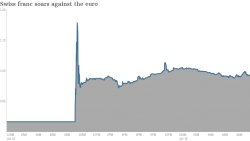

The 15th January decision by the Swiss National Bank (SNB) to revoke the cap on the Swiss Franc has sent shivers around the globe. The Euro-Swiss Exchange rate crashed rapidly, followed closely by the SMI (Swiss Market Index) share prices. This marks the end of the stability which has characterized modern Swiss economic history, and the beginning of a new turbulent period.

The official story

In September 2011 the SNB introduced a cap on the value of the Swiss Franc against the Euro (1.20 CHF = 1.00 EUR). In effect this meant pegging the currency to the Euro. This was a direct result of the Euro currency crisis and the political crisis within the Eurozone, which has seen the Swiss Franc become regarded as a safe haven currency again, as it had been traditionally. Europe’s wealthy want to turn billions of Euros into the politically and financially stable Swiss Franc, even with the prospect of making serious currency exchange losses.

Because of a heightened demand for Swiss Francs on the currency exchange market, the Franc has become more expensive. This has been accompanied in turn by an increase in the price of goods produced in Switzerland. The actions of the SNB, in devaluing and stabilizing the Swiss Franc against the Euro, are thus first and foremost an attempt to prop up to the export industry.

Thomas Jordan, President of the SNB, has reasoned that the abrupt change of policy is justified since ‘the overvaluation of the currency has lessened since the introduction of the Euro cap’[1]. Jordan was making this claim in relation to the US Dollar in particular. And, when the cap was removed, the value of the Swiss Franc against the Dollar skyrocketed almost immediately. The Dollar was worth about 1.00 CHF before the removal of the cap and has now dropped to below 0.90 CHF.

The negative interest rates that were introduced simultaneously to the removal of the cap (making it more expensive to hold capital deposits in Swiss banks), in an effort to lessen the draw towards the Swiss Franc, will not be able to change this situation either. Instead, removing the cap has just helped the effects of these rates to be nullified. Keeping the rates’ allowances relatively high did not even allow for a placebo effect. The decision which determines what banks and financial institutions will have to pay for their SNB securities in the future is but a political decision which acts primarily to ‘signal’ the market. The reasons given by the SNB to justify the removal of the cap on the Swiss Franc are quite clearly farcical. But what then, are the reasons guiding the SNB’s actions?

Protect the Swiss financial market

The real reason for the SNB’s decision lies in the politics of the ECB (European Central Bank). On 22nd January 2015, ECB began a policy of Quantitative Easing (QE) that involves buying up great amounts of state bonds. With this policy in place, the monetary volume within the Eurozone is expected to increase by 1,140bn Euros within the next two years. Additional (and likely) political and economic earthquakes in the Eurozone may contribute to further, massive appreciation pressures on the Swiss currency.

The SNB and the bourgeois economists talk about the over-shooting of exchange rates on the currency markets. Other economists, social democrats and trade unionists emphasise the massive cleft between the exchange rate and purchasing power parity. In their opinion, then, the Franc being strong at present is utterly unjustified.

Yet, the currency speculators and large capital owners, to put it mildly, could not care less. As long as the economic and political instability in the Eurozone (and beyond) is continuing, the currency flight and the pressure on the Swiss Franc will be matching it. The President of Economiesuisse, Hein Karrer comments: “One has to expect further volatility and upward pressure on the Swiss Franc.”[2] He elaborates that this is because “the international economic and political risks […] will lead to a high demand for the Swiss Franc.”[3] Thanks to the increased flow of capital into Switzerland, the financial market will be the one other beneficiary besides the speculators.

One would think that in this situation, given the need to defend the position of Swiss big business, a stable exchange rate would be even more crucial. This is indeed a valid line of thinking. Nevertheless, the SNB Directorate seems to forecast a great enough inflow of Euros that it would have proved difficult to defend a fixed exchange rate. Once the exchange rate had been pierced, the speculative attacks on the Swiss Franc would have increased massively.

A cap in relation to the Euro, in order to defend against the effects of the QE measures, would have meant flooding the European currency market with Swiss Francs. Fritz Zurbrügg, a member of the SNB Directorate, commented, “In the days before the decision, the sums involved in the interventions increased steadily. Calculated over a month, we would have had to intervene with 100bn Swiss Francs in January alone.” [4]

Over time, these enormous sums of free Swiss Francs, which can’t be withdrawn easily once they have served their use, would have made it near-impossible for the SNB to control the value of the Swiss Franc. The Swiss Franc would have turned into the plaything of currency speculators. This would have damaged the core of the Swiss financial market’s business model even more seriously, since it would in essence put an end to the stability on which it prides itself.

A central task of the SNB is to defend the interests of the Swiss financial market. It isn’t surprising, then, that since the New Year, many Swiss financiers (Oswald Grübel, Martin Ebner, etc.) have pleaded against the currency cap. Credit Suisse has, according to its own reports, made profits, and Weber, the UBS president, has congratulated the SNB. In addition, increasing pressure had been placed on the SNB by different foreign state funds to remove the currency cap. The SNB seems to have caved in to those pressures. When we connect this with the SNB’s statutory mandate, which has to be the basis for all of its activities – “to promote currency stability and upholding the ‘interest of Switzerland in its entirety’ ” – it has now become clear that the SNB equates the latter with the interests of the parasitical Swiss financial market.

The export industry draws the short straw

The reactions of the industrialists and tourism entrepreneurs speak for themselves: they are quite clearly in panic. The considerable pre-existing difficulties involved in exporting into the Euro zone – which is by a long way the greatest export market for Swiss products – will now increase further. As the Swiss Franc becomes more expensive, prices for Swiss export products will rise simultaneously.

Swissmem – the association for companies in the machine, electro and metal industry – predicts an increase of 15-20% in product prices in the Euro and Dollar areas during the Franc re-appreciation. The logical consequence is that there will be fewer demands for contracts in many areas of export-oriented industry. A profit crisis of Swiss export capital is announcing itself. It is to be predicted that many companies, especially SMEs (Small and medium-sized enterprises), will halt their production. Serge Gaillard, the director of the Swiss financial administration forecasts “very weak economic growth and increasing unemployment.”[5]

Due to the great degree of specialisation and relatively low raw material costs within Swiss export industries, labour costs – i.e. wages – become the decisive factor in pricing products produced in Switzerland. It then becomes abundantly clear that exporting businesses will try to compensate for price increases with an attack on wage levels.

In this spirit, Swissmem has offered their members a seminar on “labour law possibilities”[6] in the wake of the currency cap removal. A description of the seminar explains that it will cover the topics of wages, labour time and staffing measures. We can translate these things as: How do I lower wages, increase work time and sack workers?

The pressure on workers in the export industry has already increased exponentially since 2011: pressure on wages, longer working hours, work intensification and increases in automation have been advanced aggressively.

Back then, the Euro-Franc exchange rate sunk from 1.55 to 1.20. Therefore, between 2011 and today, bosses have had to drastically lower labour unit costs. The owners of the export industry can only overcome the further strengthening of the Franc if they lower wages, lay off workers, increase working hours and replace their Swiss suppliers with ones from the Euro area.

Another alternative would be a more drastic measure: to outsource the production entirely. In addition, businesses will try to utilize illegal measures and methods such as trying to pay out wages of border-crossing workers in Euros. Or, even, trying to tie the wages of everyone to the Euro entirely to reintroduce indirectly the pegging of the Franc to the currency. Indeed, capitalists have never spared any effort when it came to finding creative ways to push wages down.

Swiss federal council member Schneider-Ammann warned: “Everyone has to work together. Firstly, we have to save expenses by minimizing the bureaucracy. Secondly, we quickly need to talk about working hours, work flexibility, wages, non-wage labour costs, allowances and expenses.” [7] He also demands the immediate implementation of Article 57, the so-called ‘crisis-article’ of the MEM collective bargaining agreement (MEM is the collective bargaining agreement in the machine, electro and metal industry). This article basically allows for an indirect removal of the collective bargaining agreement and effectively lowers working standards enormously. Of course, Schneider-Ammann also calls for the silent support of the unions in the name of the greater “good”.

If one wades through the bourgeois press releases, one will soon realise that the daily proposals that they publish by Federal Council members, businessmen, bankers and professors of economics all argue that we now have to lower working standards. It is clearly insinuated that the working class now has to tighten its belts since, at the end of the day, “we are all in the same boat”. Schneider-Ammann comments: “If employers and workers unify to prevail in the market competition, they will find the right solution.”[8] This is just a taster of what is still to come.

Some areas of the export industry have already faced a crisis due to a decrease in demand. With a further increase in product prices it is even more unlikely that they will find any sales markets at all. They can try to squeeze out what little more they can out of workers but, if there is no demand or market for their products, they will not make any profits, meaning that there is no point in production. This is the most likely scenario for European capitalism. In fact, in the short-term future, the Swiss working class will be confronted with a combination of plant closures and extensive pressures on working standards. The labour organisations, most of all the unions, are neither organizationally – nor, to an even greater extent, politically – ready for such scenario.

Similar consequences for the real estate market?

The real estate market in Switzerland seems to have ‘cooled down’ slightly since 2014. According to the ETH Zürich (Swiss Federal Institute of Technology) Real Estate Report it is the first time since the beginning of 2013 that there aren’t any Swiss districts categorized as ‘critical’. But they note that international developments, including the uncapping of the Franc-Euro exchange rate, may threaten the possibility of a real estate bubble again.

The SNB President Jordan, too, last year pointed several times to the fact that “the over-appreciation in comparison to fundamentally ‘explainable prices’ has increased further.”[9] As a result of the increases in ‘overvaluations’, the SNB raised the countercyclical capital buffer for the real estate market from 1% to 2% of bank capital at the end of July 2014. The effect was negligible, and the measure was effectively neutralized by the introduction of the negative interest rates. Together, several factors have combined to provide more fertile ground than ever for financial investment in real estate. In addition, it has to be presumed that an incrementally increasing part of newly exchanged foreign capital will be invested in real estate. This could further push up artificial demand on the real estate market and inflate the (financial) bubble further.

An alternative scenario is presented by the NZZ (Neue Zürcher Zeitung – a renowned Swiss bourgeois newspaper). They note on the topic of the real estate market: “The more the economy is suffering and the greater the pressure on the Swiss export industry, tourism and retail trade due to a revaluation, the stronger the fetters on development in the real estate market.”[10] The NZZ predicts that this real estate slump would result in a price correction between 10%-15%. Such a development could magnify an impending recession enormously and lead to the kind of long-term stagnation we saw in the 1990s. It is unclear, still, which scenario will be played out. Nonetheless, the first would only delay the inevitable bursting of the bubble for some time.

The bourgeois prepare the ground for an attack

The Swiss Institute for Business Cycle Research (Konjunkturforschungsstelle KOF ETH) has suggested that one could throw all of the predictions of the economic developments in Switzerland out of the window. As if answering the call, the UBS corrected its growth predictions for Switzerland down from 1.8% to 0.5%. The now-heralded new phase of the crisis will be once again pushed onto the backs of the working class. This won’t only be the case within businesses as described above, but rather there will be a general, large scale attack on all of the concessions the working class may have gained in the past.

The planned corporate tax reform III will now with great likelihood be implemented more swiftly without provisions for financing to counterbalance its negative effects. The tax reductions for enterprises that this reform will implement will likely be followed by future tax deductions.

As with the corporate tax reform II, a reduction in national tax revenues will lead to austerity measures on communal, cantonal and national levels. And the lessons of the past few years have taught us repeatedly who will bear the brunt of such austerity measures. Due to the fact that there will likely not be any SNB dividends paid out to cantonal governments (and to the national government) for years to come in addition to the lowering of state fees for businesses in all kinds of areas, these austerity measures are likely to be even larger than previously predicted.

The bourgeoisie will also try to tamper with all social welfare institutions – from the pension system to work accident insurance funding – for example, through the lowering or removal of employer contributions to the pension system. The pension fund payouts will be reduced once more due to the massive losses on the stock markets. In an effort to save their profits, the bourgeoisie will now try to push the costs of the crisis onto the backs of the working class on all fronts. We now have to ask ourselves: how we can counter this coming onslaught?

And the working class movement?

Globally, we are now in an epoch of crisis and revolutions. Whoever thought that Switzerland would, or could, remain unscathed is thoroughly mistaken. Illusions of Swiss resilience against the crisis will turn to dust.

The underlying problems that are expressing themselves in the exchange rate crisis are but symptoms of the organic crisis of capitalism: overproduction. The consequence of it is that since the bourgeoisie in Europe can’t find any viable investment opportunities, they shuffle their capital into the presumably stable Swiss financial harbour in an effort to weather the storm. But the storm will outlast them.

Our task as Marxists is not to fight symptoms. Our task is to analyse the systemic core of the issue and fight for the fundamental overturn of the capitalist system. We have always emphasized that Switzerland is not an island of candy canes and happiness; rather, we have predicted that Switzerland would not be spared from the crisis. The bourgeoisie propaganda harping on about the Swiss exception must be stripped bare and exposed for what it is: a farce. And instead, we must propose a real alternative to the current situation. These are the tasks of the working class movement.

From the start, the leaders of the SGB (Swiss Federation of Trade Unions – Schweizerischer Gewerkschaftsbund) and the SP (Swiss Socialist Party) supported the decision to cap the Swiss Franc. They argued, that the capping will save jobs in Switzerland. Of course, one cannot entirely refute this claim. But there must be an end now to this nostalgia. The reality is and will be that the cap on the Swiss Franc has been scrapped and that from now onwards the SNB will only be able to intervene sparingly.

The pleas from the left to re-introduce a cap once again, if only to achieve a 1.10 Euro exchange rate, shows the complete incapability of the reformists. Corrado Pardini, an SP Member of Parliament as well as one of the leaders of Unia (the largest Swiss trade union), responds to the possibility of the introduction of Euro wages by claiming: “We [the trade unions] will utilize all possible means and trade union weaponry to fight Euro wages.”[11]

But in another interview, Pardini revealed the real “economic programme” that the trade unions and the SP are launching:

“We don’t need confrontations between the social partners. And even less, employers who want to abuse the situation and push it onto the backs of the workers. […] There is a need for a new pact between employers and workers to stabilise the economy. We need to tame the pending negative consequences of the Mass Immigration Referendum [of February 2014] and the removal of the Swiss Franc cap. As one! […] Firstly, there is the need for a clear statement from the employers in support of the social partnership and fair wages. Specifically: Swiss work for Swiss wages. Secondly, politics has to offer support measures to enterprises that are particularly hard hit in the export industry and the tourism sector. [And thirdly, we have] to use this chance to invest in the social-ecological reconstruction as well as pushing forward the challenges of the coming digital revolution. There is a need for investments in research and development, in jobs and products with great value creation. With this strategy, we will overcome the crisis.”[12]

Firstly, we can point out that the left is counting on the social partnership, which has brought about barely any improvements to the living conditions of the working class in a long time. Rather, it had been the bourgeoisie’s tool to suffocate any resistance against their assaults at the core. In truth, then, the employers have cancelled the social partnership and are upholding it only verbally when it is of use to them.

Secondly, repeating the 2008 calls sheepishly, the left counts on Keynesian stimulus spending to revive the economy. But such economic injections provide, if anything, only short-term help mainly benefiting capitalists. In the end, the working class are paying for these stimulus packages; even more so now, with the current politics of austerity.

The third and last demand is social-ecological reconstruction. What it entails is not properly described. And if any details are given – for example, on the plans regarding “the productive pact for Switzerland”[13] by Unia – it entails only ways of how to support the capitalists to ensure their profits in the future and minimize their risks by shifting them onto the backs of the general public. Clearly, these approaches by the reformist left do not provide a viable alternative to the system which is currently prevailing.

Nevertheless, in spite of the lack of perspective of the reformist leadership, we would be wrong to assume that the workers in companies hit by the crisis will put up with what is to come without a reaction. On the contrary, they already have shouldered much of the burden in the past couple of years: no increases in real wages; ‘flexibilisation’ of work to temporary work and work time increases. Thus, they simply will not swallow additional attempts to cut into their working and living standards.

The most immediate confrontations are likely to occur first on an enterprise level. The enormous pressure which will accumulate will force the unions to start to organise the struggles on a company level, to some extent. After all, the last couple of years have left their trace in the consciousness of the working class. These renewed escalations will ultimately heighten the level of the class struggle significantly.

What is certain is that there will be struggles. But they shall not remain isolated by any means. Instead, they must be connected and raised to a systemic level on the basis of a socialist programme. Because of the abolition of the cap on the Swiss Franc, a central question has arisen for the working class: How do we fight against the worsening of our living and working conditions? This, clearly can only be answered by questioning the compatibilities of the capitalist system and showing the need for revolutionary change. An intensification of the current situation will ultimately mean: “capitulation or confrontation.”

The task for the Marxists is that of preparing the ground for a revolutionary alternative to emerge in the coming period within the Swiss youth and working class, as social partnership breaks down.

[2] http://www.nzz.ch/wirtschaft/der-politische-druck-auf-die-snb-waere-gestiegen-1.18462936, (Stand: 16.01.2015).

[3] Ibid.

[4] www.nzz.ch/wirtschaft/mindestkurs-haette-im-januar-100-milliarden-franken-gekostet-1.18466362, (Stand: 22.1.2015).

[5] www.derbund.ch/wirtschaft/das-ende-des-mindestkurses/Jeder-fuenfte-Industriebetrieb-ist-existenziell-bedroht/story/25574265 (Stand: 18.01.2015).

[6] www.swissmem.ch/aktuell/einzelansicht/event/ausgebucht-aufhebung-des-euro-mindestkurses-moegliche-arbeitsrechtliche- massnahmen-aus-or-und-gav/eventBack/61.html, (Zugriff: 25.01.2015)

www.tagesanzeiger.ch/wirtschaft/wef/Der-Bundesrat-fordert-Diskussion-ueber-Loehne/story/22560011?dossier_id=2521, (Stand: 23.01.2015).

[8] Ibid.

[9] www.tagesanzeiger.ch/wirtschaft/Die-Sorgen-des-NationalbankPraesidenten/story/15216791?track , (Stand: 08.03.2014).

[10] www.nzz.ch/wirtschaft/immobilien-werden-eher-noch-attraktiver-1.18462347, (Stand: 16.01.2015).

[11] www.aargauerzeitung.ch/wirtschaft/gewerkschafter-will-alle-kampfmittel-gegen-euroloehne-einsetzen-128763243, (Stand: 23.01.2015).

[12] www.blick.ch/news/politik/gewerkschafter-pardini-ueber-franken-krise-darf-mir-der-chef-jetzt-den-lohn-kuerzen- id3418140.html, (Stand: 19.01.2015).

[13] www.unia.ch/fileadmin/user_upload/user_upload/Industrie-Pakt-fuer-Produktion.pdf.

Thanks guys! Jaxson yes, financial world could be very interesting sometimes 🙂

Vlad

Thanks for sharing the Swiss Franc Story. Looks like you have done a research stuff to gather all this..well done.

Another good article, you help me improve my knowledge so just wanted to say thank you!

Getting a chance to read interesting articles everyday, thanks for sharing Vlad..