European stocks paused their advance after officials from the Federal Reserve and European Central Bank pushed back against bets of aggressive interest rate cuts next year.

The Stoxx Europe 600 index slipped 0.1%, while futures on the S&P 500 trimmed gains to 0.2%. Shares of Vodafone Group Plc jumped almost 7% after Billionaire Xavier Niel’s Iliad proposed combining its Italian business with Vodafone’s local operations.

The dollar was broadly steady while yields on two-year Treasuries dropped three basis points, paring Friday’s jump when New York Fed President John Williams led a chorus of officials in saying it’s too early to begin thinking about lowering borrowing costs.

US shares had their biggest weekly gain in a month after traders interpreted Fed signals last week as a green light to ratchet up bets on rate cuts next year. Now, a raft of central bankers are making the case that market expectation are overdone, with European Central Bank Governing Council member Bostjan Vasle joining the chorus on Monday.

“Can risk assets keep surfing that wave? Not if the Fed starts tempering expectations of quick cuts, and/or the US economy suddenly comes to a halt,” said Vincent Chaigneau, head of research at Generali Investments. “Last Christmas, everyone and their grandma feared a recession. A year later, they all worship Goldilocks. Beware the pitfalls of the consensus.”

Attention shifts to Japan with week with the nation’s central bank beginning a two-day policy meeting Monday. While speculation has grown the Bank of Japan will soon end the world’s last negative-rate regime, economists see April as the most likely timing for a change, with around 15% expecting Ueda to pull the plug on negative rates in January, according to a Bloomberg survey of more than 50 economists.

“The BOJ has little need to rush into making policy changes,” Societe General economists led by Wei Yao wrote in a note. “But markets will be watching for any sign the board is willing to end negative rates or yield curve control.”

In commodities, gold edged higher, while crude oil erased earlier gains. Bitcoin lost 2.4% to $40,891.

Key events this week:

- ECB holds biennial conference on fiscal policy and EMU governance, Monday

- Pro-democracy media tycoon Jimmy Lai heads to court in Hong Kong, Monday

- Nasdaq 100 index annual reconstitution, Monday

- RBA Dec. policy meeting minutes, Tuesday

- Bank of Japan decision, Tuesday

- Canada inflation, Tuesday

- Eurozone inflation, Tuesday

- Atlanta Fed President Raphael Bostic speaks, Tuesday

- New Zealand issues half-year economic and fiscal update, Wednesday

- China loan prime rates, Wednesday

- UK inflation, Wednesday

- Bank Indonesia rate decision, Thursday

- US GDP, Thursday

- Nike earnings, Thursday

- Japan inflation, Friday

- UK GDP, Friday

Some of the main moves in markets:

Stocks

- The Stoxx Europe 600 was little changed as of 10:17 a.m. London time

- S&P 500 futures rose 0.2%

- Nasdaq 100 futures rose 0.1%

- Futures on the Dow Jones Industrial Average rose 0.2%

- The MSCI Asia Pacific Index fell 0.7%

- The MSCI Emerging Markets Index fell 0.4%

Currencies

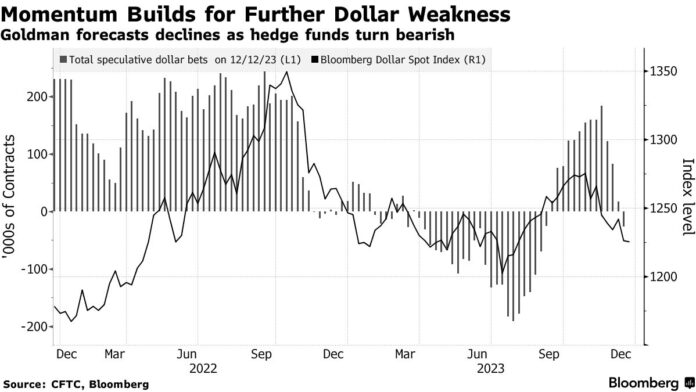

- The Bloomberg Dollar Spot Index was little changed

- The euro rose 0.2% to $1.0916

- The Japanese yen fell 0.3% to 142.52 per dollar

- The offshore yuan was little changed at 7.1389 per dollar

- The British pound was little changed at $1.2675

Cryptocurrencies

- Bitcoin fell 2.3% to $40,907.99

- Ether fell 3.9% to $2,149.81

Bonds

- The yield on 10-year Treasuries declined one basis point to 3.90%

- Germany’s 10-year yield was little changed at 2.02%

- Britain’s 10-year yield declined three basis points to 3.66%

Commodities

- Brent crude fell 0.7% to $76.04 a barrel

- Spot gold rose 0.2% to $2,023.17 an ounce