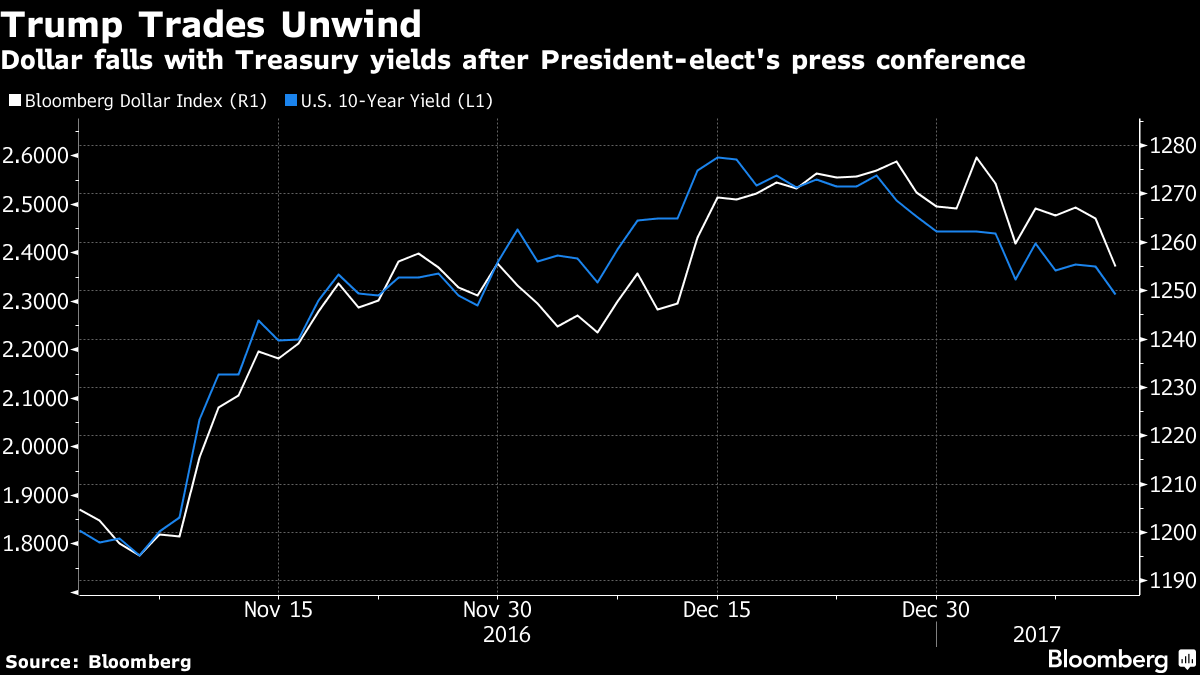

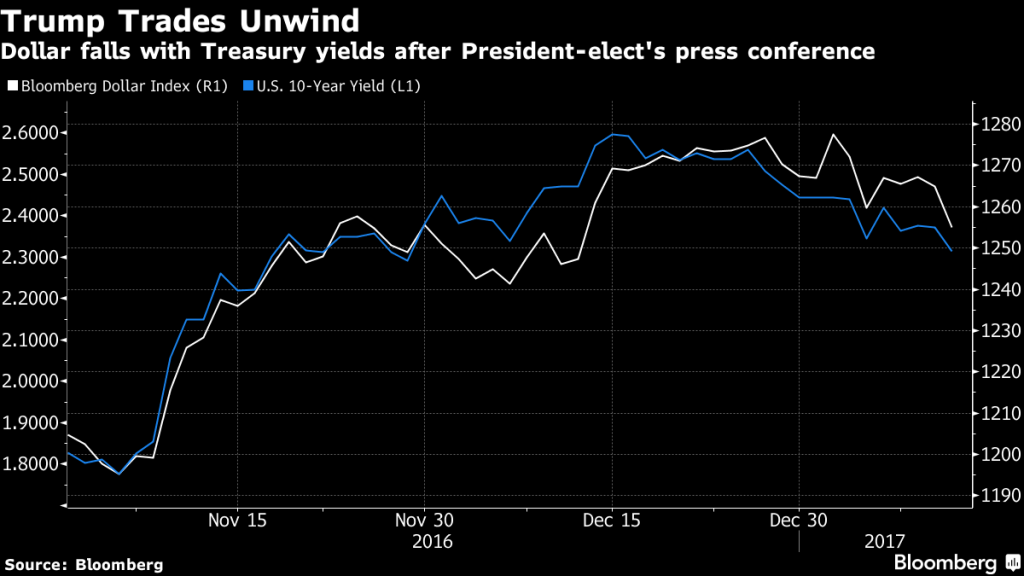

Dollar Slumps, Bonds Rally as Trump Bets Unwind. The dollar slid and Treasuries gained with commodities as Donald Trump’s press conference sent a wake-up call to the market about exalted expectations for fiscal stimulus in the U.S. Gold advanced.

The U.S. currency slumped against most major peers and the 10-year Treasury yield touched the lowest since November as Trump’s first press conference since his election victory gave scant detail on policy. European stocks headed for their lowest close since the end of 2016 and drugmakers across the globe sold off. Turkey’s currency climbed for the first time in six days as the nation’s central bank tightened lira liquidity. Gold advanced to a seven-week high and industrial metals rallied.

U.S. President-elect Trump’s press conference left investors with few specifics on the timing and scope of planned policies from infrastructure spending to trade pacts. Since his victory, the dollar and global equities have rallied, while bonds sold off, on bets inflation would pick up with growth. Health-care stocks were pressured Thursday as Trump said he’d force the pharmaceutical industry to bid for government business in the world’s largest drug market.

“Markets are disappointed by a lack of detail around the much touted stimulus plans,” said Michael McCarthy, Sydney-based chief market strategist at CMC Markets Plc. “There is a growing fear that recent positive moves are based on bombast, and could unravel very quickly.”

Read more from our Markets Live blog here.

Currencies

- The Bloomberg Dollar Spot Index, a gauge of the greenback against 10 major peers, fell 0.8 percent at 10:01 a.m. London time. It’s flat since the Fed’s rate decision on Dec. 14.

- The euro strengthened 0.5 percent to $1.0639.

- Turkey’s lira jumped 0.7 percent to 3.8362 versus the dollar. The central bank is implementing measures to force banks to borrow at a higher rate, according to a person with direct knowledge of the matter.

Stocks

- The Stoxx Europe 600 Index lost 0.5 percent and the FTSE 100 fell 0.2 percent, halting a record streak of gains.

- Health-care shares headed for their biggest drop since November, deepening losses that began late yesterday

- Futures on the S&P 500 Index fell 0.3 percent. The underlying gauge increased 0.3 percent on Wednesday, staging an afternoon rally and recouping losses of as much as 0.4 percent.

Bonds

- The benchmark 10-year Treasury yield fell five basis points to 2.32 percent, touching the lowest level since Nov. 30.

- German 10-year yields dropped three basis points to 0.29 percent, while those in the U.K. slid five basis points to 1.29 percent.

Commodities

- Gold rose above $1,200 an ounce for the first time since November as the dollar sagged.

- Copper added 2.2 percent to $5,842 a metric ton, the highest in a month after Indonesia confirmed a halt to concentrate exports. Zinc rose 2.1 percent and nickel gained 1.5 percent.

- West Texas Intermediate crude climbed 0.4 percent to $52.48 a barrel, extending its biggest rally in almost six weeks after government data published Wednesday showed U.S. refiners processed a record amount of crude.

- U.S. natural gas rose 3 percent to $3.32 per million British thermal units as a Bloomberg survey showed inventories probably fell by 141 billion cubic feet last week. U.K. natural gas rose 1.3 percent to 56.70 pence a therm, a fourth day of gains amid forecasts for cold weather.

Source – Bloomberg

Thanks for sharing with us Vlad

thanks for posting this info

Looks like a consolidated statistics…good job