One currency which has surprised many investors recently is the British pound, despite expectation of a rate hike. The British pound has traded more than 800 pips down in the last couple of months. It is currently struggling to find ground and move back higher in the short term. The GBPUSD pair closed below the 1.6000 support area on a number of occasions, which can be considered a solid bearish sign in the near term.

There were a couple of important releases lined up during the start of the week and there are still remaining in the coming days. The released ones are the UK manufacturing and construction PMI, and the ones which will be released in the coming days are the services PMI, production data, BOE interest rate decision and trade balance data. So, there are a lot of important releases lined up which has the potential to impact the British pound to a great extent.

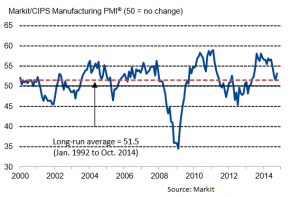

UK Manufacturing PMI

The first important release in the UK was the Manufacturing Purchasing Managers Index (PMI) released by both the Chartered Institute of Purchasing & Supply and the Markit Economics. The forecast was slated for a decline from the previous reading of 51.6 to 51.2. However, the outcome was much higher than expected, as the UK manufacturing PMI jumped to 53.2 in October 2014.

The report also appreciated the fact that there was some relief. It highlighted that the UK manufacturing sector made a bright start to the final quarter of 2014, with rates of expansion in production and new business accelerating sharply from their September lows. The GBPUSD pair climbed a bit higher from the daily lows and tested the 1.6000-10 area after the release.

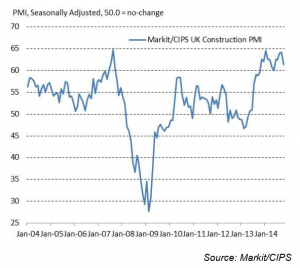

UK Construction PMI

Yesterday, there was one more release in the UK i.e. the Construction Purchasing Managers Index (PMI) which was also released by both the Chartered Institute of Purchasing & Supply and the Markit Economics. The forecast was slated for a decline from the previous reading of 64.2 to 63.5. However, the outcome was disappointing this time, as the UK construction PMI declined to 61.4 in October 2014.

The report mentioned weakness and the pointed out that there was a strong overall increase in UK construction output, but the pace of expansion was the weakest since May. The GBPUSD pair was not affected much by the release, but the bullish tone was somehow got hampered. There was a chance of a run towards the 1.6040 level, which vanished after the release.

UK Services PMI and BOE Rate Decision

There are a couple of important releases lined up during the coming days in the UK, including the UK services PMI and the BOE interest rate decision. The UK services PMI has the potential to cause swing moves in the GBPUSD pair.

Technically, the GBPUSD pair has a solid resistance around the 1.6080-1.6100 area, which is likely to act as a strong hurdle for the pair. We need to see how the pair trades in the coming sessions. On the downside, the 1.5920-00 area holds the key for more losses in the short term.

So, keep an eye on all the important levels friends and trade accordingly.

Get my Daily Market forecast with trade opportunities HERE: Vladimir’s Markets Forecast