Determining whether forex social trading is really worth it varies from trader to trader which is why this article aims to provide you enough information to accurately determine whether or not forex social trading is for you.

Given the natural deduction regarding how trader’s demands, styles, and needs are unique, each trader needs to determine for themselves whether forex social trading is ideal for their style of trading.

While it is well-known that many forex traders are leveraging the power of social media networks such as Facebook, Telegram, YouTube, and Twitter to conduct social trading, there is far more than what meets the eye with forex social trading.

What makes forex social trading such an alluring opportunity would be that it opens the foreign exchange markets to less-experienced traders.

Prospective traders who don’t wish to tackle the extensive learning curve can benefit significantly from the advantages that stem from social trading but there are also dangers that every trader should be warned about which we’ll cover in a bit.

What is Forex Social Trading?

The term forex social trading refers to forex trading conducted in a social trading environment.

Generally, we encounter forex social trading opportunities across social media titans like Facebook, YouTube, Twitter, and Telegram although you should know that for trading to be “social trading” that the social environment doesn’t have to stem through a social network.

This is perhaps most prevalent when traders use social trading features found with select trading brokers, although that may not always be the case.

Sometimes you can come across forex social trading offers that are site-based such as a forum or chat-enabled text box where traders can bounce trade recommendations, strategies, and methodologies back and forth.

More often than not, however, you’ll come across forex social trading opportunities amongst forex trading brokers and through social media platforms where various trading groups have been constructed to reflect a social trading atmosphere.

Types of Social Trading

Now there are two primary styles of social trading platforms and both reflect a variance in the trading mechanisms used which is what makes them easily distinguishable.

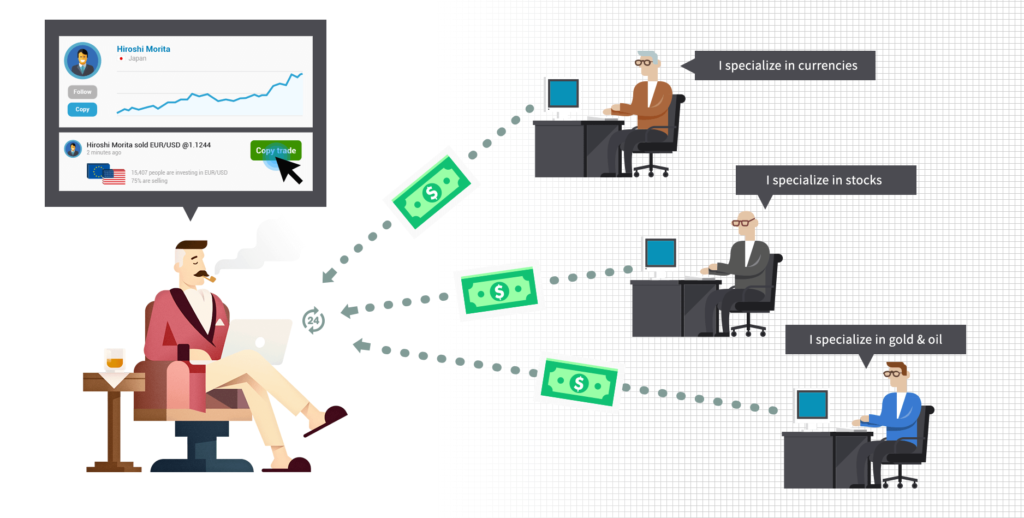

Copy Trading

The most popular form of forex social trading would likely be copy trading where traders are able to follow a trader and have that trader’s investment instantaneously executed to their trading account.

Sometimes forex traders are able to filter copy trading options based upon trading approaches or primary assets invested although more often than not traders tend to evaluate a trader’s cumulative ROI, the volume of trades, winning percentage, and risk degree before making a commitment.

For forex traders who don’t have the time or incentive to execute their own trades, social copy trading may be the best option for you and can worth be it if you don’t have a problem with trusting a trader that you’ve never met before.

** Before you copy an investor, make sure that you compare the absolute gain to the total number of trades – sometimes you may come across traders that have between 5,000% to 14,500% account gains but have only a handful of trades, this signifies that this trader is likely NOT incorporating a money management strategy and could be trading more off of peer speculation opposed to knowledge-based. **

Mirror Trading

Mirror trading is more ideal for traders who are looking to formulate trading methodologies and approaches based upon other trader’s strategies.

Typically, prospective mirror traders narrow down their social mirror trade providers through a specific trading strategy or a refined selection of invested assets.

Additionally, if a mirror trade follower proves to be following along, they are able to opt-in and execute the same trades from a multitude of investors while fine-tuning the strategy to fully suit their style of trading.

Social mirror trading is not as common as social copy trading and as a result, tends to be swept under-the-rug and forgotten about.

Regarding whether social mirror trading is “worth it” that would depend upon if the trader is a more technical or fundamental based trader.

Should a trader gravitate towards technical trading techniques then without a doubt social mirror trading can pay off large dividends whereas for traders who don’t prefer to tangle into the vast depths of the technical forex trading construct then you’ll likely not benefit from social mirror trading and should consider social copy trading.

4 Factors to Seek Out

Regulation

There are a wide number of legitimate appearing forex brokers that offer forex social trading options but nearly all of them fail to reflect regulation and licensing.

If you are considering social trading with a broker that is not regulated then not only are you putting yourself at far more risk but you are doing yourself a disservice but not choosing to conduct business with a broker that must adhere to strict governing guidelines to prevent fraudulent trading activities.

Brokers that are not regulated may conduct price manipulation, platform slippages, or have ‘price anomalies’ where your funds are all but lost.

No matter if the broker you are considering has rave reviews or not, always choose to invest with a regulated broker (additionally, failure to do so may be against governing law for your residing jurisdiction).

Supported Assets

One of the disadvantages regarding forex social trading would be how sometimes the currency pairs that you feel most comfortable or knowledgeable about aren’t available or supported through social trading.

Therefore, it is crucial that you navigate your prospective broker or contact their live support before committing your hard-earned money.

One way to edge your way around this hiccup would be to utilize a forex social copier that is not broker dependent but rather independently based like a social-based trading group or forum-based provider.

Minimum Deposit

While it is commonly seen as an advantage to possess a lower minimum deposit sum, sometimes it can work against a prospective trader due to the inability to thoroughly test social trade leaders’ strategies to determine which one is most suitable for you.

Additionally, for forex social trading services outside a broker, try to see or request a free trial period of no less than one to two weeks.

After the end of your trial you should know whether the service is ideal for you and if you’re lucky you may have been able to generate enough winnings to pay for the price of the social trading service too, so its a win-win across the board.

Fees, Spreads, and Commissions

Generally, forex brokers have their fees incorporated into the spreads of their trade options but sometimes you may come across a broker that has hidden charges such as an ‘overnight’ fee, withdrawal fee, or some unspecified fee relating to trade execution.

Another thing you’ll want to keep an eye out for in regards to social trading forex brokers would be their deposit bonuses where sometimes they will match your initial deposit up to 100%.

While traders accept this unknowingly as a welcome gift, there is always a catch with accepting broker deposit bonuses and generally, they materialize in the form of a minimum trade volume that must be met before a trader can conduct a withdrawal.

Typically, this trade volume stipulation is 40x the accepted bonus amount, meaning that if you accepted a $1,000 deposit bonus you would have to generate a total trade volume of at least $40,000 before you could successfully execute a withdrawal.

Now considering how more than 75% of retail FX traders tend to lose money, this ‘gamble’ generally pays off for the brokerage and works against a trader who wishes to withdrawal funds in an attempt to mitigate losses.

How to Choose a Trader to Follow

Novice forex social traders have an uncanny knack of choosing to copy traders that have the highest percentage gain or sum of followers without taken under due consideration the risk-reward ratio, the total sum of trades executed, trade frequency, and supported assets.

This is a detrimental error to perform, especially amongst forex traders who are looking to conduct social mirror trading.

Money Management Importance

Just because you may be following a trader who has a better success rate or cumulative return-on-investment than you does NOT then give you the green light to go gung-ho and throw money management out the window.

In fact, it should be the opposite!

You should be far more conservative than you would normally because you are accepting trade recommendations from a trader you’ve never met.

Some forex traders have reported going as high as 25% to 50% of their trading account balance per trade as opposed to the 2% to 5% rule used by trader with substantially more experience.

The Bottom Line

Forex social trading is worth it in my opinion but only if you can ensure that the service provider or brokerage that you are working with is credible, authentic, and possesses a considerable history of positive trader reviews.

Should you be considering signing up with an unregulated forex broker or an unproven forex social trade provider then you are ultimately setting yourself up on a trajectory that will likely result in failure.

Before investing your time researching into social trading ask yourself if it is really worth the hassle and what are the drawbacks that are accompanied by the offer at hand?

If you can answer both questions definitively then your path is rather straightforward.

Should you be unable to find a regulated or legitimate forex social trading platform please don’t hesitate to connect with us at support@vladimirribakov.com or drop us a comment below!

Thanks for your time and may your trading be abundantly prosperous!

Tim Lanoue

Guest Author