There were several important economic releases lined up in the Euro zone yesterday, including the French consumer price index, Italian consumer price index, Spanish consumer price index, Euro zone industrial production data, Euro zone ZEW economic sentiment and German ZEW economic sentiment. The most important one out of these was the German ZEW economic sentiment. The outcome was very discouraging, as the sentiment registered a negative reading for October.

The Euro was seen trading lower after the release, as the EURUSD buyers were not able to digest the horrible economic data. However, the pair did survive any major downside towards the 1.2600 level, but it does not mean that it can head again towards the same.

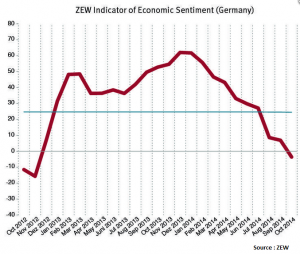

German ZEW economic sentiment

As mentioned, the most important release was the German ZEW economic sentiment. The forecast was slated for a decline of 5.9 points from 6.9 to 1.0. However, the outcome was a lot lower than expectation, as ZEW Indicator of Economic Sentiment for Germany dropped by 10.5 points in October 2014. It is currently at -3.6. This is the tenth consecutive decrease in the sentiment, which marks the weakness in the Euro zone activity. This is the first time since November of 2012 that the German ZEW economic sentiment is in the negative zone.

Professor Clemens Fuest, President ZEW mentioned in the report that “ZEW’s financial market experts expect the economic situation in Germany to decline further over the medium term. Geopolitical tensions and the weak economic development in some parts of the Eurozone, which is falling short of previous expectations, are a source of persistent uncertainty.” His statement speaks volume and points that the situation might worsen in the short to medium term.

Euro Zone ZEW economic sentiment

The Euro zone ZEW economic sentiment was also released at the same time. The forecast was slated for a decline of 7.1 points from 14.2 to 7.1. However, the outcome was a lot lower than expectation, as ZEW Indicator of Economic Sentiment for Euro zone dropped by 10.1 points in October 2014. It is currently at 4.1. Moreover, the indicator for the current economic situation in the euro area has decreased by 13.0 points to a value of minus 56.8 points, according to the report.

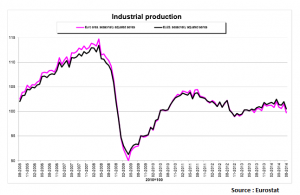

Euro Area Industrial Production

The Euro are industrial production data was the other important release yesterday, which was published by the Eurostat. The forecast was slated for a decline of 1.6% in August 2014 compared with July 2014. However, the outcome was disappointing, as the Euro area industrial production declined by 1.8% in August 2014. If we consider the yearly change, then the Euro area industrial production declined by 1.9% in August 2014, compared with August 2013.

Technically, the EURUSD pair once again failed to close above the 1.2700 resistance area. It is broadly stuck in a range of 1.2700 and 1.2600. We need a daily close on either side. If the pair manages to close below the 1.2600 level, then it would call for a move towards the 1.2500 level. On the other hand, a close above 1.2600 level might take the pair towards the 1.2800-50 zone.

So, keep an eye on all the important levels friends and trade accordingly.

Get my Daily Market forecast with trade opportunities HERE: Vladimir’s Markets Forecast