Venturing into the dynamic world of trading demands more than a surface-level understanding of charts and indicators. It’s a nuanced journey that intertwines analytical prowess, emotional intelligence, and an unwavering commitment to continuous improvement. With over 15 years of trading experience, I would like to unfold a roadmap for aspiring traders, offering insights that go beyond mere technicalities. This exploration takes us through the ABCs of trading – from meticulous analysis to strategic execution and effective management. We’ll navigate the terrain of perseverance, understanding the essence of dedication and effort required to weather the storms of market volatility. Embracing emotions becomes a cornerstone of effective trading, with debunking the myth of trading without emotions and advocating for a realistic approach to trading psychology.

As we journey through this guide, we’ll also confront the twin adversaries of traders – pain and boredom. My practical advice on dealing with these emotions and using them as stepping stones for growth forms a crucial part of the narrative. Additionally, we’ll explore the importance of emotional intelligence in trading and how it can set successful traders apart. The guide doesn’t stop at the psychological aspects; it extends to the strategic realm, emphasizing the significance of evolution. The old ways will not open new doors, encouraging traders to break free from past patterns and embrace continuous improvement. Case studies and practical applications enrich the narrative, providing tangible examples of how these principles manifest in real-world trading scenarios.

Embark on this journey to master the art of trading with a comprehensive understanding of analysis, perseverance, emotional intelligence, and adaptability. These insights serve as a beacon for those navigating the complexities of the financial markets, offering a holistic guide to success. Whether you’re a novice trader or someone looking to refine your strategy, this guide equips you with the tools needed to thrive in the ever-evolving landscape of trading.

This article is available to you, thanks to the support of our recommended broker Eight Cap

- 1 Explore My Free Mentorship Program

- 2 Analyze, Execute, and Manage: The ABCs of Trading

- 3 What Comes Easy Won’t Last: The Essence of Perseverance

- 4 Pain and Boredom: The Twin Adversaries of Traders

- 5 Embracing Emotions: A Realistic Approach to Trading Psychology

- 6 Old Ways Will Not Open New Doors: The Need for Evolution

- 7 Conclusion

Explore My Free Mentorship Program

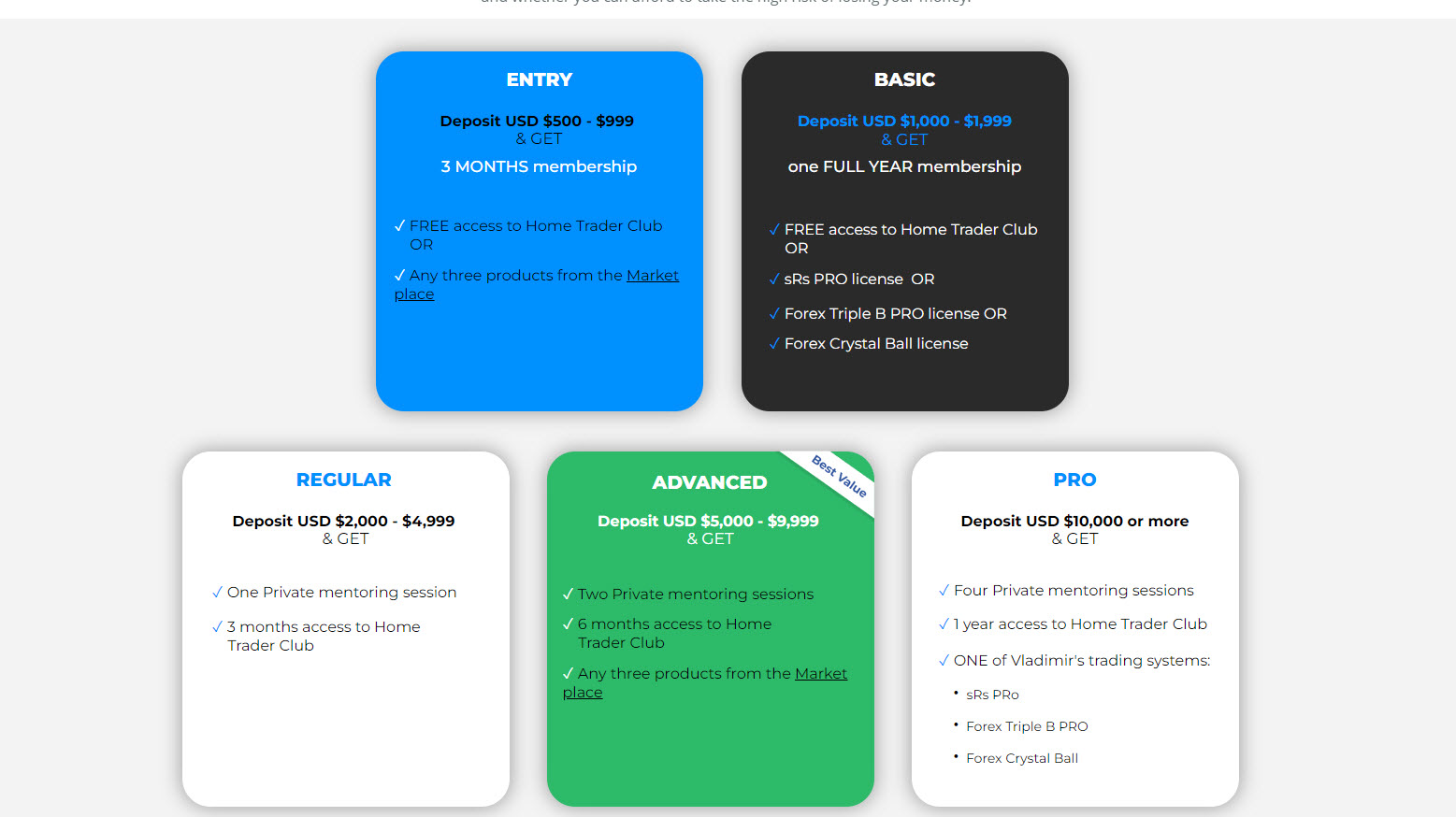

As an Internationally Certified Financial Technician (CFTe, IFTA) and former private capital hedge fund trader, I have successfully mentored numerous students who are now thriving in the trading world. Students who learned with me, are now full-time traders, work in the trading industry, run their own capital firms or are fully funded traders by private companies, develop automated trading solutions and manage others’ capitals. I am a very proud mentor and I am proud of the success stories I’ve helped create, and for a limited time, I’m offering my mentorship program for free through a partnership with Eight Cap broker. Join Eight Cap, become an active trader, and choose the offer that suits you best –

For more details, visit: Home Trader Club Mentorship Program

I’m excited to work with you and help you reach your desired level of success!

Analyze, Execute, and Manage: The ABCs of Trading

The Pitfall of Impulsive Trading

The first piece of advice revolves around a structured approach to trading. Early in my trading career, I fell into the trap of impulsive trading – reacting to high or low breakouts without proper analysis. My wisdom now advocates for a systematic process of analyzing the market, executing well-thought-out trades, and then diligently managing those trades.

The Three Pillars: Analyze, Execute, and Manage

To make informed decisions, we need to follow a three-step process: analyze the market thoroughly, execute trades based on a well-defined plan, and then manage those trades effectively. Trading is not about blindly following others or succumbing to market rumors but adhering to a set of rules derived from meticulous analysis.

Going Beyond Technical Analysis

On the analysis aspect, traders should look beyond technical analysis. Fundamental analysis, market sentiment, and macroeconomic factors should be integral components of their analytical toolkit. Understanding the broader market context contributes to making well-informed decisions.

Crafting a Comprehensive Trading Plan

The necessity of crafting a comprehensive trading plan is very important. This plan should encompass risk management strategies, clear entry and exit points, and a realistic assessment of profit targets. By having a well-defined plan in place, traders can navigate the market with greater confidence.

Case Study: Analyzing Market Trends

To illustrate the importance of thorough analysis, let’s take a closer look at a hypothetical scenario. Suppose a trader identifies a potential trend reversal based on technical indicators. Before executing a trade, it becomes crucial to delve deeper into the market dynamics. Factors such as upcoming economic events, geopolitical developments, and overall market sentiment could influence the success of the trade. This in-depth analysis forms the foundation for a well-executed and managed trade.

What Comes Easy Won’t Last: The Essence of Perseverance

Acknowledging the Journey’s Hardships

I’d like to highlight a profound saying that deeply connects with the path of trading: “What comes easily won’t endure, and what endures won’t come easily.” This underscores the essential understanding aspiring traders must grasp regarding the substantial dedication and effort needed for success in the world of trading.

Trading’s Parallel with Other Professions

Similar to that of the other professions, you need to understand the considerable effort demanded in this field. Recognizing and embracing the difficulties becomes crucial for traders, fostering resilience and unwavering commitment to their objectives.

Learning from Setbacks

Expanding on the theme of perseverance, traders are encouraged to view setbacks not as failures but as learning opportunities. Each loss, each challenge, contributes to the trader’s growth and understanding of the market.

Consider a scenario where a trader faces a series of losses due to unexpected market volatility. Instead of viewing this as a failure, the trader can leverage it as a learning experience. By analyzing the specific market conditions leading to the losses, the trader can adjust their strategy and risk management approach. This adaptive mindset, born out of perseverance, is a testament to the trader’s commitment to continuous improvement.

Pain and Boredom: The Twin Adversaries of Traders

The Two Enemies of Trader Happiness

Pain and boredom are the two enemies of trader happiness; Forcing trades during periods of boredom and succumbing to emotional reactions after losses. These emotions can adversely affect decision-making.

Constructive Responses to Pain and Boredom

I would like to suggest constructive ways to deal with pain and boredom, such as engaging in educational activities, analyzing trading journals, or taking a break from the market. Recognizing these challenges and addressing them proactively is crucial for maintaining a healthy and successful trading mindset.

The Importance of Patience

Delving deeper into the concept of boredom, traders are advised to cultivate patience. Waiting for the right setups, exercising restraint during quiet market periods, and avoiding impulsive decisions are essential aspects of a trader’s patience toolkit. Successful trading requires a balance between active engagement and strategic waiting.

Case Study: Managing Emotional Responses

Consider a scenario where a trader faces a string of losses, leading to emotional distress. Instead of succumbing to the urge to revenge-trade, the trader can implement a structured approach. This involves taking a step back, reassessing the market conditions, and refraining from impulsive decisions. By managing emotions effectively, the trader maintains a clear-headed approach to trading.

Embracing Emotions: A Realistic Approach to Trading Psychology

Trading Without Emotions: A Myth

The notion of trading devoid of emotions is essentially a fallacy, given that traders are inherently emotional beings. It underscores the significance of comprehending and adeptly managing these emotions as a pivotal factor in achieving effective and successful trading outcomes. Recognizing and navigating the emotional landscape becomes an integral part of the trader’s skill set, allowing for more informed and rational decision-making amid the dynamic and often unpredictable nature of financial markets.

Learning from Emotional Responses

Instead of attempting to eliminate emotions, traders should learn from their emotional responses. By understanding how emotions influence decision-making, traders can develop strategies to navigate through tough moments and avoid impulsive actions.

Emotional Intelligence in Trading

Building on the importance of emotions, aspiring traders are urged to develop emotional intelligence. This involves not only understanding one’s own emotions but also being attuned to market sentiment and the emotions of other market participants. Emotional intelligence enhances decision-making and fosters a deeper connection with the market.

Case Study: Leveraging Emotional Intelligence

Consider a scenario where market sentiment suddenly shifts due to unexpected news. Traders with high emotional intelligence can quickly assess the situation, adapt their strategies, and make informed decisions. This ability to read and respond to market emotions sets successful traders apart, showcasing the practical application of emotional intelligence.

Old Ways Will Not Open New Doors: The Need for Evolution

Breaking Free from Past Patterns

Highlighting the significance of embracing change, relying on old methods will not lead to new opportunities. Every individual trader needs to emphasize the importance of finding a unique approach that resonates with an individual’s trading style.

Continuous Improvement and Adaptation

Traders should move beyond past mistakes and failed strategies, for continuous improvement and adaptation. Rather than sticking to what didn’t work, traders should explore new avenues, strategies, and techniques that align with their evolving understanding of the market.

Integrating Technological Advancements

In the ever-evolving landscape of financial markets, embracing technological advancements is paramount. Traders are encouraged to leverage automation, artificial intelligence, and advanced analytics to gain a competitive edge. Staying abreast of technological developments ensures traders remain relevant and efficient in their strategies.

Case Study: Adapting to Algorithmic Trading

Consider a scenario where a trader, accustomed to traditional manual trading, recognizes the increasing prevalence of algorithmic trading. Instead of resisting this change, the trader embraces it by learning algorithmic strategies or incorporating algorithmic tools into their approach. This adaptability not only enhances the trader’s efficiency but also opens new doors to lucrative opportunities.

You can watch the video of this webinar here

Conclusion

Embarking on a trading journey requires more than just technical knowledge; it demands a holistic understanding of the psychological, emotional, and strategic aspects of trading. I hope my insights serve as a valuable guide for aspiring traders, offering a roadmap to navigate the complexities of the financial markets. By analyzing, persevering, managing emotions, and embracing change, traders can increase their chances of long-term success in the dynamic world of trading. As the trading landscape continues to evolve, this comprehensive guide equips aspiring traders with the insights needed to thrive in an ever-changing market environment. With each case study and practical application, traders are encouraged to approach their journey with resilience, adaptability, and a commitment to continuous improvement.

This extended exploration not only reinforces my key takeaways but provides a deeper understanding of their practical implications. Aspiring traders can use this comprehensive guide as a foundation for their own trading philosophy, integrating the wisdom gained from years of experience. The road to mastering the trading landscape may be challenging, but with the right mindset and knowledge, aspiring traders can navigate the complexities and unlock the doors to sustained success.

To your success,

Vladimir Ribakov

Home Trader Club

Thank you for putting all this info together. Super helpful to have it handy and in just one place. Best!