The market has been relatively quiet for the last two days, as there was no major market moving news. However, the volatility may pick up today, as there are a lot of fundamental data to be released for the UK and US. Thursday is a Thanksgiving Day, and on Friday, the US market will be closed early. This is the reason why Wednesday might act as a Friday for this week, in my opinion. Liquidity might reduce substantially going ahead in the week. So, let us look at all the fundamental events lined up during the day.

UK GDP (QoQ)

At GMT 09:30 AM, second estimate for the UK GDP (quarter-on-quarter) for the third quarter will be released. The market is expecting a strong rise in the growth with a reading of 0.8%. All the recent data for the UK again proved that the UK economy is improving. UK GDP is on the rise from the last two quarters as can be seen in the figure below. This will be the second release of the third quarterly GDP for 2013, and if the outcome is surprising, then one can expect a lot of volatility for the British pound, considering the recent solid economic data for the UK. The BOE Governor also said that he sees recovery signs for the UK. However, he insisted that the central bank is in no hurry to increase the rates. The higher exchange rates may have an impact upon the growth, and central bank cannot allow that to happen.

UK business investment (QoQ) data will also be released along with the GDP figures. The market is expecting a strong gain of 2.3% against the previous decline of -2.7%. Later at GMT 11:00 AM, the Confederation of British Industry (CBI) Distributive Trades Survey (DTS) number will be released, which is expected to rise from 2 to 8. If the data does not disappoint, then we can witness some gains in the GBPUSD.

US Core durable Goods Orders

One of the most important events for the US today will be the core durable goods orders. The US core durable goods orders are likely to grow by 0.5% in October, and durable goods orders (MoM) are expected to decline by -1.9% from the September’s 3.8% gain. There has been no improvement in the new orders for the last couple of months, and if the data disappoints again, then I expect some US dollar selling later in the day.

Chicago PMI and Michigan Consumer Sentiment

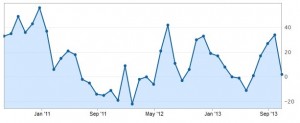

The Chicago Purchasing Managers’ Index (PMI) is on the rise for the last couple of months as can be seen in the chart below. It registered a 10 point rise in October to 65.9, beating the expectations of 55.00. This time market is expecting a drop of around 5 points from 65.9 to 65.0. Any better than expected reading may boost the US dollar in the short term.

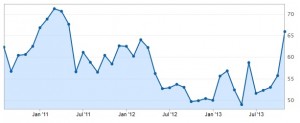

On the contrary, the University of Michigan Consumer Sentiment Index is declining for the past couple of months as seen below. This time the market is expecting a rise from 72.0 to 73.5. Let’s hope the down trend in the Michigan Consumer Sentiment index from 82.1 peak stops, and the index rises again to help the US dollar.

Technically, I was buying GBPUSD for the last couple of days. The reason for buying the pair is that it has broken a channel on the daily chart as shown below. We bought GBPUSD when the pair tested the broken channel trend line, which acted as a support for the pair. Our initial target almost hit, and there are chances that the pair might test the previous monthly high. If the economic data for the UK does not disappoint, then we may see GBPUSD trading above the 1.6260 level. Support for the pair comes at around the 1.6140 and 1.6060 levels as plotted in the chart shown below.

Get my Daily Market forecast with trade opportunities HERE: Vladimir’s Markets Forecast

Happy Trading Friends!