now remain sustainably high,” wrote a team of Jefferies strategists including Sean Darby. “Inflation pressures will mount further, forcing central banks into an ugly tightening cycle.”

That backdrop heralds fresh challenges for a global recovery that was already struggling with elevated price pressures and tightening monetary policy. Money market indicators for inflation expectations are rearing up again. Two-year breakeven rates on U.S. Treasury inflation-protected securities — or the difference between those yields and the ones on typical Treasuries — climbed to the highest since Bloomberg started compiling the data in 2004.

“This is a triple-hit to the global economy, with a toxic combination of higher inflation, lower economic growth, and greater uncertainty,” Ben Laidler, global markets strategist at eToro, said. “The only silver lining is growth is strong, a buffer to any slowdown, and policymakers and investors already prepared for high inflation.”

Investors remain worried that Fed tightening could choke the expansion in the world’s largest economy. Six quarter-point hikes are still expected by the Federal Reserve, five by the Bank of England and one by the European Central Bank by year-end. That’s in line with what was priced in before the attack on Ukraine.

In cryptocurrencies, Bitcoin slid to about $35,600 amid risk aversion. The second-largest token Ether also suffered heavy losses as the most speculative areas of markets were worst-hit.

The escalation by Russia “will spur further risk-off moves into safe-haven assets, considering that the situation will remain volatile with retaliation measures coming from Western powers,” said Jun Rong Yeap, a strategist at IG Asia Pte.

Here are some events to watch this week:

- EIA crude oil inventory report Thursday

- Fed officials Loretta Mester and Raphael Bostic speak Thursday

- U.S. consumer income, U.S. durable goods, PCE deflator, University of Michigan consumer sentiment Friday

Some of the main moves in markets:

Stocks

- The S&P 500 fell 1.5% as of 9:51 a.m. New York time

- The Nasdaq 100 fell 1.2%

- The Dow Jones Industrial Average fell 2%

- The Stoxx Europe 600 fell 3.2%

- The MSCI World index fell 2.6%

Currencies

- The Bloomberg Dollar Spot Index rose 1.1%

- The euro fell 1.4% to $1.1150

- The British pound fell 1.4% to $1.3348

- The Japanese yen was little changed at 115.10 per dollar

Bonds

- The yield on 10-year Treasuries declined nine basis points to 1.90%

- Germany’s 10-year yield declined seven basis points to 0.16%

- Britain’s 10-year yield declined seven basis points to 1.41%

Commodities

- West Texas Intermediate crude rose 5.6% to $97.27 a barrel

- Gold futures rose 1.4% to $1,937.40 an ounce