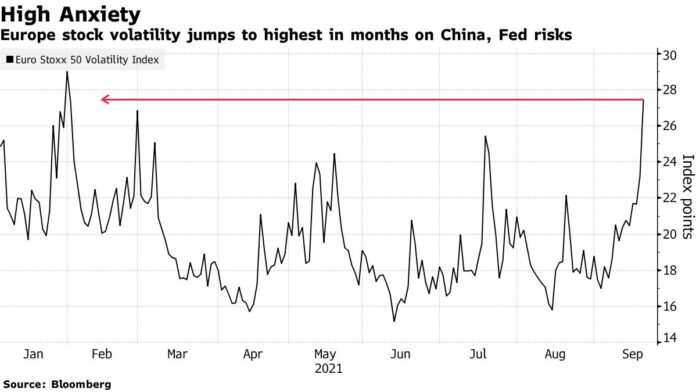

The global stock rout sparked by investor angst over China’s real-estate sector and Federal Reserve tapering worsened on Monday, with U.S. stocks falling more than 1% and European equities tumbling the most in almost a year.

The S&P 500 fell the most on an intraday basis in a month, a test for the buy-the-dip mentality as the gauge jabs at its 50-day moving average. The benchmark index is still up around 17% this year. Treasuries gained along with the dollar before Wednesday’s Fed meeting, where policy makers are expected to start laying the groundwork for paring stimulus.

“While the Evergrande situation is front and center, the reality is, stock market valuations are overstretched and the market has enjoyed too long of a break from volatility,” said David Bahnsen, chief investment officer at Newport Beach, California-based wealth management firm The Bahnsen Group.

The Stoxx Europe 600 index dropped more than 2% to a two-month low and was on track at one point for the biggest decline since October 2020. Raw materials led the broad-based retreat as iron ore extended a slump below $100 a ton and base metals declined after China stepped up restrictions on industrial activity. Germany’s DAX underperformed as a rebalancing takes effect.

Hong Kong shares slumped amid the biggest selloff in property stocks in more than a year as traders tracked the risk of contagion from the debt crisis at developer China Evergrande Group, which is fueling new fears about China’s growth path.

Aside from Evergrande and the prospect of reduced Fed stimulus, financial markets also face risks from uncertainty over the outlook for President Joe Biden’s $4 trillion economic agenda as well as the need to raise or suspend the U.S. debt ceiling. Investors were already fretting over a slowing global recovery from the pandemic and inflation stoked by commodity prices.

“The edges of the bullish narrative cover are being pulled and the darker underlying reality is coming to the fore,” said Sebastien Galy, a senior macro strategist at Nordea Investment Funds SA. “It is taking the market more time to price in these shocks than I had expected, and the market is far more realistic as the buy-on-dip mentality fades with the fear of inflation.”

Treasury Secretary Janet Yellen said the U.S. government will run out of money to pay its bills sometime in October without action on the debt ceiling, warning of “economic catastrophe” unless lawmakers take the necessary steps.

Meanwhile, emerging-market stocks headed for their biggest drop in a month, while Russia’s ruble and Chile’s peso led developing-nation currency declines. Bitcoin fell below $43,000. WTI crude oil extended a drop toward $70 a barrel.

Here are key events to watch this week:

- Canada federal election, Monday

- Bank of Japan rate decision, Wednesday

- Federal Reserve rate decision, Wednesday

- Bank of England rate decision, Thursday

- Fed Chair Jerome Powell, Fed Governor Michelle Bowman and Vice Chairman Richard Clarida discuss pandemic recovery, Friday

Some of the main moves in markets:

Stocks

- The S&P 500 fell 1.3% as of 9:58 a.m. New York time

- The Nasdaq 100 fell 1.5%

- The Dow Jones Industrial Average fell 1.2%

- The Stoxx Europe 600 fell 1.8%

- The MSCI World index fell 1.4%

Currencies

- The Bloomberg Dollar Spot Index rose 0.2%

- The euro was little changed at $1.1717

- The British pound fell 0.4% to $1.3680

- The Japanese yen rose 0.3% to 109.61 per dollar

Bonds

- The yield on 10-year Treasuries declined three basis points to 1.33%

- Germany’s 10-year yield declined three basis points to -0.31%

- Britain’s 10-year yield declined four basis points to 0.81%

Commodities

- West Texas Intermediate crude fell 1.3% to $71.02 a barrel

- Gold futures rose 0.4% to $1,758.40 an ounce