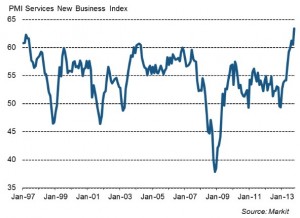

One of the most resilient currencies in the past week was the sterling. The economic data for the UK continue to outperform from the last couple of weeks. The UK services PMI released in the last week exceeded all the expectations as it climbed higher towards 62.5 to register a 16 year high as seen in the chart below. The UK construction PMI also registered a better than expected reading.

One of the questions many investors might be asking is whether the pound can continue to move higher? It would be very difficult to answer as the BOE is not willing to change its stance on their policies. The central bank may also not like to see the pound at higher levels.

There are few important risk events scheduled during the week for the UK.

1. Tuesday – UK Inflation data

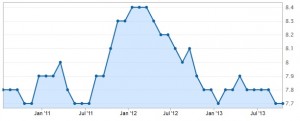

The UK CPI (MoM) has been climbing higher for the last couple of months as seen in the chart below. This time most economists are expecting a minor 0.1% decline from 0.4% to 0.3%. Any higher reading may trigger a move for the GBPUSD as the pressure on the BOE releases a bit.

2. Wednesday – UK employment report

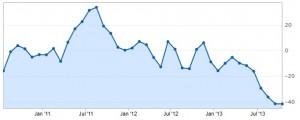

The UK unemployment rate has been steady for the last couple of months. There was a drop of 0.1% in August from 7.8% as can be seen in the chart. The market is expecting the rate to remain at around 7.7% level.

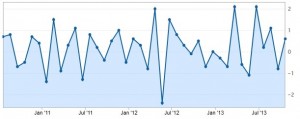

The change in the number of unemployed people in the UK is also heading south from the last several outcomes as seen in the chart.

3. Wednesday – BOE Inflation Report

The market is expecting an improvement in the outlook for the UK in the second quarterly inflation report from the Bank of England Governor Mark Carney. It is very difficult to measure by how much the forecasts may change. In August, Mark Carney said that the central bank would not raise the interest rate until the unemployment rate falls below 7%. Let us see whether they stick to the level. The UK inflation outlook would be another key aspect to watch out in the report.

4. Thursday – UK Retails Sales (MoM)

The previous two outcomes for the retail sales have been mixed as it fell by 0.8% and then climbed back to register a gain of 0.6% on 17th October 2013. This time the UK retail sales figure is again expected to decline from 0.6% to 0.1%.

Looking into the technical details, GBPUSD has been range bound from the last couple of weeks between 1.5900 and 1.6200/40. This week can be an interesting one as the pair may attempt to break this range. The next area of interest after a break to the downside will be 1.5750 and for the upside 1.6300/80. It is worth noting that the 100 day moving average is around 1.5750 region, which may well act as a strong support for the pair.

Get my Daily Market forecast with trade opportunities HERE: Vladimir’s Markets Forecast

Happy Trading Friends!