- 1 Introduction – Who is Fibonacci?

- 2 The Fibonacci Sequence

- 3 How are the Fibonacci retracement and extension levels derived from the above sequence?

- 4 Important Fibonacci levels

- 5 What makes the Fibonacci Method of trading so popular?

- 6 Fibonacci Retracements vs Extensions

- 7 How to plot Fibonacci levels on the chart

- 8 Combining Fibonacci with other technical tools

Introduction – Who is Fibonacci?

Leonardo Bonacci – also known as Leonardo Fibonacci – was an Italian mathematician in the 12th century. He was considered the most talented Western mathematician of his time and one of the greatest of all time. Although Fibonacci himself did not come up with what is now known as the Fibonacci sequence, he certainly introduced the phenomenon to the West in his book Liber Abaci.

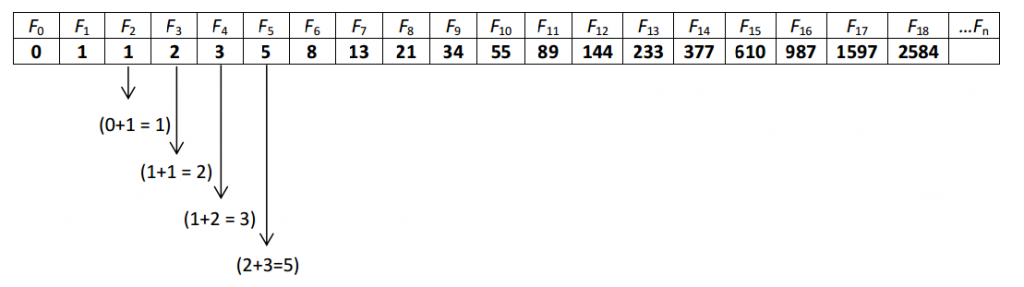

The Fibonacci Sequence

As can be seen, each number in the sequence is the sum of the prior two numbers. Thus, the Fibonacci sequence can be summarized using this formula: ?? = (??−? ) + (??−? )

How are the Fibonacci retracement and extension levels derived from the above sequence?

61.8% = divide current number with next (from 13 onward) e.g. 55/89 = 0.618 (approx.)

161.8% = divide next number with current e.g. 89/55 = 1.618. This is also called the “golden ratio”

38.2% = 0.6182 (or skip 1 sequence in division e.g. 55/144 = 0.382)

23.6% = skip 3 sequences in division e.g. 34/144 = 0.236 (approx.)

78.6% = √0.618

127.2% = √1.618

261.8% = 1.6182 or 1.618 0.618

0%, 50%, 100% & 200% are not Fibonacci numbers, but are nonetheless used by some traders as they are psychological levels

Important Fibonacci levels

As seen above there are many fibonacci numbers however traders use and rely on some levels more than the others. The most commonly used numbers are:

161.8%

100%

61.8%

50%

38.2%

23.6%

Here is an example where the EURGBP had an up move followed by a correction before it continued up. See how the fibonacci retracement levels are the places where the price stopped and fluctuated. This is because these levels act as support or resistance and many traders have their orders placed there: buy/sell, targets and stops.

What makes the Fibonacci Method of trading so popular?

First of all this is a self-fulfilling prophecy. It has nothing magical about this levels but when a huge part of the traders rely on them, they become important and relevant. Pure psychological correlation. You can say the same thing about trend lines for example. If many people draw a trend line the same way, and all these traders see the same thing, this trend line will become very very strong and reliable as all these traders are going to use it as a dynamic support or resistance.

Another reason is that Fibonacci method is one of the oldest methods out there. There are tons of books, video tutorials, seminar and webinars on the subject. It has been around for years and the vast popularity is increasing every single day. Same as the Elliot Waves theory.

Fibonacci Retracements vs Extensions

The Fibonacci retracement tool as the name suggests is used when the price is correcting itself during a trend. The correct way to place the fibonacci retracement is to find a top or bottom (swing) and let the price run. Once you see an opposite move, this is where the second point is set. Let’s have a look at an example:

Note 1 – in this case once we saw the first break of a previous low, and after a green candle we could’ve placed the fibo tool.

Note 2 – notice that the trend is very strong and in price managed to retrace only to 23.6% and then at the second attempt up it almost reached 38.%.

In summary the fibonacci retracement is used to forecast levels to which the price is very likely to correct itself during a trend. Usually used as Entry levels.

Fibonacci Extension on the other hand is used to predict or forecast what levels the price might reach in the direction of the trend. The projection is a perfect way to set your targets. It uses 3 reference points on the chart as opposed to the retracement tool. Example:

This is a perfect example of how the extension tool works. Initial move (breaking last low, meaning the price is going into a down trend). Price stops and turn up (most likely going for correction, at least as long as last high is holding). Next step is to see a top created during the correction. Once that top is there we can use it to project the future price movements and where the price is expected to reach. The three most important levels are 61.8% , 100% and the 161,8%.

In this example price went to 100% by the pip! Of course you can expect a small deviation above/below a given level. Even though 61.8 didn’t hold, the price still respected the level which coincided with a strong supportive zone (look left on the chart). This is how you get multiple confirmations from both fibonacci extension and horizontal S/R.

How to plot Fibonacci levels on the chart

Almost all trading platforms will have Fibonacci as part of their technical tools, so one does not have to worry about calculating the retracement and extension levels manually. All the trader has to do is identify a distinct high and a distinct low and plot the Fibonacci levels by dragging it from one extreme to the next.

It is important to select the candlesticks’ wicks, so as to obtain more accurate results. They are always drawn from the left to the right:

- for an upward trending market, it is drawn from the low to the high, and

- for a downward trending market, it is drawn from the high to the low

Once plotted, the trading platform would automatically display the Fibonacci retracements and extensions, and also their corresponding price levels. The Fibonacci tool is highly customisable, so one could add or remove certain levels.

Combining Fibonacci with other technical tools

Trading is a game of probabilities. As traders and analysts, our aim should be to find opportunities which have higher probabilities of success. It is important to remember that fibonacci levels are not always as accurate and reliable as we would want to – just like any other form of technical analysis. This is why combining it with other methods of technical or fundamental analysis would bring better results and accuracy.

Converging fibonacci retracement/extension levels

One way would be to use fibonacci levels on multiple time frames and multiple trends. When there are two levels that would end up at the pretty much same zone you can expect that this level would be a pretty strong support/resistance zone.

Same applies for the extensions. When projecting the targets you would many times end up with two different projection levels at the same zone. These levels are called magnet levels and are a great zones for protections and entries as price tends to reach them and bounce off of them.

Divergences

Divergences are also another very accurate way to spot potential entries. Let me show you an example.

In red you can see where I have plotted the fibonacci retracement tool (1 and 2). Next in blue numbers I have marked the Fibonacci extension tool (1,2,3) thus creating a sell zone where I expect the price to stop and continue lower. The levels that converge are 50% and 61,8% from the retracement along with 61.8% and 100% (red text and lines) for the extension.

This is where we got bearish divergence. Not very extreme but still it was divergence, you can check the chart yourself to make sure :). This is an example of a well structured and argument based entry. This is how all your entries should look like when you go back and review them. There must be a reason or better of a few reasons why you have entered a certain trade.

Other methods to get extra confirmations are trend lines of course, horizontal support and resistance, false breaks, candlesticks patterns, formations such as flags or triangles/wedges.

Really anything that you have in your arsenal would be helpful.

Back to the example above. The entry would have happened right after the price entered the sell zone and the divergence was there for a fact. And when is the divergence a fact? When the macd history bar ticks down (down as this is bearish divergence). There is a strong red bar closing below the 3 previous candles which is also a good sign that the bearish momentum is there.

Place your stop loss above the high created and aim last swing low (0% fibo retracement – in other words #2 red or #1 blue).

It is important to always always always check your Risk:reward ratio. This is the correlation between the potential loss and potential reward you can get from this trade. You want a risk:reward ratio of minimum 1:2 meaning that you will risk $1 with the possibility to win $2.

That would be all for part one of this article. Fibonacci methods of finding entries and exits are amazing and I advise you to look into it. Many traders make money on daily basis, basing their trades entirely on the methods explained above. Remember that the strategy you use is not as important as mastering it.

Any strategy or method could produce extremely good returns for 1 trader while his buddy is losing money. If you like this post share with your friends – thank you in advance!

I would also love to hear your comments below. Do you use fibonacci tools? Do you find them accurate? What time frames do you mostly used them on? How about multi time frame analysis?

Yours,

Vladimir

Sources: en.wikipedia.org / forex.com

Thanks Vladimir, this a lot of gift to me, i appreciate the lesson and i lent more from your text i have been using fibo retracement and extension targeting 50% – 61.8% retracement but the extension i use for my take profit but now i learn to use extension for confirming the fibo retracement zone, i also use bkmgc2 indicator for more confirmation. i wish to learn more directly from you i will love to communicate directly with you.

thank you

Hi Abraham and than you for your comment!

Fibo 50-61,8% are indeed one of the most commonly used levels. You can talk directly to me by using the blog chat that you will find in the home page of the blog! Looking forward to hear from you and share ideas.

Vlad