Before we discuss some of the upcoming events let’s review one of the most important data, which was released on Tuesday, the US retail sales figures. The outcome was better than expected, as the market was expecting only 0.1% growth in December compared to the previous reading of 0.4% (revised down from 0.7%), and the official release stated that the retail sales grew by 0.2% in December. However, as pointed out the other side of the outcome was that the previous reading was revised down from 0.7% to 0.4%.

The U.S. Census Bureau in the official statement highlighted that the retail trade sales were up 0.2 percent from November 2013, and 4.0 percent above last year. Non store retailers were up 9.9 percent from December of 2012 and auto and other motor vehicle dealers were up 6.2 percent from last year.

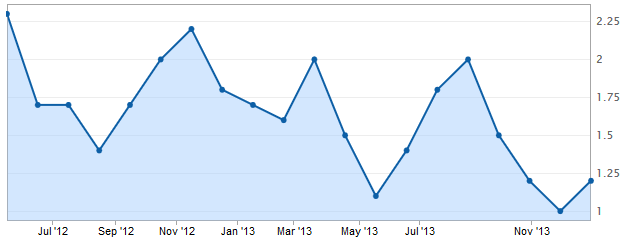

The figure below illustrates the growth in the US retail sales.

The retail sales data was encouraging. Now the market focus is shifted to the upcoming inflation data. The market is expecting a 0.3% rise in the last month, up from the previous reading of 0.0%. The US core CPI is expected to move down from 0.2% to 0.1%. The year-over-year reading is expected to register a rate of 1.5%, and 1.7% for the Consumer Price Index Ex Food & Energy. As we all know that inflation is the second most important factor which the Fed considers when it comes to reductions of asset purchases and rate hike projections. So, we need to keep a close eye on this data, as it may cause a lot of volatility. If the data misses the expectations, then this can be another setback for the US dollar after the disappointing Nonfarm payrolls data, which registered a reading of 74K only.

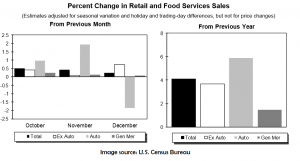

The figure below illustrates the percentage change in the US CPI (YoY) over later two years.

Earlier, in the European session, there is an important event scheduled for the Euro zone as well. The Euro zone CPI figures for December will be released. The Euro zone CPI (YoY) is expected to decline from 0.9% to 0.8%. This is another important data, which plays a significant role in the ECB meetings. At the last press conference, the ECB President Mario Draghi stated that the inflation is in line with the expectations. He was not that worried this time, which released some pressure from the EURUSD buyers. Let’s wait and see whether this particular data comes in line with the expectations or not.

The figure below illustrates the percentage change in the Euro zone CPI (YoY) over later two years.

One of the most important events lined up later during the day is the Ben Bernanke’s speech. He will be speaking at around the GMT 04:10 PM. His comments are always monitored closely. We need to see what he has to say about the recent labor data. It would also be interesting to know what he thinks of the possibility of another reduction in the asset purchases in the upcoming meetings.

Technically, the EURUSD traded a touch lower in the European session yesterday. The pair traded as low as 1.3585. The pair has now retraced some of the losses. The pair found support in the form of an up move channel, as can be seen in the chart below. The pair was unable to break the channel, and traded higher. The 1.3640 level is the first resistance on the way up for the pair. However, major resistance lies at around the 1.3700 level, as highlighted in the chart below. A break above may call for more gains in the pair, in my opinion.

On the downside, the support lies at around the 1.3550/40 level, which is a crucial swing level.

So, keep an eye on these levels, and plan your trades accordingly.

Get my Daily Market forecast with trade opportunities HERE: Vladimir’s Markets Forecast

Happy Trading Friends!