European stocks opened higher on Monday while U.S. futures also traded in the black in a tentative rebound from last week when the spread of the COVID-19 Omicron variant and expectations of tighter U.S. monetary policy rocked global markets.

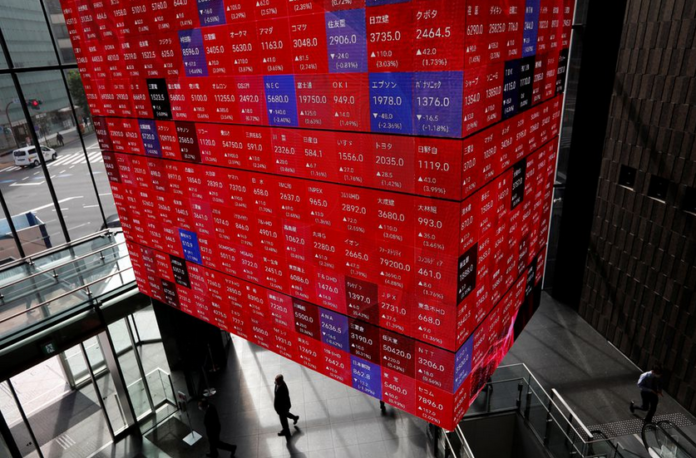

Optimism in Europe overcame a rough session in Asia where the MSCI index of Asia-Pacific shares outside Japan (.MIAPJ0000PUS) lost almost 1%.

China’s central bank said it would cut the amount of cash banks must hold as reserves in an attempt to revive economic growth while the region has seen a series of corporate setbacks after ride-hailing giant Didi (DIDI.N) decided to withdraw from its New York listing last week.

Shares in China’s Evergrande (3333.HK) plunged 20% after the developer said there was no guarantee it would have enough funds to meet debt repayments.

Another giant, Alibaba (9988.HK) dropped more than 5% after announcing it would reorganise its e-commerce businesses while U.S. regulatory opposition to the sale of Softbank-owned chip firm Arm pushed the Japanese conglomerate 8% lower.

The mood was more upbeat moving West with the pan-European STOXX 600 (.STOXX) up 0.7% and S&P 500 futures adding 0.5%.

Ten-year U.S. yields were also rising back above 1.38% after losing almost 13 basis points last week.

November’s mixed U.S. jobs report did little to shake market expectations of more aggressive tightening by the Federal Reserve.

As uncertainty runs high over the human and economic cost expected from the Omicron variant, investors are focusing on rising U.S. inflation which could prevent the Fed from coming to the rescue should market mayhem re-emerge.

“By severely limiting the FOMC’s ability to respond to downside risks posed by Omicron, inflation has effectively destroyed the Fed put,” Jefferies analysts said in note.

Inflation is “now the dominant driver of not only rates, but all risk assets”, they added as traders wait for Friday’s U.S. consumer price report.

The U.S. dollar index ticked up 0.05% in European morning trading after hitting brief 13-month peaks against the Australian and New Zealand dollars which both later rebounded.

The euro eased a touch to $1.1289 , still well above its recent trough at $1.1184.

Bitcoin was down 2.8% and was last at $48,060. It hit a low of $41,967 over the weekend as profit-taking and macro-economic concerns prompted nearly $1 billion worth of selling across cryptocurrencies.

Oil prices rose by more than $1 a barrel after top exporter Saudi Arabia raised prices for its crude sold to Asia and the United States, and as indirect U.S.-Iran talks on reviving a nuclear deal appeared to hit an impasse.

Brent climbed $1.74 to $71.61 a barrel, while U.S. crude added $1.85 to $68.11 per barrel.

Gold prices edged 0.15% lower, pressured by the resilient dollar.