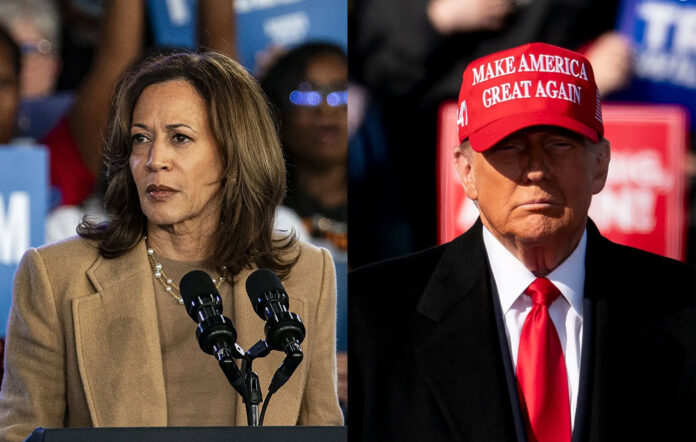

The dollar dropped and US Treasuries rallied as investors walked back bets on Donald Trump winning the presidential election after weekend polls indicated Kamala Harris was gaining ground.

An index of the greenback dropped the most in six weeks. Ten-year Treasury yields fell 10 basis points to 4.28%. The Mexican peso — which tumbled in the aftermath of Trump’s 2016 victory — was among the top performing major currencies tracked by Bloomberg.

Harris received some encouraging signals from an ABC News and Ipsos poll giving her a 49%-46% edge nationally against Trump in the race for the White House. Other surveys showed the two candidates poised for a photo finish, with voters narrowly split both nationally and across the pivotal swing states.

“Somehow markets persuaded themselves that Trump was well ahead and had been priced as if it was quite a clear victory for him, which seems crazy,” Erik Nielsen, chief economics adviser at UniCredit SpA, told Bloomberg TV. “What you’re seeing now is a realization that we got ahead of ourselves.”

Futures contracts for the S&P 500 and Nasdaq 100 edged higher. Nvidia Corp. rose 1.9% in early trading on news that it will replace Intel Corp. in the Dow Jones Industrial Average. Intel dropped 1.3%.

Monday’s moves are undoing some of the gains in the dollar and Treasury yields after investors had ramped up wagers on a second term for Trump. The argument goes that his support for looser fiscal policy and steep tariffs will deepen the federal deficit and fuel inflation, pushing up interest rates to the detriment of Treasuries but the benefit of the dollar.

Among a flurry of polls, a survey by the Des Moines Register pointed to a lead for Harris in Iowa — a state that Trump has won in both of his previous contests. While the survey was likely an outlier, it served to underscore the ever-shifting dynamics of the race.

“The Trump trade has moved so fast,” said Citigroup Inc. strategist Beata Manthey. “Investors are in a sit-and-wait mode so they’ll take action once we have the results.”

In addition to the US election, trading across financial markets this week will also be shaped by central bank decisions for the US, UK and Australia, among others.

The Federal Reserve is expected to cut rates by 25 basis points Thursday after policymakers had communicated a desire to proceed with a more gradual pace of cuts after September’s half-point reduction.

The Bank of England is expected to lower its benchmark rate by a quarter point to 4.75%.

Oil

West Texas Intermediate, the US crude benchmark, rose almost 3% on Monday as OPEC+ agreed to push back its December production increase by one month and Iran escalated its rhetoric against Israel.

In China, the top legislative body reviewed a proposal to transfer some off-balance-sheet debt of local governments to their official accounts, aiming to ease their financial burden in a move foreshadowed by officials.

Corporate Highlights:

- Commerzbank AG Chief Executive Officer Bettina Orlopp is seeking to unlock more capital to pay out or invest, as she makes the case for an independent bank in the face of a potential takeover by rival UniCredit SpA.

- BCE Inc., Canada’s largest telecommunications company, agreed to buy an internet provider in the Pacific Northwest.

- New data from Viking Therapeutics Inc. on an obesity pill to eventually compete with blockbuster shots from Eli Lilly & Co. and Novo Nordisk A/S sent shares of the small biotech company soaring.

- Anglo American Plc has agreed to sell a A$1.6 billion ($1.05 billion) stake in one of its Australian coal mines, boosting the company’s efforts to execute its turnaround strategy.

Key events this week:

- US factory orders, Monday

- Australia rate decision, Tuesday

- China Caixin Services PMI, Tuesday

- Indonesia GDP, Tuesday

- Philippines CPI, Tuesday

- South Korea CPI, Tuesday

- US trade, ISM Services index, Tuesday

- US Presidential Election, Tuesday

- Brazil rate decision, Wednesday

- New Zealand unemployment, Wednesday

- Poland rate decision, Wednesday

- Taiwan CPI, Wednesday

- Vietnam CPI, trade, industrial production, Wednesday

- ECB President Christine Lagarde speaks, Wednesday

- China trade, forex reserves, Thursday

- Eurozone retail sales, Thursday

- Mexico CPI, Thursday

- Norway rate decision, Thursday

- Peru rate decision, Thursday

- Sweden rate decision, CPI, Thursday

- UK BOE rate decision, Thursday

- US Fed rate decision, initial jobless claims, productivity, Thursday

- Brazil inflation, Friday

- Canada employment, Friday

- Chile CPI, Friday

- Taiwan trade, Friday

- US University of Michigan consumer sentiment, Friday

- Fed Governor Michelle Bowman speaks, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures rose 0.2% as of 8:18 a.m. New York time

- Nasdaq 100 futures rose 0.1%

- Futures on the Dow Jones Industrial Average were little changed

- The Stoxx Europe 600 was little changed

- The MSCI World Index rose 0.2%

Currencies

- The Bloomberg Dollar Spot Index fell 0.6%

- The euro rose 0.7% to $1.0908

- The British pound rose 0.4% to $1.2980

- The Japanese yen rose 0.8% to 151.81 per dollar

Cryptocurrencies

- Bitcoin was little changed at $69,130.12

- Ether rose 0.4% to $2,478.12

Bonds

- The yield on 10-year Treasuries declined 10 basis points to 4.28%

- Germany’s 10-year yield was little changed at 2.40%

- Britain’s 10-year yield declined one basis point to 4.43%

Commodities

- West Texas Intermediate crude rose 3% to $71.54 a barrel

- Spot gold rose 0.2% to $2,742.82 an ounce